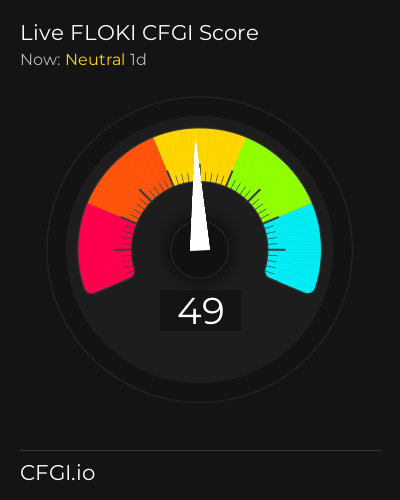

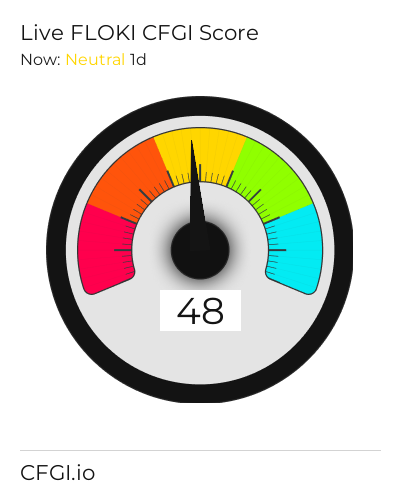

Historical Values

-

Now

Neutral 58 -

Yesterday

Neutral 58 -

7 Days Ago

Neutral 58 -

1 Month Ago

Neutral 58

Floki Breakdown

Price Score Greed

The Price Score indicator is a relevant indicator to analyze and assign the Floki price evolution a certain numerical value.

This module studies the price trend to determine if the Floki market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Floki price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the Floki Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Floki bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Greed

The Impulse indicator measures the current Floki price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Floki market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Greed

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Floki the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Fear

Dominance Fear

This other indicator takes into account the dominance of Floki with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Floki's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Floki and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Extreme Fear

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Floki has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Floki. For this, specific search terms are used that determine the purchasing or ceding interest of Floki, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Neutral

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Floki and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Floki moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Extreme Fear

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Floki on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

Floki News

Floki News

FLOKI Price Prediction: Targets $0.000280 by February Amid Mixed Technical Signals

Sentiment: Positive

Read moreFLOKI Price Prediction: Mixed Signals Point to $0.000280 Recovery by February 2026

Sentiment: Positive

Read moreFLOKI Price Prediction: Technical Recovery Targets $0.000280 by February 2026

Sentiment: Positive

Read moreFLOKI Price Prediction: Whales Just Went All In as FLOKI Explodes 950% – Is This the Start of a Meme Coin Frenzy?

Sentiment: Positive

Read moreSHIB Price Sinks as Burn Rate Collapses 82%—Whales Dump for PEPE and FLOKI

Sentiment: Negative

Read moreTop Meme Coins to Watch in 2026: SHIB, FLOKI & BONK Crypto Price Predictions

Sentiment: Positive

Read moreFLOKI Price Prediction: $0.000185-$0.000280 Target as Technical Indicators Signal 40% Rally

Sentiment: Positive

Read moreFLOKI Price Prediction: Targeting $0.000185-$0.000280 Despite Overbought Conditions Over Next 30 Days

Sentiment: Positive

Read moreFLOKI Price Prediction: Target $0.000055-$0.000185 Despite Overbought Conditions

Sentiment: Positive

Read moreFLOKI Price Prediction: Targeting $0.000185 Recovery Within 30 Days as Technical Indicators Signal Bullish Momentum

Sentiment: Positive

Read moreFLOKI Price Prediction: Recovery Target $0.000050-$0.000320 Within 30 Days as Technical Indicators Signal Oversold Bounce

Sentiment: Positive

Read moreFLOKI Price Prediction: Target $0.000055 in 7-14 Days as Technical Reversal Signals Emerge

