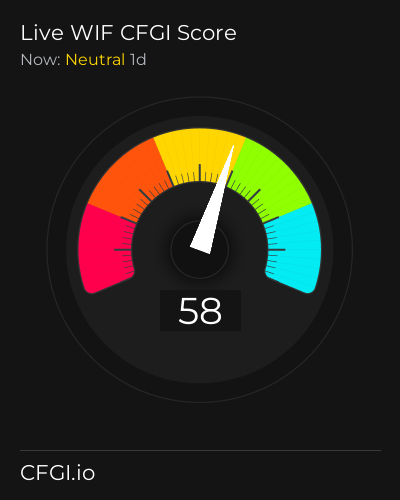

Historical Values

-

Now

Neutral 56 -

Yesterday

Neutral 56 -

7 Days Ago

Neutral 56 -

1 Month Ago

Neutral 56

Dogwifhat Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Dogwifhat price evolution a certain numerical value.

This module studies the price trend to determine if the Dogwifhat market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Dogwifhat price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the Dogwifhat Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Dogwifhat bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Neutral

The Impulse indicator measures the current Dogwifhat price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Dogwifhat market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Greed

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Dogwifhat the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Fear

Dominance Greed

This other indicator takes into account the dominance of Dogwifhat with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Dogwifhat's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Dogwifhat and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Fear

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Dogwifhat has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Dogwifhat. For this, specific search terms are used that determine the purchasing or ceding interest of Dogwifhat, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Greed

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Dogwifhat and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Dogwifhat moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Greed

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Dogwifhat on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

Dogwifhat News

Dogwifhat News

Crypto Price Analysis 7-11: BITCOIN: BTC, ETHEREUM: ETH, SOLANA: SOL, RIPPLE: XRP, FILECOIN: FIL, DOGWIFHAT: WIF

Sentiment: Positive

Read moreCrypto price recap: BTC hits $112k and ETH eyes breakout as PENGU, WIF surge

Sentiment: Positive

Read moreSolana Meme Coins Surge: $PENGU, $USELESS & $WIF On Fire; Snorter Token Next?

Sentiment: Positive

Read moreDog Coins Rally as Bitcoin Tops $110K With BONK, WIF Posting Double-Digit Gains

Sentiment: Positive

Read moreDogwifhat ($WIF) Defies Memecoin Stereotypes With 21% Jump and Solana Validator Launch

Sentiment: Positive

Read moreDogwifhat Price Prediction 2025, 2026 – 2030: Will WIF Price Leap To $5?

Sentiment: Positive

Read moreWIF Price Prediction: 35% Daily Jump Puts Long-Awaited Breakout in Motion – Is $2 Within Sight?

Sentiment: Positive

Read moreCrypto Analyst Calls for New Bitcoin All-Time High After Brief Dip Below $100,000, Predicts Rallies for Ethereum and WIF

Sentiment: Positive

Read moreSolana treasury firm DeFi Dev Corp spins up Dogwifhat validator, plans to split WIF staking rewards with community

Sentiment: Positive

Read moreNPC Skyrockets With 44% Rise, WIF, LAUNCHCOIN Trail | Meme Coins To Watch Today

Sentiment: Positive

Read moreCrypto Price Analysis 6-19: BITCOIN: BTC, ETHEREUM: ETH, SOLANA: SOL, INJECTIVE: INJ, INTERNET COMPUTER: ICP, DOGWIFHAT: WIF

Sentiment: Negative

Read moreEthereum and Solana Meme Coins PEPE, FLOKI, WIF Lead Losses as Market Dips

Sentiment: Negative

Read moreBONK Eyes 90% Breakout as Volume Surges 53% – Will Solana's Rising Meme King Eclipse WIF?

Sentiment: Positive

Read moreTrader Says One Layer-1 Altcoin ‘Destined' for New All-Time High, Warns of Potential 50% Correction for WIF and POPCAT

Sentiment: Neutral

Read moreWIF price prediction – Stuck near $1-resistance, is a 20% correction ahead?

Sentiment: Negative

Read more$WIF Crashes Below $1: Is This the Beginning of a Full Memecoin Meltdown?

