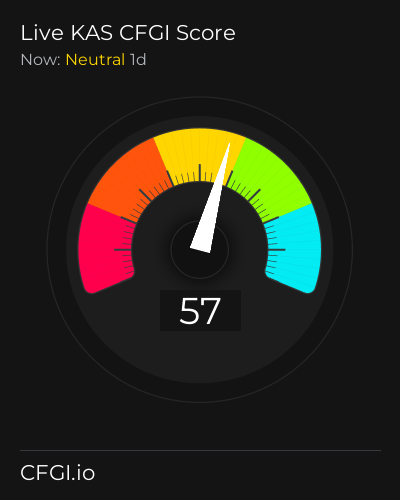

Historical Values

-

Now

Neutral 54 -

Yesterday

Neutral 54 -

7 Days Ago

Neutral 54 -

1 Month Ago

Neutral 54

Kaspa Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Kaspa price evolution a certain numerical value.

This module studies the price trend to determine if the Kaspa market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Kaspa price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the Kaspa Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Kaspa bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Greed

The Impulse indicator measures the current Kaspa price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Kaspa market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Neutral

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Kaspa the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Neutral

Dominance Greed

This other indicator takes into account the dominance of Kaspa with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Kaspa's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Kaspa and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Kaspa has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Kaspa. For this, specific search terms are used that determine the purchasing or ceding interest of Kaspa, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Greed

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Kaspa and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Kaspa moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Greed

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Kaspa on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

Kaspa News

Kaspa News

Kaspa [KAS] on a long-term downtrend? Here's why it should worry investors!

Sentiment: Negative

Read moreKaspa (KAS) Breaks Key Barrier With 10% Jump, Poised for a Strong Q2 Close

Sentiment: Positive

Read moreSolana (SOL), Kaspa (KAS), and Sonic (SONIC): Top Layer 1 Crypto Leaders - Market Analysis

Sentiment: Positive

Read moreSolana (SOL), Sui (SUI), and Kaspa (KAS) power higher with market still in disbelief

Sentiment: Positive

Read moreBitcoin rallies amid macroeconomic concerns — Are HYPE, ONDO, RNDR and KAS next?

Sentiment: Positive

Read moreCrypto Market Today (Mar 12): BTC Brushes $83K, XRP Jumps 7%, & KAS Adds 16%

Sentiment: Positive

Read moreCrypto Prices Today (Feb 14): BTC Holds $97K, Altcoins Flux, But XRP & KAS Soar 4%

Sentiment: Positive

Read moreKAS supply hits record high – Examining the odds of a 10% decline in price

Sentiment: Negative

Read moreCrypto price update Jan 16: BTC hovers near $100k, WIF, KAS surge over 10%

Sentiment: Positive

Read moreSpacePay (SPY), Solana (SOL) and Kaspa (KAS): Three Cryptocurrencies To Potentially Surge In 2025

Sentiment: Positive

Read moreAnalysts Predict Ripple Won't Reach $1 in Near Months, See XRP Competitors like KAS, UNI and Cybro as Better Opportunities for Surge

Sentiment: Negative

Read moreKaspa (KAS) to $1? Uniswap (UNI) Holders Anticipate DTX Exchange's (DTX) All-In-One Wallet

Sentiment: Positive

Read moreRipple (XRP) Eyes Breakout; Analyst Highlights Kaspa (KAS) Key Resistance; Is This New Hybrid Exchange the Next Big Thing?