Sentiment: Positive

Read moreFLOKI Price Prediction: Technical Setup Points to $0.000055 Target Within 7 Days

Sentiment: Positive

Read moreFLOKI Price Prediction: Recovery to $0.000055 Within 7 Days as Oversold Conditions Signal Reversal

Sentiment: Positive

Read moreFLOKI Price Prediction: Oversold Conditions Signal Recovery to $0.000055-$0.000185 by January 2025

Sentiment: Positive

Read moreFLOKI Price Prediction: $0.000047 Target by Year-End Amid Technical Recovery Signals

Sentiment: Positive

Read moreFLOKI Price Prediction: Recovery to $0.000055 Target Within 2 Weeks Despite Current Bearish Momentum

Sentiment: Positive

Read moreFLOKI Price Prediction: Recovery to $0.000055 Expected as Technical Indicators Signal Bullish Reversal

Sentiment: Positive

Read moreFLOKI Price Prediction: Targeting $0.000055 Rally as Oversold Conditions Signal 27% Upside Within 7 Days

Sentiment: Positive

Read moreFLOKI Price Prediction: Targeting $0.000055 Recovery Within 7 Days Amid Bullish Technical Setup

Sentiment: Positive

Read moreFLOKI Price Prediction: Recovery to $0.000055 Expected Within 7 Days as Technical Indicators Signal Bullish Momentum

Sentiment: Positive

Read moreFLOKI Price Prediction: $0.000055 Target Within 7 Days as RSI Shows Oversold Recovery Signal

Sentiment: Positive

Read moreFLOKI Price Prediction: Recovery to $0.000055-$0.000185 Expected by January 2026

Sentiment: Positive

Read moreFLOKI Price Prediction: $0.000186 Target in Sight as Technical Indicators Turn Bullish

Sentiment: Positive

Read moreFLOKI Price Prediction: Technical Recovery to $0.00007321 Target by March 2026

Sentiment: Positive

Read moreFLOKI Price Prediction: Recovery to $0.000051 Expected by Mid-December 2025

Sentiment: Positive

Read moreFLOKI Price Prediction: Oversold Bounce to $0.000055 Target by December 15, 2025

Sentiment: Positive

Read moreFLOKI Price Prediction: Recovery Target $0.000280 by January 2026 After Oversold Bounce

Sentiment: Positive

Read moreFLOKI Price Prediction: Targeting $0.000280-$0.000320 Recovery Within 30 Days

Sentiment: Positive

Read moreFLOKI Price Prediction: Recovery to $0.000280-$0.000320 Target as Oversold Conditions Signal 40-60% Upside

Sentiment: Positive

Read moreFLOKI Price Prediction: Recovery to $0.000280 Target as Technical Indicators Signal Reversal Potential

Sentiment: Positive

Read moreFLOKI Price Prediction: Oversold Bounce Targets $0.000185 by December 2025

Sentiment: Positive

Read moreFLOKI Price Prediction: Technical Recovery Expected Despite 69% Drop from Highs - Target $0.000185 by December 2025

Sentiment: Positive

Read moreFLOKI Price Prediction: Recovery to $0.000075 Expected by December 2025 Despite Current Oversold Conditions

Sentiment: Positive

Read moreFLOKI Price Prediction: Targeting $0.000075-$0.000167 by November End Despite Current Weakness

Sentiment: Positive

Read moreFLOKI Price Prediction: Targeting $0.000065-$0.000070 Range Within 2-4 Weeks Despite Current Bearish Momentum

Sentiment: Positive

Read moreFLOKI Price Prediction: Recovery to $0.000070 by December 2025 Amid Technical Oversold Bounce

Sentiment: Positive

Read moreFLOKI Price Prediction: Targeting $0.000070 Recovery by December 2025 Amid Oversold Bounce Setup

Sentiment: Positive

Read moreFLOKI Price Prediction: Targeting $0.000070 by December 2025 Amid Bullish Technical Setup

