Historical Values

-

Now

Greed 79 -

Yesterday

Greed 79 -

7 Days Ago

Greed 79 -

1 Month Ago

Greed 79

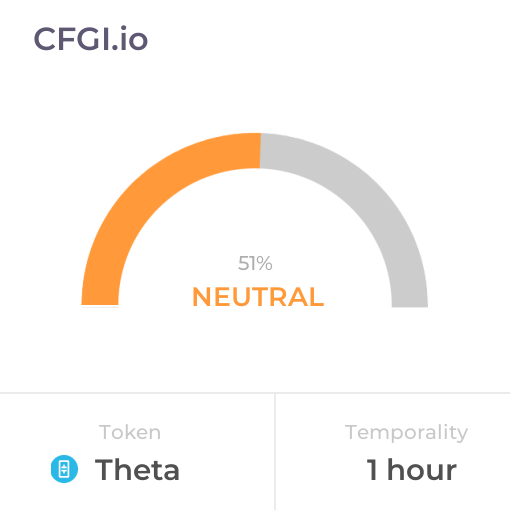

Theta Breakdown

Price Score Extreme Greed

The Price Score indicator is a relevant indicator to analyze and assign the Theta price evolution a certain numerical value.

This module studies the price trend to determine if the Theta market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Theta price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the Theta Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Theta bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Extreme Greed

The Impulse indicator measures the current Theta price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Theta market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Extreme Greed

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Theta the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Extreme Greed

Dominance Neutral

This other indicator takes into account the dominance of Theta with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Theta's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Theta and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Theta has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Theta. For this, specific search terms are used that determine the purchasing or ceding interest of Theta, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Greed

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Theta and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Theta moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Neutral

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Theta on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

Theta News

Theta News

Former Theta Labs executives allege fraud, market manipulation, retaliation in lawsuit

Sentiment: Negative

Read moreTheta Capital Seeks to Raise $200M Through New Blockchain Investment Fund: Bloomberg

Sentiment: Positive

Read moreTheta Capital Management Launches $200M Blockchain Fund Targeting 10-15 Investments

Sentiment: Positive

Read moreTheta Capital plans to raise $200 million for its latest blockchain funds-of-funds

Sentiment: Positive

Read moreTheta Fuel (TFUEL): A Decentralized Video Streaming And Content Delivery Network, And Its Token

Sentiment: Neutral

Read moreCrypto Price Analysis 7-14: BITCOIN: BTC, ETHEREUM: ETH, SOLANA: SOL, DOGECOIN: DOGE, CHAINLINK: LINK, THETA NETWORK: THETA

Sentiment: Positive

Read moreTheta Capital Completes $175M Crypto Fundraising for Blockchain Ventures

Sentiment: Positive

Read moreTheta Capital Just Raised $175M to Supercharge the Next Generation of Crypto Startups

Sentiment: Positive

Read moreTheta Capital Management Raises Over $175 Million for Fund-of-Funds Targeting Early-Stage Crypto Startups

Sentiment: Positive

Read moreTheta Capital bags $175m to back Coinfund, Polychain and other crypto VCs

Sentiment: Positive

Read moreTheta Price Prediction 2030: Is $1.09 the Ceiling—While Qubetics' Tokenisation Marketplace Draws Long-Term Eyes?

Sentiment: Neutral

Read more‘We end up with a far more accurate AI agent': Theta Labs CEO on Rockets' ClutchBot

Sentiment: Neutral

Read moreInterview: New Jersey Devils introduce AI chatbot ‘Bott Stevens' via Theta EdgeCloud

Sentiment: Neutral

Read moreAltcoins Surge: Sui ($SUI), Aptos ($APT), Theta Network ($THETA) - Market Analysis & Insights

Sentiment: Positive

Read moreCrypto Price Analysis 2-6: BITCOIN: BTC, ETHEREUM: ETH, SOLANA: SOL, DOGWIFHAT: WIF, BITTENSOR: TAO, INTERNET COMPUTER: ICP, THETA NETWORK: THETA

Sentiment: Neutral

Read moreNTU Adopts Theta Labs' EdgeCloud to Boost AI Research in Speech and Language Processing

Sentiment: Positive

Read moreCrypto Price Analysis 1-17 BITCOIN: BTC, ETHEREUM: ETH, SOLANA: SOL, INJECTIVE: INJ, DOGECOIN: DOGE, COSMOS: ATOM, THETA NETWORK: THETA

Sentiment: Positive

Read moreAltcoins start to wake up again: Solana $SOL, Binance Coin $BNB, and Theta Network ($THETA) ready to run

Sentiment: Positive

Read moreCrypto Price Analysis 12-19 BITCOIN: BTC, ETHEREUM: ETH, SOLANA: SOL, DOGWIFHAT: WIF, TONCOIN: TON, HEDERA: HBAR, THETA NETWORK: THETA

Sentiment: Negative

Read moreCORE, THETA, and CRV Lead the Gains While Fear and Greed Index Signals ‘Extreme Greed'

