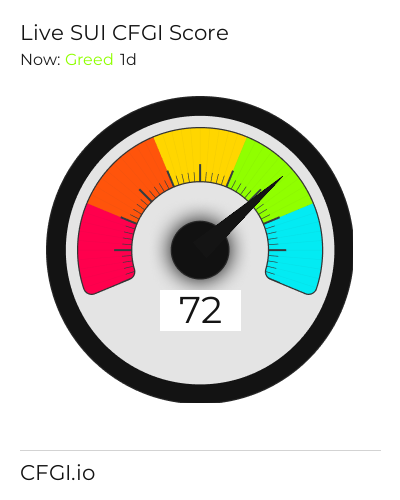

Historical Values

-

Now

Neutral 57 -

Yesterday

Neutral 57 -

7 Days Ago

Neutral 57 -

1 Month Ago

Neutral 57

Sui Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Sui price evolution a certain numerical value.

This module studies the price trend to determine if the Sui market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Sui price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the Sui Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Sui bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Greed

The Impulse indicator measures the current Sui price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Sui market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Neutral

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Sui the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Extreme Greed

Dominance Neutral

This other indicator takes into account the dominance of Sui with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Sui's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Sui and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Extreme Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Sui has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Sui. For this, specific search terms are used that determine the purchasing or ceding interest of Sui, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Extreme Fear

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Sui and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Sui moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Extreme Greed

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Sui on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

Sui News

Sui News

Sui (SUI), Near Protocol (NEAR), and Sonic (S) Poised to Lead Altcoin Surge

Sentiment: Positive

Read moreSolana Rival SUI Gearing Up for Major Outperformance Following Correction, According to Real Vision CEO Raoul Pal

Sentiment: Positive

Read moreTop Crypto News This Week: Bybit's Byreal Testnet, Pump.fun's New Rival, $123 Million Sui Unlock, and More

Sentiment: Neutral

Read moreSUI Price Faces Breakdown as $123M Token Unlock Threatens 38% Crash Below $2

Sentiment: Negative

Read moreSUI Price at Make-or-Break $2 Level, Will $123M Token Unlocks Trigger Crash to $1.65?

Sentiment: Negative

Read moreSui (SUI) Eyes Breakout With Bullish Dual Pattern: Is A Rally To $27 On?

Sentiment: Positive

Read moreSUI Rebounds From Key Support as Nasdaq-Listed Lion Group Eyes Treasury Purchase

Sentiment: Neutral

Read moreSui Price Prediction: Is SUI Poised to Drop to $2? Latest Price Action Suggests So

Sentiment: Negative

Read moreAptos Price Prediction: Can It Outperform Sui and Sei as On-Chain Growth Accelerates?

Sentiment: Positive

Read morePrice predictions 6/25: BTC, ETH, XRP, BNB, SOL, DOGE, ADA, HYPE, BCH, SUI

Sentiment: Positive

Read moreAurora Mobile Allocates 20% of Cash to Bitcoin, Ethereum, Solana, and SUI in Bold Treasury Shift

Sentiment: Positive

Read moreSui Foundation Launches Second Hydropower Accelerator Cohort for Blockchain Innovation

Sentiment: Positive

Read moreEverything Blockchain Commits $10M to Multi-Token Crypto Treasury Including SOL, XRP, SUI, TAO and HYPE

Sentiment: Positive

Read morePrice predictions 6/20: BTC, ETH, XRP, BNB, SOL, DOGE, ADA, HYPE, BCH, SUI

Sentiment: Negative

Read moreEverything Blockchain Commits $10M to SOL, XRP, SUI, TAO, and HYPE in Strategic Crypto Push

Sentiment: Positive

Read moreSolana (SOL), Tron (TRX), Sui (SUI) Price Analysis: Layer 1s Facing Longer Term Bearish Price Momentum

Sentiment: Negative

Read moreChatGPT's 38-Signal SUI Price Forecast Flags Major Breakout Ahead of Key Catalyst

Sentiment: Positive

Read moreSUI Reverses After Wild Swings; Trading Volume Spikes 11% Above 30-Day Average

Sentiment: Neutral

Read morePrice predictions 6/18: BTC, ETH, XRP, BNB, SOL, DOGE, ADA, HYPE, SUI, BCH

Sentiment: Negative

Read moreSUI vs. SOL Price Forecast: Which L1 Blockchain Has the Stronger Bull Case?

Sentiment: Neutral

Read moreSui Technology Powers Successful Launch of Claynosaurz's Popkins NFT Collection

Sentiment: Positive

Read moreSUI Is ‘On the Edge of a New Run Towards Highs,' Says Crypto Analyst Michaël Van De Poppe

Sentiment: Positive

Read moreSUI Price Poised for Breakout as TVL Soars and On-Chain Metrics Strengthen

Sentiment: Positive

Read moreSUI Charts A Comeback: Inverse Head And Shoulders Signals Quiet Surge Ahead

Sentiment: Positive

Read moreSUI Drops 10% to $3.02, but Is a Turnaround Forming After Buyers Step In Near $3?

