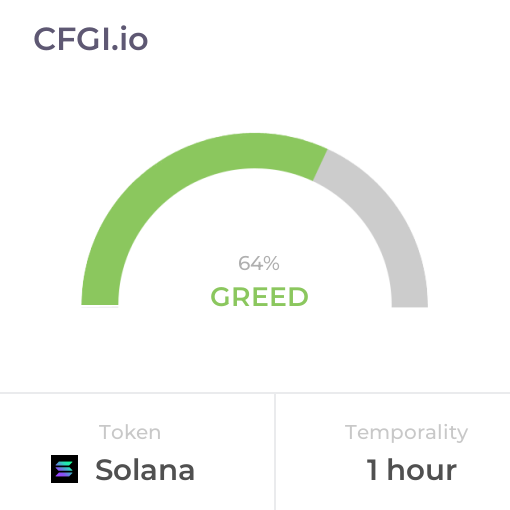

Historical Values

-

Now

Neutral 57 -

Yesterday

Neutral 57 -

7 Days Ago

Neutral 57 -

1 Month Ago

Neutral 57

Solana Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Solana price evolution a certain numerical value.

This module studies the price trend to determine if the Solana market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Fear

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Solana price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Fear

Like volatility, the Solana Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Solana bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Neutral

The Impulse indicator measures the current Solana price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Solana market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Greed

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Solana the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Greed

Dominance Neutral

This other indicator takes into account the dominance of Solana with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Solana's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Solana and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Solana has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Solana. For this, specific search terms are used that determine the purchasing or ceding interest of Solana, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Greed

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Solana and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Solana moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Neutral

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Solana on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

Solana News

Solana News

Price predictions 2/20: BTC, ETH, XRP, BNB, SOL, DOGE, BCH, ADA, HYPE, XMR

Sentiment: Negative

Read moreSOL, BNB, XRP Sell Pressure at 5-Year High as No Signs of Institutional Altcoin Accumulation

Sentiment: Negative

Read moreBreaking: CME Group To Launch 24/7 BTC, ETH, XRP, SOL Futures Trading On May 29

Sentiment: Positive

Read moreTop Reasons Why Solana (SOL) Price Is Preparing for a Short Squeeze to $100

Sentiment: Positive

Read morePrice predictions 2/18: BTC, ETH, XRP, BNB, SOL, DOGE, BCH, ADA, HYPE, XMR

Sentiment: Negative

Read moreSolana (SOL) Price Struggles at $85 as Network Activity Cools: Is $80 at Risk?

Sentiment: Negative

Read moreSecond-Largest ETF Exodus Hits Solana While Sushi's Bold SOL DEX Play Continues

Sentiment: Negative

Read moreSOL Price Prediction: Targets $95 Recovery by March Despite Current Weakness

Sentiment: Positive

Read moreSolana ETFs Attract $31M While Crypto Funds Lose $173M, Is SOL Gearing for a Possible Rally

Sentiment: Positive

Read moreSolana News: SOL Sell-Off Eases as Institutional Inflows Return, RWAs Hit Records

Sentiment: Positive

Read moreSolana Price Prediction: Bulls Need to Recapture $118 to Bring SOL Back to Life

Sentiment: Positive

Read moreSolana (SOL) Price Consolidates Near $85 — Here's Why a Break Above $90 Could Trigger a Bigger Move

Sentiment: Neutral

Read moreCrypto Funds See 4th Week of Outflows, but XRP and SOL Shine: CoinShares Report

Sentiment: Neutral

Read moreSolana (SOL) Gears Up For Another Rally Attempt — Can Bulls Clear $92 Barrier?

Sentiment: Positive

Read morePrice predictions 2/16: SPX, DXY, BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH

Sentiment: Negative

Read moreJupiter launches native staking as collateral, unlocking $30B in staked SOL for DeFi

Sentiment: Positive

Read moreSolana's RWA Ecosystem Climbs to $1.66B, Signaling a Potential Shift for SOL

Sentiment: Positive

Read moreSolana Price Rejected at a Critical Level as DEX Volume Drops 20% — What Next for SOL?

Sentiment: Negative

Read moreSOL price prediction as Solana RWA Tokenization value breaks $1.66B record

Sentiment: Positive

Read moreMorgan Stanley, Other TradFi Load Up SOL as Solana RWA Tokenized Value Hits $1.66B ATH

Sentiment: Positive

Read moreSOL Price Prediction: Targets $95-$105 Recovery by March After Technical Consolidation

Sentiment: Positive

Read moreSolana Company Unveils First Digital Asset Treasury for Institutional Borrowing Against Staked SOL

Sentiment: Positive

Read moreSolana (SOL) Price Prediction 2026, 2027-2030: Technical Outlook and Long-Term Forecast

Sentiment: Positive

Read moreCrypto Prices Surge Today: BTC, ETH, XRP, SOL Soar Despite US Government Shutdown

Sentiment: Positive

Read moreBitcoin, ETH, SOL, ADA, BNB, XRP Remain Under Pressure After Coinbase's $667 Million Loss