Sentiment: Positive

Read moreCrypto Price Analysis 11-28 BITCOIN: BTC, ETHEREUM: ETH, SOLANA: SOL, TRON: TRX, TONCOIN: TON, CELESTIA: TIA, THETA NETWORK: THETA

Sentiment: Neutral

Read moreCrypto Price Analysis 11-21 BITCOIN: BTC, ETHEREUM: ETH, SOLANA: SOL, TONCOIN: TON, THETA NETWORK: THETA, JUPITER: JUP, HELIUM: HNT

Sentiment: Positive

Read moreBinance to Delist Several Spot Trading Pairs Including DAR/BTC and THETA/ETH

Sentiment: Negative

Read morePrices and news of the crypto Cronos (CRO), Theta Network (THETA), and JasmyCoin (JASMY)

Sentiment: Neutral

Read moreTheta Labs inks AI research deal with University of Oregon's Distopia Lab

Sentiment: Positive

Read moreWhat's New in DePin? Theta Releases EdgeCloud for Android, Anyone Announces Testnet, and More

Sentiment: Positive

Read moreProtocol Village: Theta Labs Launches 'EdgeCloud for Mobile,' Implements AI Video Detection

Sentiment: Positive

Read moreSeoul Women's University taps Theta EdgeCloud to power AI research with DePIN

Sentiment: Positive

Read moreHere's What's Next for These Altcoins: FTM, RENDER, and THETA Prices Aim for a Bullish Monthly Close

Sentiment: Positive

Read moreTheta Labs Awarded US Patent for Off-Chain Verification of Distributed Computing Tasks

Sentiment: Positive

Read moreTheta Network Price Prediction 2024, 2025, 2030: Will THETA Price Hit $5 This Year?

Sentiment: Positive

Read moreTheta Surges to $3 Following Partnership with Aethir to Launch Hybrid GPU Marketplace for AI

Sentiment: Positive

Read moreTheta partners with Aethir to launch largest hybrid GPU marketplace for AI and DePIN

Sentiment: Positive

Read moreToncoin (TON) and Theta (THETA) have huge potential in crypto bull market

Sentiment: Positive

Read moreTheta EdgeCloud to Launch with Meta Llama 2, Google Gemma, Stable Diffusion, and Other Popular AI Models

Sentiment: Positive

Read moreTheta Nears EdgeCloud Launch To Support AI Models Including Stable Diffusion and Llama 2

Sentiment: Positive

Read moreBitcoin Falls Below $64,000 Ahead Of Fed Meeting; dogwifhat, Theta Network Among Top Losers

Sentiment: Negative

Read moreNear Protocol (NEAR) and Theta (THETA) lead the altcoins but resistance heavy

Sentiment: Positive

Read moreBinance to Launch New Trading Pairs Including DOGE, SHIB, PEPE, THETA, and AGIX

Sentiment: Positive

Read moreTheta Capital Management B.V. Announces $200M Theta Blockchain Ventures IV Fund

Sentiment: Positive

Read moreAltcoins Theta, Pyth, and Stacks Surge With Bitcoin in Latest Crypto Rally

Sentiment: Positive

Read moreTheta EdgeCloud Set to Revolutionize AI Computing with Decentralized GPU Power

Sentiment: Positive

Read moreCrypto Market Analysis As Metaverse Tokens Regain Momentum: THETA, MANA, APE

Sentiment: Positive

Read morePrices and news of the crypto Fetch.Ai (FET), Chainlink (LINK) and Theta Network (THETA)

Sentiment: Positive

Read moreTheta Network Price Prediction 2024, 2025, 2030: Is THETA A Good Investment For This Year?

Sentiment: Positive

Read moreTheta Name Service Integration in Theta Web Wallet: A Game-Changer for Global Adoption

Sentiment: Positive

Read moreTheta Network Announces its 2024 Roadmap and There are Huge News for Video, Media and AI

Sentiment: Positive

Read moreHistorical Values

-

Now

Greed 79 -

Yesterday

Neutral 79 -

7 Days Ago

Greed 73 -

1 Month Ago

Greed 61

Theta Breakdown

Price Score Extreme Greed

The Price Score indicator is a relevant indicator to analyze and assign the Theta price evolution a certain numerical value.

This module studies the price trend to determine if the Theta market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Theta price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the Theta Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Theta bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Extreme Greed

The Impulse indicator measures the current Theta price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Theta market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Extreme Greed

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Theta the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Extreme Greed

Dominance Neutral

This other indicator takes into account the dominance of Theta with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Theta's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Theta and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Theta has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Theta. For this, specific search terms are used that determine the purchasing or ceding interest of Theta, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Greed

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Theta and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Theta moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Neutral

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Theta on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

THETA Price

1 THETA = $0.21

Theta CFGI Score & THETA Price History

THETA Price & Theta Sentiment Breakdown Charts

Price Score Sentiment

Volatility Sentiment

Volume Sentiment

Impulse Sentiment

Technical Sentiment

Social Sentiment

Dominance Sentiment

Search Sentiment

Whales Sentiment

Order Book Sentiment