Historical Values

-

Now

Extreme greed 82 -

Yesterday

Extreme greed 82 -

7 Days Ago

Extreme greed 82 -

1 Month Ago

Extreme greed 82

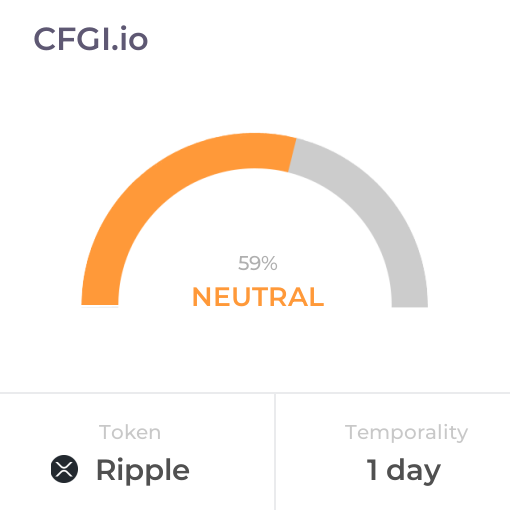

Ripple Breakdown

Price Score Extreme Greed

The Price Score indicator is a relevant indicator to analyze and assign the Ripple price evolution a certain numerical value.

This module studies the price trend to determine if the Ripple market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Extreme Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Ripple price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Extreme Greed

Like volatility, the Ripple Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Ripple bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Extreme Greed

The Impulse indicator measures the current Ripple price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Ripple market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Greed

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Ripple the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Extreme Greed

Dominance Extreme Fear

This other indicator takes into account the dominance of Ripple with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Ripple's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Ripple and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Extreme Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Ripple has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Ripple. For this, specific search terms are used that determine the purchasing or ceding interest of Ripple, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Neutral

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Ripple and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Ripple moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Extreme Fear

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Ripple on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

Ripple News

Ripple News

XRP ETF Incoming? Pro-Ripple Lawyer Breaks Silence Ahead of July 18 Rumors

Sentiment: Positive

Read moreXRP Technical Signals Hint at a 300% Incoming Rally, Fueling the Best Crypto of 2025

Sentiment: Positive

Read moreXRP (XRP) Price: Token Breaks $2.84 Resistance Level With 176M Volume Spike

Sentiment: Positive

Read moreXRP price ‘highly rare' setup eyes 60% gain past $3, veteran trader says

Sentiment: Positive

Read moreXRP Poised to Benefit as Fedwire Adopts ISO 20022 Upgrade, Analyst Claims

Sentiment: Positive

Read moreXRP is about to cross $3 for the first time in 7 years — analyst eyes $6 once $3 mark is breached

Sentiment: Positive

Read moreRipple (XRP) Soars on ETF Launch, Regulatory Milestones, and Strategic Partnerships

Sentiment: Positive

Read moreXRP Price Prediction from Elon Musk's Grok AI Hints at $10 to $400 Surge

Sentiment: Positive

Read moreXRP Rallies 8% on Rising Institutional Bid, Eyes $3.40 After 'Triangle Breakout'

Sentiment: Positive

Read moreXRP News Today: Bulls Eye $3.40 as Crypto Week Drives Momentum; BTC Hits New High

Sentiment: Positive

Read moreWill Ethereum (ETH) Aim for $4,000? Solana (SOL) Is Sleeping Giant, Massive XRP Breakthrough Doesn't End

Sentiment: Positive

Read moreAnalyst Predicts Imminent New All-Time Highs for XRP, Says Second-Largest Altcoin's Chart Looks ‘Disgustingly Good'

Sentiment: Positive

Read moreRipple's $21 Trillion Dream: What Capturing 20% Of SWIFT Volume Means For XRP

Sentiment: Positive

Read moreRipple's XRP Price Heating Up for $10 As XRP Whale Holdings Surpass 42 Billion Coins

Sentiment: Positive

Read moreXRP Price Prediction: Could Ripple Reach $27? Analysts Think It's Possible

Sentiment: Positive

Read moreXRP Price Prediction: Its Ascent to #3 After 25.8% Weekly Gain – Will Momentum Hold?

Sentiment: Positive

Read moreXRP Needs to Break This Key Resistance to Target a New All-Time High: Ripple Price Analysis

Sentiment: Positive

Read moreBitwise Says ETH, XRP, LINK, SOL Could Dominate $257 Trillion Tokenizaation Market

Sentiment: Positive

Read moreXRP or XLM: We Asked 4 AIs Who Wins in 2025? The Dominant Answer May Surprise You

Sentiment: Neutral

Read moreRipple (XRP) Surges to $2.79 Amid ETF Momentum and BNY Mellon Partnership

Sentiment: Positive

Read moreXRP, SOL, LTC ETF Explosion Coming: Market Experts Predict 95% Approval Odds for Spot ETFs this Year

Sentiment: Positive

Read moreDogecoin, Shiba Inu, XRP Explosion Sparks Altseason As Massive Whale Buys Signal Altcoin Revival

Sentiment: Positive

Read moreBitcoin, Ether Tentative, XRP Steady as Trump Announces 30% Tariff on EU and Mexico

Sentiment: Negative

Read moreXRP Lawsuit Countdown Begins as Lawyer Predicts SEC Appeal Dismissal Soon

Sentiment: Positive

Read moreTrump Fed Warning Spurs Crypto Price Surge Toward $4 Trillion As Bitcoin, Ethereum And XRP Suddenly Soar

Sentiment: Positive

Read moreXRP Price Could Jump to $4 While You Sleep This Week, Says Crypto Analyst

Sentiment: Positive

Read moreXRP Price Prediction: Investors on High Alert for July 14, 21, 25 – What's Next for XRP?

