Historical Values

-

Now

Greed 68 -

Yesterday

Greed 68 -

7 Days Ago

Greed 68 -

1 Month Ago

Greed 68

Ethereum Classic Breakdown

Price Score Greed

The Price Score indicator is a relevant indicator to analyze and assign the Ethereum Classic price evolution a certain numerical value.

This module studies the price trend to determine if the Ethereum Classic market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Ethereum Classic price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the Ethereum Classic Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Ethereum Classic bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Neutral

The Impulse indicator measures the current Ethereum Classic price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Ethereum Classic market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Neutral

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Ethereum Classic the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Extreme Greed

Dominance Greed

This other indicator takes into account the dominance of Ethereum Classic with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Ethereum Classic's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Ethereum Classic and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Extreme Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Ethereum Classic has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Ethereum Classic. For this, specific search terms are used that determine the purchasing or ceding interest of Ethereum Classic, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Greed

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Ethereum Classic and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Ethereum Classic moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Greed

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Ethereum Classic on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

Ethereum Classic News

Ethereum Classic News

Ethereum Classic Price Prediction - What could affect ETC''s future price?

Sentiment: Neutral

Read moreEurope's asset manager HANetf rolls out ETC to double or short Bitcoin and Ethereum

Sentiment: Neutral

Read moreEthereum Classic [ETC] rejects key demand zone – Is a short squeeze next?

Sentiment: Positive

Read moreETC trading activity heats up – Will it be a hedge against a bearish ETH?

Sentiment: Positive

Read moreThis year in crypto – Spot Bitcoin & Ethereum ETF approvals, ‘Trump pump,' etc.

Sentiment: Positive

Read moreEthereum Name Service (ENS) & Ethereum Classic (ETC) Record Huge Gains—Which One Will Reach $50 First?

Sentiment: Positive

Read moreEthereum Classic – Trend reversal in sight? Watch out for these key ETC levels!

Sentiment: Positive

Read moreEthereum Classic Price Prediction 2024, 2025-2030: Will ETC Price Cross $50?

Sentiment: Positive

Read moreETC Group advises holding Ethereum, Solana, and Aptos through market shifts

Sentiment: Positive

Read moreBitcoin Remains Bullish in Q4 Despite Middle East Tensions and Positive U.S. Jobs Data: K33 and ETC Group Analysts

Sentiment: Positive

Read moreEthereum Classic price prediction – Assessing the odds of ETC hitting $20 again

Sentiment: Negative

Read moreEthereum Classic (ETC) price soars despite trading volume and liquidation concerns

Sentiment: Positive

Read moreBitwise Acquires ETC Group: European expansion and new opportunities for crypto investors

Sentiment: Positive

Read moreThe Daily: Crypto not in Democrats' party platform, Bitwise acquires ETC Group, Shaq's NFT legal battle and more

Sentiment: Neutral

Read moreBitwise AUM surpasses $4.5 billion, expands to Europe with ETC Group purchase

Sentiment: Positive

Read moreBitwise Acquires ETC Group, Europe's Largest Physical Bitcoin ETP Issuer

Sentiment: Positive

Read moreBitwise Asset Management Acquires London-Based Crypto ETP Issuer ETC Group, Strengthening European Market Presence

Sentiment: Positive

Read moreBitwise acquires physical bitcoin ETP issuer ETC Group amidst European expansion

Sentiment: Positive

Read moreBitwise Sets Sails for Europe by Buying ETC Group's $1 Billion ETP Portfolio

Sentiment: Positive

Read moreBitwise Expands into Europe with Acquisition of ETC Group's $1B ETP Portfolio

Sentiment: Positive

Read moreCoinDesk 20 Performance Update: Index Gains 1.2% With BCH and ETC Leading

Sentiment: Positive

Read moreEthereum-Based Tokens Fight the Bearish Heat Here's What's Next for ETC, ENS & LDO Prices!

