Historical Values

-

Now

Greed 65 -

Yesterday

Greed 65 -

7 Days Ago

Greed 65 -

1 Month Ago

Greed 65

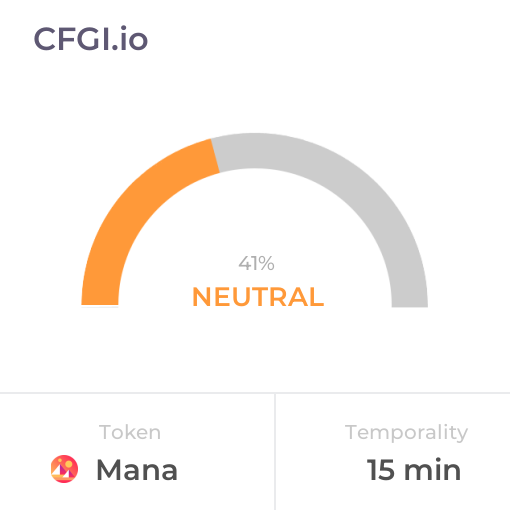

Mana Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Mana price evolution a certain numerical value.

This module studies the price trend to determine if the Mana market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Mana price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Extreme Greed

Like volatility, the Mana Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Mana bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Greed

The Impulse indicator measures the current Mana price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Mana market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Neutral

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Mana the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Greed

Dominance Greed

This other indicator takes into account the dominance of Mana with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Mana's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Mana and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Extreme Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Mana has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Mana. For this, specific search terms are used that determine the purchasing or ceding interest of Mana, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Extreme Greed

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Mana and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Mana moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Neutral

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Mana on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

Mana News

Mana News

Safello Expands Cryptocurrency Offering With XRP, BNB, MANA, and Five More Digital Assets

Sentiment: Positive

Read moreDecentraland Price Prediction 2025, 2026 – 2030: Will MANA Price Hit $1?

Sentiment: Positive

Read moreDecentraland (MANA): A Decentralized Metaverse Where Users Have Creative Control And Ownership Of Virtual Land

Sentiment: Positive

Read moreDecentraland (MANA): the price rises again by 42% in a month. Technical analysis and future scenarios

Sentiment: Positive

Read moreBitcoin tops $87K amid political jitters, STX, MANA, FARTCOIN jump over 10%

Sentiment: Positive

Read moreCrypto price predictions: Stellar (XLM), Decentraland (MANA), Stacks (STX)

Sentiment: Positive

Read moreMANA price outlook as Decentraland leads NFT sector in developer engagement

Sentiment: Positive

Read moreDecentraland Price Prediction 2024, 2025, 2030: Will MANA Price Reach $1 This Year?

Sentiment: Positive

Read moreDecentraland: Whales Make Waves as MANA Surges Amid Increased Investor Interest

Sentiment: Positive

Read moreMetaverse tokens SAND and MANA signal recoveries as NFT sales volume jumps 40%

Sentiment: Positive

Read moreThe Sandbox (SAND) Price Primed to Hit $1 After Momental Surge— Decentraland (MANA) Price to Follow the Suit

Sentiment: Positive

Read moreDecentraland (MANA) poised for recovery as Donald Trump ignites the NFT market

Sentiment: Positive

Read moreAltcoins Shine: $MANA, $BAT, $LDO See Large Inflows Despite Bitcoin's Jitters

Sentiment: Positive

Read moreCrypto Price Prediction As GameFi Tokens Go Ballistic: Tech Savvy Investors Eye SAND, MANA, GALA

Sentiment: Positive

Read moreCrypto Market Analysis As Metaverse Tokens Regain Momentum: THETA, MANA, APE

Sentiment: Positive

Read moreDecentraland Price Displays Bullish Trend! What's Next For MANA Price This Month?

Sentiment: Positive

Read moreSelling opportunity ahead: A close look at MANA/USDT amid bearish momentum

Sentiment: Negative

Read moreDecentraland's MANA in ‘Depression' Phase: Analyst Eyeing a Possible Revival

Sentiment: Positive

Read moreDecentraland Price Prediction 2023, 2024, 2025: Will MANA Price Reach $0.75 This Year?

Sentiment: Neutral

Read moreDecentraland (MANA) Price Targets $0.50 after Receiving $10 Million Whale Investment

Sentiment: Positive

Read moreAs P2E Pump Speculations Rise, AXS, MANA, And SAND Tokens Record Massive Spikes!

Sentiment: Neutral

Read moreDecentraland Price Prediction 2023, 2024, 2025: Will MANA Price Reach $0.6 This Year?

Sentiment: Positive

Read moreDecentraland Price Prediction 2023, 2024, 2025: Will MANA Price Reach $0.5 This Year?

Sentiment: Neutral

Read moreDecentraland Price Prediction 2023, 2024, 2025: Will MANA Price Reach $1 This Year?