Sentiment: Positive

Read moreBitcoin's all-time high fuels $1B in liquidations as ETH, XRP, MOG soar double digits

Sentiment: Positive

Read moreXRP shoots to 3rd in crypto ranking after monster $30 billion weekly inflow

Sentiment: Positive

Read moreXRP Replaces USDT at the #3 Spot—Is the Long-Awaited $10 Bull Run Finally Here?

Sentiment: Positive

Read moreRipple's XRP Lawsuit: What Really Happened After the ‘Confusing' March Victory Call

Sentiment: Positive

Read moreXRP Price Retests Key Zone After Hitting $2.97: Can Bulls Sustain a Move Above $3?

Sentiment: Positive

Read moreXLM Explodes by 22% Followed by XRP, BTC Price Calms at $118K: Weekend Watch

Sentiment: Positive

Read moreRipple's XRP Surged to 4-Month High: 4 Catalysts Fueling the Latest Rally

Sentiment: Positive

Read moreInvestors Are “Suffering Harm” Due To SEC's Surprise Pause On ETF Holding XRP And Solana, Asserts Grayscale

Sentiment: Negative

Read moreXRP News Today: XRP Flips USDT to Target ETH and the #2 Spot; BTC Hits $118k

Sentiment: Positive

Read moreRipple (XRP) Surges Amid BNY Mellon Partnership & Regulatory Gains: July 2025 Market Analysis

Sentiment: Positive

Read moreHistorical Values

-

Now

Extreme greed 82 -

Yesterday

Neutral 82 -

7 Days Ago

Greed 60 -

1 Month Ago

Fear 36

Ripple Breakdown

Price Score Extreme Greed

The Price Score indicator is a relevant indicator to analyze and assign the Ripple price evolution a certain numerical value.

This module studies the price trend to determine if the Ripple market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Extreme Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Ripple price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

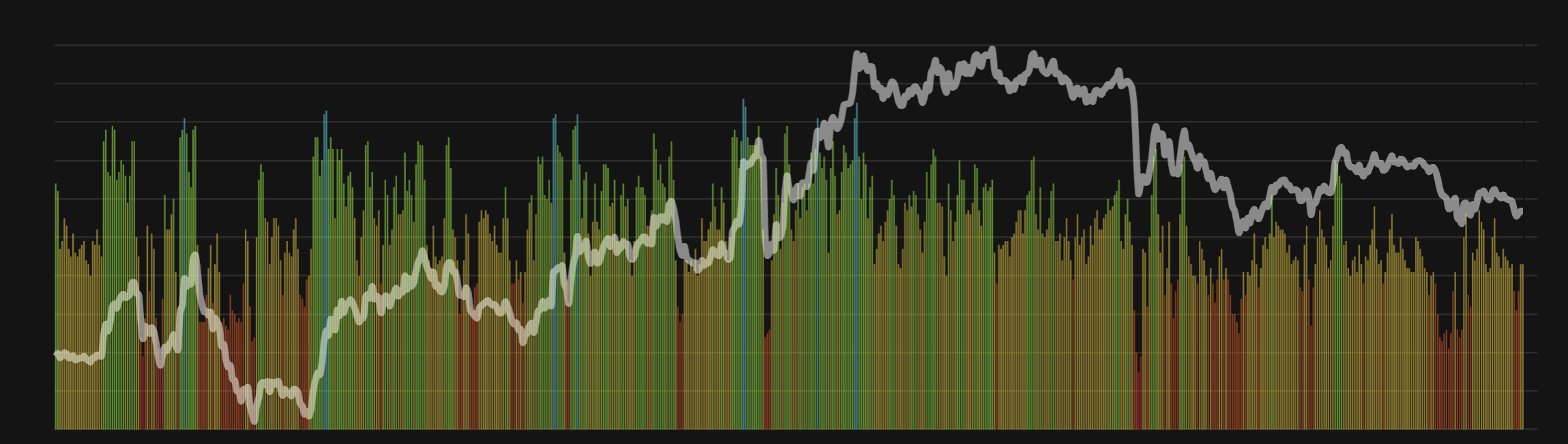

Volume Extreme Greed

Like volatility, the Ripple Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Ripple bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Extreme Greed

The Impulse indicator measures the current Ripple price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Ripple market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Greed

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Ripple the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Extreme Greed

Dominance Extreme Fear

This other indicator takes into account the dominance of Ripple with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Ripple's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Ripple and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Extreme Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Ripple has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Ripple. For this, specific search terms are used that determine the purchasing or ceding interest of Ripple, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Neutral

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Ripple and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Ripple moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Extreme Fear

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Ripple on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

