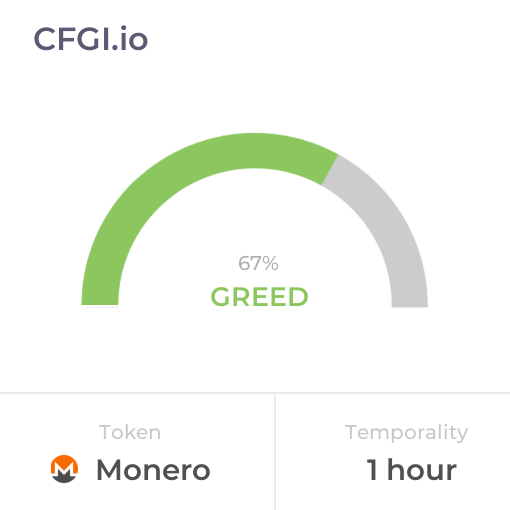

Historical Values

-

Now

Neutral 50 -

Yesterday

Neutral 50 -

7 Days Ago

Neutral 50 -

1 Month Ago

Neutral 50

Monero Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Monero price evolution a certain numerical value.

This module studies the price trend to determine if the Monero market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Neutral

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Monero price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Neutral

Like volatility, the Monero Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Monero bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Neutral

The Impulse indicator measures the current Monero price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Monero market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Neutral

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Monero the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Neutral

Dominance Neutral

This other indicator takes into account the dominance of Monero with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Monero's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Monero and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Neutral

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Monero has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Monero. For this, specific search terms are used that determine the purchasing or ceding interest of Monero, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Neutral

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Monero and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Monero moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Neutral

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Monero on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

Monero News

Monero News

Price predictions 2/13: BTC, ETH, BNB, XRP, SOL, DOGE, BCH, HYPE, ADA, XMR

Sentiment: Positive

Read moreMonero (XMR) Continues to Carve Unique Niche in Web3 Privacy Space : Analysis

Sentiment: Positive

Read morePrice predictions 2/11: BTC, ETH, BNB, XRP, SOL, DOGE, BCH, HYPE, ADA, XMR

Sentiment: Neutral

Read moreMonero XMR Attempts First Recovery in a Month, But Death Cross Risk Looms

Sentiment: Negative

Read morePrice predictions 2/6: BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH, HYPE, XMR

Sentiment: Neutral

Read moreRegulatory pressures drive demand for secure XMR to USDT Exchange in 2026

Sentiment: Negative

Read morePrice predictions 2/4: BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH, HYPE, XMR

Sentiment: Negative

Read moreMonero Price Rebounds at Channel Support: Is XMR Headed Back Toward $500?

Sentiment: Positive

Read moreCrypto prices today (Feb. 2): BTC dips below $77K, XRP, LINK, XMR slide amid market crash

Sentiment: Negative

Read moreMonero Price Rebounds Strongly as Shorts Capitulate: Where is XMR Headed Next?

Sentiment: Positive

Read moreMonero Approaches $500 Resistance—Is a 50% XMR Price Rally Back on the Table?

Sentiment: Positive

Read morePrice predictions 1/30: BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH, HYPE, XMR

Sentiment: Negative

Read morePrice predictions 1/28: BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH, HYPE, XMR

Sentiment: Positive

Read moreCrypto prices today (Jan. 28): BTC, BNB, XMR, ADA show modest gains ahead of Fed rate decision

Sentiment: Positive

Read moreAnticipation Fuels $GHOST Price Spike — Can the Rising Privacy Token Outshine ZEC and XMR?

Sentiment: Positive

Read moreDash plunges after India flags privacy coins – Yet XMR and ZEC hold up, why?

Sentiment: Negative

Read moreCrypto prices today (Jan. 22): BTC, BNB, XMR, SUI rebound as Trump cancels EU tariff threats

Sentiment: Positive

Read morePrice predictions 1/21: BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH, XMR, LINK

Sentiment: Neutral

Read moreMonero (XMR) Price Drops 20% Below $500: Warning Sign or Strategic Pullback?

Sentiment: Negative

Read moreCrypto prices today (Jan. 21): BTC dips below $90K, BNB, XMR, PUMP slide amid U.S.-EU tariff tensions

Sentiment: Negative

Read moreXMR to USDT Exchange: How to Convert Monero to Tether Without KYC (2026)

Sentiment: Positive

Read moreBitcoin price slips below $93K amidst trade war fears, XMR leads altcoin gains

Sentiment: Neutral

Read morePrivacy Tokens Surge: XMR, DASH and DUSK Buck the Broader Crypto Sell-Off

Sentiment: Positive

Read moreInvestors Rotate Into DUSK After Missing XMR and DASH Rallies, but Data Raises Warnings

Sentiment: Positive

Read moreMonero (XMR) Plunges 12% Daily, Bitcoin (BTC) Stands Calm at $95K: Market Watch

