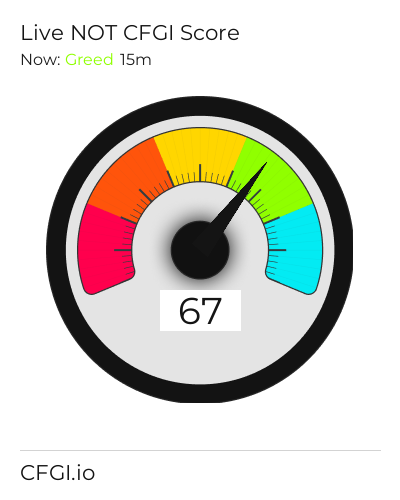

Historical Values

-

Now

Greed 68 -

Yesterday

Greed 68 -

7 Days Ago

Greed 68 -

1 Month Ago

Greed 68

Notcoin Breakdown

Price Score Greed

The Price Score indicator is a relevant indicator to analyze and assign the Notcoin price evolution a certain numerical value.

This module studies the price trend to determine if the Notcoin market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Extreme Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Notcoin price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the Notcoin Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Notcoin bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Extreme Greed

The Impulse indicator measures the current Notcoin price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Notcoin market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Greed

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Notcoin the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Extreme Fear

Dominance Extreme Greed

This other indicator takes into account the dominance of Notcoin with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Notcoin's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Notcoin and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Extreme Fear

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Notcoin has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Notcoin. For this, specific search terms are used that determine the purchasing or ceding interest of Notcoin, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Extreme Fear

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Notcoin and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Notcoin moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Greed

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Notcoin on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

Notcoin News

Notcoin News

XRP Is Not Competing For Digital Gold Status, The Settlement Layer Is The Real Deal

Sentiment: Positive

Read moreBitcoin Is Mirroring 2017, Not 2021, And An Explosive Rally Will Begin After This Happens

Sentiment: Positive

Read moreIran's 700% Crypto Withdrawal Surge Reveals Bitcoin's Real Wartime Role – and It's Not Digital Gold

Sentiment: Negative

Read moreBitcoin Stable As US-Iran Conflict Continues, But Here's Why That May Not Last

Sentiment: Negative

Read moreSolana Meme Coin SANAE TOKEN Scandal: Creator Says ‘Not a Single Yen Earned' as Japan PM Denies Link

Sentiment: Negative

Read moreDogecoin Price Struggles Near $0.095: 5 Historical Reasons DOGE Is Not Surging

Sentiment: Negative

Read moreBitcoin's 5% spike higher Monday driven by short-covering, not fresh buying, says analyst.

Sentiment: Neutral

Read moreIran Conflict Not Major Concern For Bitcoin Mining Hashrate, Say Experts

Sentiment: Positive

Read moreNotcoin (NOT) Price Prediction 2026, 2027 – 2030: Is NOT Set for a Gradual Comeback?

Sentiment: Positive

Read moreNotcoin (NOT) Price Prediction 2026, 2027 – 2030: Is NOT Set for a Gradual Comeback?

Sentiment: Positive

Read moreCharles Hoskinson Fires Back: Cardano's Not Done Yet Despite 5 Years of Losses

Sentiment: Positive

Read moreCharles Hoskinson Fires Back: Cardano's Not Done Yet Despite 5 Years of Losses

Sentiment: Positive

Read moreNot the Bottom Yet? CryptoQuant Data Exposes Bitcoin's Brutal Deleveraging

Sentiment: Negative

Read moreNot the Bottom Yet? CryptoQuant Data Exposes Bitcoin's Brutal Deleveraging

Sentiment: Negative

Read moreNot the Bottom Yet? CryptoQuant Data Exposes Bitcoin's Brutal Deleveraging

Sentiment: Negative

Read moreNot the Bottom Yet? CryptoQuant Data Exposes Bitcoin's Brutal Deleveraging

Sentiment: Negative

Read moreGrant Cardone To Tokenize $5B Of Real Estate, But XRP Is Not On His Partner Shortlist

Sentiment: Positive

Read moreGrant Cardone To Tokenize $5B Of Real Estate, But XRP Is Not On His Partner Shortlist