Sentiment: Negative

Read morePEPE, WIF, POPCAT Price Prediction For June — Technical Setups Indicate Memecoin Boom

Sentiment: Positive

Read moreWIF Price Rallies 12%; MUBARAK, MOODENG Follow | Meme Coins To Watch Today

Sentiment: Positive

Read morePOPCAT, WIF, and MUBARAK surge over 10% — which memecoin looks the most bullish?

Sentiment: Positive

Read more3 Memecoins Facing Bear Flag Breakdowns: Dogecoin (DOGE), Pepe (PEPE), Dogwifhat (WIF) Price Analysis

Sentiment: Negative

Read moreMemecoins tank as BONK, FARTCOIN, PENGU, and WIF lead losses – Bitcoin to blame?

Sentiment: Negative

Read moreExpert Says Dogwifhat Price Could Hit $3.15 If WIF Buyers Can Overcome This Critical Resistance

Sentiment: Positive

Read moreCan Dogecoin (DOGE), Pepe (PEPE), and Dogwifhat (WIF) Surge Again? Price Analysis

Sentiment: Positive

Read moreCrypto Price Analysis 5-23: BITCOIN: BTC, ETHEREUM: ETH, SOLANA: SOL, RIPPLE: XRP, DOGWIFHAT: WIF, INJECTIVE: INJ

Sentiment: Positive

Read moreWIF traders should expect a 9% price rally, but THESE are the risks ahead!

Sentiment: Positive

Read moreBitcoin hits all-time high, traders brace for breakout above $110K, WIF top gainer

Sentiment: Positive

Read moreWhy are altcoins like Pepe, Shiba Inu, Pi Network, and WIF crashing today?

Sentiment: Negative

Read moreBitcoin stuck under $105K amid macro shifts, WIF and Pi grab altcoin spotlight

Sentiment: Neutral

Read moreDogwifhat (WIF) Targets $1.50 Amid 50% Weekly Jump – Here Are The Levels To Watch

Sentiment: Positive

Read moreDogwifhat Price Forecast: WIF Faces Critical Resistance Around $1, Is $2 Possible This Month?

Sentiment: Neutral

Read moreIf You Slept on WIF Gains, Don't Ignore BTFD Coin—Top New Meme Coin to Join in May 2025 With 200% Bonus and 8900% Upside

Sentiment: Positive

Read moreMemecoin Rally Fading? Pepe (PEPE), Bonk (BONK), and Dogwifhat (WIF) Lose Momentum

Sentiment: Negative

Read moreCrypto Price Prediction as TRUMP, WIF, MOODENG, KAITO Spike Double Digits

Sentiment: Positive

Read moreCan WIF Price Hit $2? Pattern Breakout and 100% OI Surge to $445M Signal Major Upside

Sentiment: Positive

Read moreDogecoin (DOGE), Shiba Inu (SHIB), and Dogwifhat (WIF) Memecoins Surge in Value

Sentiment: Positive

Read moreDogwifhat (WIF) Flips Floki (FLOKI) After 45% Daily Pump: What Are the Next Targets?

Sentiment: Positive

Read moreDogwifhat (WIF) Eyes $1.50 After 133% Breakout: Can Bulls Maintain Momentum?

Sentiment: Positive

Read moreCrypto Price Analysis 5-7: BITCOIN: BTC, ETHEREUM: ETH, SOLANA: SOL, DOGWIFHAT: WIF, INTERNET COMPUTER: ICP, CARDANO: ADA, POLKADOT: DOT

Sentiment: Positive

Read moreCrypto Price Analysis 4-29: BITCOIN: BTC, ETHEREUM: ETH, SOLANA: SOL, DOGWIFHAT: WIF, ARBITRUM: ARB, RIPPLE: XRP, HEDERA: HBAR

Sentiment: Neutral

Read moreCrypto Price Analysis 4-24: BITCOIN: BTC, ETHEREUM: ETH, SOLANA: SOL, RIPPLE: XRP, DOGWIFHAT: WIF, CELESTIA: TIA, TONCOIN: TON

Sentiment: Neutral

Read moreDogWifHat ($WIF) Rallies 25% as Meme Coin Market Rebounds to $53.95 Billion

Sentiment: Positive

Read moreWIF, BONK & FLOKI Prices Attract Massive Gains—Has the Memecoin Mania Begun?

