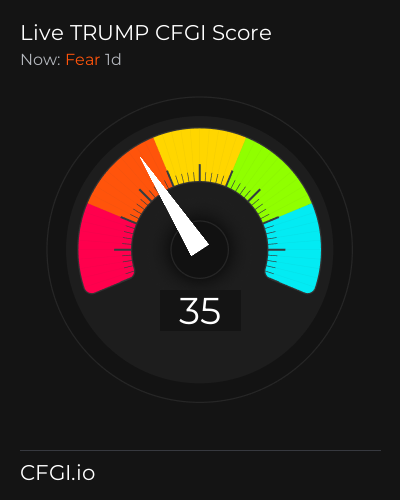

Historical Values

-

Now

Greed 66 -

Yesterday

Greed 66 -

7 Days Ago

Greed 66 -

1 Month Ago

Greed 66

Trump Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Trump price evolution a certain numerical value.

This module studies the price trend to determine if the Trump market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Trump price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the Trump Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Trump bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Greed

The Impulse indicator measures the current Trump price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Trump market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Neutral

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Trump the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Extreme Greed

Dominance Greed

This other indicator takes into account the dominance of Trump with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Trump's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Trump and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Extreme Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Trump has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Trump. For this, specific search terms are used that determine the purchasing or ceding interest of Trump, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Extreme Fear

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Trump and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Trump moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Neutral

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Trump on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

Trump News

Trump News

Binance Developed Code for Trump-Backed USD1 Stablecoin Before CZ's Pardon Bid

Sentiment: Negative

Read moreTron's Justin Sun Goes All-In on Trump Empire with $100 Million TRUMP Token Buy

Sentiment: Positive

Read moreJustin Sun Pledges $100M to TRUMP Coin, Fueling Surge and TRON Integration

Sentiment: Positive

Read moreRipple Price Prediction As XRP Joins Trump-Backed ‘Crypto Blue Chip ETF'

Sentiment: Positive

Read moreIf You Bought Ethereum When Eric Trump Said So, You're Finally in the Green

Sentiment: Neutral

Read moreBitcoin breaks ATH again, Dow Jones gains 200 points as Trump threatens new tariffs

Sentiment: Positive

Read moreBitcoin Hits Another All-Time High Price After Trump Renews Rate Cut Push

Sentiment: Positive

Read moreTrump Family's WLFI Token: Experts Bullish On $5 Price Projection Post-Launch

Sentiment: Positive

Read moreTrump says Bitcoin and tech boom show US economy is back, urges Fed to cut rates

Sentiment: Positive

Read moreOfficial Trump Price Analysis: TRUMP Eyes Breakout and Targets $15.70 Next

Sentiment: Positive

Read moreWorld Liberty Governance Vote Gains Support While TRON Backs TRUMP Token

Sentiment: Positive

Read moreBitrue adds Trump-backed USD1 stablecoin as base trading pair for 10 tokens

Sentiment: Neutral

Read moreBitcoin Price Prediction: Trump Family Quietly Expands Crypto Holdings – Big Announcement Soon?

Sentiment: Positive

Read moreBitcoin Holds Near $109K as Traders Wait for Direction; Trump Media Files for ‘Crypto Blue Chip ETF'

Sentiment: Positive

Read moreTrump Media žiada o nové Bitcoin ETF, ktoré zahŕňa aj Ethereum, XRP a Solanu

Sentiment: Positive

Read moreBitrue Backs Politically-Linked Stablecoin USD1 Despite Expected Pushback Over Trump Ties

Sentiment: Neutral

Read moreJustin Sun Buys $100M in TRUMP Token to Align TRON with Pro-Crypto U.S. Stance

Sentiment: Positive

Read moreTrump-backed World Liberty Financial opens vote to make WLFI token tradable

Sentiment: Positive

Read moreTRUMP Meme Coin Gains Following Justin Sun's $100 Million Investment Announcement

Sentiment: Positive

Read moreDonald Trump Jr. acquires stake in Bitcoin-heavy social media company Thumzup

Sentiment: Positive

Read moreTrump Jr. Buys Stake in Cash-Burning Social Media App Building Bitcoin Reserve

Sentiment: Neutral

Read moreBitcoin Treasury Firm Thumzup Considering Dogecoin, XRP Buys as Trump Jr. Invests

Sentiment: Positive

Read moreJustin Sun Announces Plans to Purchase Official Trump Meme Worth $100M: What Next for $TRUMP Price?

