Historical Values

-

Now

Greed 78 -

Yesterday

Greed 78 -

7 Days Ago

Greed 78 -

1 Month Ago

Greed 78

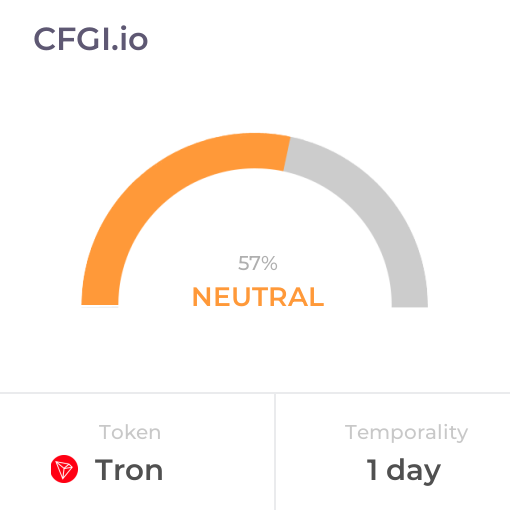

Tron Breakdown

Price Score Extreme Greed

The Price Score indicator is a relevant indicator to analyze and assign the Tron price evolution a certain numerical value.

This module studies the price trend to determine if the Tron market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Extreme Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Tron price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Extreme Greed

Like volatility, the Tron Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Tron bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Greed

The Impulse indicator measures the current Tron price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Tron market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Greed

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Tron the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Greed

Dominance Neutral

This other indicator takes into account the dominance of Tron with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Tron's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Tron and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Extreme Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Tron has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Tron. For this, specific search terms are used that determine the purchasing or ceding interest of Tron, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Neutral

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Tron and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Tron moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Neutral

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Tron on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

Tron News

Tron News

TRON (TRX) Surges Amid Institutional Adoption: Key Analysis and Market Outlook

Sentiment: Positive

Read moreTRX Gears Up for Breakout as Tron Inc. Goes Public—Is $0.32 the Launch Point?

Sentiment: Positive

Read moreDogecoin Surges 6.2%, Flips TRX Amid Institutional Accumulation and Meme Revival

Sentiment: Positive

Read moreTRON (TRX) Surges Amid Institutional Adoption, Rebranding, and Record USDT Transfers

Sentiment: Positive

Read moreSRM Entertainment rebrands as Tron Inc., to adopt ‘TRON' ticker after staking 365 million TRX for crypto treasury

Sentiment: Positive

Read moreTRON (TRX) Surges Amid Record USDT Transfers, Institutional Adoption, and Bullish Momentum

Sentiment: Positive

Read moreProvably fair crypto casino expands TRX block hash betting to Binance Chain

Sentiment: Positive

Read moreTRON (TRX) Price: Technical Indicators Show Continued Bullish Momentum as Token Trades at $0.30

Sentiment: Positive

Read moreTRON (TRX) Surges Amid Institutional Adoption, SkyLink Launch, and Bullish Momentum

Sentiment: Positive

Read moreTRON (TRX) Surges to $0.31: Institutional Adoption, SkyLink Launch, and Bullish Momentum

Sentiment: Positive

Read moreTRON (TRX) Surges Amid Bullish Momentum, Institutional Adoption, and Regulatory Challenges

Sentiment: Neutral

Read moreTRON (TRX) Price Analysis: Strong Bullish Momentum Points to Further Gains in 2025

Sentiment: Positive

Read moreTRON (TRX) Price Prediction 2025: Can TRX Reach $0.63 or Will Volatility Strike First?

Sentiment: Neutral

Read moreTron Price Analysis: TRX Outperforms BTC as Stablecoin Deposits Hit $80 Billion

Sentiment: Positive

Read moreTRX revenue hits 4-year low as $185 mln exits TRON – Is a deeper dump underway?