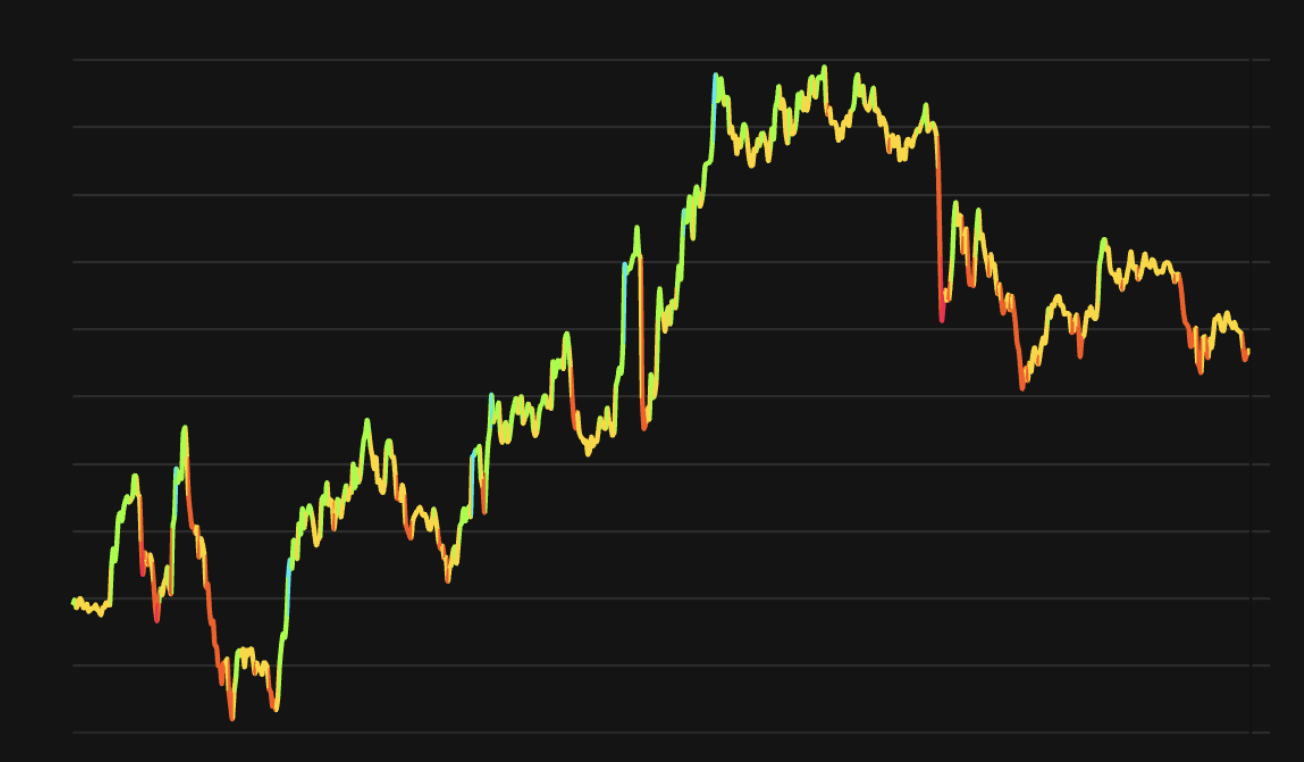

XRP Price

1 XRP = $2.91

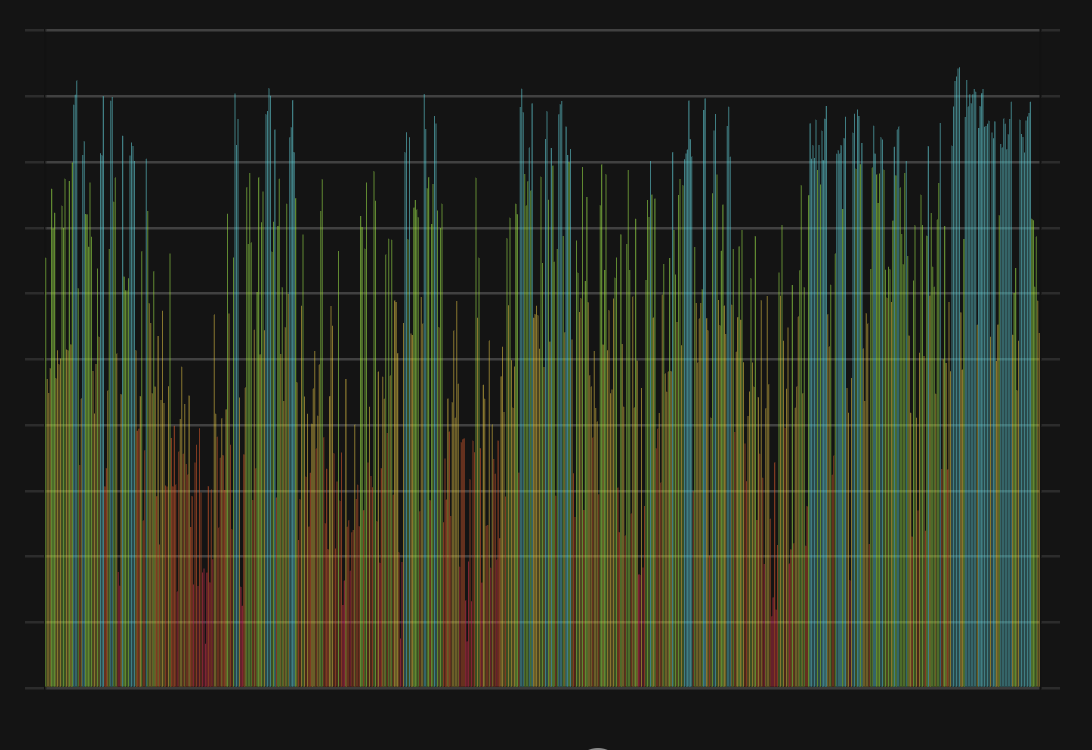