Sentiment: Positive

Read moreGrant Cardone To Tokenize $5B Of Real Estate, But XRP Is Not On His Partner Shortlist

Sentiment: Positive

Read moreBitcoin's five-month losing streak may not end in March as $70K caps price

Sentiment: Negative

Read more'Not Your Market Price': Nick Szabo Questions Who Controls Bitcoin ETF Pricing After Jane Street Allegations

Sentiment: Negative

Read more'Not Your Market Price': Nick Szabo Questions Who Controls Bitcoin ETF Pricing After Jane Street Allegations

Sentiment: Negative

Read more'Not Your Market Price': Nick Szabo Questions Who Controls Bitcoin ETF Pricing After Jane Street Allegations

Sentiment: Negative

Read more'Not Your Market Price': Nick Szabo Questions Who Controls Bitcoin ETF Pricing After Jane Street Allegations

Sentiment: Negative

Read moreBlackRock's $254 Million Bitcoin Purchase in 24 Hours: They Are Not Stopping

Sentiment: Positive

Read moreBlackRock's $254 Million Bitcoin Purchase in 24 Hours: They Are Not Stopping

Sentiment: Positive

Read moreBlackRock's $254 Million Bitcoin Purchase in 24 Hours: They Are Not Stopping

Sentiment: Positive

Read moreBlackRock's $254 Million Bitcoin Purchase in 24 Hours: They Are Not Stopping

Sentiment: Positive

Read moreGlobal Money Supply Hits Record High: Why Gold Is Rallying but Bitcoin Is Not

Sentiment: Positive

Read moreEric Trump Says He Believes In BTC 'Long Term' And American Bitcoin's 'Growth Metric' Is To Increase Its Stash, Not Chase Exhashes Like Other Miners

Sentiment: Positive

Read moreBitwise CIO Reveals What's Really Behind Bitcoin's Decline and It's Not Jane Street

Sentiment: Negative

Read moreBitcoin 5TH Wave Is Not Over Yet, And Price Could Still Crash To $52,000; Analyst Warns

Sentiment: Negative

Read moreBitcoin bear market not 'over already' as price rejects at $68K trend line

Sentiment: Negative

Read morePolkadot (DOT) Price Rallies 30% Thanks to Bitcoin – But Not for the Obvious Reason

Sentiment: Positive

Read moreCircle's $461M payout shows who captures USDC yield — and it's not Circle

Sentiment: Positive

Read moreBitcoin snaps back near $69,000 but analysts warn the market may not be out of the woods yet

Sentiment: Neutral

Read moreBitcoin's Dry Powder Myth Busted: Outflows – Not Buyers – Driving Low SSR

Sentiment: Negative

Read moreBitcoin Rebounds To $69,000, But Analyst Warns It's Probably 'A Trap, Not A Bottom'

Sentiment: Negative

Read moreThis Is Not The First Time XRP Has Crashed 69%, Here's What Happened Last Time

Sentiment: Positive

Read moreVitalik Buterin Draws the Line: Ethereum Will Not Back ‘Just Any' DeFi Project

Sentiment: Positive

Read more‘We Designed XRPL So Ripple Could Not Control It': David Schwartz Breaks Silence

Sentiment: Positive

Read moreBitcoin losing $63k means crypto winter will not thaw any time soon as tariff shock rattles ETF flows

Sentiment: Negative

Read morePeter Schiff: If You Invested $10,000 In Bitcoin In 2021, You'd Be Down $900—But Not With Gold

Sentiment: Negative

Read moreEthereum price drops to $1.8K as data suggests ETH bears are not done yet

Sentiment: Negative

Read more'If you're not accumulating bitcoin at this stage, then when,' asks prominent analyst

Sentiment: Positive

Read moreMorning Crypto Report: Mr. XRP Yoshitaka Kitao Predicts 2026 On-Chain Revolution, Bitcoin in 'Not Digital Gold' Period: CryptoQuant CEO, Ethereum Foundation to Stake 70,000 ETH

Sentiment: Positive

Read moreAre Bitcoin ETFs quietly accumulating or just not selling? The flow data that matters

