Historical Values

-

Now

Neutral 50 -

Yesterday

Neutral 50 -

7 Days Ago

Neutral 50 -

1 Month Ago

Neutral 50

FTX token Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the FTX token price evolution a certain numerical value.

This module studies the price trend to determine if the FTX token market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Neutral

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current FTX token price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Neutral

Like volatility, the FTX token Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in FTX token bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Neutral

The Impulse indicator measures the current FTX token price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the FTX token market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Neutral

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for FTX token the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Neutral

Dominance Neutral

This other indicator takes into account the dominance of FTX token with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases FTX token's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of FTX token and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Neutral

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on FTX token has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in FTX token. For this, specific search terms are used that determine the purchasing or ceding interest of FTX token, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Neutral

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of FTX token and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of FTX token moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Neutral

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for FTX token on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

FTX token News

FTX token News

FTT holds key support as FTX rejects Three Arrows' $1.53B bid in bankruptcy dispute

Sentiment: Neutral

Read moreBinance adds 17 tokens to its second Vote to Delist round, featuring JASMY, FTT, VOXEL, and GPS

Sentiment: Negative

Read moreFTT Spikes Over 40% After SBF's First Tweet in Two Years, Community Reacts

Sentiment: Positive

Read moreBankman-Fried's First Social Media Posts in Two Years Cause Temporary FTT Price Jump

Sentiment: Positive

Read moreSam Bankman Breaks The Silence After 2 Years And Causes FTT Crypto To Surge.

Sentiment: Positive

Read moreFTT Surges 30% as Disgraced FTX Founder Sam Bankman-Fried Posts for First Time in 2 Years

Sentiment: Positive

Read moreSam Bankman-Fried's Prison Tweets Shock the Internet – FTT Price Reacts!

Sentiment: Negative

Read moreFTX Token (FTT) jumps 36% as Sam Bankman-Fried returns to X after two years

Sentiment: Neutral

Read moreJailed FTX Founder SBF's Tweets Drive Native Token Price, FTT Surges 30%

Sentiment: Positive

Read moreFTT Briefly Spikes After Sam Bankman-Fried Tweets for First Time in 2 Years

Sentiment: Neutral

Read moreSam Bankman-Fried posts on X first time in two years; FTT token soars 30%

Sentiment: Positive

Read moreKaiko Research: Bitfinex's LEO, WBTC, and HYPE lead overvalued asset category, draw FTX/FTT comparison

Sentiment: Negative

Read moreFTX Token (FTT) Price Rises as FTX Plans Creditor Payments on February 18

Sentiment: Positive

Read moreFTX Token Jumps 8%: Could $1.2B Creditor Repayments Drive FTT Price to $6?

Sentiment: Positive

Read moreUniswap price soars while FTX's FTT token and Ripple (XRP) struggle with regulatory challenges

Sentiment: Neutral

Read moreFTX Token (FTT) Plummets 16% Following Profit-Taking Amid Repayment Plan Uncertainty

Sentiment: Negative

Read moreFTX Token crashes after repayment plan approval: is this the end for FTT?

Sentiment: Negative

Read moreFTX Token (FTT) Price Crashes 16% as Massive Selling Follows Repayment Plan

Sentiment: Negative

Read moreFTX Bankruptcy Plan Approved: $16 Billion In Assets To Be Repaid, FTT Price Soars 20%

Sentiment: Positive

Read moreLight at the End of the Tunnel? FTT Surges 60% as FTX Repayment Plan Nears Approval

Sentiment: Positive

Read moreFTT Price Jumps Over 70% on Speculation of Imminent FTX Bankruptcy Distributions

Sentiment: Positive

Read moreCrypto News Today (Sept 30th, 2024): Bitcoin Price Falls to $64k, FTX Token (FTT) Surged +80% in 24-Hours!

Sentiment: Neutral

Read moreCharity tied to former FTX exec made $150M from deal on FTT tokens: Report

Sentiment: Negative

Read moreFTX Token Price Prediction: Will FTT Price Record A 100% Upside This AltSeason?

Sentiment: Positive

Read moreFTT Surges 50% On FTX Creditors' Claims Settlement And Billions In Compensation: How High Can It Rise?

Sentiment: Positive

Read moreFTX Claimants Will Get Their Solana NFTs Back—But FTT Holders Get Nothing

Sentiment: Negative

Read moreFTX empties FTT treasury wallet, transferring assets worth over $250 million

Sentiment: Negative

Read moreFTT Soared 15% After SBF Appealed Fraud Conviction and 25-Year Sentencing

Sentiment: Negative

Read moreFTX Token Faces Repeated Rejection! FTT Price On A Path To Record New Low?

Sentiment: Negative

Read moreCrypto Prices Today: Bitcoin Inches Closer To Dip Below $40K As SUI & FTT Take The Lead

Sentiment: Positive

Read moreBTC Calms at $46K After ETF Rollercoaster, BCH and FTT Explode by Double Digits (Market Watch)

Sentiment: Positive

Read moreFTX Price Rally Seems Fading Away! Has FTT Price Reached Its Yearly High?