Sentiment: Negative

Read morePrice predictions 6/13: BTC, ETH, XRP, BNB, SOL, DOGE, ADA, HYPE, SUI, LINK

Sentiment: Neutral

Read moreReal Vision partners with Sui to bring on-chain rewards to financial media

Sentiment: Positive

Read morePrice predictions 6/11: BTC, ETH, XRP, BNB, SOL, DOGE, ADA, HYPE, SUI, LINK

Sentiment: Positive

Read moreReal Vision and Sui Team Up to Enhance Membership with Blockchain Integration

Sentiment: Positive

Read moreSUI TVL notches double-digit gains, eyes return to $2B as ETF whispers grow

Sentiment: Positive

Read moreTrader Predicts Parabolic Sui Rally to New Highs, Says Recent $223,000,000 DEX Hack Gave ‘Amazing Opportunity'

Sentiment: Positive

Read moreHyperliquid Market Cap Rockets Past SUI On Record Hype, Hitting $42 – Will It Surpass Cardano?

Sentiment: Positive

Read moreEthereum (ETH), Solana (SOL), or Sui (SUI): Which Layer1 Will Surge Most in June 2025?

Sentiment: Positive

Read moreSUI Surges 5% on Triple Volume Breakout Amid Trade Talks Between U.S. and China

Sentiment: Positive

Read moreSui ‘A Key Pillar' To The Next Altseason — Analyst Asserts As XRP Demand Dwindles

Sentiment: Positive

Read moreSui DEX Cetus Restarts from $220 Million Exploit, Hits Top Ten DEX in Hours

Sentiment: Positive

Read moreHistorical Values

-

Now

Neutral 57 -

Yesterday

Neutral 53 -

7 Days Ago

Fear 36 -

1 Month Ago

Neutral 42

Sui Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Sui price evolution a certain numerical value.

This module studies the price trend to determine if the Sui market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Sui price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the Sui Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Sui bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Greed

The Impulse indicator measures the current Sui price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Sui market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Neutral

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Sui the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Extreme Greed

Dominance Neutral

This other indicator takes into account the dominance of Sui with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Sui's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Sui and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Extreme Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Sui has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Sui. For this, specific search terms are used that determine the purchasing or ceding interest of Sui, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Extreme Fear

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Sui and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Sui moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Extreme Greed

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Sui on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

