Historical Values

-

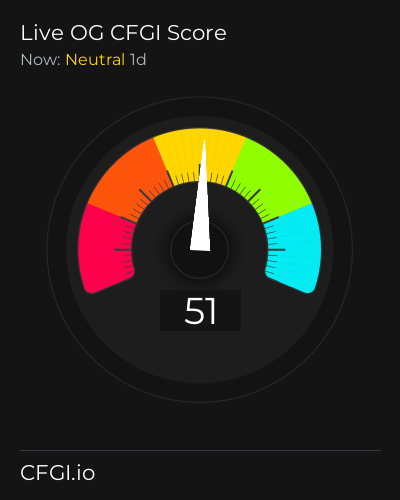

Now

Neutral 45 -

Yesterday

Neutral 45 -

7 Days Ago

Neutral 45 -

1 Month Ago

Neutral 45

OG Fan Token Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the OG Fan Token price evolution a certain numerical value.

This module studies the price trend to determine if the OG Fan Token market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Fear

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current OG Fan Token price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Fear

Like volatility, the OG Fan Token Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in OG Fan Token bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Neutral

The Impulse indicator measures the current OG Fan Token price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the OG Fan Token market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Greed

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for OG Fan Token the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Fear

Dominance Greed

This other indicator takes into account the dominance of OG Fan Token with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases OG Fan Token's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of OG Fan Token and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Fear

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on OG Fan Token has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in OG Fan Token. For this, specific search terms are used that determine the purchasing or ceding interest of OG Fan Token, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Extreme Fear

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of OG Fan Token and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of OG Fan Token moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Neutral

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for OG Fan Token on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

OG Fan Token News

OG Fan Token News

Bitcoin Freezes Over $100,000 As OG Whales ‘Dump On Wall Street': Expert

Sentiment: Negative

Read moreEthereum OG Dumps Another 501 ETH After 2-Year Dormancy – More Selling to Come?

Sentiment: Negative

Read moreBitcoin ‘OG' Wallets are Back on the Move—Will This Push the BTC Price to $110K?

Sentiment: Positive

Read moreZachXBT reveals $7M of the OG holder's stolen Bitcoin was frozen with Binance's help

Sentiment: Neutral

Read moreZachXBT says $7 million of OG Bitcoiner's stolen crypto frozen with help of Binance

Sentiment: Positive

Read more$200,000,000,000,000 BTC Market Cap Now in Play As ‘Hyperbitcoinization' Takes Shape: Bitcoin OG Adam Back

Sentiment: Positive

Read moreMonero's 50% price pump likely tied to $330m theft from OG Bitcoiner, ZachXBT says

Sentiment: Negative

Read moreBitcoin OG Foresees Ripple's XRP Doing Something Crazy And Reaching $24 This Year — But There's A Catch

Sentiment: Positive

Read morePierre Rochard, the Bitcoin Maximalist OG, on Mining, Markets and Modern Finance

Sentiment: Neutral

Read moreEthereum OG Wallet from 2017 Sells All Remaining ETH, Inks $8,660,000 in Profit: Lookonchain

Sentiment: Neutral

Read moreBitcoin OG Arthur Hayes Predicts Bitcoin ‘More Likely' To Rocket To $110,000 Amid Fed's Policy Shift

Sentiment: Positive

Read moreVitalik Buterin Calls Charges Against Bitcoin OG Roger Ver ‘Absurd' and Something To Stand Against

Sentiment: Negative

Read moreBitcoin 'Four Meggers': OrdinalsBot Inscribes Largest-Ever File on the OG Blockchain

Sentiment: Positive

Read moreCelebrating Crypto's Early Icons: BTCC OG Week Honors Bitcoin and Meme Coin Pioneers

Sentiment: Positive

Read moreThis OG Bitcoin Whale Turned $120 Into Staggering $179 Million After HODLing Their Stash Since 2010

Sentiment: Positive

Read moreXRP Price Prediction: Ripple OG Spots Pattern to New Highs, Points to Altcoin Rival with 17,789% Target in 2025

Sentiment: Positive

Read moreEthereum OG Vinay Gupta wants to pitch Trump on bringing effective UK crypto policy to the US

Sentiment: Positive

Read moreBitcoin OG Warns Cardano's ADA Within A Whisker Of Crushing Another 90%. Here's Why

Sentiment: Negative

Read more‘Smart Money' Investors Accumulating One OG Ethereum Ecosystem Altcoin: Defi Veteran Arthur Cheong

Sentiment: Positive

Read moreBitcoin OG Says “Super Bullish” BTC News Coming In Next Few Days — Is A Mega Price Boom Near?

