Historical Values

-

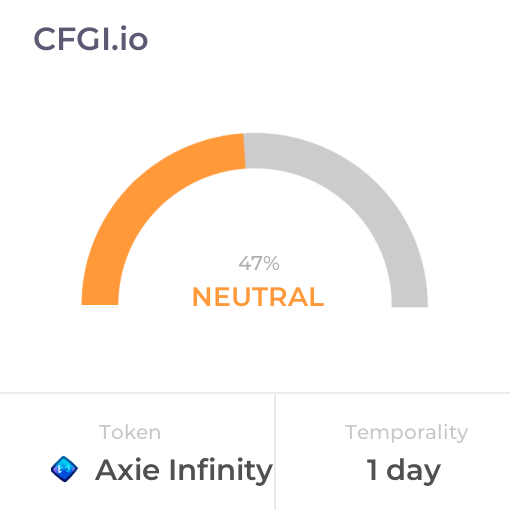

Now

Neutral 48 -

Yesterday

Neutral 48 -

7 Days Ago

Neutral 48 -

1 Month Ago

Neutral 48

Axie Infinity Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Axie Infinity price evolution a certain numerical value.

This module studies the price trend to determine if the Axie Infinity market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Axie Infinity price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the Axie Infinity Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Axie Infinity bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Neutral

The Impulse indicator measures the current Axie Infinity price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Axie Infinity market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Fear

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Axie Infinity the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Greed

Dominance Greed

This other indicator takes into account the dominance of Axie Infinity with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Axie Infinity's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Axie Infinity and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Axie Infinity has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Axie Infinity. For this, specific search terms are used that determine the purchasing or ceding interest of Axie Infinity, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Greed

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Axie Infinity and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Axie Infinity moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Neutral

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Axie Infinity on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

Axie Infinity News

Axie Infinity News

Axie Infinity (AXS) Price Prediction: Encouraging Trends for Web3 Adoption

Sentiment: Positive

Read moreAXS Price Rebounds as Breakout Structure Forms: Is a 100% Rally Setting Up?

Sentiment: Positive

Read moreDid Axie Infinity (AXS) Whales Just Buy Into a Pullback Risk After a 41% Rally?

Sentiment: Positive

Read moreSAND, AXS, MANA Lead the Charge – But This Small-Cap Surge Isn't Real Strength

Sentiment: Negative

Read moreAxie Infinity token AXS posts 137% gain following changes to the game rewards system

Sentiment: Positive

Read moreIs The 180% Axie Infinity (AXS) Rally Just Exit Liquidity For Holders? Charts Have The Answer

Sentiment: Negative

Read moreThree Gaming Tokens – SAND, AXS, and MANA – Just Defied Crypto Market Decline

Sentiment: Positive

Read moreAxie Infinity Explodes: AXS Price Soars 34% as Volume Surges 1,600% in 24 Hours

Sentiment: Positive

Read moreWhy is the Axie Infinity (AXS) Price Rising Today? Is Liquidity Rotating Into GameFi?

Sentiment: Positive

Read moreGameFi funding sinks 55% in 2025 as Web 2.5 games gain ground — can GALA, AXS, ENJ bounce back?

Sentiment: Negative

Read moreAXS eyes 80% surge as Axie Infinity's Origins Season 13 kicks off with massive rewards

Sentiment: Positive

Read moreAxie Infinity's Elite 8 Tournament starts next week: will AXS price rally 50%?

Sentiment: Positive

Read moreCrypto Price Analysis 3-26: BITCOIN: BTC, ETHEREUM: ETH, SOLANA: SOL, UNISWAP: UNI, APTOS: APT, DOGWIFHAT: WIF, AXIE INFINITY: AXS

Sentiment: Positive

Read moreCrypto Price Analysis 3-12: BITCOIN: BTC, ETHEREUM: ETH, SOLANA: SOL, APTOS: APT, UNISWAP: UNI, FILECOIN: FIL, AXIE INFINITY: AXS

Sentiment: Positive

Read moreCrypto Price Analysis 3-7: BITCOIN: BTC, ETHEREUM: ETH, SOLANA: SOL, DOGWIFHAT: WIF, RIPPLE: XRP, ETHENA: ENA, AXIE INFINITY: AXS

Sentiment: Negative

Read moreAxie Infinity (AXS) Price Prediction March 2025, 2026, 2030, 2040 – 2050

Sentiment: Positive

Read moreThe SEC Strikes Again! New Tokens Targeted in the Binance Lawsuit: AXS, Filecoin, Cosmos and More

Sentiment: Negative

Read moreAxie Infinity Price Prediction 2024, 2025, 2030: Will AXS Price Hit $10 This Year?