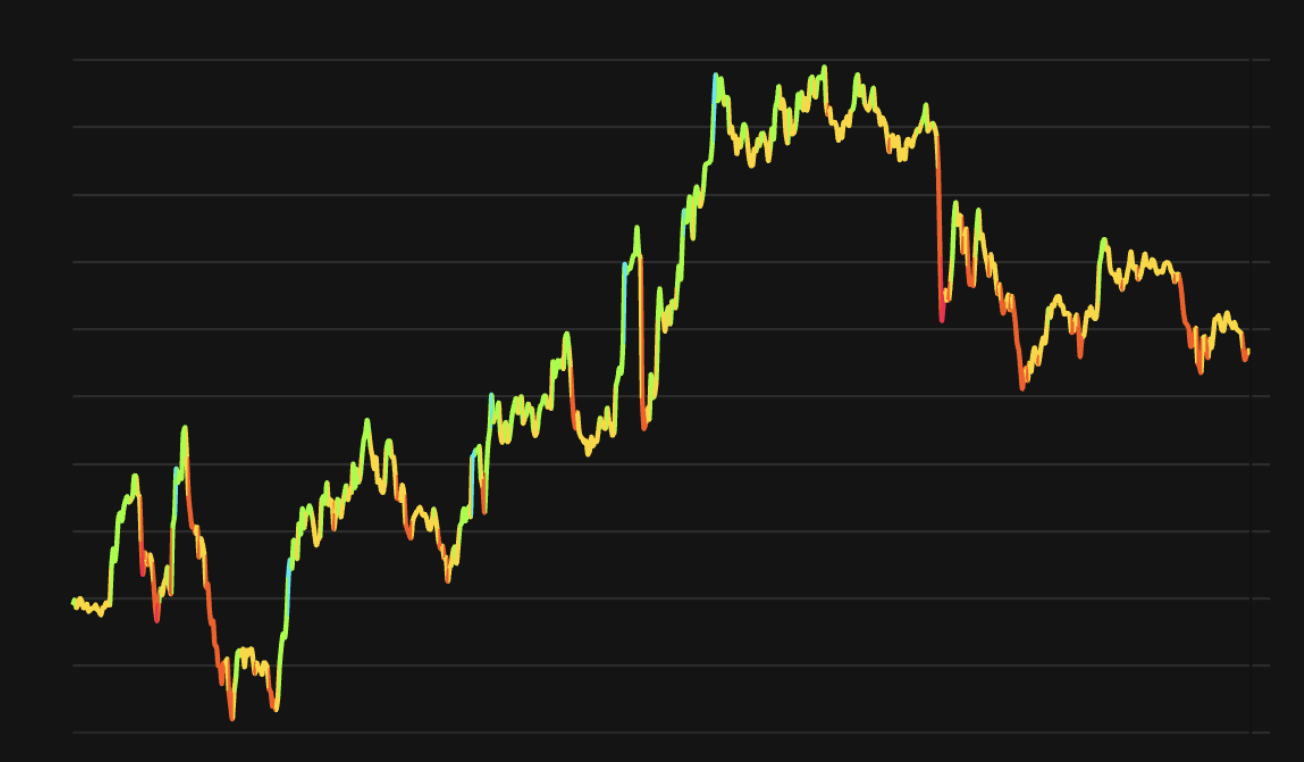

SUI Price

1 SUI = $2.97

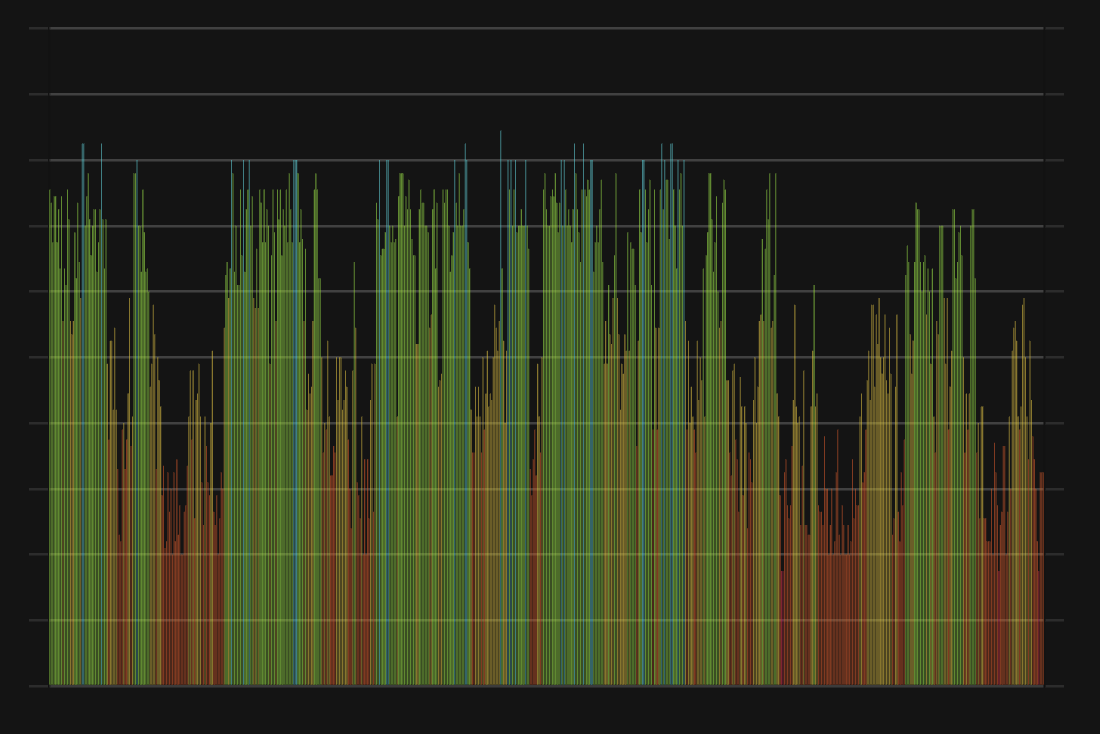

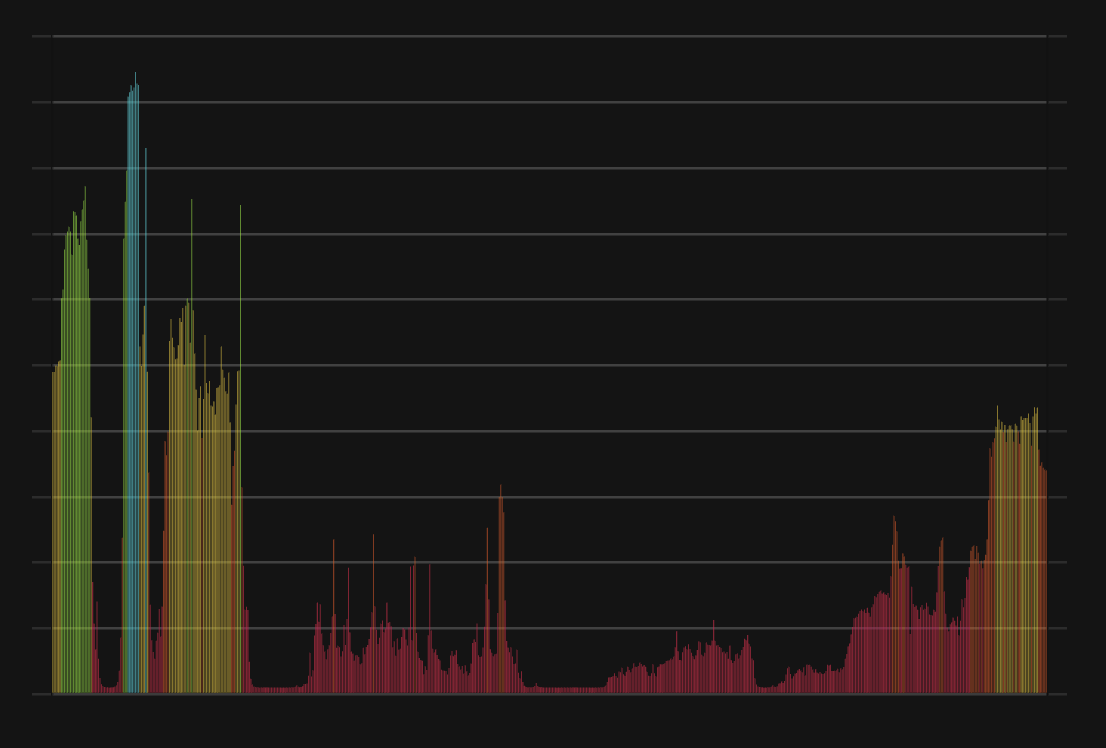