Sentiment: Positive

Read moreCrypto Price Analysis 4-21: BITCOIN: BTC, ETHEREUM: ETH, SOLANA: SOL, DOGWIFHAT: WIF, ARBITRUM: ARB, LITECOIN: LTC, POLKADOT: DOT

Sentiment: Positive

Read moreCrypto Price Analysis 4-15: BITCOIN: BTC, ETHEREUM: ETH, SOLANA: SOL, DOGWIFHAT: WIF, CHAINLINK: LINK, POLKADOT: DOT, CARDANO: ADA

Sentiment: Neutral

Read moreCrypto Price Analysis 4-10: BITCOIN: BTC, ETHEREUM: ETH, SOLANA: SOL, CELESTIA: TIA, DOGWIFHAT: WIF, JUPITER: JUP, PENDLE: PENDLE

Sentiment: Positive

Read moreCrypto Price Analysis 4-7: BITCOIN: BTC, ETHEREUM: ETH, SOLANA: SOL, DOGECOIN: DOGE, DOGWIFHAT: WIF, CELESTIA: TIA, ARBITRUM: ARB

Sentiment: Negative

Read moreCrypto Price Analysis 4-3: BITCOIN: BTC, ETHEREUM: ETH, SOLANA: SOL, CELESTIA: TIA, ARBITRUM: ARB, DOGWIFHAT: WIF, POLKADOT: DOT

Sentiment: Negative

Read moreNo ‘Sphere WIF Hat' In Las Vegas: Dogwifhat Fundraiser Announces Start Of Refunds

Sentiment: Negative

Read moreCrypto Price Analysis 4-1: BITCOIN: BTC, ETHEREUM: ETH, SOLANA: SOL, RIPPLE: XRP, DOGWIFHAT: WIF, ARBITRUM: ARB, INTERNET COMPUTER: ICP

Sentiment: Positive

Read moreCrypto Price Analysis 3-26: BITCOIN: BTC, ETHEREUM: ETH, SOLANA: SOL, UNISWAP: UNI, APTOS: APT, DOGWIFHAT: WIF, AXIE INFINITY: AXS

Sentiment: Positive

Read moreCrypto Price Analysis 3-7: BITCOIN: BTC, ETHEREUM: ETH, SOLANA: SOL, DOGWIFHAT: WIF, RIPPLE: XRP, ETHENA: ENA, AXIE INFINITY: AXS

Sentiment: Negative

Read moreDogwifhat (WIF) price prediction – Here are the odds for a potential near-term rebound

Sentiment: Neutral

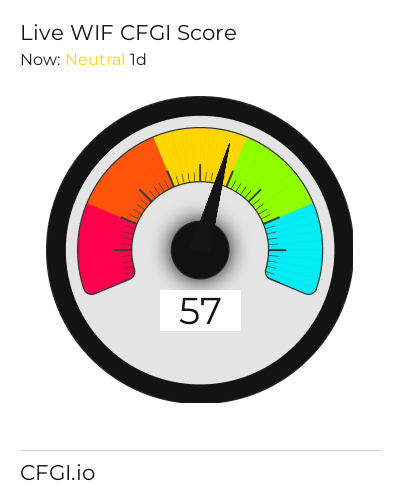

Read moreHistorical Values

-

Now

Neutral 56 -

Yesterday

Neutral 61 -

7 Days Ago

Neutral 42 -

1 Month Ago

Neutral 46

Dogwifhat Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Dogwifhat price evolution a certain numerical value.

This module studies the price trend to determine if the Dogwifhat market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Dogwifhat price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the Dogwifhat Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Dogwifhat bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Neutral

The Impulse indicator measures the current Dogwifhat price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Dogwifhat market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Greed

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Dogwifhat the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Fear

Dominance Greed

This other indicator takes into account the dominance of Dogwifhat with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Dogwifhat's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Dogwifhat and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Fear

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Dogwifhat has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Dogwifhat. For this, specific search terms are used that determine the purchasing or ceding interest of Dogwifhat, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Greed

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Dogwifhat and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Dogwifhat moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Greed

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Dogwifhat on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