Sentiment: Positive

Read moreEthereum Classic (ETC) Price Forecast 2024: Analyzing Market Trends and Predictions

Sentiment: Neutral

Read moreETC Group says crypto hedge funds' bitcoin exposure has recently dropped

Sentiment: Negative

Read moreEthereum Classic (ETC) Rallies Against Market After Launching Native Stablecoin

Sentiment: Positive

Read moreEthereum Classic (ETC) Price Prediction April 2024, 2025, 2026, 2030, 2040 – 2050

Sentiment: Positive

Read moreEthereum Classic Price Prediction 2024-2030: Will ETC Price Cross $25 In 2024?

Sentiment: Positive

Read moreETC Group, CoinShares, WisdomTree set to list crypto ETPs on London Stock Exchange

Sentiment: Positive

Read moreEthereum Classic Price Forecast: Will ETC Soar To $60 Mark By The End Of March?

Sentiment: Positive

Read moreEthereum (ETH) Staking ETP Introduced by ETC Group, Listed on Deutsche Börse XETRA

Sentiment: Positive

Read moreCan Bitcoin Price Weather The Storm If Genesis Offloads $1.6B In BTC, ETH, ETC Held In Grayscale Products?

Sentiment: Positive

Read moreEthereum Classic Price Faces Repeated Rejection! What's Next For ETC Price?

Sentiment: Negative

Read moreEthereum Classic Price Displays Strong Bearish Move! ETC Price To Drop 20% Soon?

Sentiment: Negative

Read moreEthereum Classic (ETC) Explodes Over 50% In Massive Price Jump – Here's Why

Sentiment: Positive

Read moreEthereum Classic Price Massive Double-Digit Rally Hits Pause, $50 ETC Up Next Or Sell-Off?

Sentiment: Positive

Read moreBitcoin (BTC) Price Could Surpass $100K in 2024 Due to Increased Adoption of Digital Assets – ETC Group Report

Sentiment: Positive

Read moreA Spot Bitcoin ETF in U.S. ‘Opens Up the Universe of the Pensions, Insurers, etc', Says Goldman's Head of Digital Assets

Sentiment: Positive

Read moreBitcoin Price Prediction: ETC Group Anticipates Surpassing $100,000 By End 2024

Sentiment: Positive

Read moreETC Group Explains Why ‘2024 Is Poised To Be a Transformative Year for Cryptoassets'

Sentiment: Positive

Read moreBitcoin Cash (BCH) and Ethereum Classic (ETC) Prices Forecast: Old Players Still Got It?

Sentiment: Neutral

Read moreCryptoassets Eclipse Traditional Assets in Recent Market Shift, Notes ETC Group's Head of Research

Sentiment: Positive

Read moreEthereum Classic Price Stumbles Again! Will ETC Price Retest It's Low Soon?

Sentiment: Negative

Read moreETC Group CSO Bradley Duke Sheds Light on Bitcoin's FOMO-Driven Rally Amid Spot ETF Frenzy

Sentiment: Positive

Read moreETC/USDT technical analysis: forecasting a potential decline near resistance

Sentiment: Negative

Read moreEther ETF news sparks rallies for Ethereum Classic (ETC), THORChain (RUNE) and RocketPool (RPL)

Sentiment: Positive

Read moreAnalyzing Future Trajectories of Ethereum Classic (ETC), Fantom (FTM), and Stellar (XLM) with Crypto Guru

Sentiment: Positive

Read moreEthereum Classic Price Prediction 2023, 2024, 2025: Will ETC Price Cross $25 In 2023?

Sentiment: Positive

Read moreHistorical Values

-

Now

Greed 68 -

Yesterday

Neutral 68 -

7 Days Ago

Greed 61 -

1 Month Ago

Neutral 43

Ethereum Classic Breakdown

Price Score Greed

The Price Score indicator is a relevant indicator to analyze and assign the Ethereum Classic price evolution a certain numerical value.