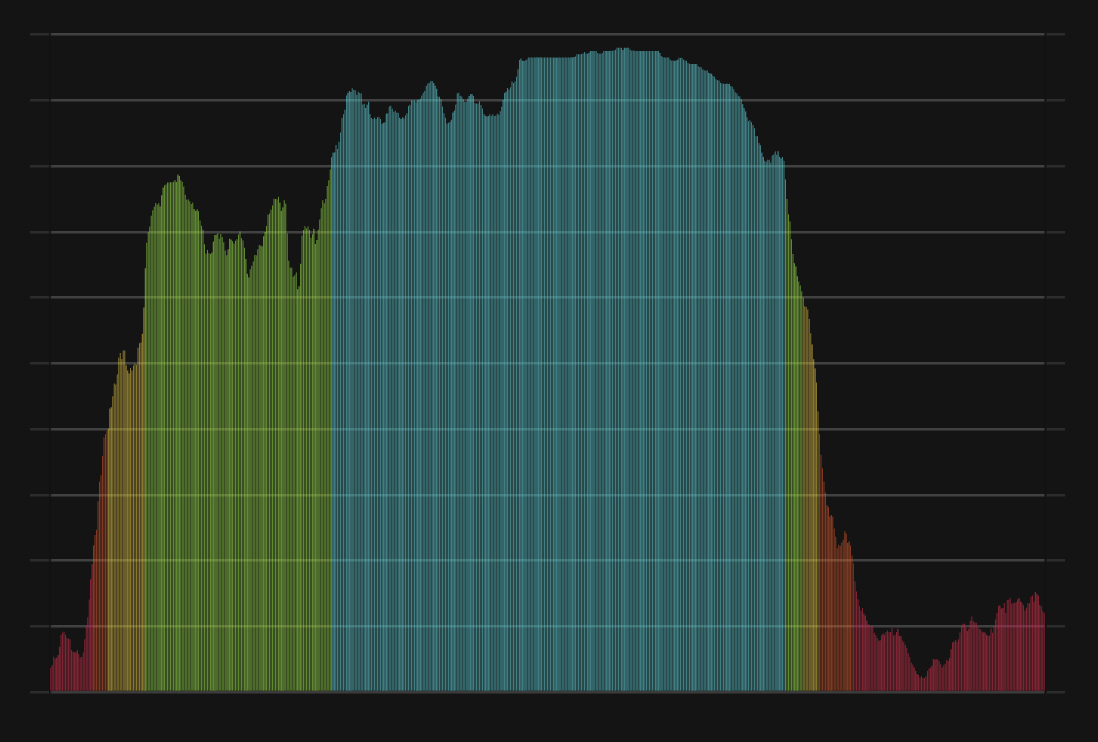

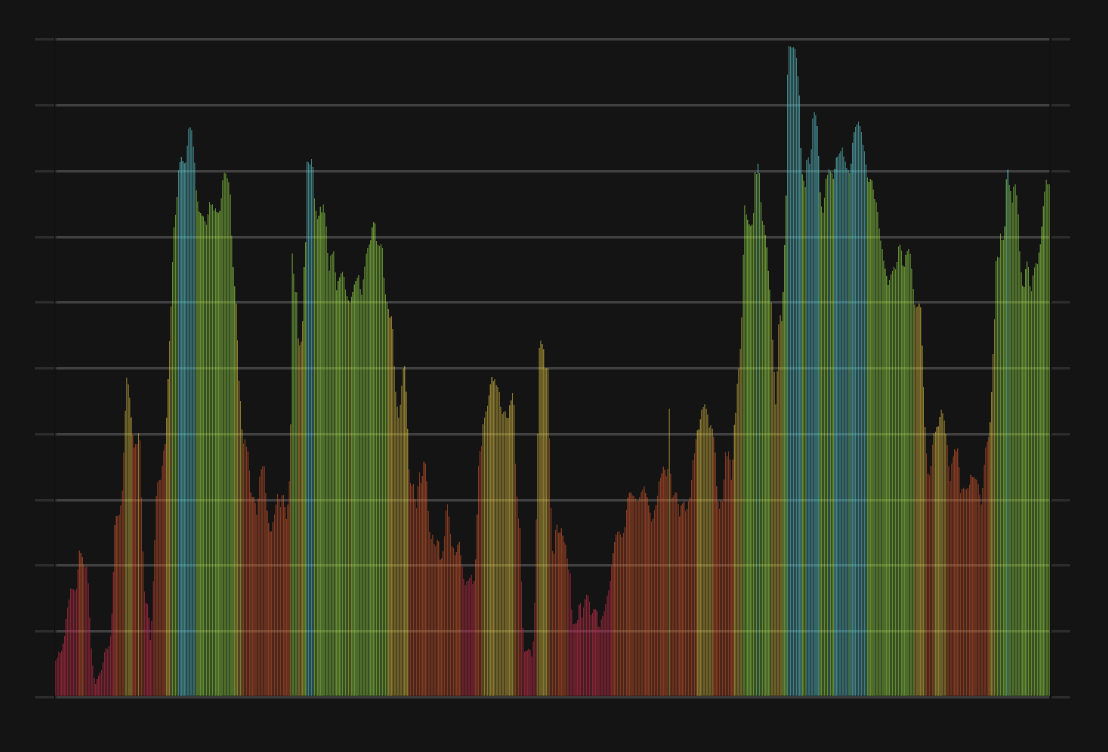

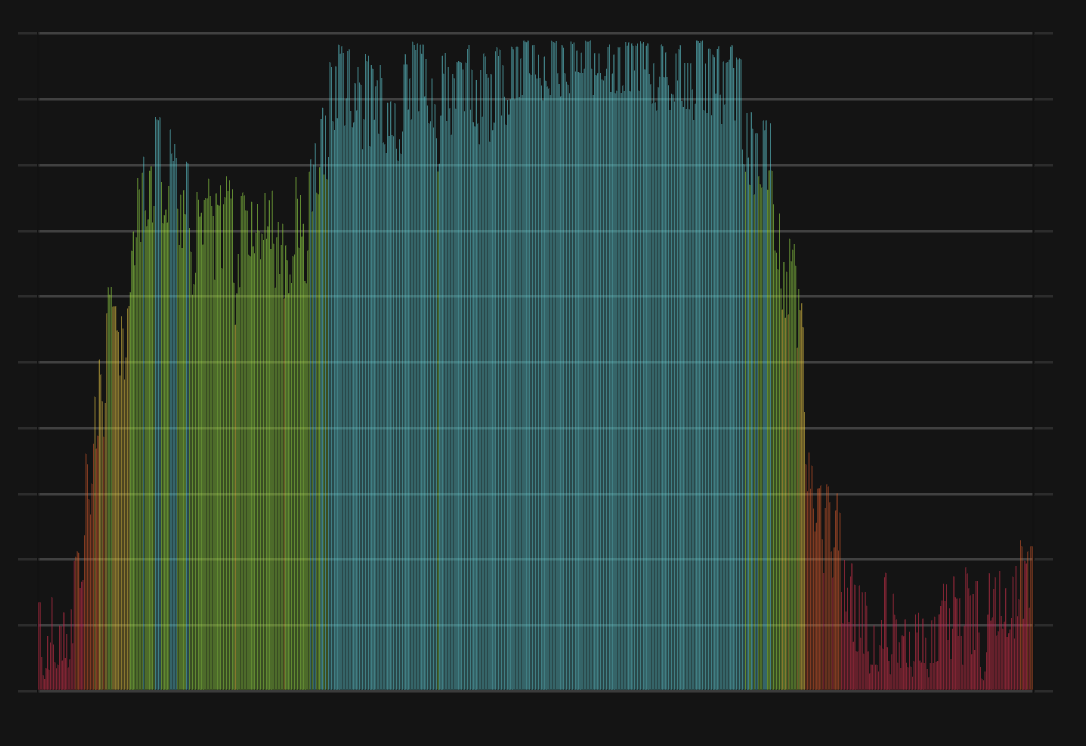