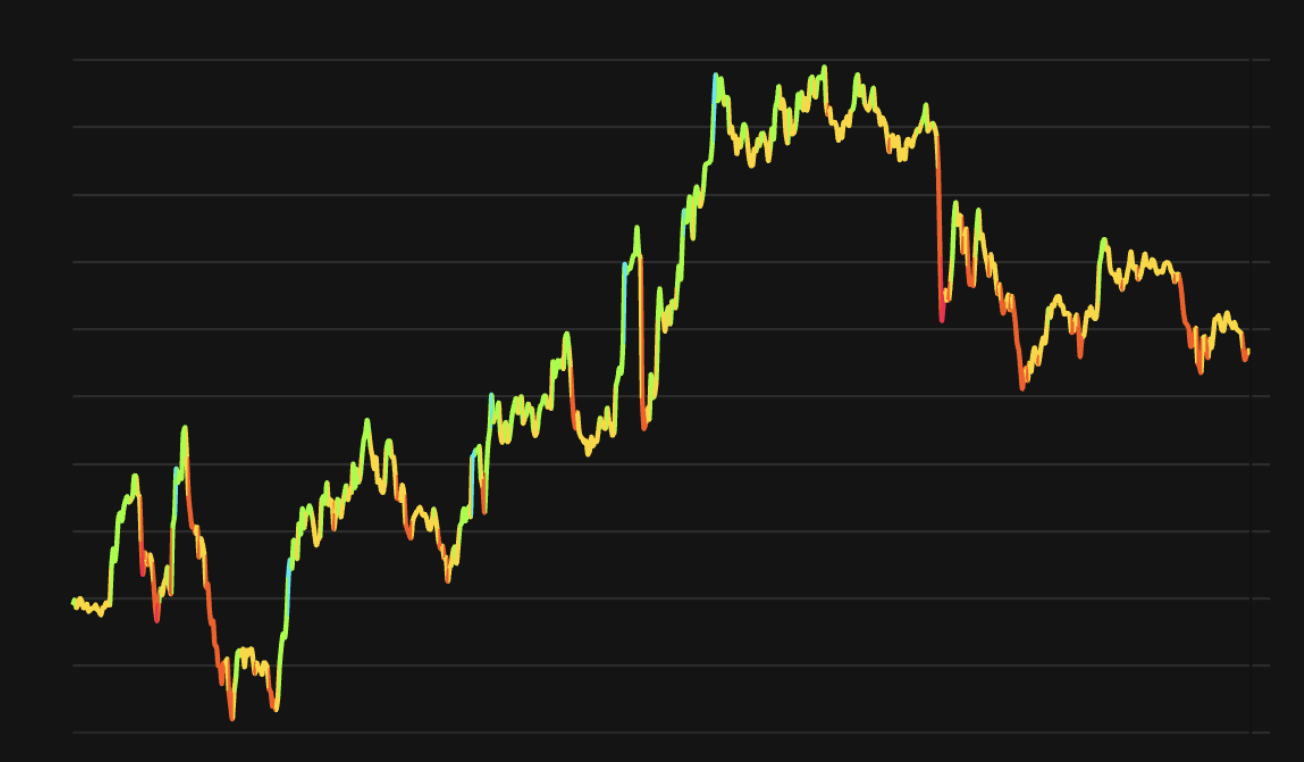

WIF Price

1 WIF = $0.976

Dogwifhat CFGI Score & WIF Price History

WIF Price & Dogwifhat Sentiment Breakdown Charts

Price Score Sentiment

Volatility Sentiment

Volume Sentiment

Impulse Sentiment

Technical Sentiment

Social Sentiment

Dominance Sentiment

Search Sentiment

Whales Sentiment

Order Book Sentiment

![dogwifhat [WIF] surges 18%, hits 3-week high – Is $1 within reach?](https://crypto.snapi.dev/images/v1/r/9/o/gladys-25-727272.webp)

![dogwifhat [WIF] sees 24% weekly loss – Is $0.](https://crypto.snapi.dev/images/v1/y/v/8/f3eb1c95-967d-4e33-9792-ec892a-707703.webp)

![dogwifhat's [WIF] 3-day rally has eyes glued, yet a hidden risk lurks](https://crypto.snapi.dev/images/v1/2/p/j/gladys-8-686618.jpg)

![Mapping dogwifhat's [WIF] road ahead: Is it time for traders to sell at](https://crypto.snapi.dev/images/v1/f/s/w/wif-featured-679657.webp)