Sentiment: Negative

Read moreXMR rallies in response to a hacker laundering $282M from a wallet attack

Sentiment: Negative

Read morePrice predictions 1/16: BTC, ETH, XRP, BNB, SOL, DOGE, ADA, XMR, BCH, LINK

Sentiment: Positive

Read moreHyperliquid Joins Monero Party as XMR Price Rockets 81% With No Spot Markets

Sentiment: Positive

Read moreMonero (XMR) Hits New All-Time High Near $800 as Demand for Crypto Privacy Surges

Sentiment: Positive

Read morePrice predictions 1/14: BTC, ETH, XRP, BNB, SOL, DOGE, ADA, XMR, BCH, LINK

Sentiment: Positive

Read moreMonero (XMR) Sets a New ATH: We Asked 4 AIs if $1,000 is in Play This Month

Sentiment: Positive

Read moreMonero (XMR) Pushes to New Highs as Privacy Demand Outpaces Regulatory Pressure

Sentiment: Positive

Read moreMonero (XMR) Price Beats Gravity While One Metric Falls To It — Is $880 Still On?

Sentiment: Positive

Read moreMonero (XMR) outlook – Bears still in charge, but a short-term bounce is getting real

Sentiment: Negative

Read moreBitcoin (BTC) Challenges $92K Again, Monero (XMR) Charts New ATH: Market Watch

Sentiment: Positive

Read moreMonero (XMR) Hits New $610 All-Time High – Veteran Trader Shares Silver-Like Setup

Sentiment: Positive

Read morePeter Brandt Sees Monero (XMR) Following Silver's Historic Breakout Pattern

Sentiment: Positive

Read moreMonero Price News: As Zcash Devs Depart, XMR Steps In to Lead Privacy Coins

Sentiment: Positive

Read moreBitcoin price stuck as bulls defend $90K, IP, XMR lead altcoins with double digit gains

Sentiment: Positive

Read moreMonero (XMR) Price Breakout Mirrors Silver Price Rally, Says Peter Brandt

Sentiment: Positive

Read moreMonero (XMR) Explodes Again by 17%, Bitcoin (BTC) Rejected at $92K: Market Watch

Sentiment: Positive

Read moreMonero (XMR) Price Explodes to New Highs Amid Renewed Interest in Privacy Coins—Is $1000 Next?

Sentiment: Positive

Read morePeter Brandt Reveals How Monero (XMR) Could Print a “God Candle” Like Silver

Sentiment: Positive

Read moreMonero's XMR hits $500 for the first time since 2021 as rival Zcash fumbles

Sentiment: Positive

Read more3 Catalysts That Could Help Monero (XMR) Lead Market Performance in 2026

Sentiment: Positive

Read moreMonero Price Prediction: Can XMR Reach $500 In 2025 – 146% Gains YoY Make It Possible

Sentiment: Positive

Read moreBetter Cryptocurrency to Buy Now With $3,000: XRP (Ripple) vs. Monero (XMR)

Sentiment: Positive

Read moreCrypto prices today (Dec. 19): BTC, SOL, XMR, WLFI at crossroads as BoJ raises rates by 25 bps

Sentiment: Neutral

Read moreMonero Price Prediction: XMR Price Spikes 5% Overnight, Could Investors See $450 Before Christmas?

Sentiment: Positive

Read moreXMR price shows resilience at $400 amid market bearish conditions: Could a new ATH be next?

Sentiment: Positive

Read moreZcash Leads in Hype — But Monero (XMR) Is Quietly Dominating Where It Matters

Sentiment: Positive

Read moreCrypto prices today (Dec. 10): BTC, ZEC, AVAX, XMR rally ahead of key Fed rate decision

Sentiment: Positive

Read moreHistorical Values

-

Now

Neutral 50 -

Yesterday

Neutral 47 -

7 Days Ago

Fear 29 -

1 Month Ago

Greed 72

Monero Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Monero price evolution a certain numerical value.

This module studies the price trend to determine if the Monero market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Neutral

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Monero price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Neutral

Like volatility, the Monero Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Monero bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Neutral

The Impulse indicator measures the current Monero price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Monero market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Neutral

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Monero the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Neutral

Dominance Neutral

This other indicator takes into account the dominance of Monero with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Monero's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Monero and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Neutral

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Monero has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Monero. For this, specific search terms are used that determine the purchasing or ceding interest of Monero, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Neutral

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Monero and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Monero moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Neutral

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Monero on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

XMR Price

1 XMR = $

Monero CFGI Score & XMR Price History

XMR Price & Monero Sentiment Breakdown Charts

Price Score Sentiment

Volatility Sentiment

Volume Sentiment

Impulse Sentiment

Technical Sentiment

Social Sentiment

Dominance Sentiment

Search Sentiment

Whales Sentiment

Order Book Sentiment

![Monero's [XMR] rally looks unstoppable – but the data says otherwise](https://crypto.snapi.dev/images/v1/a/x/a/samyukhtha-10-1-854354.webp)