Sui CFGI Score & SUI Price History

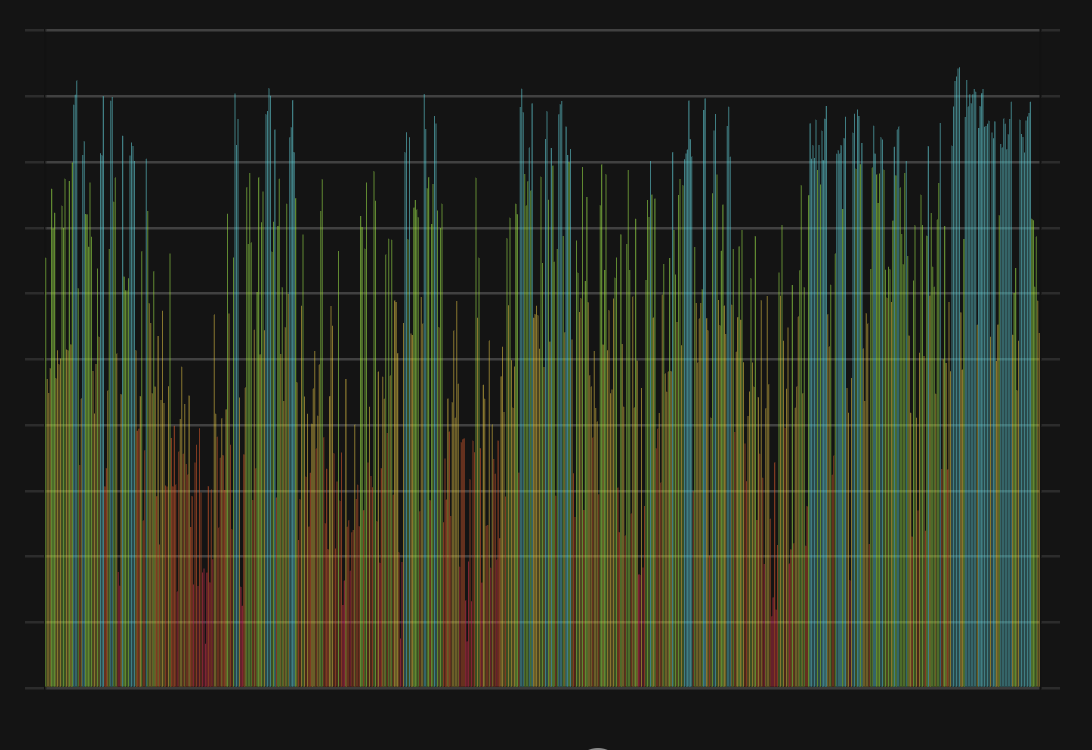

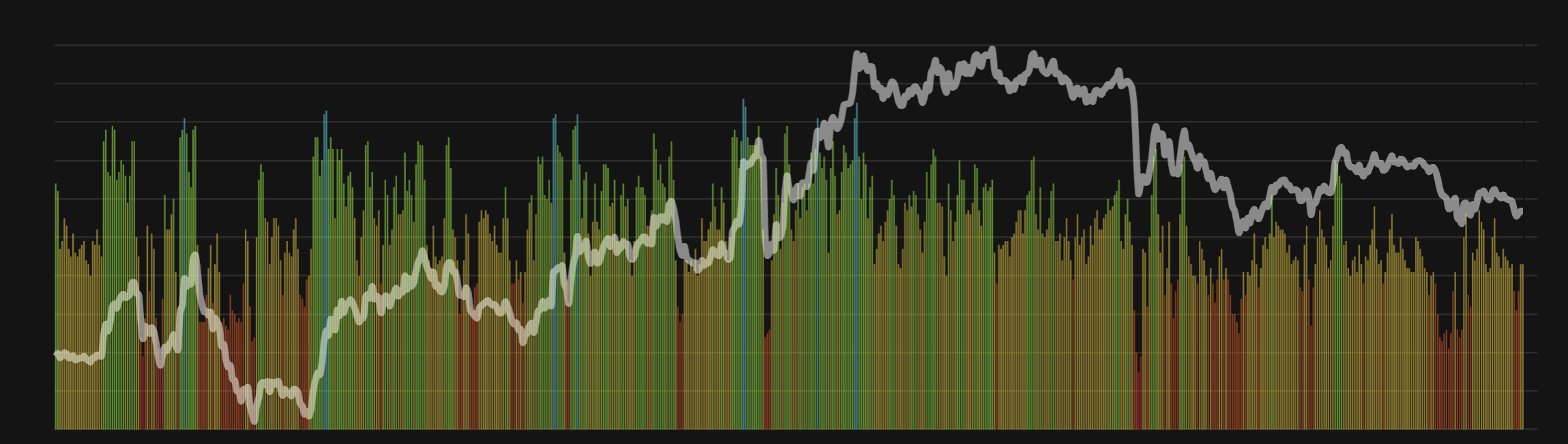

