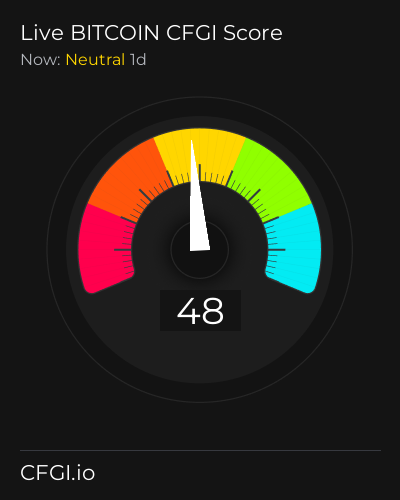

Historical Values

-

Now

Greed 75 -

Yesterday

Greed 75 -

7 Days Ago

Greed 75 -

1 Month Ago

Greed 75

HPOS1I Breakdown

Price Score Greed

The Price Score indicator is a relevant indicator to analyze and assign the HPOS1I price evolution a certain numerical value.

This module studies the price trend to determine if the HPOS1I market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Extreme Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current HPOS1I price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Extreme Greed

Like volatility, the HPOS1I Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in HPOS1I bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Extreme Greed

The Impulse indicator measures the current HPOS1I price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the HPOS1I market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Greed

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for HPOS1I the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Neutral

Dominance Greed

This other indicator takes into account the dominance of HPOS1I with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases HPOS1I's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of HPOS1I and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Neutral

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on HPOS1I has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in HPOS1I. For this, specific search terms are used that determine the purchasing or ceding interest of HPOS1I, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Extreme Fear

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of HPOS1I and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of HPOS1I moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Greed

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for HPOS1I on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

HPOS1I News

HPOS1I News

‘This Could Very Well Be the Ultimate Bull Trap' – Trader Issues Urgent Crypto Warning As Bitcoin Blasts Past $118,000

Sentiment: Negative

Read moreBitcoin, Ethereum and Ripple rally as Trump's tariff uncertainty clears and $130k is in sight

Sentiment: Positive

Read moreThe Daily: Bitcoin sees fresh all-time highs, Ethereum reclaims a key level, BlackRock's crypto ETFs set new records, and more

Sentiment: Positive

Read moreWhy Bitcoin is On Fire And Everyone's Going HYPER About Bitcoin Hyper Token

Sentiment: Positive

Read moreWorld's 11th Richest: Satoshi Nakamoto Overtakes Michael Dell With $129B Bitcoin Fortune

Sentiment: Positive

Read moreBitcoin Dominance Falls: 9 Factors To Watch For That Says The Altcoin Season Has Begun

Sentiment: Positive

Read moreWorld's Smartest Banker Warns Investors, Banks To Kick Off Earnings Season, Bitcoin Hits $118K

Sentiment: Positive

Read moreBitcoin touches new all-time highs, topping $118,000 as institutions pile into ETFs

Sentiment: Positive

Read moreBitcoin Just Hit a New All-Time High. But Is the Leading Cryptocurrency a Buy?

Sentiment: Positive

Read moreBlackRock's bitcoin ETF becomes fastest ever to hit $80 billion as BTC tops $118,000

Sentiment: Positive

Read moreBitcoin Is The ‘Manhattan' Of The Digital Age, Says Scaramucci–Here's Why

Sentiment: Positive

Read moreBitcoin Hits Dollar All-Time High, But Trails In Euro, Swiss Franc: Dollar What's Driving The Divergence?

Sentiment: Positive

Read moreTrader Outlines Catalysts That Could Trigger 350% Bitcoin Rally, Updates Outlook on Ethereum and Avalanche

Sentiment: Positive

Read moreNBA Legend Scottie Pippen Says “SEND EVERYTHING HIGHER” as Bitcoin Hits New Highs

Sentiment: Positive

Read moreBitcoin back to $118,000 after teasing bulls with $120,000 milestone breach

Sentiment: Positive

Read moreStocks slip amid Trump's tariff threats, Bitcoin spike buoys crypto stocks

Sentiment: Neutral

Read moreSpot Bitcoin ETFs See $1B of Inflows as IBIT Becomes Fastest Fund to Hit $80B in Assets

Sentiment: Positive

Read moreEthereum futures volume surpasses Bitcoin for first time amid 5 month high

Sentiment: Positive

Read more12-Year-Old Bitcoin Fortune Springs to Life—$47M Shifted to Bitgo as BTC Hits Record High

Sentiment: Positive

Read moreBitcoin Price Today Breaks All-Time High as Stock Market Soars – What's Coming Next?