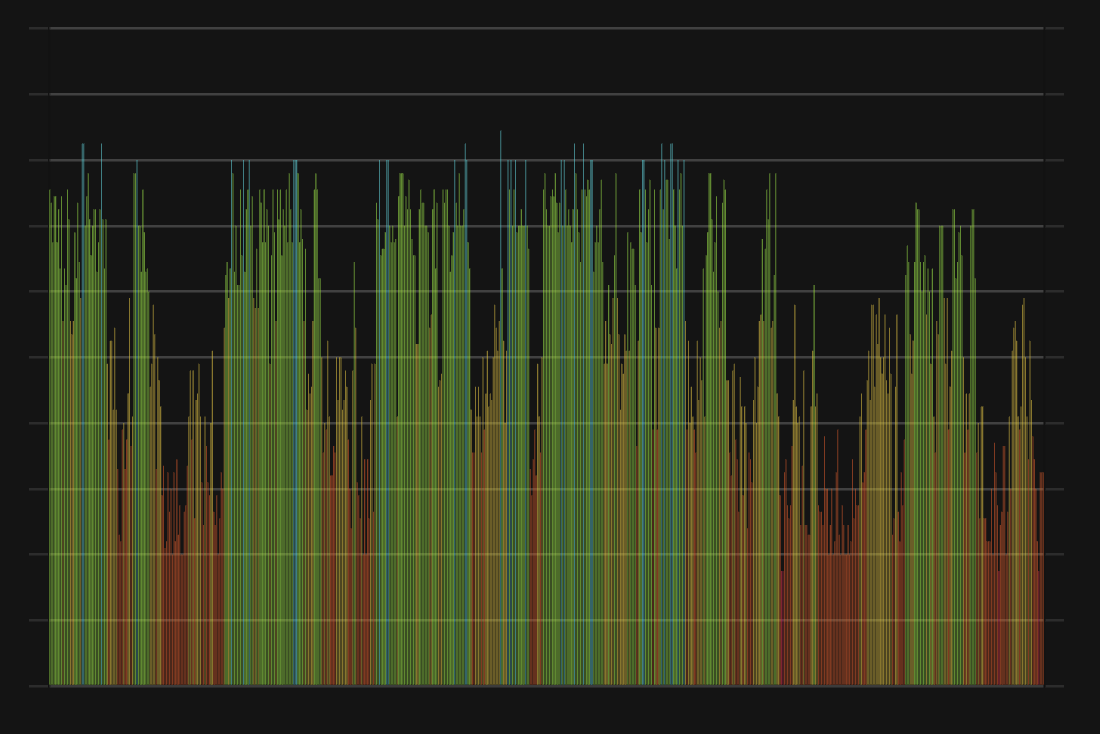

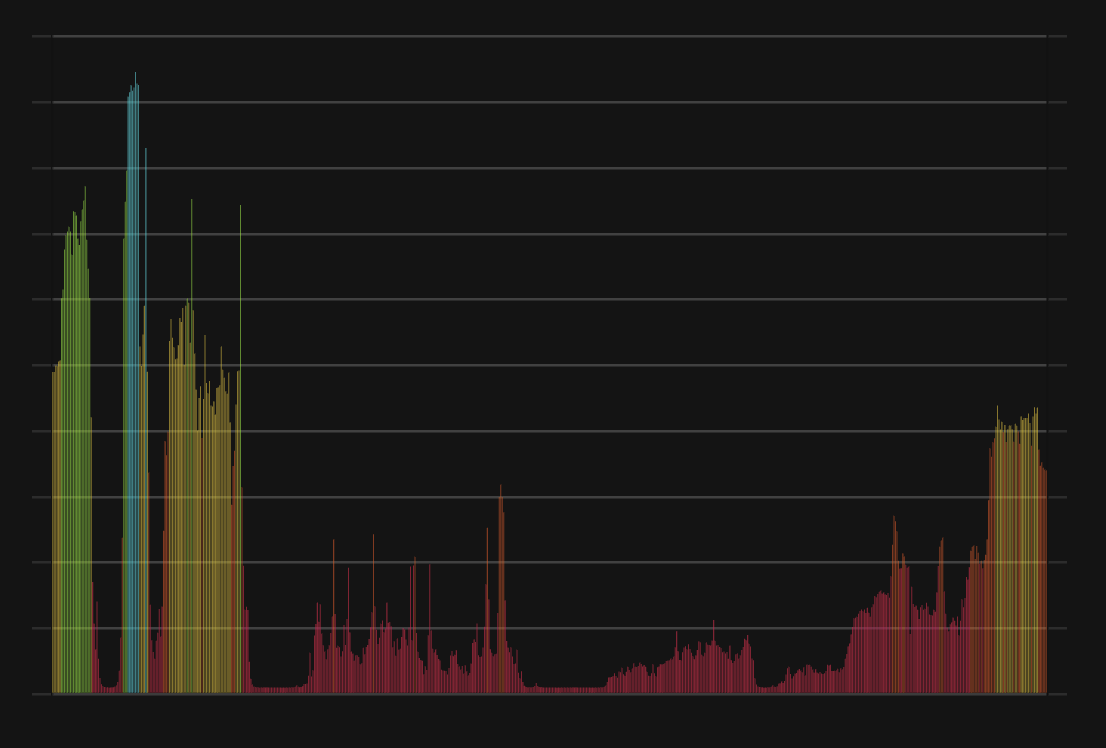

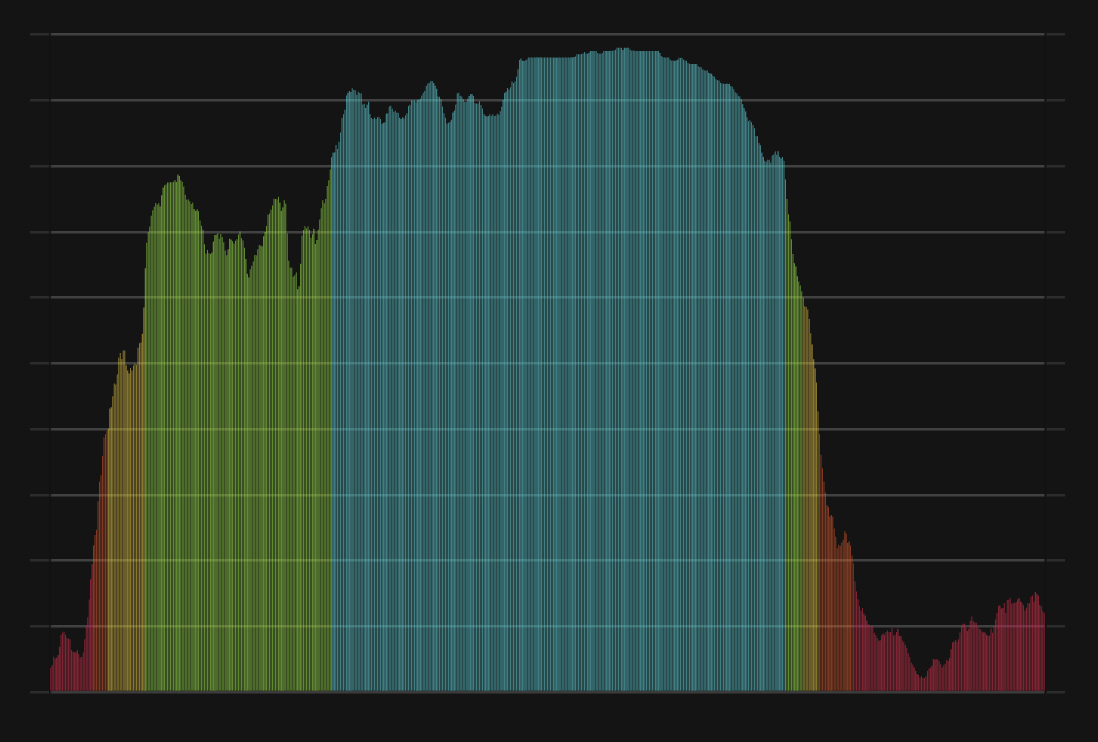

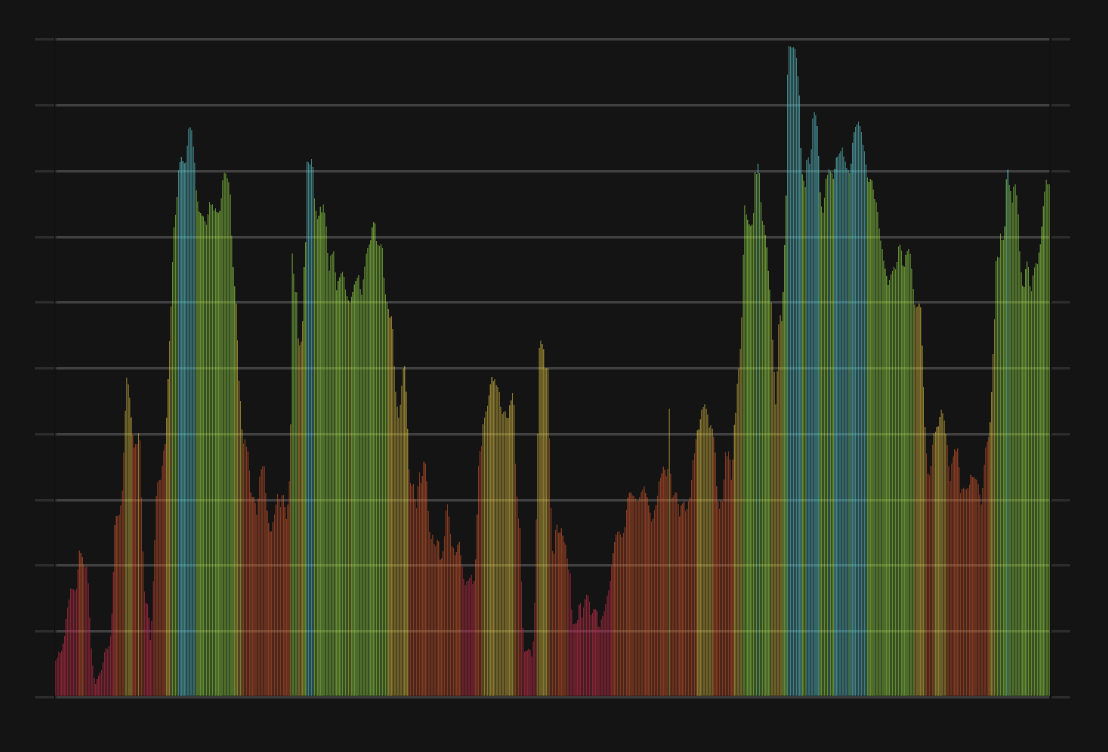