SUI Price & Sui Sentiment Breakdown Charts

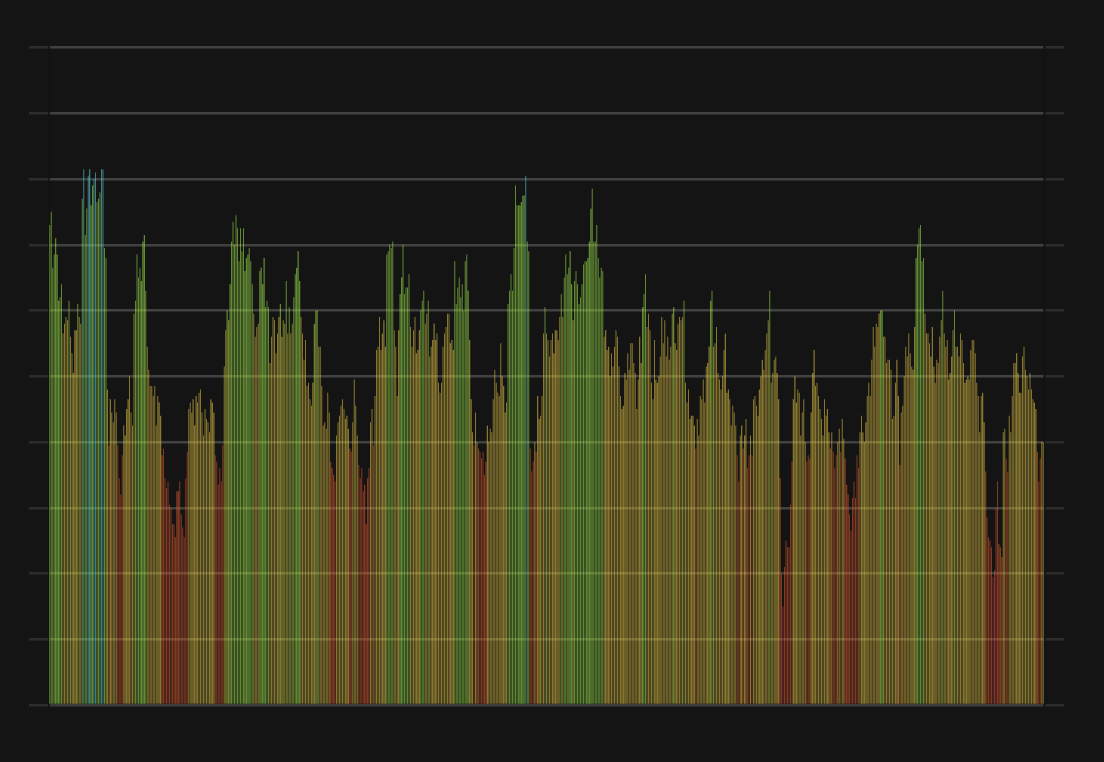

Price Score Sentiment

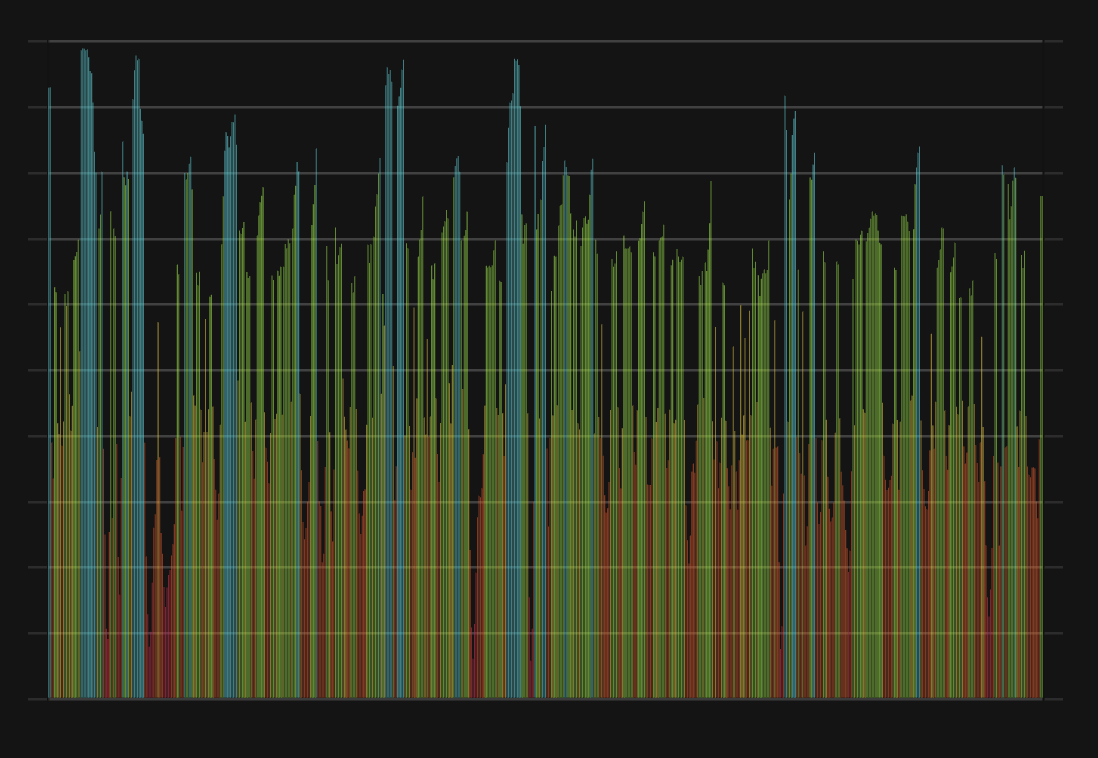