Sentiment: Positive

Read moreBitcoin OG Urges Investors: Buy the Dip Amid $400 Billion Crypto Market Sell-Off

Sentiment: Positive

Read moreBitcoin OG Urges Investors to ‘Buy the Dip' After $400 Crypto Billion Market Sell-Off

Sentiment: Positive

Read moreDogecoin Is The 'OG' Meme Coin And A 'Billboard' For PEPE And WIF, But: 'Forget SHIB,' Trader Exclaims

Sentiment: Neutral

Read moreBitcoin Dominance: Traders Preferring The OG To Dogecoin & Other Altcoins

Sentiment: Positive

Read more$1,000,000 or More? Billionaire Crypto OG Brock Pierce Unveils ‘Reasonable' Price Target for Bitcoin

Sentiment: Positive

Read moreBitcoin OG Adam Back Says BTC Can Hit Fresh All-Time High This Easter Weekend — Here's Why

Sentiment: Positive

Read moreThis Bitcoin OG May Come Back To Development After Craig Wright Court Loss

Sentiment: Positive

Read moreStacks Creator Ali Calls Bitcoin 'Apex Predator' as Development Flourishes on OG Blockchain

Sentiment: Positive

Read moreWhy Crypto OG Arthur Hayes Foresees A Phenomenal Solana (SOL) Rally After This Momentous Event

Sentiment: Positive

Read moreWhy SEC-Approved Spot Bitcoin ETFs Are a Very Big Deal in Terms of Sucking Up New Bitcoins, Explains Bitcoin OG

Sentiment: Positive

Read moreBitcoin ETF Inflows Have 30x Larger Impact Than the Halving, According to BTC OG Adam Back – Here's Why

Sentiment: Positive

Read moreBTC price targets $42K 2023 close as Bitcoin OG says ETF 'not priced in'

Sentiment: Negative

Read moreBitcoin OG Adam Back Bets BTC Will Break $100,000 Before Next Halving – Here's His Outlook

Sentiment: Positive

Read moreBitcoin OG Arthur Hayes Believes The “Moon Ain't Far Away” As BTC Bounces Higher Despite Regulatory Actions

Sentiment: Positive

Read moreHyperbitcoinization coming, says Bitcoin OG as 'wholecoiners' hit 1 million

Sentiment: Positive

Read moreMove Over Bitcoin: 3 Cryptos Seeing Higher and Faster Growth Than the OG

Sentiment: Positive

Read moreCoinDesk Had a 'Stash' of BTC, and Other Stories Told by Consensus OG Joon Ian Wong

Sentiment: Neutral

Read moreHacker Drained OG MetaMask Addresses Of $10.4 Million In ETH Since December 2022

Sentiment: Negative

Read moreArbitrum, Shiba, Lunc, OG, and Kaspa Trending Today: A Mixed Bag of Crypto Fortunes

Sentiment: Neutral

Read moreBitcoin Price Predictions: How High Can the Bank Failures Boost the ‘OG' Crypto?

Sentiment: Positive

Read moreThis OG Bitcoin Developer Claims BTC Market Cap Could Reach $200 Trillion in 9 Years

Sentiment: Positive

Read moreBitcoin OG shows up: miner from the second week of the blockchain's life says hi

Sentiment: Neutral

Read moreMega OG Whales Pile Up Bitcoin, Claims Lark Davis! How Will This Impact BTC Price?

Sentiment: Neutral

Read moreBitcoin OG Adam Back Explains Why He Expects Bitcoin Price to Reach $100K in 2022

Sentiment: Positive

Read moreDOGE: This bullish pattern on the chart bodes well for the OG dog-themed coin

Sentiment: Positive

Read moreThe OG Wolf of Wall Street owns six figures worth XRP. Here's how XRP could be the next big thing

Sentiment: Positive

Read moreHistorical Values

-

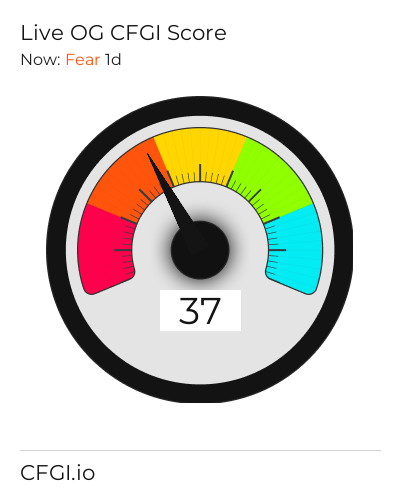

Now

Neutral 45 -

Yesterday

Neutral 48 -

7 Days Ago

Neutral 56 -

1 Month Ago

Neutral 42

OG Fan Token Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the OG Fan Token price evolution a certain numerical value.