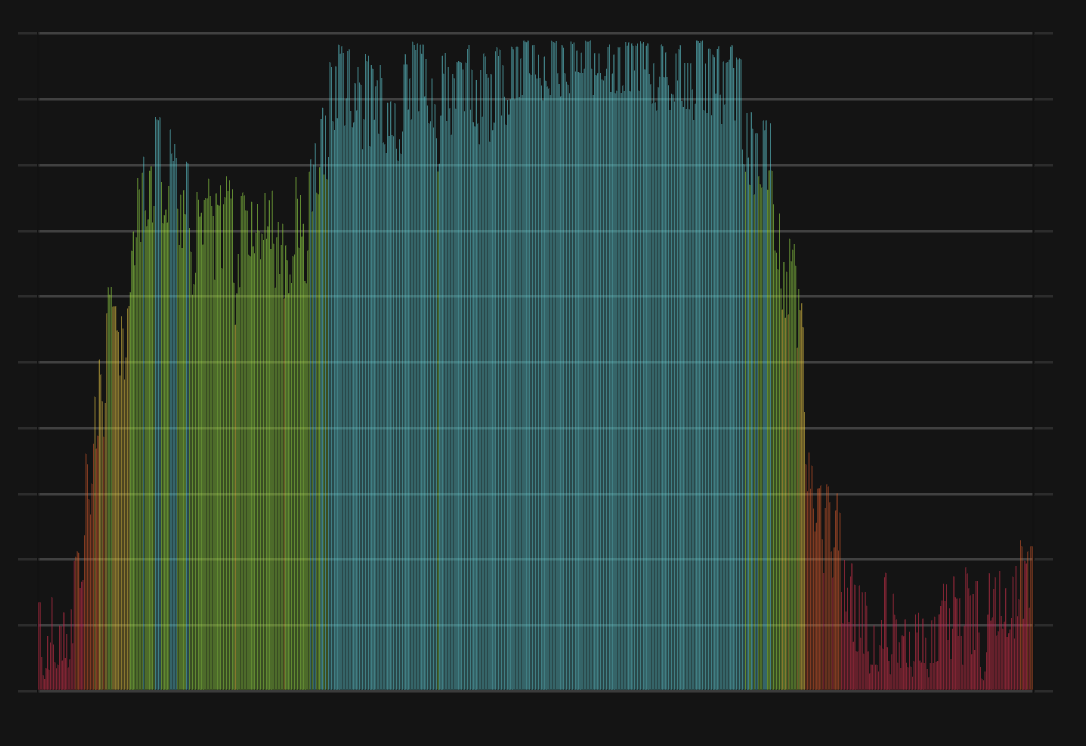

Ripple CFGI Score & XRP Price History

XRP Price & Ripple Sentiment