Volatility Sentiment

Volume Sentiment

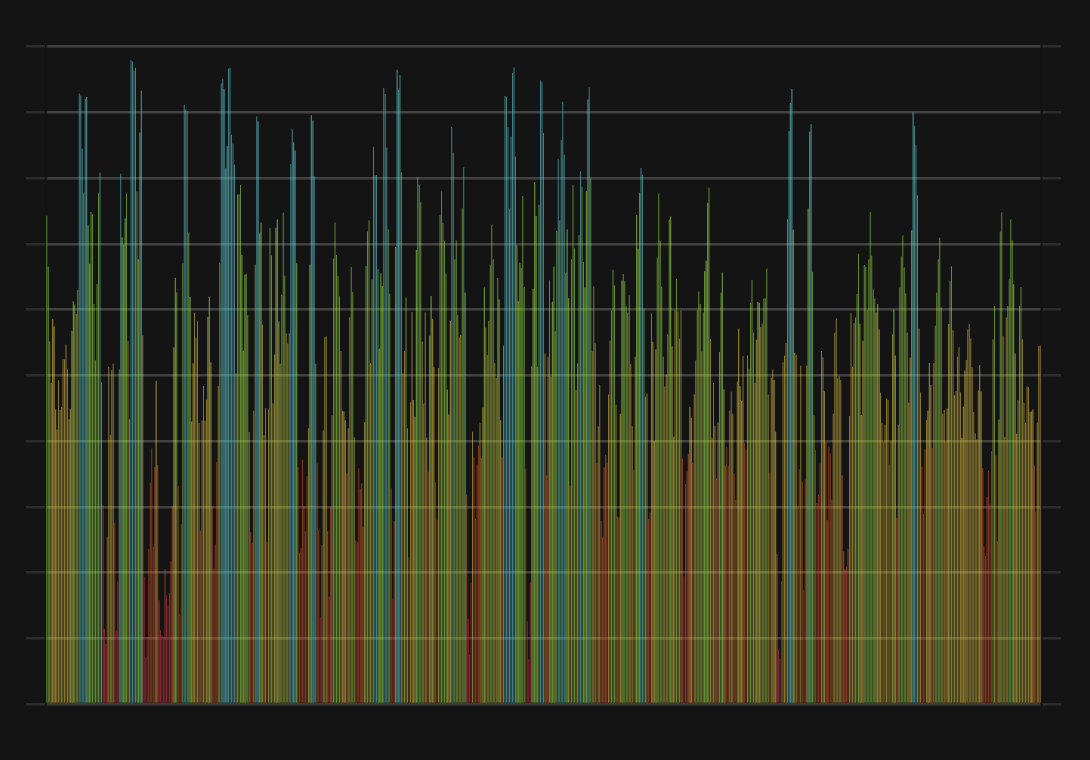

Impulse Sentiment

Technical Sentiment

