Historical Values

-

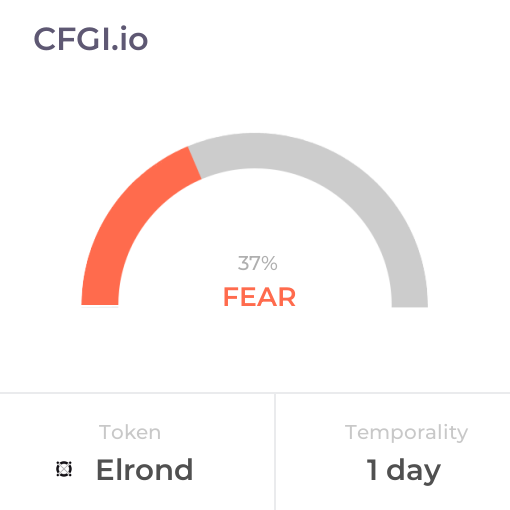

Now

Greed 63 -

Yesterday

Greed 63 -

7 Days Ago

Greed 63 -

1 Month Ago

Greed 63

MultiversX Breakdown

Price Score Greed

The Price Score indicator is a relevant indicator to analyze and assign the MultiversX price evolution a certain numerical value.

This module studies the price trend to determine if the MultiversX market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current MultiversX price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the MultiversX Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in MultiversX bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Greed

The Impulse indicator measures the current MultiversX price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the MultiversX market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Neutral

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for MultiversX the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Greed

Dominance Extreme Greed

This other indicator takes into account the dominance of MultiversX with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases MultiversX's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of MultiversX and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on MultiversX has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in MultiversX. For this, specific search terms are used that determine the purchasing or ceding interest of MultiversX, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Fear

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of MultiversX and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of MultiversX moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Greed

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for MultiversX on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

MultiversX News

MultiversX News

AI predicts ADA and EGLD price amid potential Cardano-MultiversX collaboration

Sentiment: Positive

Read moreChinese giant Alibaba to partner with MultiversX as EGLD enters the Asian market

Sentiment: Positive

Read moreMultiversX (EGLD) Continues To Lead All Crypto Gaming Projects in Level of Development Activity: Santiment

Sentiment: Positive

Read moreMultiversX (EGLD) Clocks More Development Activity Than Any Other Crypto Gaming Project: Santiment

Sentiment: Positive

Read moreCryptocurrency Prices Today Aug 30: BTC & ETH Fight Turbulence, BEAM & EGLD Soar 4%

Sentiment: Neutral

Read moreElrond Price Prediction 2024, 2025, 2030: Will EGLD Price Reclaim $100 This Year?

Sentiment: Positive

Read moreElrond Price Prediction 2024, 2025, 2030: Will EGLD Price Reclaim $50 In July?

Sentiment: Positive

Read moreBinance Announces Support for Chiliz (CHZ) and MultiversX (EGLD) Network Upgrades & Hard Forks

Sentiment: Positive

Read moreElrond Price Prediction 2024, 2025, 2030: Will EGLD Reach The $100 Mark This Year?

Sentiment: Positive

Read moreMultiversX (EGLD) Marks a Stunning 81% Surge This Year: Eyeing a Return to Peak Valuation?

Sentiment: Positive

Read morePrices and news of the crypto Tron (TRX), Helium (HNT), and MultiversX (EGLD)

Sentiment: Neutral

Read moreBitcoin's 8-week win streak is in danger, but ATOM, FIL, EGLD, and ALGO don't care

Sentiment: Positive

Read moreElrond Price Prediction 2023, 2024, 2025: Will EGLD Reach The $50 Mark This Year?

Sentiment: Positive

Read morePrices and news of crypto assets MultiversX (EGLD), formerly Elrond, and Chainlink (LINK)

Sentiment: Neutral

Read moreElrond Price Prediction 2023, 2024, 2025: Will EGLD Reach The $50 Mark In 2023?

Sentiment: Positive

Read moreDO, GRT, FXS, INJ, CFX, LTC Enjoy Market Upswing as Top Gainers; RPL, XDC, KLAY, SUI, BCH, EGLD Face Downward Pressure

Sentiment: Positive

Read moreWoo, CFX, FTM, RPL, CRV, LRC Soar as Top Gainers; SUI, TON, HT, EGLD, BTT, CRO Face Market Declines

Sentiment: Neutral

Read moreMKR, FXS, RPL, CHZ, LEO Shine as Top Gainers; RNDR, ICP, EGLD, HT, HBAR, XDC Face Downturns

Sentiment: Neutral

Read moreDaily Crypto Movers: CRO, IMX, WOO, ISP, RNDR, and SOL Lead Gains; EGLD, XMR, FLR, BNB, STX, and BCH Experience Losses

