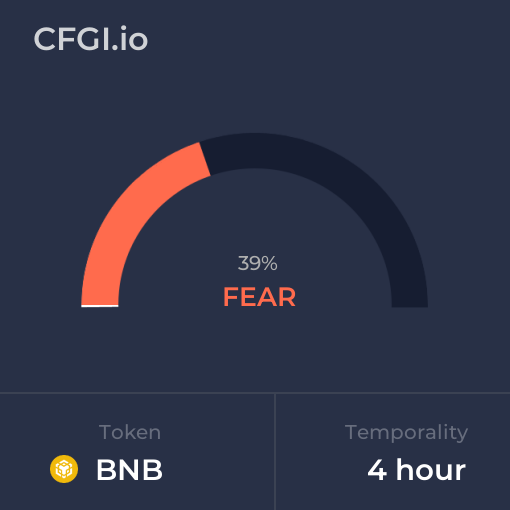

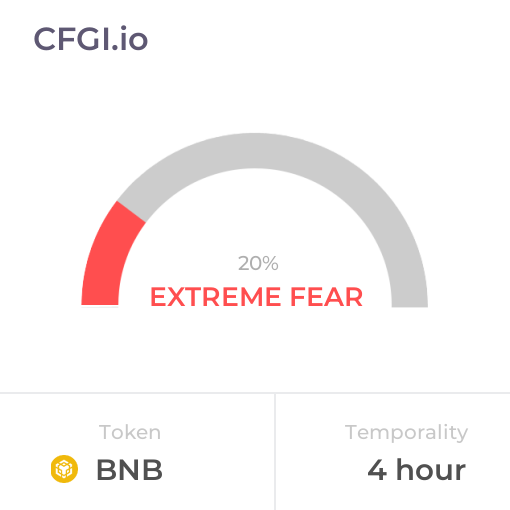

Historical Values

-

Now

Fear 35 -

Yesterday

Fear 35 -

7 Days Ago

Fear 35 -

1 Month Ago

Fear 35

BNB Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the BNB price evolution a certain numerical value.

This module studies the price trend to determine if the BNB market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Fear

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current BNB price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Fear

Like volatility, the BNB Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in BNB bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Extreme Fear

The Impulse indicator measures the current BNB price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the BNB market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Fear

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for BNB the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Greed

Dominance Neutral

This other indicator takes into account the dominance of BNB with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases BNB's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of BNB and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on BNB has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in BNB. For this, specific search terms are used that determine the purchasing or ceding interest of BNB, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Extreme Fear

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of BNB and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of BNB moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Neutral

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for BNB on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

BNB News

BNB News

Solana Crushes BNB Chain With 8x More Transactions — Here's Why It Matters

Sentiment: Positive

Read morePrice predictions 3/4: BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH, HYPE, LINK

Sentiment: Positive

Read moreBNB Chain News: New ERC-8004 Capabilities and Staking Products Boost the Network

Sentiment: Positive

Read moreCoinShares Unveils BNB Staking ETP With On-Chain Rewards and No Management Fees

Sentiment: Positive

Read moreBNB Beacon Chain Recovery Tool Enters Final Sunset Phase - Act Before April 30

Sentiment: Negative

Read morePredict.fun Completes Strategic Acquisition of Probable in BNB Ecosystem Move

Sentiment: Positive

Read moreBNB Price Prediction: Targets $667-$670 Breakout by March End Despite Mixed Signals

Sentiment: Positive

Read moreBNB Chain Rolls Out Production-Ready AI Agent Tools With Live On-Chain Capabilities

Sentiment: Positive

Read moreYZi Labs Deploys $100M Into HashGlobal Fund to Accelerate Institutional BNB Exposure

Sentiment: Positive

Read moreBNB Chain Awards $10K at Bengaluru Hackathon, Winners Eye $1B Builder Fund

Sentiment: Positive

Read moreBNB Price Prediction: Targets $667-670 Breakout After Neutral Consolidation

Sentiment: Positive

Read morePrice predictions 3/2: SPX, DXY, BTC, ETH, XRP, BNB, SOL, DOGE, BCH, ADA

Sentiment: Positive

Read moreXRP–BNB Rivalry Heats Up With BTC Settled at $66K After Weekend Developments

Sentiment: Positive

Read moreBTC Touched $68K After Khamenei Reported Death, XRP Surpasses BNB: Weekend Watch

Sentiment: Positive

Read moreBTC Touched $68K After Khamenei Reported Death, XRP Surpasses BNB: Weekend Watch

Sentiment: Positive

Read moreBNB Price Prediction: Targets $650-670 by Mid-March as Technical Recovery Emerges

Sentiment: Positive

Read moreBNB Price Prediction: Targets $650-670 by Mid-March as Technical Recovery Emerges

Sentiment: Positive

Read moreYZi Labs exposes hidden 10x ownership stake in BNB treasury company CEA Industries

Sentiment: Negative

Read moreYZi Labs exposes hidden 10x ownership stake in BNB treasury company CEA Industries

Sentiment: Negative

Read moreYZi Labs exposes hidden 10x ownership stake in BNB treasury company CEA Industries