Sentiment: Negative

Read moreXRP, TRX, and DOGE Lead Bullish Momentum as Perpetual Funding Rates Surge

Sentiment: Positive

Read moreXRP, TRX, DOGE Lead Majors With Positive Funding Rates as Bitcoin's Traditionally Weak Quarter Begins

Sentiment: Positive

Read moreSRM Entertainment stakes 365 million TRX amid $100 million Tron treasury strategy

Sentiment: Positive

Read moreTron (TRX) Surpasses Dogecoin in Market Cap as Stablecoin Utility Drives Growth

Sentiment: Positive

Read moreChatGPT o3's 38-Signal AI TRX Price Forecast Reveals Bullish Structure Amid $80 Billion USDT Milestone

Sentiment: Positive

Read moreDOGE Price Prediction: Dogecoin Set to Overtake Tron (TRX) as Bulls Target 5-Day Pivot Point

Sentiment: Positive

Read moreUSDT Supply on Tron Hits $80 Billion, Raising Bullish Speculation for TRX

Sentiment: Positive

Read moreTECHNICAL ANALYSIS OF TRON ($TRX) PRICE: BULLISH MOMENTUM, MASSIVE ADOPTION, AND RESILIENCE AMID GEOPOLITICAL TENSIONS

Sentiment: Positive

Read moreSolana (SOL), Tron (TRX), Sui (SUI) Price Analysis: Layer 1s Facing Longer Term Bearish Price Momentum

Sentiment: Negative

Read moreTron (TRX) Skyrockets 973% in Whale Moves Amid $343 Million Market Sell-off

Sentiment: Neutral

Read moreTron Goes Public: Billionaire Justin Sun's Bold Reverse Merger Sparks $TRX Surge

Sentiment: Positive

Read moreBreaking: Tron ($TRX) Plans US Public Offering – What This Means for Crypto

Sentiment: Positive

Read moreSRM to build $210M TRX treasury, rebrand as Tron Inc. with Justin Sun as adviser

Sentiment: Positive

Read moreTron Looks to go Public in the U.S., Form Strategy Like TRX Holding Firm: FT

Sentiment: Positive

Read moreTRON (TRX) Sharpe Ratio Signals ‘Far from Overheating' as USDT Activity Hits Record High

Sentiment: Neutral

Read moreTron ($TRX) Primed for Lift-Off After Range Breakout—Bullish Channel Points to $0.30

Sentiment: Positive

Read moreTRX Price Rebounds On Trump-Backed Stablecoin Launch: Can Bulls Break $0.30?

Sentiment: Positive

Read moreHTX Launches TRX Options, Empowering Users with Flexible and Diversified Trading Strategies

Sentiment: Positive

Read moreTRX Price Up As Tron Rolls Out The Red Carpet For Trump-Backed Stablecoin

Sentiment: Positive

Read moreTRON kicks off vote on reducing TRX block and voting rewards to boost deflation

Sentiment: Negative

Read moreDecoupling Trend Emerges in Tron Network: TRX Rises, Smart Contract Creation Flattens

Sentiment: Neutral

Read moreTRON records new all-time high in daily active addresses — is TRX gearing up for a breakout?

Sentiment: Positive

Read moreTron (TRX) to hit $1 in this Bull Cycle, Could Overtake Solana in Market Capitalization

Sentiment: Positive

Read moreTron's (TRX) Transfer Volume Soars to $121 Billion in May, Marking a New All-Time High

Sentiment: Positive

Read moreAnalyst Explains Reason Behind Tron Price Sluggishness — Are TRX Bears Now In Control?

Sentiment: Negative

Read moreJustin Sun's Trump Jr. Photo-Op Fuels TRX Rally—Is Political Clout the Secret Weapon for Crypto's Next Surge?

Sentiment: Positive

Read moreTron's TRX Faces Rising Risk of Bearish Momentum After High-Volume Drop to 27 Cents

Sentiment: Negative

Read moreSunPump to Boost TRON Meme Coin Ecosystem – What Does it Mean for TRX Price?

Sentiment: Neutral

Read moreTron Price Analysis: TRX Halts Below $0.30 as Justin Sun Attends Trump Dinner

Sentiment: Neutral

Read moreTRON's next move hinges on breaking $0.28 – Are TRX bulls ready to charge?

Sentiment: Positive

Read moreTron (TRX) Looks to Reclaim ATH as Sharpe Ratio and Risk Metrics Signal Strength

Sentiment: Positive

Read moreTron (TRX) Price: Network Surpasses Ethereum in USDT Circulation with $75.8 Billion

Sentiment: Positive

Read moreHistorical Values

-

Now

Greed 78 -

Yesterday

Neutral 78 -

7 Days Ago

Greed 68 -

1 Month Ago

Neutral 46

Tron Breakdown

Price Score Extreme Greed

The Price Score indicator is a relevant indicator to analyze and assign the Tron price evolution a certain numerical value.