Breakdown Charts

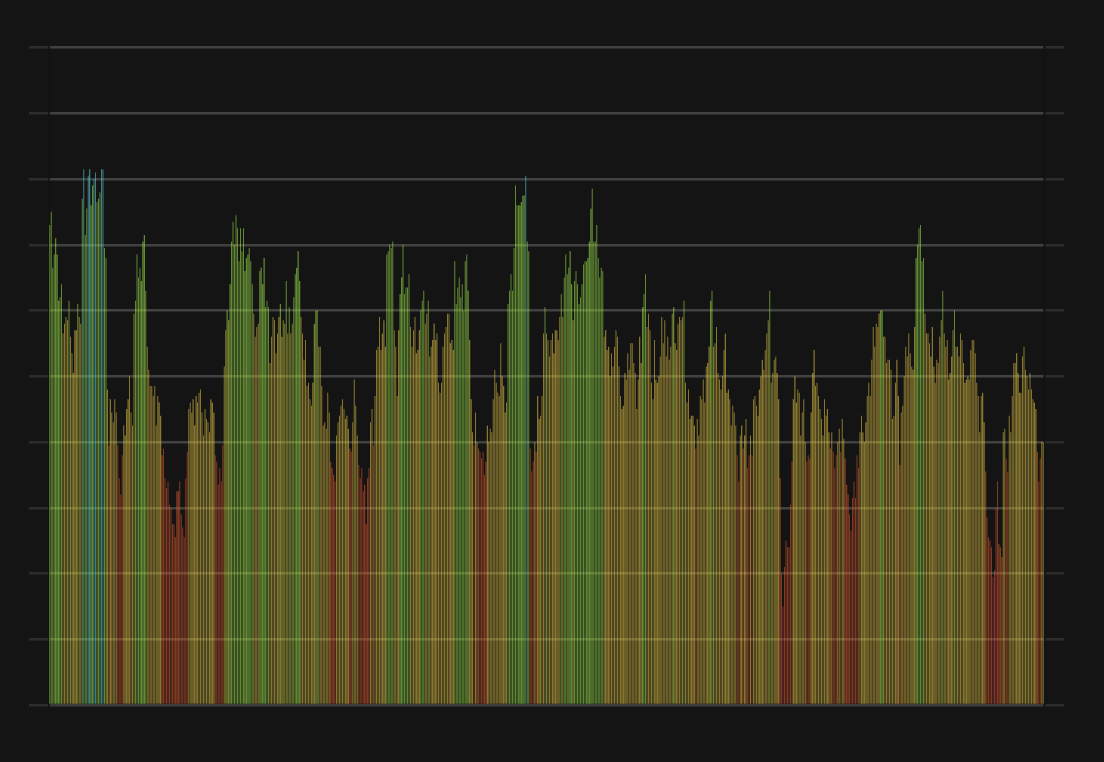

Price Score Sentiment

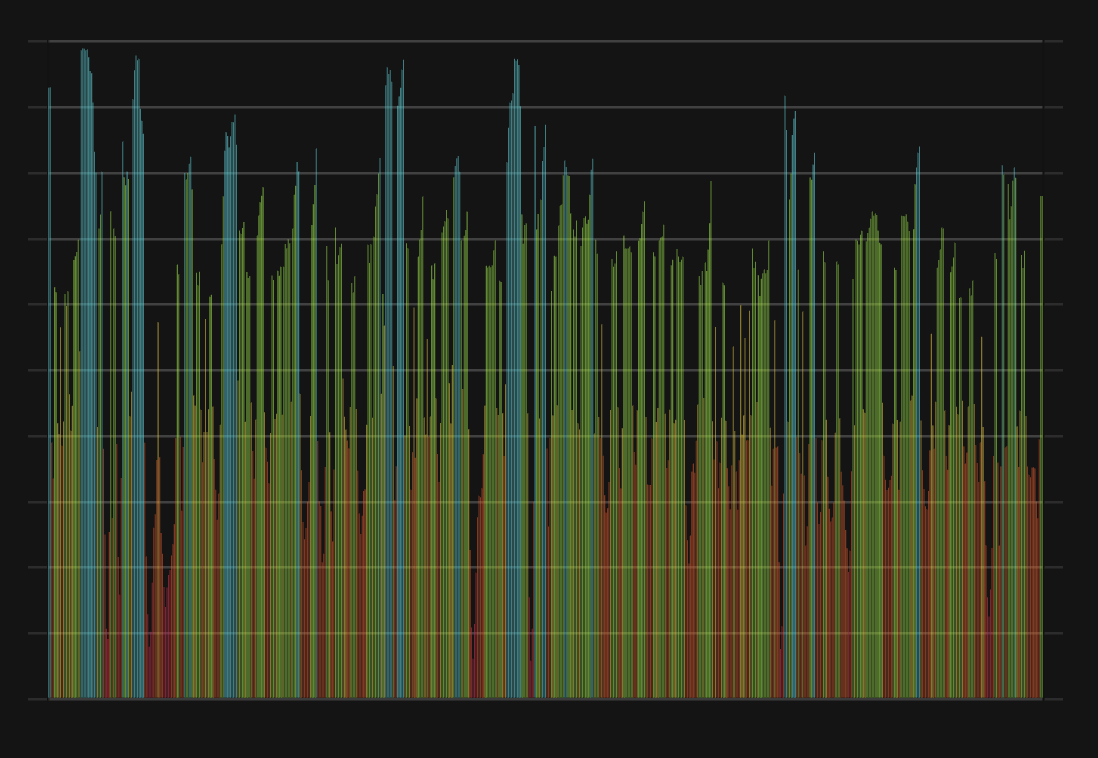