Sentiment: Negative

Read moreBNB Price Prediction: Targets $650-670 Recovery by March Amid Oversold Conditions

Sentiment: Positive

Read moreBNB Price News: High Volatility and Thin Volumes Could Easily Break $600 Support

Sentiment: Negative

Read moreBNB Price News: High Volatility and Thin Volumes Could Easily Break $600 Support

Sentiment: Negative

Read moreBNB Price News: High Volatility and Thin Volumes Could Easily Break $600 Support

Sentiment: Negative

Read moreBNB Price News: High Volatility and Thin Volumes Could Easily Break $600 Support

Sentiment: Negative

Read morePrice predictions 2/27: BTC, ETH, XRP, BNB, SOL, DOGE, BCH, ADA, HYPE, LINK

Sentiment: Positive

Read morePrice predictions 2/27: BTC, ETH, XRP, BNB, SOL, DOGE, BCH, ADA, HYPE, LINK

Sentiment: Positive

Read morePrice predictions 2/27: BTC, ETH, XRP, BNB, SOL, DOGE, BCH, ADA, HYPE, LINK

Sentiment: Positive

Read morePrice predictions 2/27: BTC, ETH, XRP, BNB, SOL, DOGE, BCH, ADA, HYPE, LINK

Sentiment: Positive

Read moreFormer Biden Economists Declare BTC, ETH, BNB, XRP, SOL, ADA are Pointless and Trump Cannot Save Them

Sentiment: Negative

Read moreBNB Price Prediction: Targets $650-670 by March 2026 After Technical Recovery

Sentiment: Positive

Read moreVenus Protocol Teams Up With Fluid to Debut Venus Flux, a Unified Liquidity Layer on BNB Chain

Sentiment: Positive

Read moreVenus Flux launches as Venus Protocol and Fluid unveil a unified liquidity layer on BNB Chain

Sentiment: Positive

Read morePrice predictions 2/25: BTC, ETH, XRP, BNB, SOL, DOGE, BCH, ADA, HYPE, XMR

Sentiment: Positive

Read moreBNB price rebounds on SFP confirmation, resistance level at $635 now in focus

Sentiment: Positive

Read moreBNB Chain News: Ecosystem Slide Decelerates as Messari Reports 228% RWA Growth

Sentiment: Neutral

Read moreBNB Chain News: Ecosystem Slide Decelerates as Messari Reports 228% RWA Growth

Sentiment: Neutral

Read moreBNB Chain News: Ecosystem Slide Decelerates as Messari Reports 228% RWA Growth

Sentiment: Neutral

Read moreBNB Chain News: Ecosystem Slide Decelerates as Messari Reports 228% RWA Growth

Sentiment: Neutral

Read moreBinance Coin BNB Price Cools Off After Volume Overheating: Is $400 the Real Target?

Sentiment: Negative

Read moreThe ‘Next-Generation Trading Chain': BNB Chain Eyes 2026 Optimization Following Strong Ecosystem Momentum

Sentiment: Positive

Read moreBNB Price Prediction: Oversold Signal Points to $650 Recovery by March 2026

Sentiment: Positive

Read morePrice predictions 2/23: SPX, DXY, BTC, ETH, XRP, BNB, SOL, DOGE, BCH, ADA

Sentiment: Negative

Read moreBNB Price Prediction: Targets $650-$680 Recovery as Oversold Conditions Signal Potential Bounce

Sentiment: Positive

Read moreBNB, Solana, Cardano, XRP Sell Pressure Hits 5-Year Extreme—What it Means and Why it Matters

Sentiment: Negative

Read moreBNB Holders Earned 177% Returns in 15 Months Through Binance Reward Programs

Sentiment: Positive

Read moreETH, XRP, SOL, BNB, ADA Kick Off Push As Historical Data Reads Extremely Bullish

Sentiment: Positive

Read moreBNB Price Prediction: Targets $680-$730 Range by March 2026 as Technical Indicators Show Mixed Signals

Sentiment: Positive

Read morePrice predictions 2/20: BTC, ETH, XRP, BNB, SOL, DOGE, BCH, ADA, HYPE, XMR

Sentiment: Negative

Read moreAltcoin Season Triggers are Flashing; Here's What to Expect for BNB, Solana, Cardano, DOGE, XRP

Sentiment: Positive

Read moreBNB Price Prediction: Oversold Conditions Target $625-$650 Recovery by March 2026

Sentiment: Positive

Read moreSOL, BNB, XRP Sell Pressure at 5-Year High as No Signs of Institutional Altcoin Accumulation

Sentiment: Negative

Read moreGovernance Tensions Rise at BNB Treasury Firm as Major Holders Clash Over SEC Disclosures

Sentiment: Negative

Read morePrice predictions 2/18: BTC, ETH, XRP, BNB, SOL, DOGE, BCH, ADA, HYPE, XMR

Sentiment: Negative

Read moreBNB Price Prediction: Targets $635-$650 Recovery by March After Oversold Bounce

Sentiment: Positive

Read moreBinance Coin (BNB) Price Prediction 2026, 2027 – 2030: Will BNB Price Hit $2000?

