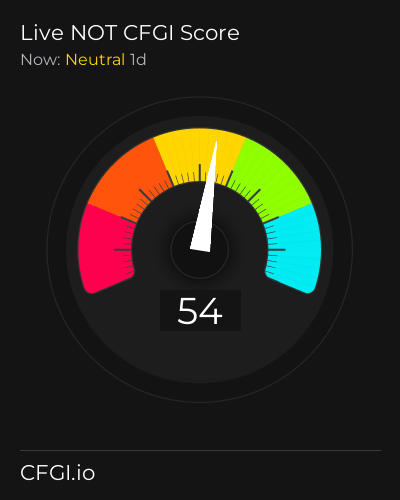

Historical Values

-

Now

Neutral 44 -

Yesterday

Neutral 44 -

7 Days Ago

Neutral 44 -

1 Month Ago

Neutral 44

Notcoin Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Notcoin price evolution a certain numerical value.

This module studies the price trend to determine if the Notcoin market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Notcoin price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the Notcoin Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Notcoin bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Neutral

The Impulse indicator measures the current Notcoin price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Notcoin market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Neutral

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Notcoin the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Extreme Fear

Dominance Greed

This other indicator takes into account the dominance of Notcoin with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Notcoin's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Notcoin and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Extreme Fear

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Notcoin has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Notcoin. For this, specific search terms are used that determine the purchasing or ceding interest of Notcoin, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Extreme Fear

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Notcoin and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Notcoin moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Neutral

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Notcoin on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

Notcoin News

Notcoin News

Bitcoin May Not Close at $250,000 This Year, But this Analyst is Convinced BTC Can Hit These Levels

Sentiment: Positive

Read moreXRP, Ethereum, Solana And One Surprise Crypto (Not Bitcoin) Are Bitwise's 'Cleanest Plays'

Sentiment: Positive

Read morePump.fun Token Sale Set for July 12, Not Open to European Traders: ByBit

Sentiment: Negative

Read moreSpending Your Bitcoin (BTC) May Not Be ‘Sustainable Practice,' According to Macro Guru Lyn Alden – Here's Why

Sentiment: Negative

Read moreSharpLink's ETH treasury experiment is starting to look like a model, not a gamble

Sentiment: Positive

Read moreTornado Cash Judge Will Not Permit Van Loon Verdict to Be Discussed During Upcoming Trial

Sentiment: Neutral

Read moreTON Foundation: the Golden Visa project does not have official UAE support

Sentiment: Neutral

Read moreAsia Morning Briefing: BTC's Institutional Waves Are Building, Not Breaking

Sentiment: Positive

Read moreAnalyst Eyes Astronomical Price Target for XRP, Says Investors Not Bullish Enough on Fourth-Largest Crypto Asset

Sentiment: Positive

Read moreBitcoin Whale Moves 80,000 BTC in Address Upgrade, Not Sell-Off, Analysts Say

Sentiment: Neutral

Read moreBitcoin whale moves $8.6 billion in BTC, likely for address upgrade, not selling

Sentiment: Neutral

Read moreEthereum MVRV Holds At 1.20–1.25, Suggests Market Peak Is Not In Sight – Details

Sentiment: Neutral

Read moreXRP: Mini Death Cross Surprise, Shiba Inu (SHIB): It's Not Normal, Bitcoin (BTC): Fundamental Breakout Secured

Sentiment: Neutral

Read moreBitcoin retail investor demand is not gone; they're piling into the spot BTC ETFs

Sentiment: Positive

Read moreShiba Inu (SHIB) Outpaces Ethereum (ETH) and Pepe (PEPE): But Not in the Way You Might Think

Sentiment: Negative

Read moreAltcoin Season Not Remotely Close, Bitcoin Dominance Still Too High: Market Expert Says

Sentiment: Negative

Read moreBitcoin, Ethereum, XRP Need Not Worry About Summer Blues As Long As This Critical Support Holds, Trader Says

Sentiment: Positive

Read morePerma Bull and Wall Street Strategist Tom Lee Is Betting $250 Million On This Cryptocurrency (Hint: Not Bitcoin)

Sentiment: Positive

Read moreAltcoin Season Not Coming? Bitcoin Risks Crash To $98,200 With Negative Sentiment

Sentiment: Negative

Read moreAnalyst Says Cycle Is Not Finished Amid 2 Years Of Bitcoin Sideways Movement

Sentiment: Neutral

Read moreHere's Why Bitcoin Is Not ‘Mooning' Despite Demand From BTC Treasury Firms, According to Former Goldman Sachs Exec Michael Bucella

Sentiment: Negative

Read moreShiba Inu (SHIB) Needs This Now, This Bitcoin (BTC) Signal Not Great, XRP: First Time in History?