Sentiment: Positive

Read moreTop Meme Coin Whitelist Alert: Join Apeing ($APEING) Before Floki and Shiba Inu Surge

Sentiment: Positive

Read moreFLOKI Price Prediction: Bearish Momentum Points to $0.000032 Target as Technical Indicators Signal Decline

Sentiment: Negative

Read moreFLOKI Price Prediction: Bearish Outlook Targets $0.000032 as Technical Indicators Signal Further Decline

Sentiment: Negative

Read moreHere's Why The FLOKI Price Jumped 22% – It Has Nothing To Do With Dogecoin

Sentiment: Positive

Read moreElon Musk Reignites Floki Frenzy, Can FLOKI Hold Gains as Crypto Market Falls 3%?

Sentiment: Positive

Read moreFLOKI Tumbles 11% Despite Musk's 'CEO of X' Tweet as Bitcoin Decline Weighs on Meme Coins

Sentiment: Negative

Read moreFLOKI Jumps, DASH Draws Turnover, FET Rallies: Is Altcoin Season Crawling Back Or Just Head-Faking?

Sentiment: Neutral

Read moreFloki Price Prediction: Elon Musk's ‘Floki is Back' Post Sparks 30% Surge – 10x Move Begins Now

Sentiment: Positive

Read moreNot Just Dogecoin: Elon Musk Pumps Floki Meme Coin Price With AI Shiba Inu Video

Sentiment: Positive

Read moreElon Musk's Tweet Triggered a 25% Price Surge for Viral Meme Coin FLOKI: Details

Sentiment: Positive

Read moreFLOKI Technical Rebound Shows Strength as Meme Coin Gains 6.8% Amid Market Recovery

Sentiment: Positive

Read moreFloki Technical Analysis Shows Oversold Conditions as FLOKI Price Tests Lower Bollinger Band Support

Sentiment: Positive

Read moreFLOKI Price Consolidates Near Lower Bollinger Band as Macro Headwinds Weigh on Meme Coin Sentiment

Sentiment: Negative

Read moreFloki Price Prediction as Chart Pattern Points to 400% Move – Best Meme Coin?

Sentiment: Positive

Read moreForget Dogecoin, Shiba Inu — Floki Is Up 10% And Getting Its First ETF In Europe

Sentiment: Positive

Read moreFLOKI Launches Its First Crypto ETP in Europe, Surpassing $1 Billion in Value

Sentiment: Positive

Read moreFLOKI Price Rallies 25% as Investors Bet on BNB Gains and Europe ETP Launch

Sentiment: Positive

Read moreFLOKI Price Rallies 25% as Investors Bet on BNB Gains and Europe ETF Launch

Sentiment: Positive

Read moreFLOKI Price Prediction as ETP Listing Drives Adoption—Is a 160% Rally Ahead?

Sentiment: Positive

Read moreHistorical Values

-

Now

Neutral 58 -

Yesterday

Neutral 58 -

7 Days Ago

Neutral 58 -

1 Month Ago

Neutral 57

Floki Breakdown

Price Score Greed

The Price Score indicator is a relevant indicator to analyze and assign the Floki price evolution a certain numerical value.

This module studies the price trend to determine if the Floki market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Floki price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the Floki Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Floki bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Greed

The Impulse indicator measures the current Floki price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Floki market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Greed

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Floki the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Fear

Dominance Fear

This other indicator takes into account the dominance of Floki with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Floki's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Floki and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Extreme Fear

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Floki has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Floki. For this, specific search terms are used that determine the purchasing or ceding interest of Floki, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Neutral

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Floki and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Floki moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Extreme Fear

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Floki on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

FLOKI Price

1 FLOKI = $0.00005529

Floki CFGI Score & FLOKI Price History

FLOKI Price & Floki Sentiment Breakdown Charts

Price Score Sentiment

Volatility Sentiment

Volume Sentiment

Impulse Sentiment

Technical Sentiment

Social Sentiment

Dominance Sentiment

Search Sentiment

Whales Sentiment

Order Book Sentiment