Sentiment: Positive

Read morePrice predictions 2/16: SPX, DXY, BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH

Sentiment: Negative

Read moreHistorical Values

-

Now

Fear 35 -

Yesterday

Neutral 35 -

7 Days Ago

Neutral 42 -

1 Month Ago

Neutral 50

BNB Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the BNB price evolution a certain numerical value.

This module studies the price trend to determine if the BNB market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Fear

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current BNB price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Fear

Like volatility, the BNB Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in BNB bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Extreme Fear

The Impulse indicator measures the current BNB price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the BNB market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Fear

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for BNB the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Greed

Dominance Neutral

This other indicator takes into account the dominance of BNB with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases BNB's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of BNB and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on BNB has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in BNB. For this, specific search terms are used that determine the purchasing or ceding interest of BNB, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Extreme Fear

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of BNB and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of BNB moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Neutral

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for BNB on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

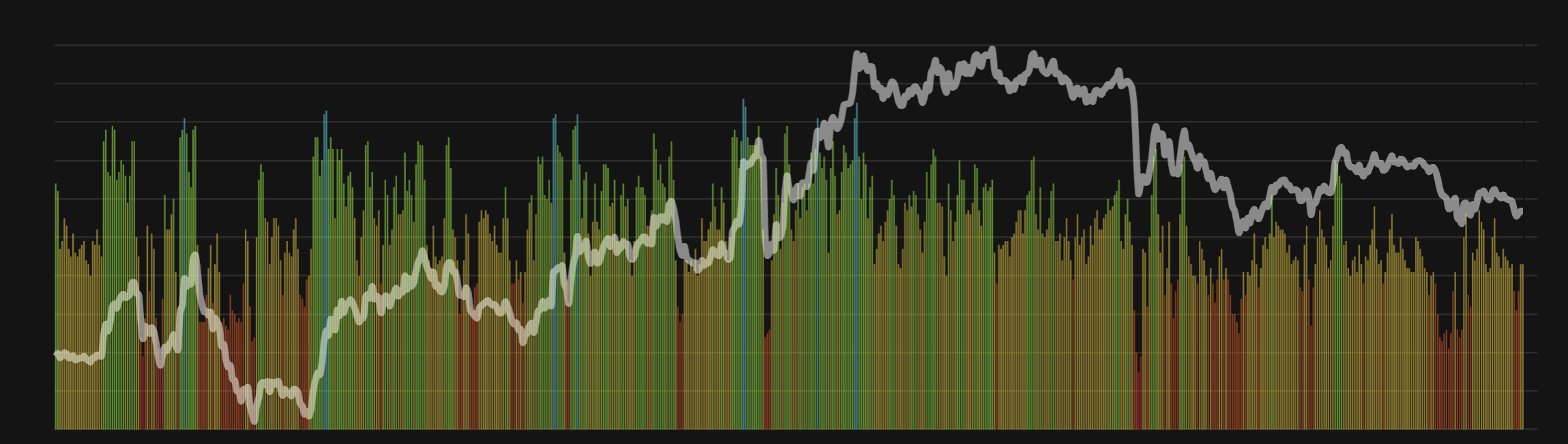

BNB Price

1 BNB = $629.54

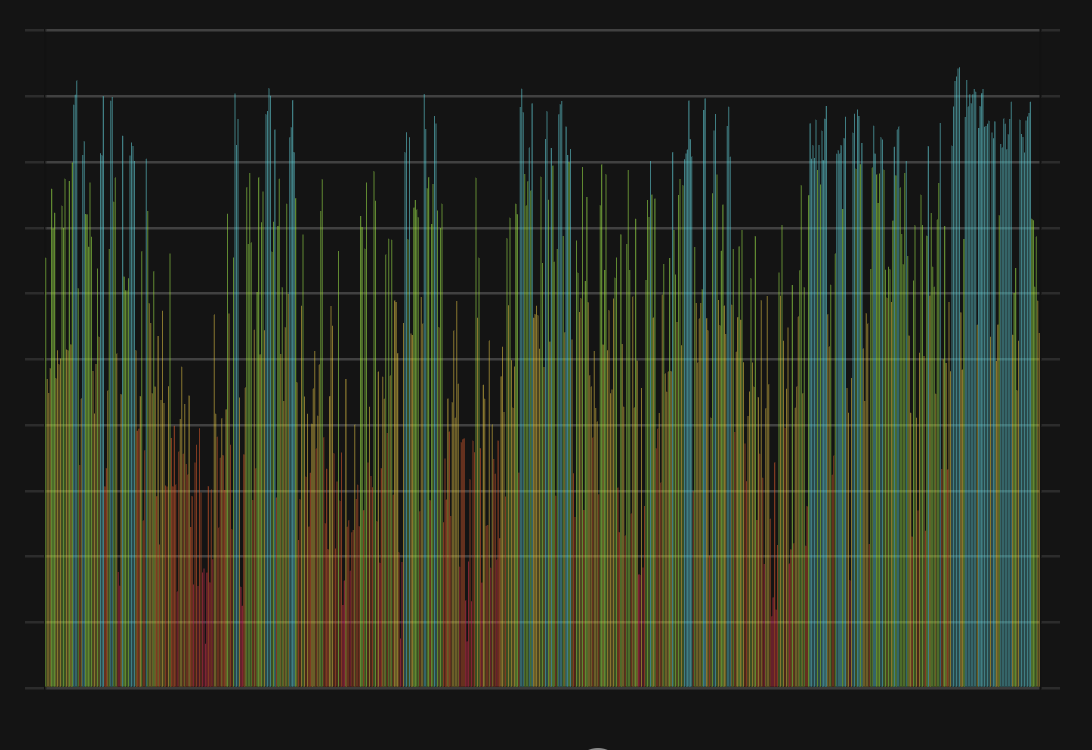

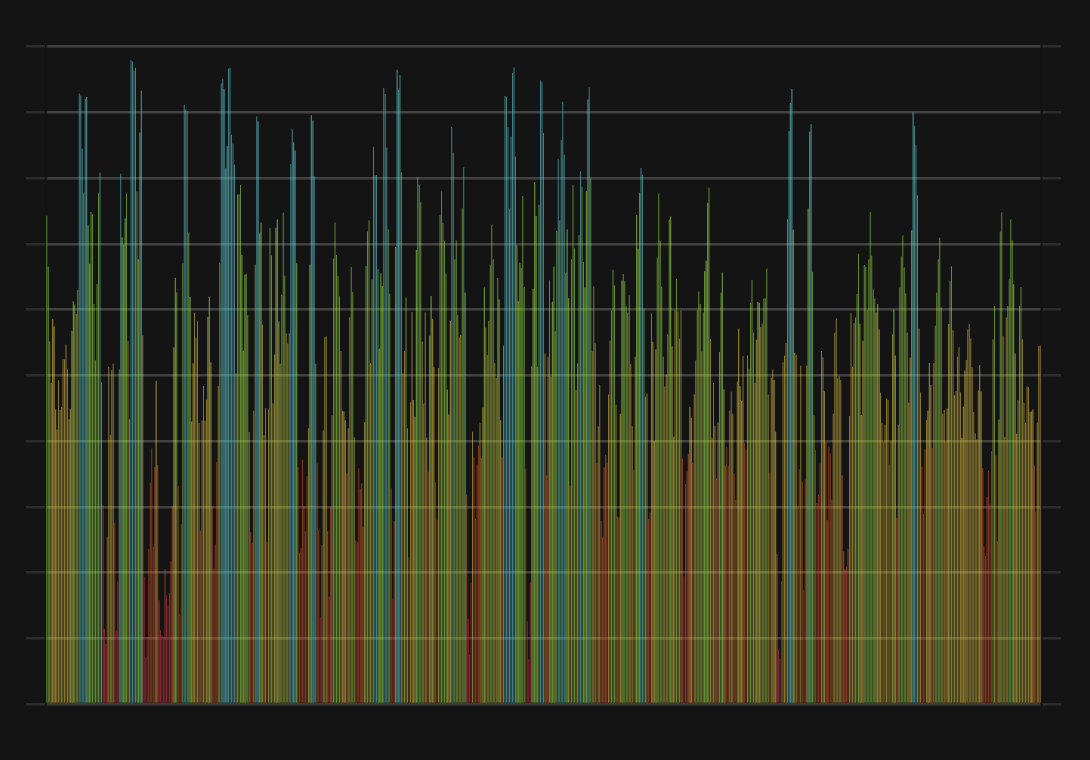

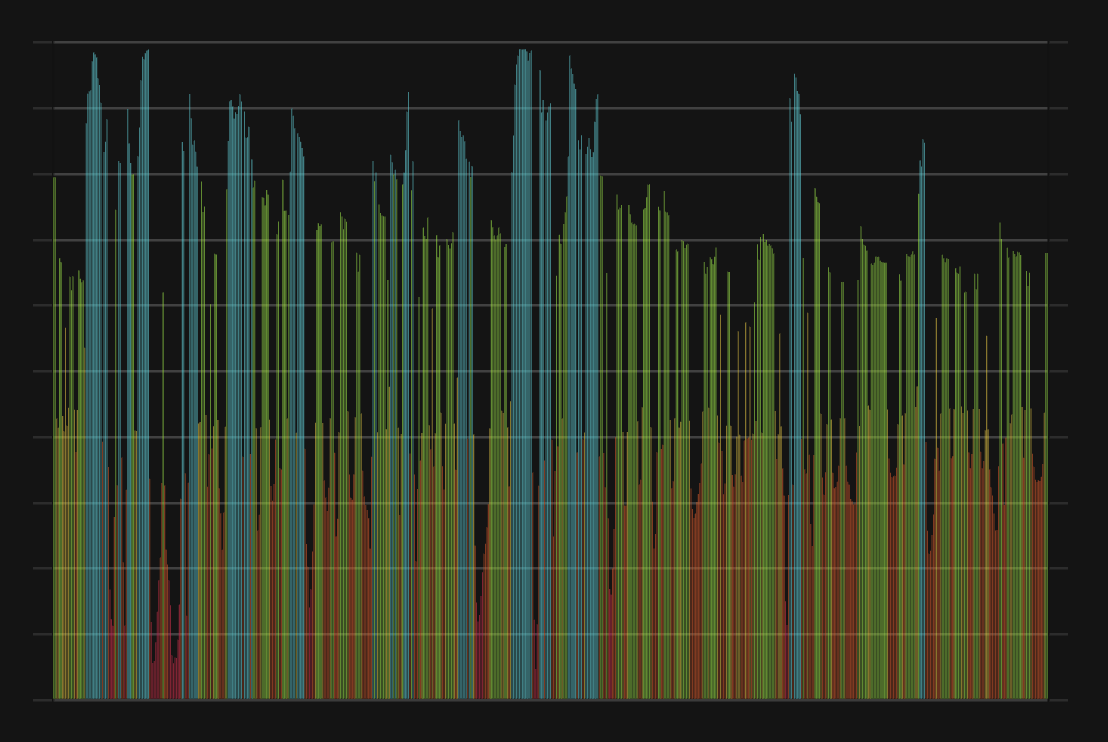

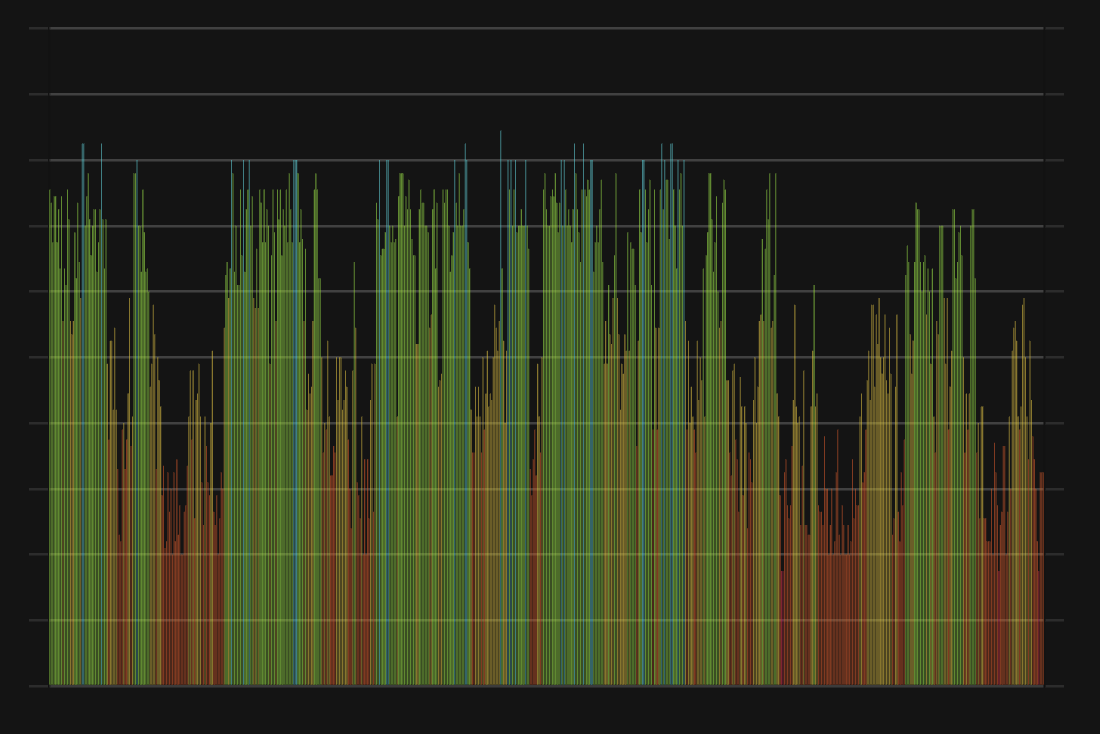

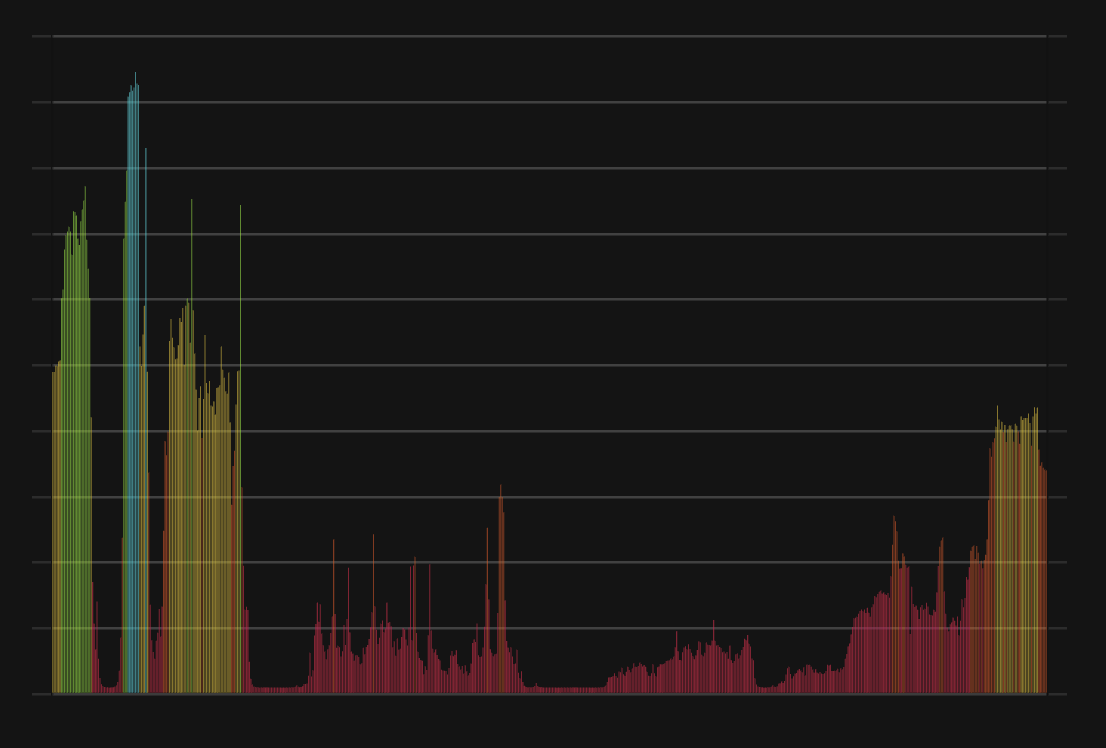

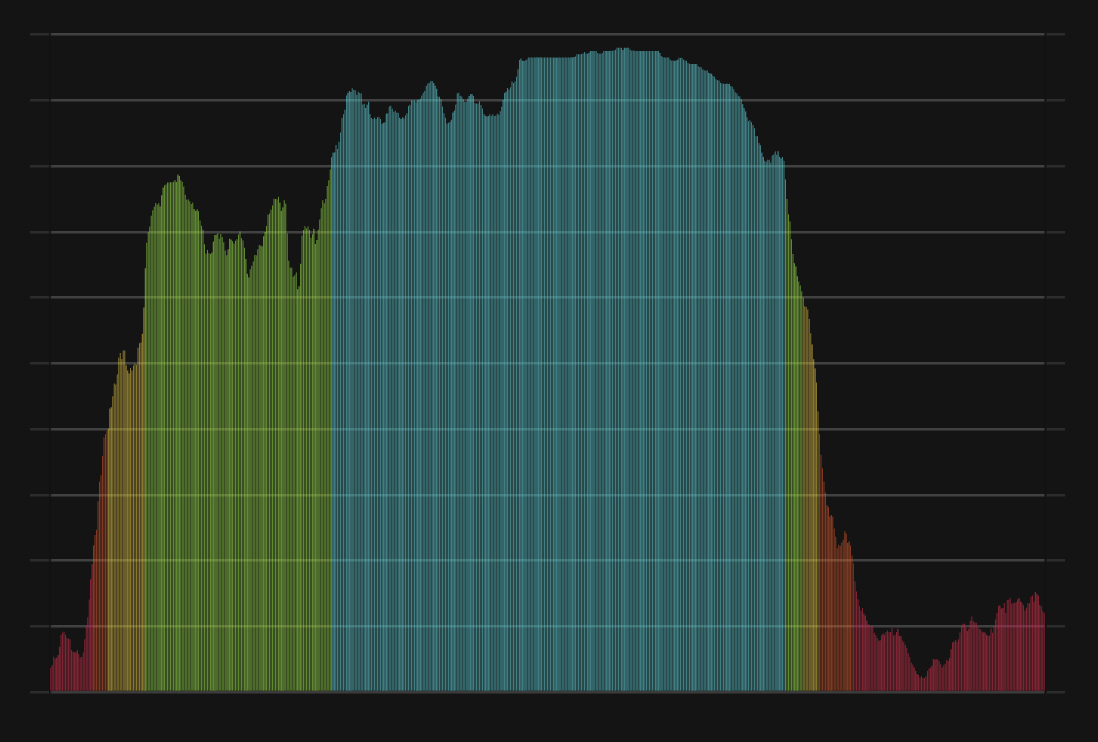