Sentiment: Negative

Read moreMichael Saylor Hits 100 Bitcoin Buys—And He's Not Stopping Despite A $7 Billion Loss

Sentiment: Positive

Read moreAnalysts say USDT contraction may signal market exhaustion, not collapse

Sentiment: Negative

Read more‘If it's not going to zero, it's going to a million': Michael Saylor's Strategy buys another 592 bitcoin for $40M

Sentiment: Positive

Read moreBitdeer CEO says bitcoin balance “will not always be zero” as miner eyes land acquisitions after liquidating entire treasury

Sentiment: Positive

Read moreTo freeze or not to freeze: Satoshi and the $440 billion in bitcoin threatened by quantum computing

Sentiment: Negative

Read moreVitalik Buterin: “Ethereum Is Not Dying” — Founder Pushes Back on Critics

Sentiment: Positive

Read moreMichael Saylor: 'If Bitcoin's Not Going To Zero, It's Going To A Million'

Sentiment: Positive

Read moreStrategy Not at Risk of Liquidation as Average Bitcoin Price Falls 10%: Arkham

Sentiment: Negative

Read moreMetaplanet CEO Fires Back At Critics: 'We Have Not Underperformed Bitcoin'

Sentiment: Negative

Read moreElizabeth Warren Urges Trump Admin Not To Stabilize Bitcoin's Price, Gets A Response From Changpeng Zhao: 'Crypto Never Needed A Bailout'

Sentiment: Positive

Read moreDon't Fall For The Bitcoin Trap: Analyst Explains Why Recovery To $76,000 Is Not A Good Thing

Sentiment: Negative

Read moreSenator Warren Urges Treasury and Fed Not to Bail Out Crypto Billionaires Saylor and CZ Amid Bitcoin Slide

Sentiment: Negative

Read moreRay Dalio Says Gold, Not Bitcoin, Protects Wealth as Global Order Breaks Down

Sentiment: Negative

Read moreBitcoin Enters A New Volatility Regime Not Seen Since Last Year, History Repeating?

Sentiment: Neutral

Read moreBitcoin Stalls at a Critical Stress Zone as On-Chain Data Warns the Bottom May Not Be In Yet

Sentiment: Negative

Read moreCathie Wood: Bitcoin's Drop Driven By Algorithmic Selling, Not Fundamentals

Sentiment: Positive

Read moreMorning Crypto Report: XRP Not Ready for $1.50: Bollinger Bands, Cardano Foundation Votes 'Yes' on 500,000 ADA Withdrawal, Kiyosaki Details 'Rich Dad' Bitcoin Strategy

Sentiment: Positive

Read moreJapan's SBI Clears XRP Rumors, Says $4B Stake Is in Ripple Labs Not Tokens

Sentiment: Positive

Read moreHistorical Values

-

Now

Greed 68 -

Yesterday

Neutral 68 -

7 Days Ago

Neutral 49 -

1 Month Ago

Fear 32

Notcoin Breakdown

Price Score Greed

The Price Score indicator is a relevant indicator to analyze and assign the Notcoin price evolution a certain numerical value.

This module studies the price trend to determine if the Notcoin market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Extreme Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Notcoin price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the Notcoin Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Notcoin bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Extreme Greed

The Impulse indicator measures the current Notcoin price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Notcoin market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Greed

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Notcoin the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Extreme Fear

Dominance Extreme Greed

This other indicator takes into account the dominance of Notcoin with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Notcoin's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Notcoin and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Extreme Fear

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Notcoin has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Notcoin. For this, specific search terms are used that determine the purchasing or ceding interest of Notcoin, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Extreme Fear

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Notcoin and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Notcoin moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Greed

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Notcoin on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

NOT Price

1 NOT = $0.0003795

Notcoin CFGI Score & NOT Price History

NOT Price & Notcoin Sentiment Breakdown Charts

Price Score Sentiment

Volatility Sentiment

Volume Sentiment

Impulse Sentiment

Technical Sentiment

Social Sentiment

Dominance Sentiment

Search Sentiment

Whales Sentiment

Order Book Sentiment