This module studies the price trend to determine if the Tron market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Extreme Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Tron price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Extreme Greed

Like volatility, the Tron Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Tron bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Greed

The Impulse indicator measures the current Tron price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Tron market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Greed

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Tron the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Greed

Dominance Neutral

This other indicator takes into account the dominance of Tron with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Tron's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Tron and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Extreme Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Tron has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Tron. For this, specific search terms are used that determine the purchasing or ceding interest of Tron, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Neutral

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Tron and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Tron moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Neutral

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Tron on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

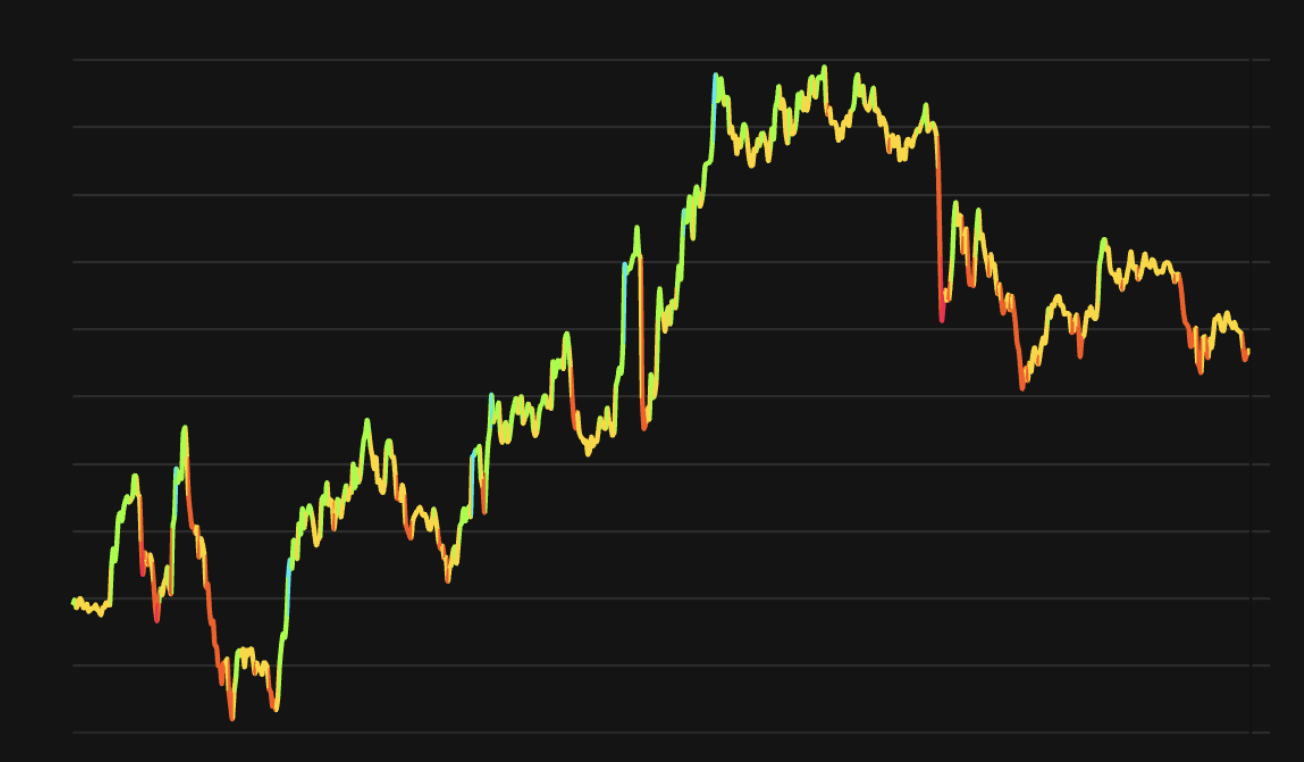

TRX Price

1 TRX = $0.3264

Tron CFGI Score & TRX Price History

TRX Price & Tron Sentiment Breakdown Charts

Price Score Sentiment

Volatility Sentiment

Volume Sentiment

Impulse Sentiment

Technical Sentiment

Social Sentiment

Dominance Sentiment

Search Sentiment

Whales Sentiment

Order Book Sentiment

![TRON [TRX] price surge imminent? – These KEY signs say yes](https://crypto.snapi.dev/images/v1/4/g/4/tron-featured-728742.webp)