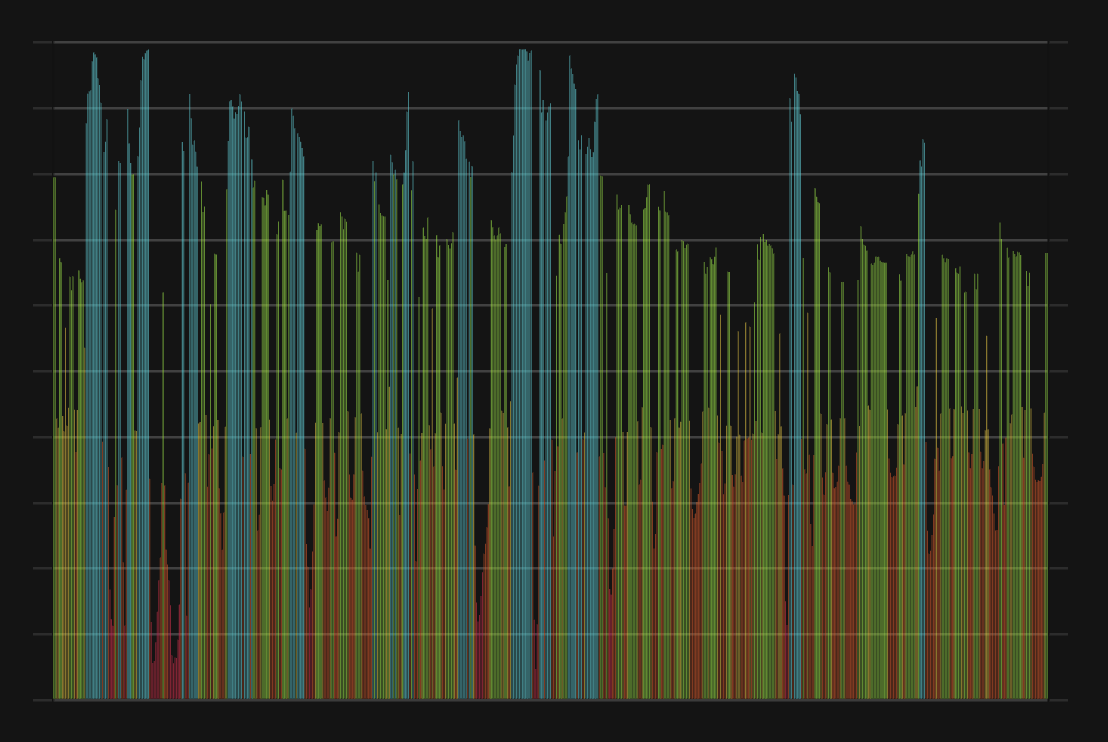

Social Sentiment

Dominance Sentiment

Search Sentiment

Whales Sentiment

Order Book Sentiment