Sentiment: Negative

Read moreBitcoin Price Not Being Suppressed, Selling by Long-Term Holders, Checkmate Says

Sentiment: Neutral

Read moreBitcoin (BTC): New ATH or $90,000? 0 Dogecoin (DOGE) as Volume Plummets, XRP Does Not Lose $2

Sentiment: Positive

Read moreStrike CEO Jack Mallers: Bitcoin Is a Moral Revolution, Not Just an Investment

Sentiment: Positive

Read moreThese 5 Altcoins Could Explode in July 2025 – Top Memecoins NOT To Miss!

Sentiment: Positive

Read more'Rich Dad Poor Dad' Author Says This Asset Will Explode in July - Not Bitcoin

Sentiment: Neutral

Read moreEthereum Not Out of the Woods Yet: Analysts Warn of a 30% Crash to $1,800

Sentiment: Negative

Read moreBitcoin Is Not The First Cryptocurrency? Shocking Ripple Revelation Takes XRP Community By Surprise

Sentiment: Neutral

Read moreEthereum Not Out Of The Woods Yet: Why Another 30% Crash To $1,800 Is Coming

Sentiment: Negative

Read moreNot Just TRUMP: MELANIA-Linked Wallets Offload Large Holdings Amid 98.4% Price Dump

Sentiment: Negative

Read moreBillionaire investor Philippe Laffont on bitcoin: Every day I do think 'why do I not own it?'

Sentiment: Positive

Read morePresident Trump Meme Coin Jumps as He Begs Israel Not to Break Ceasefire Deal

Sentiment: Neutral

Read moreXRP: Not Losing $2, Ethereum (ETH): Golden Cross Useless? Crucial Bitcoin (BTC) Signal You Shouldn't Ignore

Sentiment: Neutral

Read moreDonald Trump and Bitcoin: From 'Not a Fan' to Crypto President—With His Own Meme Coin

Sentiment: Positive

Read moreTrump Media's $400 million stock repurchase plan will not alter its multi-billion Bitcoin treasury designs

Sentiment: Neutral

Read moreBitcoin's price is slipping, and big money's not buying it – What's next?

Sentiment: Negative

Read moreNotcoin Price Prediction: Can the NOT Price Bounce Back From 20% Weekly Drop?

Sentiment: Negative

Read moreEthereum's market share gains rooted in altcoin volume decline, not ETH's surge: CryptoQuant

Sentiment: Neutral

Read morePeter Schiff Claims He “Gets Bitcoin” But Not Dollar-Pegged Stablecoins, Plans To Launch Gold-Backed Alternative

Sentiment: Negative

Read moreIs the 4-Year Bitcoin Cycle Over? Rational Root Explains Why This Time Might Not Be Different

Sentiment: Positive

Read morePeter Schiff Says He 'Gets Bitcoin' But Not USD-Pegged Stablecoins, Floats Gold-Backed Token Plan

Sentiment: Neutral

Read moreEthereum (ETH), Binance Coin (BNB), Solana (SOL) Price Pullback: Breakout Not Ready Yet?

Sentiment: Neutral

Read moreTRUMP faces $2.4 mln insider exodus – But the real dump may not have begun

Sentiment: Negative

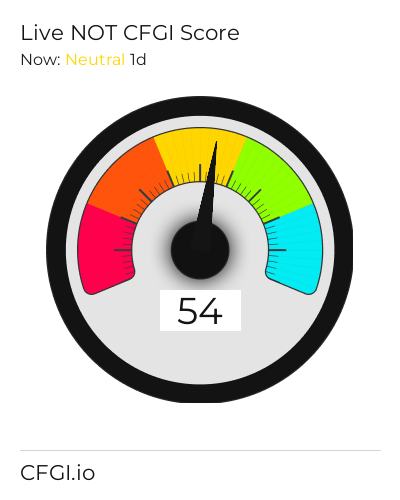

Read moreHistorical Values

-

Now

Neutral 44 -

Yesterday

Neutral 41 -

7 Days Ago

Neutral 42 -

1 Month Ago

Neutral 44

Notcoin Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Notcoin price evolution a certain numerical value.