Sentiment: Positive

Read moreKaspa Price Today: KAS 7.86% Movement Brings Confidence to Community, GoodEgg Dominates Meme Sphere

Sentiment: Positive

Read moreTop Analyst Dive Into Kaspa KRC-20, KAS Price Prediction and Kaspa Investment Strategies

Sentiment: Positive

Read moreNews and market quotes of the crypto Litecoin (LTC) Eos.io (EOS) and Kaspa (KAS)

Sentiment: Neutral

Read moreKaspa (KAS) 2024-2030 Price Prediction: Here is Everything you Need to Know

Sentiment: Positive

Read moreKaspa Soars to $0.20 ATH and Overtakes MATIC: Is There More Upside for KAS

Sentiment: Positive

Read moreKAS Price Analysis: Rounding Reversal Poised for Potential Surge to $0.28

Sentiment: Positive

Read moreKaspa (KAS) Price Prediction 2024-2030: What to Expect for This Emerging Cryptocurrency

Sentiment: Positive

Read moreBitcoin's price rally to $70K could lure buyers to XRP, KAS, STX and JASMY

Sentiment: Positive

Read moreBitcoin carves out a bottom, opening the door for KAS, MKR, AR and NOT to rally

Sentiment: Positive

Read moreBitcoin's Struggle to Recover: Why SOL, DOT, NEAR, and KAS Could Be Your Next Investment Opportunities

Sentiment: Neutral

Read moreRender (RNDR) and Kaspa (KAS) biggest altcoin gainers, but which is the best bet?

Sentiment: Positive

Read moreBitcoin price recovery to $62.5K could trigger breakout in TON, AVAX, KAS and XMR

Sentiment: Positive

Read moreKaspa (KAS) Price Prediction 2024-2030: Bullish Signals and Technical Insights

Sentiment: Positive

Read moreKaching! Kaspa (KAS) Climbs 18% As Bitcoin Mining Heavyweight Goes All In

Sentiment: Positive

Read moreCrypto Prices Today June 27: BTC & Altcoins Backtrack, KAS & MKR Flout Market Trend

Sentiment: Negative

Read moreBitcoin price loses ground as TON, PEPE, KAS and JASMY catch traders' attention

Sentiment: Positive

Read moreStacks (STX) And Kaspa (KAS) Record Bullish Reversal! Will They Hold Momentum?

Sentiment: Positive

Read moreCrypto news and price analysis: Pepe (PEPE), Kaspa (KAS) and Ethereum (ETH)

Sentiment: Neutral

Read moreKaspa Price Forecast: Is KAS Preparing For A Massive Breakout This Week?

Sentiment: Positive

Read moreKaspa (KAS) price suddenly dips to $0.1335 amid promising long-term forecasts

Sentiment: Neutral

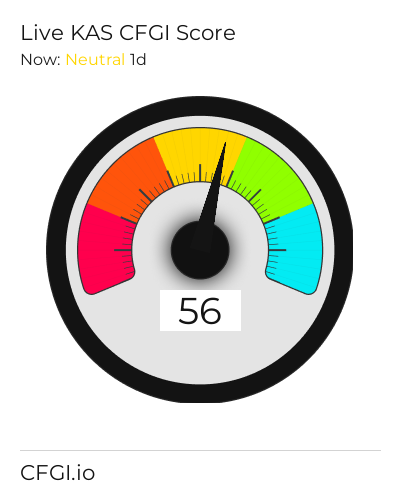

Read moreHistorical Values

-

Now

Neutral 54 -

Yesterday

Neutral 54 -

7 Days Ago

Neutral 48 -

1 Month Ago

Fear 39

Kaspa Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Kaspa price evolution a certain numerical value.

This module studies the price trend to determine if the Kaspa market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Kaspa price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the Kaspa Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Kaspa bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Greed

The Impulse indicator measures the current Kaspa price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Kaspa market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Neutral

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Kaspa the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Neutral

Dominance Greed

This other indicator takes into account the dominance of Kaspa with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Kaspa's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Kaspa and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Kaspa has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Kaspa. For this, specific search terms are used that determine the purchasing or ceding interest of Kaspa, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Greed

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Kaspa and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Kaspa moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Greed

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Kaspa on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