This module studies the price trend to determine if the OG Fan Token market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Fear

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current OG Fan Token price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Fear

Like volatility, the OG Fan Token Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in OG Fan Token bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Neutral

The Impulse indicator measures the current OG Fan Token price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the OG Fan Token market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Greed

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for OG Fan Token the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Fear

Dominance Greed

This other indicator takes into account the dominance of OG Fan Token with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases OG Fan Token's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of OG Fan Token and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Fear

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on OG Fan Token has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in OG Fan Token. For this, specific search terms are used that determine the purchasing or ceding interest of OG Fan Token, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Extreme Fear

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of OG Fan Token and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of OG Fan Token moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Neutral

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for OG Fan Token on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

OG Price

1 OG = $4.00

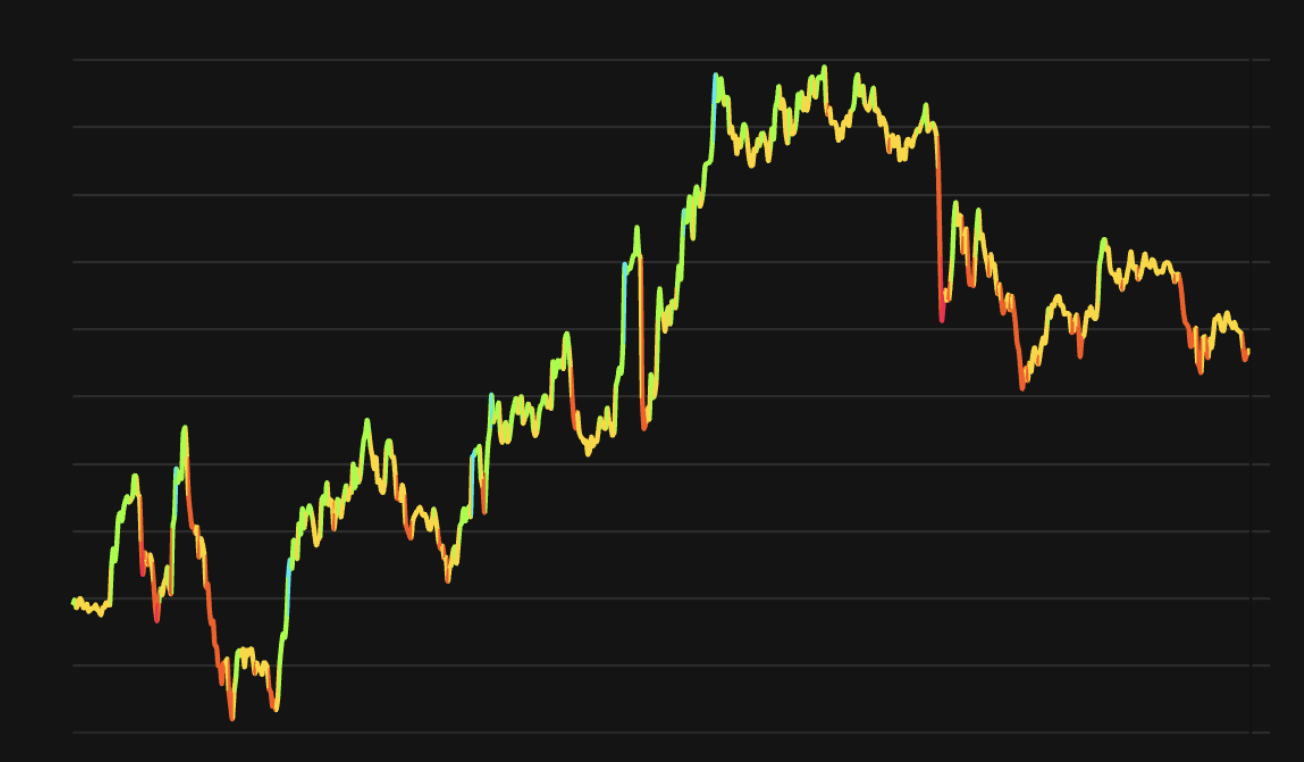

OG Fan Token CFGI Score & OG Price History

OG Price & OG Fan Token Sentiment Breakdown Charts

Price Score Sentiment

Volatility Sentiment

Volume Sentiment

Impulse Sentiment

Technical Sentiment

Social Sentiment

Dominance Sentiment

Search Sentiment

Whales Sentiment

Order Book Sentiment