Sentiment: Positive

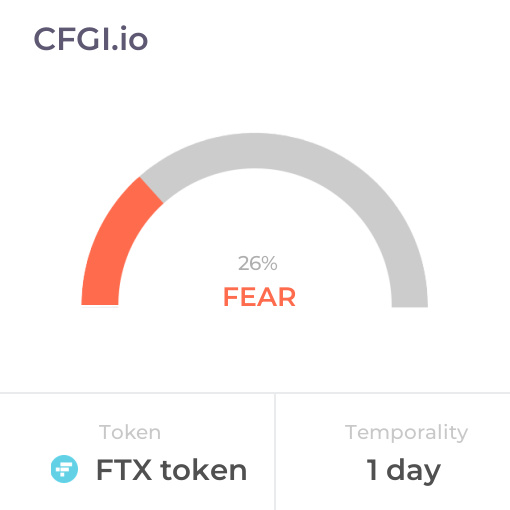

Read moreHistorical Values

-

Now

Neutral 50 -

Yesterday

Neutral 26 -

7 Days Ago

Fear 25 -

1 Month Ago

Fear 31

FTX token Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the FTX token price evolution a certain numerical value.

This module studies the price trend to determine if the FTX token market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Neutral

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current FTX token price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Neutral

Like volatility, the FTX token Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in FTX token bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Neutral

The Impulse indicator measures the current FTX token price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the FTX token market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Neutral

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for FTX token the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Neutral

Dominance Neutral

This other indicator takes into account the dominance of FTX token with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases FTX token's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of FTX token and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Neutral

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on FTX token has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in FTX token. For this, specific search terms are used that determine the purchasing or ceding interest of FTX token, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Neutral

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of FTX token and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of FTX token moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Neutral

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for FTX token on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

FTT Price

1 FTT = $

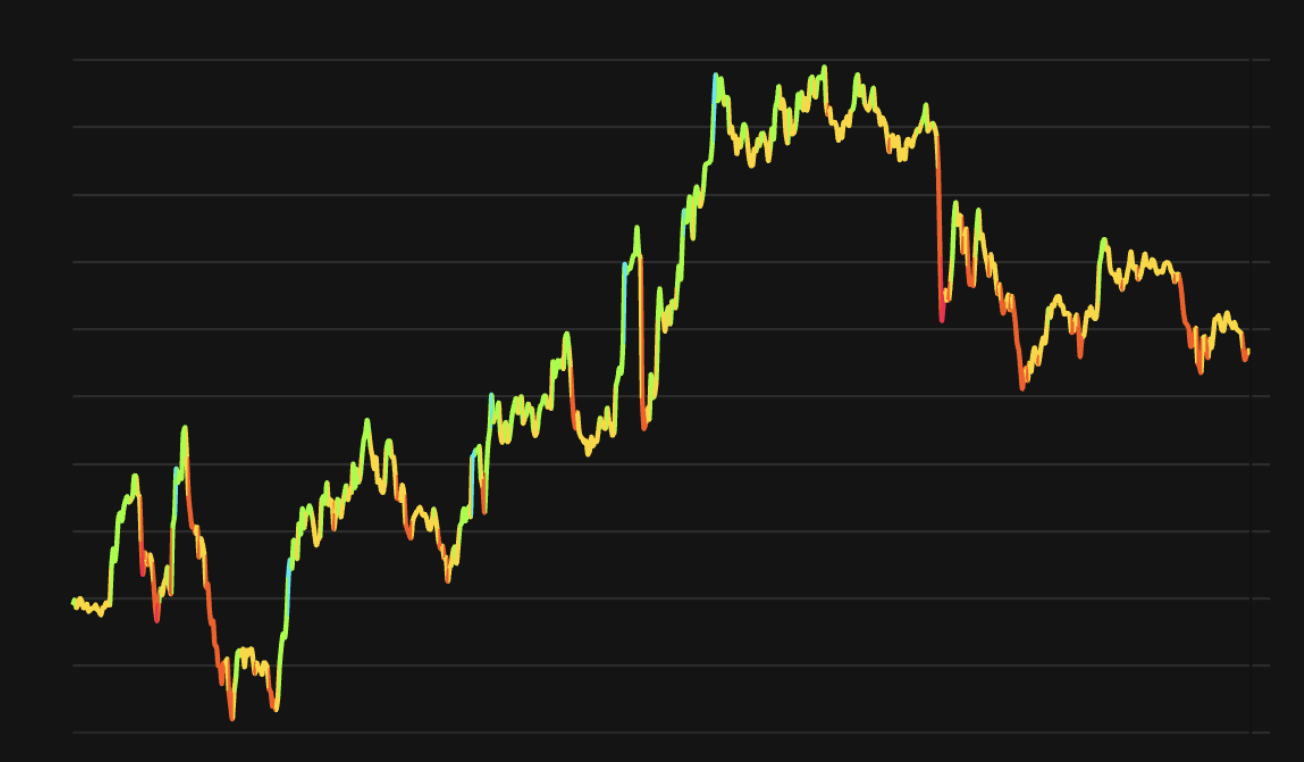

FTX token CFGI Score & FTT Price History

FTT Price & FTX token Sentiment Breakdown Charts

Price Score Sentiment

Volatility Sentiment

Volume Sentiment

Impulse Sentiment

Technical Sentiment

Social Sentiment

Dominance Sentiment

Search Sentiment

Whales Sentiment

Order Book Sentiment