Sentiment: Neutral

Read moreDaily Crypto Movers: EGLD, RNDR, INJ, CSPR, and OSMO Lead Gains; Cake, NEAR, LTC, Algo, LUNA, and EOS Experience Losses

Sentiment: Neutral

Read moreCrypto market: latest news regarding Shiba Inu (SHIB), Elrond (EGLD) and Ripple (XRP)

Sentiment: Neutral

Read moreCrypto news and prices of Polygon (MATIC), Elrond (EGLD) and Chainlink (LINK)

Sentiment: Neutral

Read moreNews and price analysis for crypto assets Elrond (EGLD), Stellar (XLM) and Velo (VELO)

Sentiment: Neutral

Read moreCrypto Price Today Mar 1st: SingularityNET and Maker Coin Jumps 17% While EGLD Shows a 2% drop

Sentiment: Neutral

Read moreMultiversX (EGLD) and Enjin Coin (ENJ) Suffer Loss As Whales Side With Collateral Network (COLT)

Sentiment: Neutral

Read moreTHETA, LIDO, KLAY and EGLD flash bullish signs as Bitcoin recaptures $23K

Sentiment: Positive

Read moreFTM, EGLD, and MATIC To Make a Comeback Anytime Soon! Analyst Maps Next Levels

Sentiment: Positive

Read more100 million new users to gain access to the MultiversX (EGLD) ecosystem via Coinbase listing

Sentiment: Positive

Read moreElrond (EGLD) Price Holds Steady Ahead of Fed Meeting – Is a Breakout Incoming?

Sentiment: Positive

Read moreOryen (ORY) Huge Opportunity To Become Bigger Than Elrond (EGLD), Quant (QNT), And OKB (OKB)

Sentiment: Positive

Read moreBest high-growth cryptocurrencies to get on October 4: QNT, MKR and EGLD

Sentiment: Positive

Read more5 Cryptos To Get Rich: Oryen (ORY), Maker (MKR), Fantom (FTM), Elrond (EGLD) And Chainlink (LINK)

Sentiment: Positive

Read moreEGLD investors may finally get a win, is Elrond's latest development the reason

Sentiment: Positive

Read moreElrond Gains Access to 300M Users With New Partnership, Helping EGLD Price Breakout

Sentiment: Positive

Read moreUniglo's (GLO) Stunning Performance Shocks Cronos (CRO) And Elrond (EGLD) Ecosystems

Sentiment: Neutral

Read moreThe Sandbox (SAND) and Elrond (EGLD) will be overtaken by Flasko (FLSK) in 2023

Sentiment: Positive

Read moreElrond (EGLD) Price Prediction 2022, 2023, 2024, 2025: How High Will EGLD Go?

Sentiment: Neutral

Read moreElrond Partners with Revolut to Make EGLD Available to Over 20M Users in 30+ Countries

Sentiment: Positive

Read moreElrond (EGLD) Builds Bearish Sentiment, Will Price Coil Up To 80 Instead?

Sentiment: Negative

Read moreElrond Network Watch: Consider This Before Filling Up Your Wallet With EGLD

Sentiment: Neutral

Read moreElrond (EGLD), Tezos (XTZ) Show Signs of Revival While Chronoly Grows By 560%

Sentiment: Neutral

Read moreGenuine Use Case Could Send Uniglo.io (GLO) Into The Top 100 List Alongside Axie Infinity (AXS) And Elrond (EGLD)

Sentiment: Neutral

Read moreElrond (EGLD) Price Prediction 2022: Will The EGLD Price Claim $500 This Year?

Sentiment: Neutral

Read moreSheild Your Portfolio From Bear Market With These Potential Big Gainers: Gnox (GNOX), Elrond (EGLD) And UniSwap (UNI)

Sentiment: Neutral

Read moreBear Market 2022: Purchase Elrond (EGLD), Near Protocol (NEAR) And RoboApe (RBA) For Future Gains

Sentiment: Positive

Read moreBinance Halts Deposits and Withdrawals of EGLD to Investigate Potential Security Issue on the Elrond Network

Sentiment: Negative

Read moreIs EGLD [Elrond] due for a major comeback after retesting structural support

Sentiment: Positive

Read moreDecoding the Top 3 Cryptocurrency Buys of this Season: Firepin Token (FRPN), Elrond (EGLD), and Tezos (XTZ)

Sentiment: Neutral

Read morePlan an early retirement with Tezos (XTZ), Quitriam Finance (QTM), and Elrond (EGLD)

Sentiment: Neutral

Read moreYou can thank us later - 2 cryptos to buy in May: Logarithmic Finance (LOG) and Elrond (EGLD)

Sentiment: Positive

Read moreElrond (EGLD) Offers a Powerful 1 Year Staking Program for Itheum Holders

Sentiment: Positive

Read moreSkynet EGLD Capital Fund Raises $40 Million to Invest in the Elrond Ecosystem

Sentiment: Neutral

Read moreMaiar Launchpad Big Success For The Most Ambitious Startups From Elrond (EGLD)

Sentiment: Positive

Read moreElrond Network Introduces Metabonding for Web3 Startups Staking EGLD and LKMEX Open

Sentiment: Positive

Read moreHistorical Values

-

Now

Greed 63 -

Yesterday

Neutral 66 -

7 Days Ago

Neutral 46 -

1 Month Ago

Neutral 42

MultiversX Breakdown

Price Score Greed

The Price Score indicator is a relevant indicator to analyze and assign the MultiversX price evolution a certain numerical value.