Sentiment: Positive

Read moreBitcoin MVRV Oscillator Predicts First Sell Pressure Level At $130,900 – Details

Sentiment: Positive

Read moreBitcoin trades near all-time high, but upside volatility could still lead to new highs

Sentiment: Positive

Read moreBitcoin Hits $118K! Ethereum, Solana, XRP Price Rally, Cardano Leads Altcoin Surge

Sentiment: Positive

Read moreBitcoin sets fresh high as market bets on US monetary easing, analyst says

Sentiment: Positive

Read moreWisdomTree Forecasts Bitcoin at $250K and Gold at $4K by 2030 in Base Case Scenario

Sentiment: Positive

Read moreBitcoin surges towards $119K as crypto 'becomes what fans always wanted'

Sentiment: Positive

Read moreBitcoin creator Satoshi Nakamoto may now be richer than Dell CEO Michael Dell

Sentiment: Positive

Read moreThe Smarter Web Company buys additional $30 million in bitcoin as CEO eyes top 20 public treasuries

Sentiment: Positive

Read moreUK bitcoin treasury companies buoyant as Smarter Web crosses £1bn after crypto hits record high

Sentiment: Positive

Read morePEPE Jumps 14% as Whales Pile In, Bitcoin Breaks $118K in Broad Crypto Rally

Sentiment: Positive

Read moreThe era of institutional Bitcoin adoption has arrived. And this time it's different

Sentiment: Positive

Read moreRussia elevates AI over Bitcoin with impending ban on data center mining

Sentiment: Negative

Read moreBitcoin flies to new all-time highs, topping $118,000 as institutions pile into ETFs

Sentiment: Positive

Read moreBitcoin leads the rally: Ark Invest reduces exposure on Coinbase and Robinhood

Sentiment: Positive

Read moreBhutan Quietly Moves $23.7M in Bitcoin to Binance as Prices Surge to Record Levels

Sentiment: Positive

Read moreOver $1 Billion Crypto Shorts Get Rekt As Bitcoin Smashes Through $118,600 For First Time

Sentiment: Positive

Read moreCardano Founder Charles Hoskinson Predicts Bitcoin Price to $250,000 Driven by New Regulation

Sentiment: Positive

Read moreBitcoin ETFs see record $1.2B inflows as market hits all-time high in dollars

Sentiment: Positive

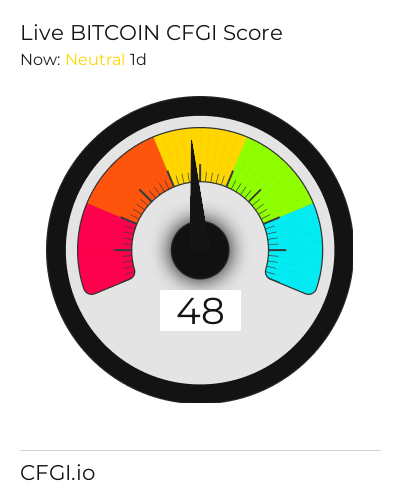

Read moreHistorical Values

-

Now

Greed 75 -

Yesterday

Neutral 77 -

7 Days Ago

Neutral 54 -

1 Month Ago

Neutral 59

HPOS1I Breakdown

Price Score Greed

The Price Score indicator is a relevant indicator to analyze and assign the HPOS1I price evolution a certain numerical value.