Sentiment: Negative

Read moreSolana Company Stock Rallies 15% as Firm Enables Loans on Staked SOL for Institutions

Sentiment: Positive

Read moreSolana Company shares jump 17% as firm rolls out borrowing against staked SOL

Sentiment: Positive

Read moreSolana Eyes $100 Again as 21Shares Announces SOL ETF Staking Payout for February 17

Sentiment: Positive

Read morePrice predictions 2/13: BTC, ETH, BNB, XRP, SOL, DOGE, BCH, HYPE, ADA, XMR

Sentiment: Positive

Read moreGoldman's $153M XRP Bet Signals Fresh Institutional Attention as Banks Sideline BTC for XRP, SOL

Sentiment: Positive

Read moreAnchorage, Kamino let institutions borrow against SOL without moving custody

Sentiment: Positive

Read moreWhy is the Crypto Market Up Today? BTC, ETH, XRP, SOL is Up as Inflation Cools

Sentiment: Positive

Read moreCrypto Market in Panic Mode Ahead of Bitcoin, ETH, XRP, SOL Options Expiry & US CPI Today

Sentiment: Negative

Read moreSolana Price Prediction: Will SOL Rebound After Citigroup Expands Tokenization to Solana?

Sentiment: Positive

Read moreWBTC Taps Hyperlane to Connect Ethereum and Solana as SOL Bulls Eye $100

Sentiment: Positive

Read moreSolana Long-Term Holders Hit 3-Year Capitulation Peak as SOL Flirts With a Breakdown Below $80

Sentiment: Negative

Read moreSolana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

Sentiment: Positive

Read moreMeme Coin News: Memes Defy SOL Slide as Pump.fun and Base App Double Down on Trading

Sentiment: Positive

Read moreOver 1 Million SOL Pulled from Exchanges as Standard Chartered Still Calls $2,000 Solana Price by 2030

Sentiment: Positive

Read moreMorning Crypto Report: XRP Gains Momentum Ahead of CPI, Binance's 15,000 Bitcoin Fund Records First Profit, 3 Key Solana (SOL) Updates for February 2026 Detailed

Sentiment: Positive

Read moreSOL Price Prediction: Solana Eyes Recovery to $95-105 by March 2026 Despite Oversold Conditions

Sentiment: Positive

Read moreSolana Price Prediction: SOL Eyes Recovery to $180 As Network Fees Bounce

Sentiment: Positive

Read moreSolana Price Prediction: SOL Faces $42 Target as Head-and-Shoulders Pattern Emerges

Sentiment: Negative

Read moreUpexi Doubles Down on Solana Despite $179M Quarterly Loss as SOL Holds $78 Support

Sentiment: Negative

Read morePrice predictions 2/11: BTC, ETH, BNB, XRP, SOL, DOGE, BCH, HYPE, ADA, XMR

Sentiment: Neutral

Read moreSolana DAT Upexi posts $179 million loss as SOL price slide hits treasury despite revenue doubling

Sentiment: Negative

Read moreGrayscale Names Top Crypto Recovery Picks After 50% Bitcoin Crash: ETH, SOL, LINK & More

Sentiment: Positive

Read moreHayes-backed Solana treasury firm doubles down on SOL despite $179M net loss

Sentiment: Positive

Read moreCrypto Analyst Says Solana (SOL) Forming Clear Market Bottom – Here's His Outlook

Sentiment: Positive

Read moreGoldman Sachs' Crypto Portfolio: BTC, ETH, XRP, and SOL Holdings Revealed

Sentiment: Positive

Read moreSolana Tests Key Support After Sharp Bounce, Analysts Weigh $98–$108 Upside for SOL

Sentiment: Positive

Read moreSolana News: SOL Rout Continues, Bear Market Fears Rise Even as On-Chain Metrics Stay Strong

Sentiment: Negative

Read moreSolana Price Prediction: SOL Bounces 12% Overnight – But This One Signal Could Ruin Everything

Sentiment: Negative

Read morePrice predictions 2/9: SPX, DXY, BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH

Sentiment: Positive

Read moreHistorical Values

-

Now

Neutral 57 -

Yesterday

Neutral 57 -

7 Days Ago

Neutral 51 -

1 Month Ago

Neutral 54

Solana Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Solana price evolution a certain numerical value.

This module studies the price trend to determine if the Solana market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Fear

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Solana price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Fear

Like volatility, the Solana Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Solana bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Neutral

The Impulse indicator measures the current Solana price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Solana market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Greed

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Solana the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Greed

Dominance Neutral

This other indicator takes into account the dominance of Solana with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Solana's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Solana and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Solana has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Solana. For this, specific search terms are used that determine the purchasing or ceding interest of Solana, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Greed

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Solana and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Solana moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Neutral

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Solana on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

SOL Price

1 SOL = $84.44

Solana CFGI Score & SOL Price History

SOL Price & Solana Sentiment Breakdown Charts

Price Score Sentiment

Volatility Sentiment

Volume Sentiment

Impulse Sentiment

Technical Sentiment

Social Sentiment

Dominance Sentiment

Search Sentiment

Whales Sentiment

Order Book Sentiment