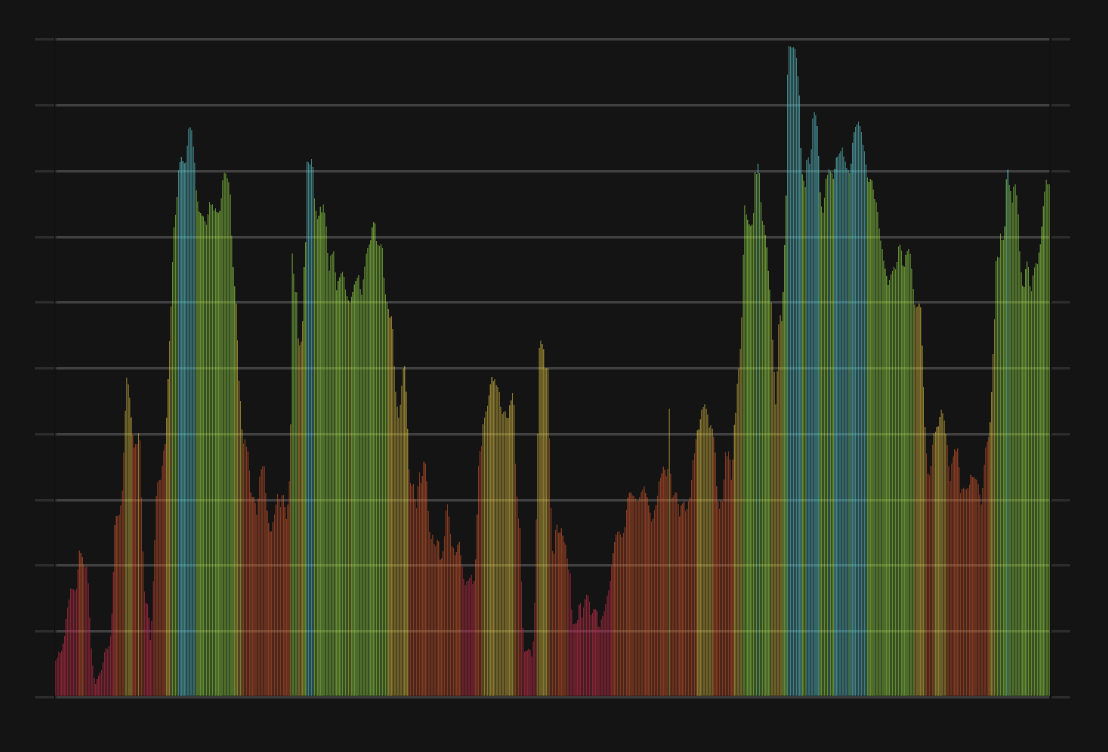

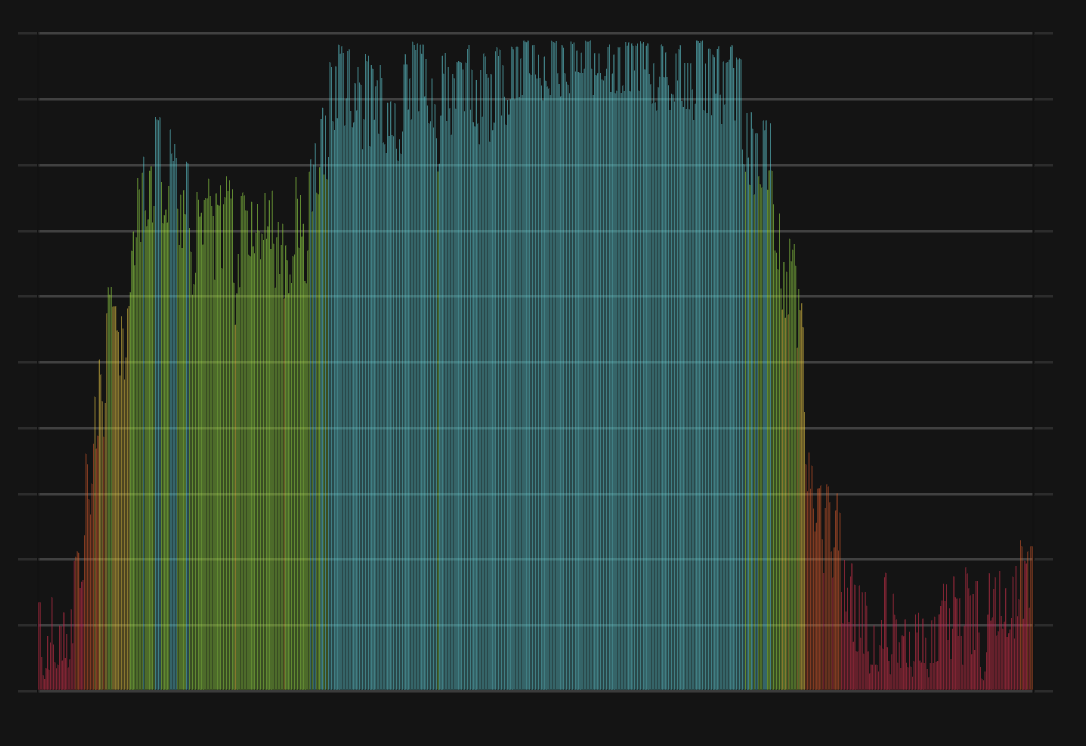

BNB CFGI Score & BNB Price History

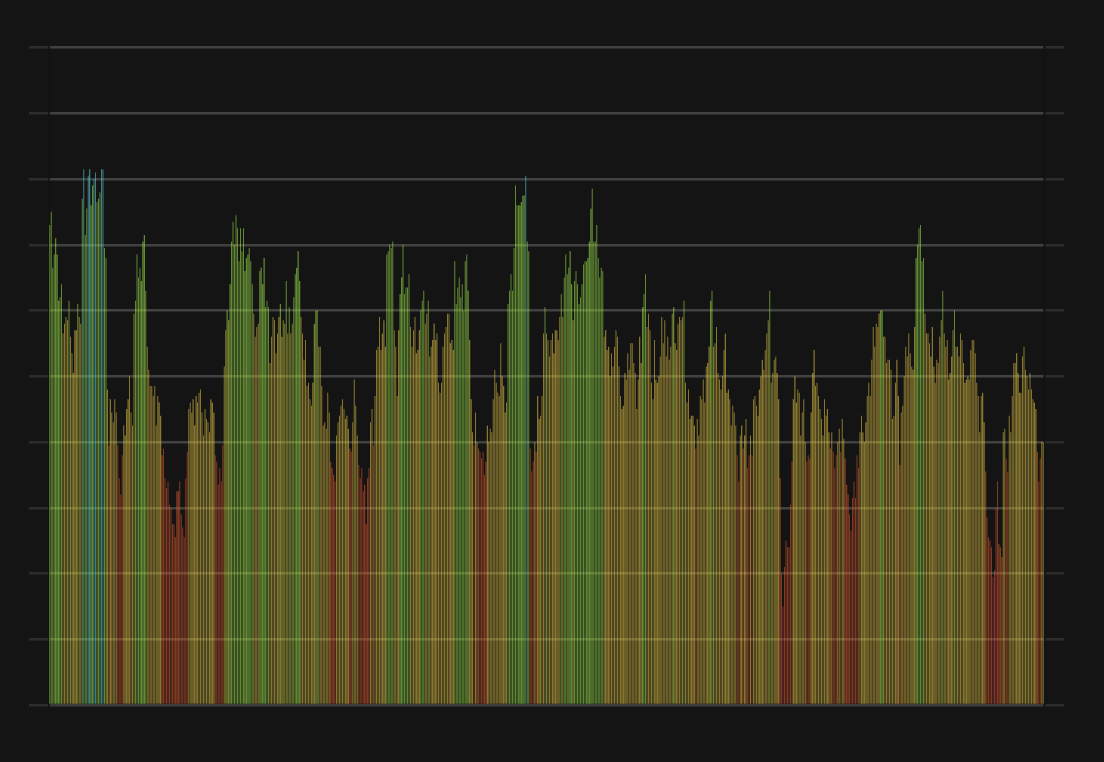

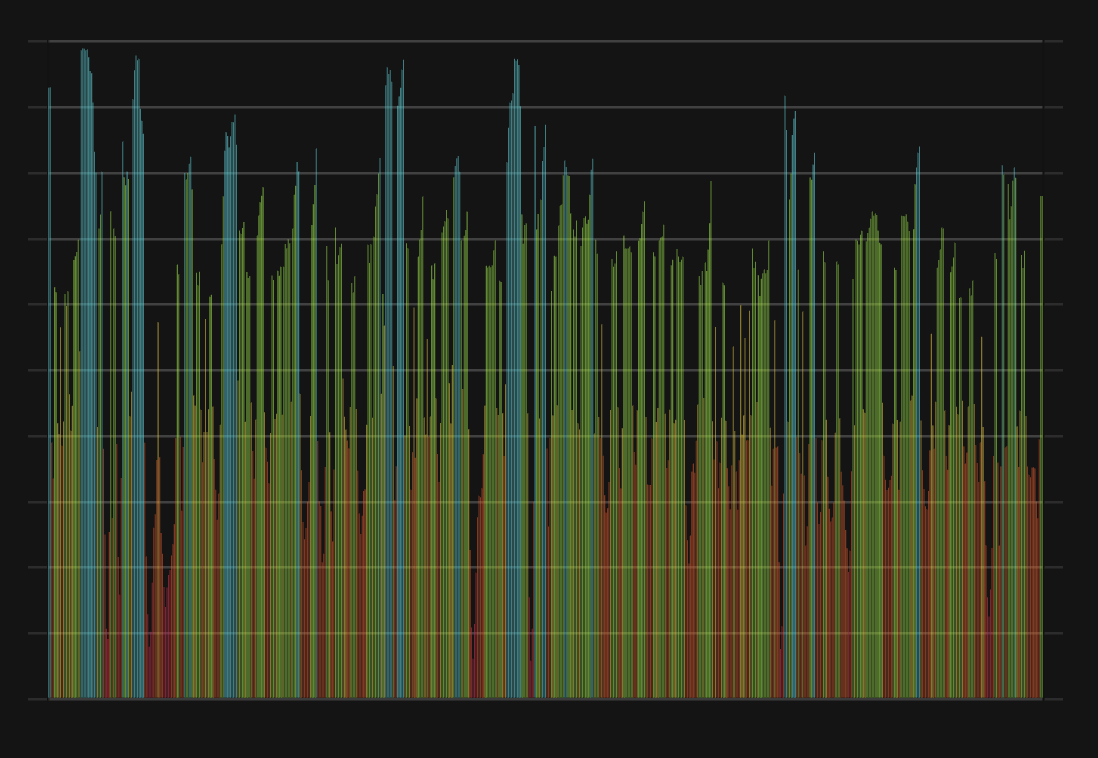

BNB Price & BNB Sentiment Breakdown Charts

Price Score Sentiment

Volatility Sentiment

Volume Sentiment

Impulse Sentiment

Technical Sentiment

Social Sentiment

Dominance Sentiment

Search Sentiment

Whales Sentiment

Order Book Sentiment