Sentiment: Positive

Read moreBitstamp Delists AXS, CHZ, MANA, MATIC, NEAR, SAND and SOL for US Customers

Sentiment: Negative

Read moreBitstamp to Delist SOL, MANA, MATIC Among Other Altcoins in US Thanks to SEC

Sentiment: Negative

Read moreCrypto Exchange Bitstamp to Suspend Trading AXS, CHZ, MANA, MATIC, NEAR, SAND, and SOL

Sentiment: Negative

Read moreDecentraland (MANA) Price Could Suffer as Metaverse Users Shift Attention Elsewhere

Sentiment: Negative

Read moreCrypto news and prices of Decentraland (MANA), Cronos (CRO), Shiba Inu (SHIB)

Sentiment: Neutral

Read moreSEC Jolts eToro Into Ditching Coins: What It Means For ALGO, MANA, DASH And MATIC

Sentiment: Negative

Read moreeToro US Disallows New Positions in $MATIC, $ALGO, and $MANA Amid SEC's War on Exchanges

Sentiment: Negative

Read moreeToro Temporarily Halts ALGO, MANA, MATIC, and DASH Purchases for US Customers

Sentiment: Negative

Read moreEtoro to Delist ALGO, MANA, DASH, and MATIC for US Customers Amid ‘Evolving Regulatory Landscape'

Sentiment: Negative

Read moreMANA Price Crash: Is the Decentraland Token Doomed to Further Catastrophic Declines?

Sentiment: Negative

Read moreWill Metaverse Coins Make a Comeback In June 2023?; $MANA, $SAND, $AXS Price Analysis

Sentiment: Positive

Read moreCrypto news: prices and analysis of SpongeBob (SPONGE), Decentraland (MANA) and Amp (AMP)

Sentiment: Neutral

Read moreRNDR, SNX, MASK, AXS, OP, LDO Ascend as Top Gainers; PEPE, CFX, CSPR, XRP, MANA, TON Navigate Market Declines

Sentiment: Positive

Read moreDecentraland (MANA) Price Rises in Metaverse Comeback – Where Will it Go?

Sentiment: Positive

Read moreMANA, RNDR, OP, XRP, SAND, CFX Soar as Top Gainers; KAVA, XDC, BSV, FLR, RPL Navigate Market Declines

Sentiment: Neutral

Read moreThe latest performances of Decentraland (MANA), Arbitrum (ARB) and Crypto.com (CRO)

Sentiment: Neutral

Read moreThe Sandbox (SAND) is Breaking out, Decentraland (MANA) Could Soon Follow

Sentiment: Positive

Read moreFidelity International Leaps into the Metaverse with Innovative Decentraland ($MANA) Campus

Sentiment: Positive

Read moreDecentraland (MANA) Long-Term Investors Hold Firm, What Next for MANA Price?

Sentiment: Positive

Read moreDecentraland (MANA) Loses Traction as Investors Panic, Will the Price Drop Further?

Sentiment: Negative

Read moreDecentraland (MANA) Turns Bearish After It Loses This Important Support Level

Sentiment: Negative

Read moreMANA bulls begin to fade in strength after the loss of an important support

Sentiment: Negative

Read moreWill Meta Tokens Boom In The Anticipated 2023 Bull Run? Apecoin(Ape), Decentraland(MANA), Sandbox(SAND) Price Analysis

Sentiment: Neutral

Read moreCrypto news: GMX, Decentraland (MANA) and Floki Inu (FLOKI), what is happening to their performance?

Sentiment: Neutral

Read moreHistorical Values

-

Now

Greed 65 -

Yesterday

Neutral 65 -

7 Days Ago

Neutral 54 -

1 Month Ago

Greed 68

Mana Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Mana price evolution a certain numerical value.

This module studies the price trend to determine if the Mana market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Mana price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Extreme Greed

Like volatility, the Mana Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Mana bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Greed

The Impulse indicator measures the current Mana price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Mana market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Neutral

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Mana the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Greed

Dominance Greed

This other indicator takes into account the dominance of Mana with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Mana's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Mana and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Extreme Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Mana has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Mana. For this, specific search terms are used that determine the purchasing or ceding interest of Mana, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Extreme Greed

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Mana and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Mana moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Neutral

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Mana on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

MANA Price

1 MANA = $0.12

Mana CFGI Score & MANA Price History

MANA Price & Mana Sentiment Breakdown Charts

Price Score Sentiment

Volatility Sentiment

Volume Sentiment

Impulse Sentiment

Technical Sentiment

Social Sentiment

Dominance Sentiment

Search Sentiment

Whales Sentiment

Order Book Sentiment

![Decentraland [MANA] vs FET – Active addresses, dev. activity, and more](https://crypto.snapi.dev/images/v1/z/t/a/mana-featured-625690.webp)