This module studies the price trend to determine if the Notcoin market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Notcoin price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the Notcoin Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Notcoin bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Neutral

The Impulse indicator measures the current Notcoin price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Notcoin market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Neutral

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Notcoin the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Extreme Fear

Dominance Greed

This other indicator takes into account the dominance of Notcoin with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Notcoin's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Notcoin and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Extreme Fear

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Notcoin has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Notcoin. For this, specific search terms are used that determine the purchasing or ceding interest of Notcoin, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Extreme Fear

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Notcoin and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Notcoin moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Neutral

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Notcoin on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

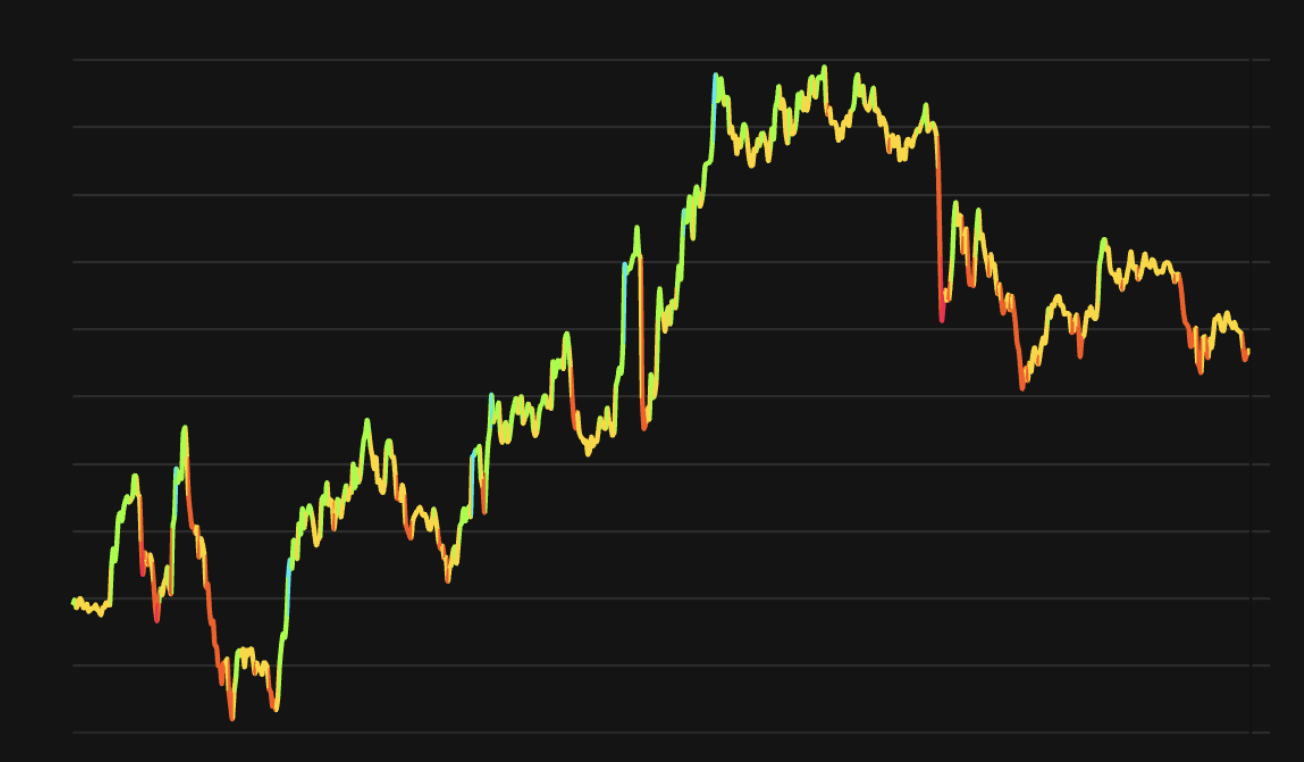

NOT Price

1 NOT = $0.0019

Notcoin CFGI Score & NOT Price History

NOT Price & Notcoin Sentiment Breakdown Charts

Price Score Sentiment

Volatility Sentiment

Volume Sentiment

Impulse Sentiment

Technical Sentiment

Social Sentiment

Dominance Sentiment

Search Sentiment

Whales Sentiment

Order Book Sentiment