Sentiment: Positive

Read moreJustin Sun has pledged to buy $100 million worth of Donald Trump's official memecoin, TRUMP

Sentiment: Positive

Read moreDonald Trump Jr. Invests $4 Million in Bitcoin Treasury Company Thumzup Media

Sentiment: Positive

Read moreDonald Trump Jr.-backed Thumzup to acquire Ether, XRP, Solana following board approval

Sentiment: Positive

Read moreBitcoin Price Rises Above $109K as Trump Calls for Biggest Interest Rate Cut in History

Sentiment: Positive

Read moreBitcoin Starts Surging Toward $110K After Trump Says 'Fed Rate' Is 300 Basis Points Too High

Sentiment: Positive

Read moreTrump Tariffs: BTC Price Reacts As US President Rolls Out New Trade Letters

Sentiment: Neutral

Read moreCronos Jumps 18% After Trump Media ETF Proposal Lists Token Among Holdings

Sentiment: Positive

Read moreBitcoin Asia 2025: Eric Trump To Address Hong Kong's Growing Role In Crypto

Sentiment: Positive

Read moreTrump-Linked Truth Social Files With SEC For ‘Crypto Blue Chip' ETF Tracking Bitcoin, Ether, XRP, And Solana

Sentiment: Positive

Read moreTRUMP Coin Set For First Major Token Unlock This July. ARB, SUIAnd More To Follow

Sentiment: Neutral

Read moreCRO price posts 20% single-day rally on inclusion in Trump Media-backed ETF, eyes $0.105

Sentiment: Positive

Read moreTrump Moves to Cement US Crypto Dominance with Bitcoin Reserve Plan Ahead of July Report

Sentiment: Positive

Read moreTrump Media Files for 'Crypto Blue Chip' ETF Holding Bitcoin, Ethereum, Solana and XRP

Sentiment: Positive

Read moreBTC Price Drops As Trump Says No Plans To Extend August 1 Tariff Deadline

Sentiment: Negative

Read moreBreaking: Donald Trump Truth Social Files For BTC, ETH, SOL, XRP, CRO ETF

Sentiment: Positive

Read moreEric Trump to Speak at BTC Asia as Hong Kong Pushes Pro-Crypto Legislation

Sentiment: Positive

Read moreBitcoin Slips Below $108K, Erases Weekend Gains as Trump Ramps Up Tariffs

Sentiment: Negative

Read moreTron and LayerZero Partner to Launch TRUMP on Mainnet, Boosting Market Access

Sentiment: Positive

Read moreTrump Meme Coin Expands to Tron with USD1 Stablecoin – Can This Push TRUMP Above $12?

Sentiment: Negative

Read moreBreaking: Trump Announces 25% Tariffs on Japan and South Korea, BTC Price Reacts

Sentiment: Neutral

Read moreMusk Teases Pro-Bitcoin America Party, Trump Fires Back, BTC Bull Token to Thrive

Sentiment: Neutral

Read moreCrypto Week: Trump Admin Gears Up for July 22 Digital Assets Report; Is a Strategic Bitcoin Reserve Ahead?

Sentiment: Neutral

Read moreBitcoin climbs back above $109,000 after weekend slump as Trump pushes tariff deadline

Sentiment: Positive

Read moreTrump-Backed Protocol Launches Proposal for WLFI Trading on Independence Day

Sentiment: Positive

Read moreTrump-backed World Liberty Financial seeks community vote on token mobility

Sentiment: Positive

Read moreTrump-Linked WLFI Proposes Token Tradability as Vote Opens on Independence Day

Sentiment: Neutral

Read moreTrump-Backed WLFI Tradability Proposal Launches Ahead of GENIUS Act Vote: Crypto Price Shift Possible

Sentiment: Neutral

Read moreThe FBI thanks Tether for the seizure of funds from the fake Trump-Vance inaugural committee

Sentiment: Neutral

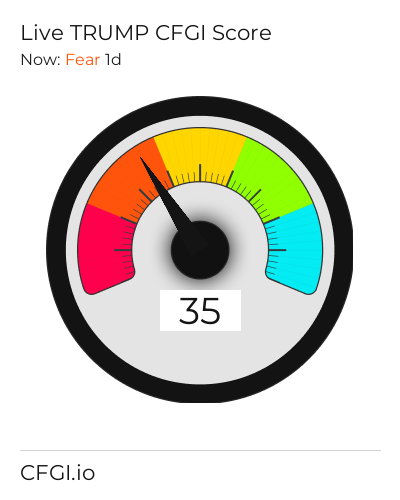

Read moreHistorical Values

-

Now

Greed 66 -

Yesterday

Neutral 72 -

7 Days Ago

Fear 34 -

1 Month Ago

Neutral 41

Trump Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Trump price evolution a certain numerical value.