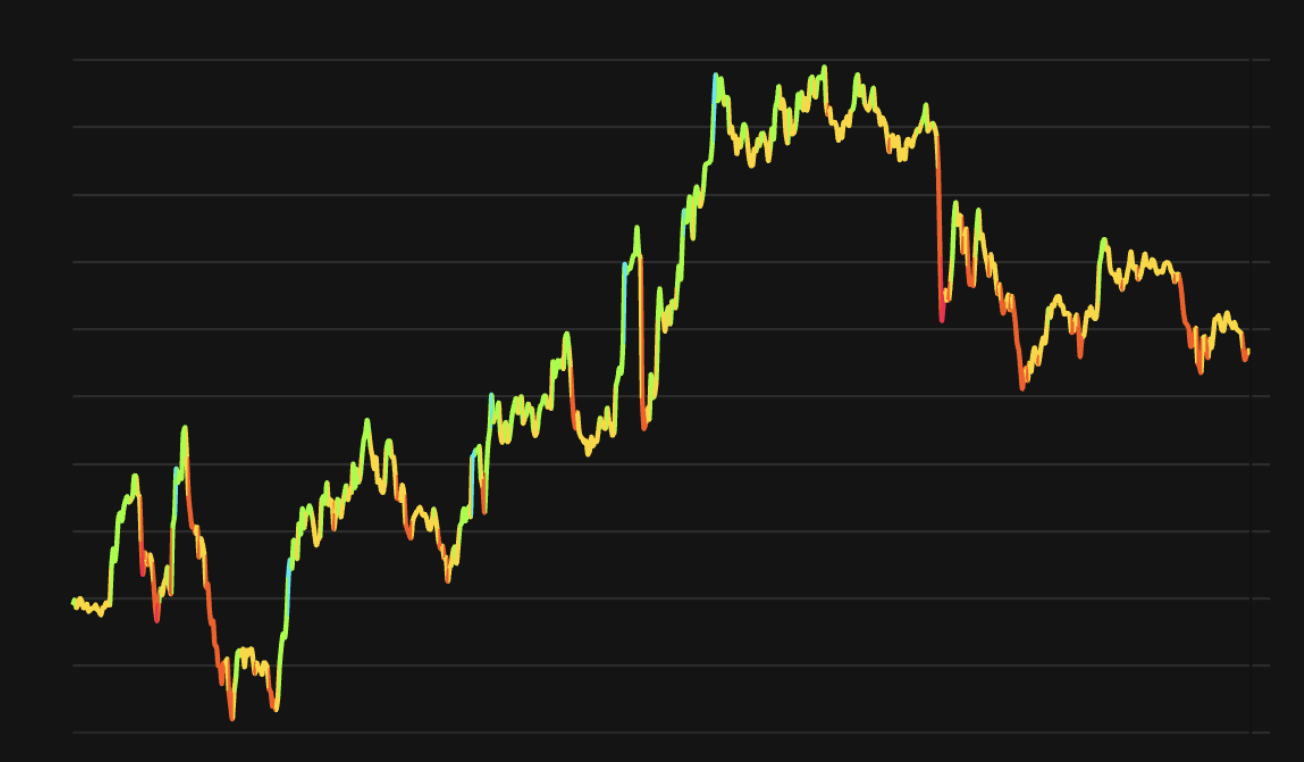

KAS Price

1 KAS = $0.077564

Kaspa CFGI Score & KAS Price History

KAS Price & Kaspa Sentiment Breakdown Charts

Price Score Sentiment

Volatility Sentiment

Volume Sentiment

Impulse Sentiment

Technical Sentiment

Social Sentiment

Dominance Sentiment

Search Sentiment

Whales Sentiment

Order Book Sentiment

![After a 25% price drop, can Kaspa [KAS] crypto rebound to $0.12?](https://crypto.snapi.dev/images/v1/l/2/a/will-kass-breakdown-end-586920.webp)

![As Bitcoin miners move to Kaspa [KAS], will BTC fall even more?](https://crypto.snapi.dev/images/v1/i/b/btc-miners-1-512965.webp)