Volatility Sentiment

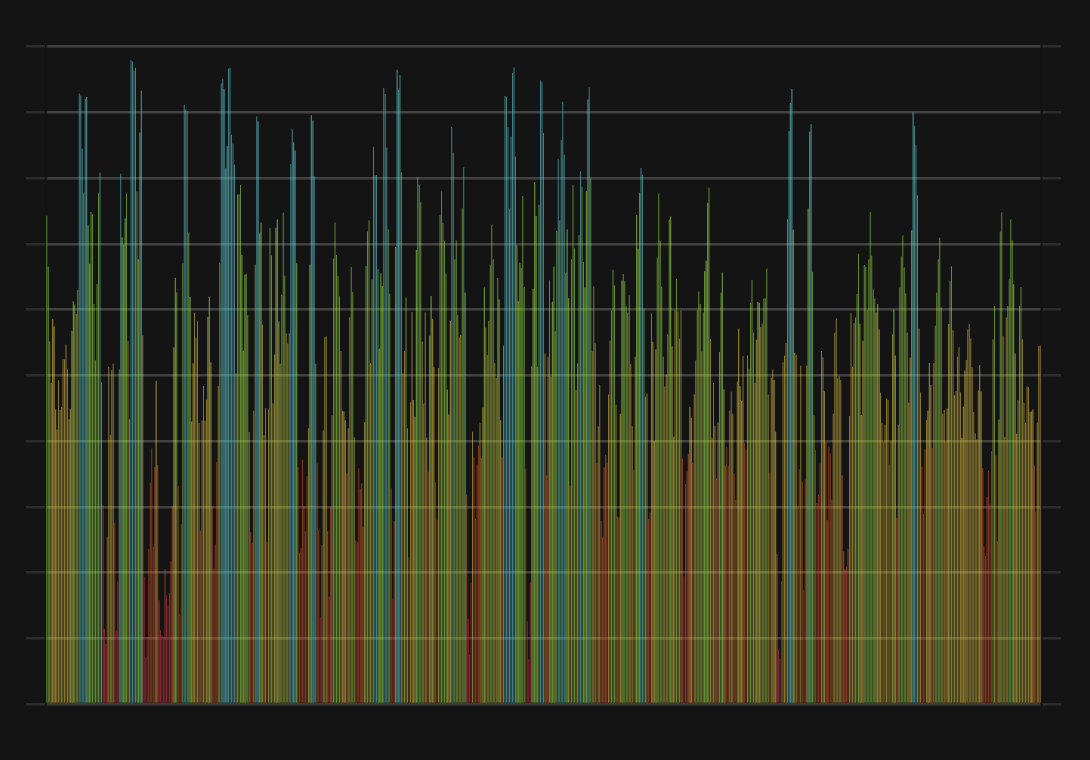

Volume Sentiment

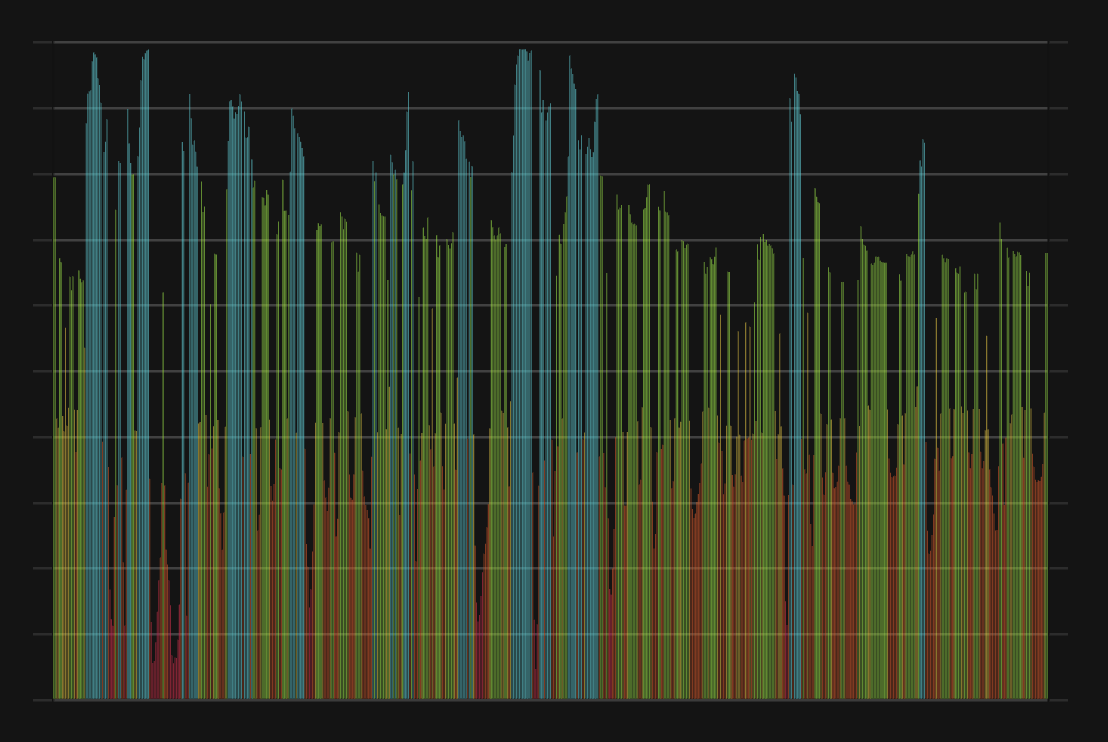

Impulse Sentiment

Technical Sentiment

Social Sentiment

Dominance Sentiment

Search Sentiment

Whales Sentiment

Order Book Sentiment