This module studies the price trend to determine if the Trump market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Trump price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the Trump Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Trump bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Greed

The Impulse indicator measures the current Trump price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Trump market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Neutral

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Trump the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Extreme Greed

Dominance Greed

This other indicator takes into account the dominance of Trump with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Trump's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Trump and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Extreme Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Trump has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Trump. For this, specific search terms are used that determine the purchasing or ceding interest of Trump, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Extreme Fear

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Trump and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Trump moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Neutral

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Trump on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

TRUMP Price

1 TRUMP = $9.89

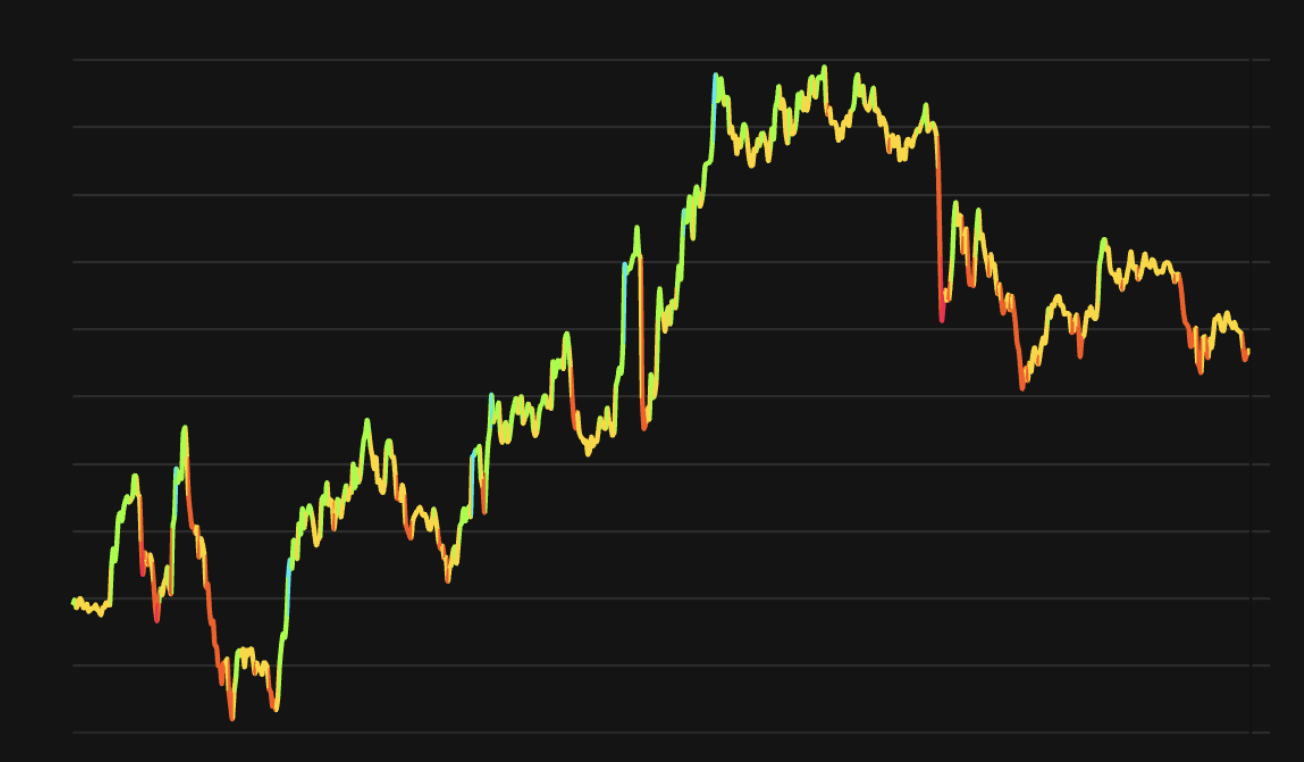

Trump CFGI Score & TRUMP Price History

TRUMP Price & Trump Sentiment Breakdown Charts

Price Score Sentiment

Volatility Sentiment

Volume Sentiment

Impulse Sentiment

Technical Sentiment

Social Sentiment

Dominance Sentiment

Search Sentiment

Whales Sentiment

Order Book Sentiment