This module studies the price trend to determine if the MultiversX market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current MultiversX price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the MultiversX Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in MultiversX bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Greed

The Impulse indicator measures the current MultiversX price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the MultiversX market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Neutral

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for MultiversX the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Greed

Dominance Extreme Greed

This other indicator takes into account the dominance of MultiversX with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases MultiversX's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of MultiversX and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on MultiversX has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in MultiversX. For this, specific search terms are used that determine the purchasing or ceding interest of MultiversX, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Fear

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of MultiversX and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of MultiversX moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Greed

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for MultiversX on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

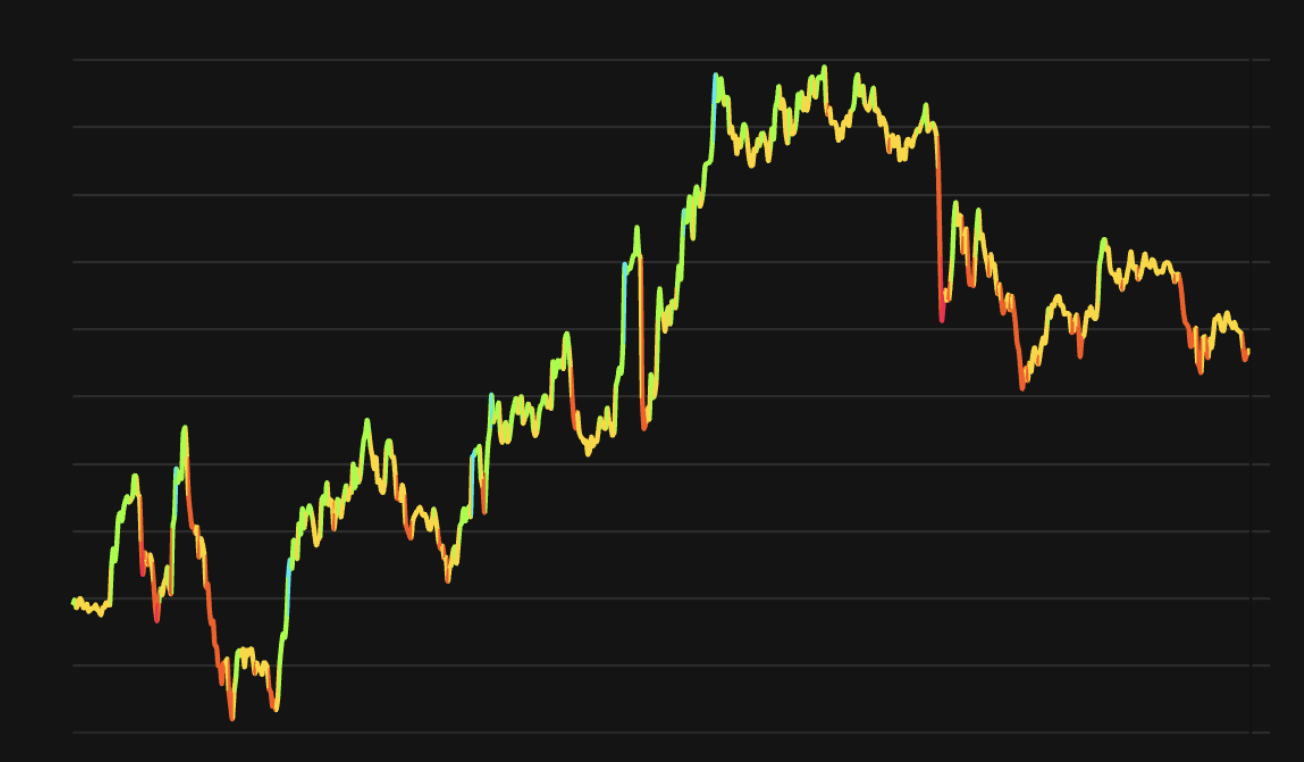

EGLD Price

1 EGLD = $15.37

MultiversX CFGI Score & EGLD Price History

EGLD Price & MultiversX Sentiment Breakdown Charts

Price Score Sentiment

Volatility Sentiment

Volume Sentiment

Impulse Sentiment

Technical Sentiment

Social Sentiment

Dominance Sentiment

Search Sentiment

Whales Sentiment

Order Book Sentiment