This module studies the price trend to determine if the HPOS1I market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Extreme Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current HPOS1I price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Extreme Greed

Like volatility, the HPOS1I Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in HPOS1I bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Extreme Greed

The Impulse indicator measures the current HPOS1I price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the HPOS1I market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Greed

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for HPOS1I the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Neutral

Dominance Greed

This other indicator takes into account the dominance of HPOS1I with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases HPOS1I's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of HPOS1I and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Neutral

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on HPOS1I has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in HPOS1I. For this, specific search terms are used that determine the purchasing or ceding interest of HPOS1I, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Extreme Fear

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of HPOS1I and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of HPOS1I moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Greed

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for HPOS1I on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

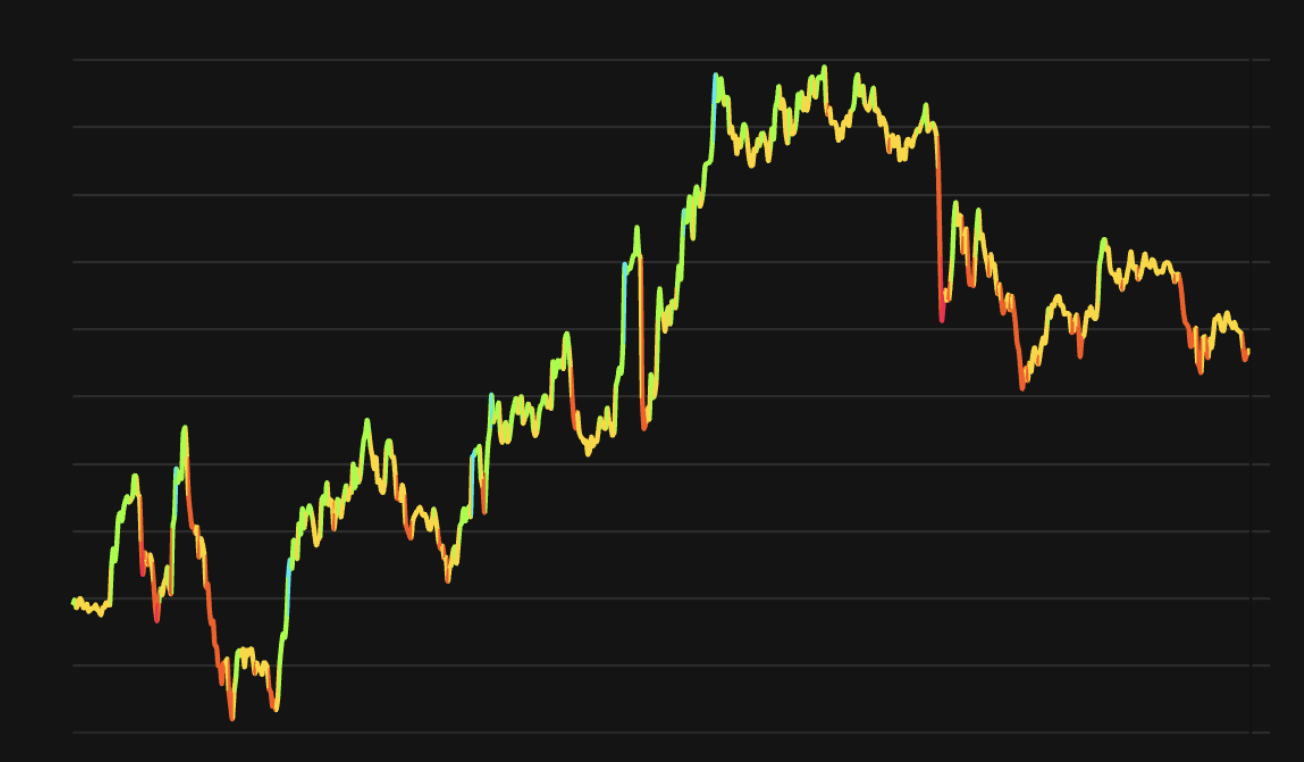

BITCOIN Price

1 BITCOIN = $0.07907

HPOS1I CFGI Score & BITCOIN Price History

BITCOIN Price & HPOS1I Sentiment Breakdown Charts

Price Score Sentiment

Volatility Sentiment

Volume Sentiment

Impulse Sentiment

Technical Sentiment

Social Sentiment

Dominance Sentiment

Search Sentiment

Whales Sentiment

Order Book Sentiment