This module studies the price trend to determine if the Ethereum Classic market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Ethereum Classic price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the Ethereum Classic Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Ethereum Classic bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Neutral

The Impulse indicator measures the current Ethereum Classic price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Ethereum Classic market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Neutral

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Ethereum Classic the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Extreme Greed

Dominance Greed

This other indicator takes into account the dominance of Ethereum Classic with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Ethereum Classic's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Ethereum Classic and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Extreme Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Ethereum Classic has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Ethereum Classic. For this, specific search terms are used that determine the purchasing or ceding interest of Ethereum Classic, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Greed

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Ethereum Classic and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Ethereum Classic moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Greed

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Ethereum Classic on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

ETC Price

1 ETC = $18.53

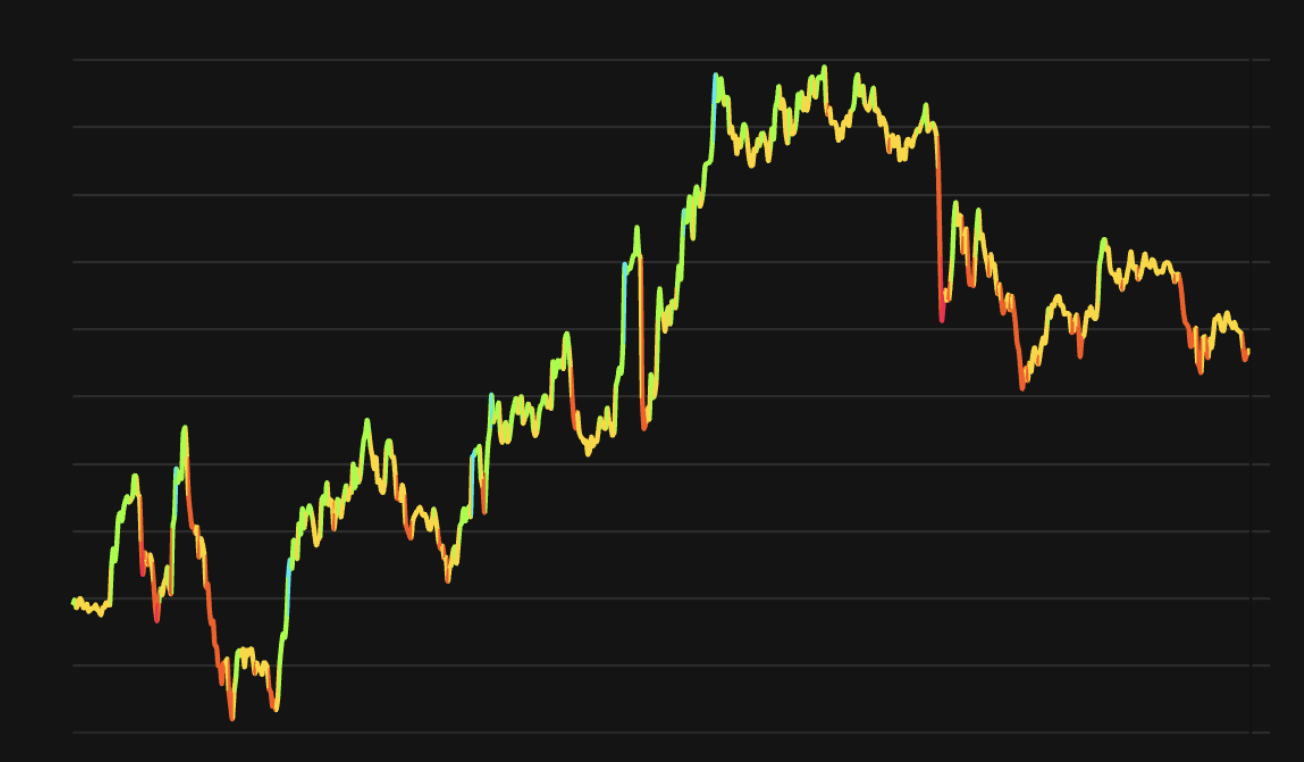

Ethereum Classic CFGI Score & ETC Price History

ETC Price & Ethereum Classic Sentiment Breakdown Charts

Price Score Sentiment

Volatility Sentiment

Volume Sentiment

Impulse Sentiment

Technical Sentiment

Social Sentiment

Dominance Sentiment

Search Sentiment

Whales Sentiment

Order Book Sentiment

![Ethereum Classic [ETC] Surges as Bullish Momentum Builds](https://crypto.snapi.dev/images/v1/placeholders/crypto/crypto60.jpg)

![Ethereum Classic [ETC] defends key support twice: $36 next?](https://crypto.snapi.dev/images/v1/placeholders/crypto/crypto71.jpg)