Sentiment: Positive

Read moreIs Axie Infinity (AXS) About To Skyrocket? Crypto Analysts Spot Major Breakout Patterns

Sentiment: Positive

Read moreAxie Infinity (AXS) Breakout Imminent: Analysts See 40% Upside Potential

Sentiment: Positive

Read moreAxie Infinity Price Prediction 2024, 2025, 2030: Will AXS Price Regain $15 Soon?

Sentiment: Positive

Read moreBinance Loans Adds AXS, PENDLE, PAXG, RNDR, and USDC to Flexible Rate Options

Sentiment: Positive

Read moreAxie Infinity (AXS): A Testament to Blockchain Gaming's Resilience and Potential

Sentiment: Positive

Read moreCrypto Weekend Rally Led by GameFi Tokens; GALA, AXS, SAND Price Analysis

Sentiment: Positive

Read moreNew crypto opportunity at $0.44 for investors who missed AXS and ILV soar

Sentiment: Positive

Read moreAxie Infinity Co-Founder Losses Over $10 Million In Hack, AXS Holds Firm

Sentiment: Negative

Read moreAxie Infinity Price Surges As It Breaks 11-Month Resistance! Will AXS Price Shine Now?

Sentiment: Positive

Read moreAxie Infinity (AXS) Breaks Through $10 Barrier – Has the Bull Run Begun?

Sentiment: Positive

Read moreAxie Infinity Price Prediction 2023, 2024, 2025: Will AXS Price Regain $10 Soon?

Sentiment: Positive

Read moreAxie Infinity Price Hints A Bearish Reversal! AXS Price To Record 10% Correction Soon?

Sentiment: Negative

Read moreAxie Infinity (AXS) Reaches 175-Day High – How Long Until It Goes Above $10?

Sentiment: Positive

Read moreAxie Infinity's AXS Soars 15% on Major Partnership: A New Era in Blockchain Gaming Unveiled

Sentiment: Positive

Read moreAXS breaks out past two-month range as bulls make their intentions clear

Sentiment: Positive

Read moreAxie Infinity (AXS) Gamer Profits Rise to 20-Month Peak – Is GameFi Making a Comeback?

Sentiment: Positive

Read moreAs P2E Pump Speculations Rise, AXS, MANA, And SAND Tokens Record Massive Spikes!

Sentiment: Neutral

Read moreCan Axie Infinity (AXS) 21% Price Gains Trigger Renewed Metaverse Interest?

Sentiment: Positive

Read moreAssessing AXS' latest route and how it differs from investor expectations

Sentiment: Neutral

Read moreBinance Removes UNI, ALGO, AXS Trading Pairs in Internal Cleansing Effort

Sentiment: Negative

Read moreAxie Infinity (AXS) Price Could Sink to All-Time Lows Ahead of $70 Token Unlock

Sentiment: Negative

Read moreAxie Infinity (AXS) Price Could Hit New 2-Year Low Following This Upcoming Event

Sentiment: Negative

Read moreAxie Infinity (AXS) Analysis: Is the Top-Ranked Metaverse Token Going to Zero?

Sentiment: Negative

Read moreAxie Infinity Faces Challenges as Native Token AXS Sees Significant Losses Amid Crypto Market Downturn

Sentiment: Negative

Read moreAxie Infinity (AXS) is the most profitable crypto on the Binance Launchpad

Sentiment: Positive

Read moreAXS profitability hits historic low: Analyzing prospects for holder recovery

Sentiment: Negative

Read moreAxie Infinity (AXS) Retests $5 – Will Long-Term Holders Trigger a Reversal?

Sentiment: Negative

Read moreAxie Infinity (AXS) Price Targets $5 as Long-Term Holders Remain Bullish

Sentiment: Positive

Read moreHistorical Values

-

Now

Neutral 48 -

Yesterday

Neutral 48 -

7 Days Ago

Neutral 44 -

1 Month Ago

Neutral 47

Axie Infinity Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Axie Infinity price evolution a certain numerical value.

This module studies the price trend to determine if the Axie Infinity market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Axie Infinity price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the Axie Infinity Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Axie Infinity bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Neutral

The Impulse indicator measures the current Axie Infinity price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Axie Infinity market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Fear

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Axie Infinity the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Greed

Dominance Greed

This other indicator takes into account the dominance of Axie Infinity with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Axie Infinity's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Axie Infinity and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Axie Infinity has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Axie Infinity. For this, specific search terms are used that determine the purchasing or ceding interest of Axie Infinity, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Greed

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Axie Infinity and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Axie Infinity moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Neutral

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Axie Infinity on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

AXS Price

1 AXS = $1.33

Axie Infinity CFGI Score & AXS Price History

AXS Price & Axie Infinity Sentiment Breakdown Charts

Price Score Sentiment

Volatility Sentiment

Volume Sentiment

Impulse Sentiment

Technical Sentiment

Social Sentiment

Dominance Sentiment

Search Sentiment

Whales Sentiment

Order Book Sentiment