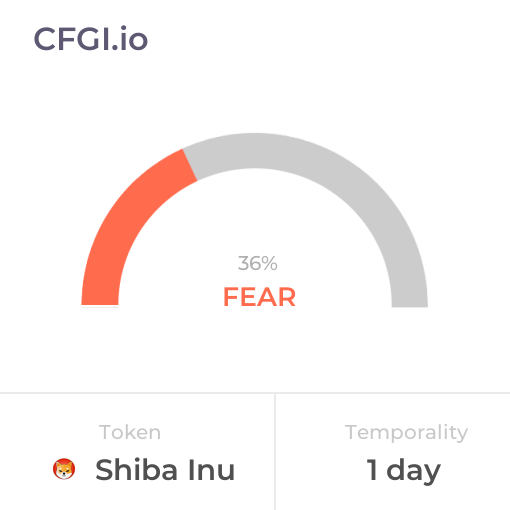

Historical Values

-

Now

Neutral 50 -

Yesterday

Neutral 50 -

7 Days Ago

Neutral 50 -

1 Month Ago

Neutral 50

Shiba Inu Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Shiba Inu price evolution a certain numerical value.

This module studies the price trend to determine if the Shiba Inu market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Shiba Inu price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the Shiba Inu Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Shiba Inu bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Greed

The Impulse indicator measures the current Shiba Inu price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Shiba Inu market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Neutral

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Shiba Inu the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Extreme Fear

Dominance Fear

This other indicator takes into account the dominance of Shiba Inu with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Shiba Inu's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Shiba Inu and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Fear

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Shiba Inu has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Shiba Inu. For this, specific search terms are used that determine the purchasing or ceding interest of Shiba Inu, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Fear

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Shiba Inu and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Shiba Inu moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Greed

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Shiba Inu on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

Shiba Inu News

Shiba Inu News

Shiba Inu (SHIB) Nears a Breaking Point That Might Trigger a 455% Increase

Sentiment: Positive

Read moreShiba Inu Price Drops After $333K Liquidation Wipes Out 59 Billion SHIB Tokens

Sentiment: Negative

Read moreSHIB Price Prediction: Technical Consolidation Suggests Cautious Outlook Through March 2026

Sentiment: Negative

Read moreRipple Cofounder Jed McCaleb Named on Forbes Rich List, Shiba Inu (SHIB) Has Chance to Break $3.5 Billion Price Threshold, Bitcoin Miner MARA Starts Selling BTC: Morning Crypto Report

Sentiment: Positive

Read moreShiba Inu Price Alert: 80 Trillion SHIB on Exchanges Could Trigger the Next Big Move

Sentiment: Positive

Read moreShiba Inu Price Surges 5% as $38K in Short Liquidations Fuel SHIB Recovery

Sentiment: Positive

Read more$2 XRP Back on the Menu: Bollinger Bands, Bitcoin (BTC) Recovers to $70,000 Amid 500% Liquidation Imbalance, 494 Billion Shiba Inu (SHIB) Leaves Singapore's Coinhako to Major Market Maker: Morning Crypto Report

Sentiment: Positive

Read moreXRP Suffers $30.3 Million Blow From ETFs, Is Shiba Inu (SHIB) Now Available in Europe by Coinbase? Dogecoin (DOGE) Hints at 37% Breakout Chance: Morning Crypto Report

Sentiment: Neutral

Read moreSHIB Price Prediction: Technical Recovery Targets $0.0000075 by End of March

Sentiment: Positive

Read moreSHIB Price Prediction: Technical Recovery Signals Mixed Outlook Despite Neutral Momentum

Sentiment: Neutral

Read moreShiba Inu (SHIB) Has 500 Billion Left Until Historic Threshold Is Broken

Sentiment: Positive

Read moreSHIB Price Prediction: Technical Recovery Targets $0.0000065 by April 2026

Sentiment: Positive

Read moreSHIB Burn Rate Jumps 53,000% But Price Drops Over 2% — Here's Why It Doesn't Matter

Sentiment: Negative

Read more+157 Billion in 24 Hours: Shiba Inu (SHIB) Inflow Wave Ends Rally Expectations

Sentiment: Negative

Read moreCrypto Market Review: Ethereum (ETH) Hits First Bullish Setup in 2026, Bitcoin Must Get Comfortable in $70,000s, Was Shiba Inu (SHIB) Price Neutralized?

Sentiment: Positive

Read moreForget DOGE (Down 4%) And SHIB (Down 10%): This Meme Coin Is The Outlier

Sentiment: Positive

Read more733 Billion SHIB Outflow: Binance's Shiba Inu Stockpile Dips 1.38% While Holding Massive 52.5 Trillion in Total Reserves

Sentiment: Negative

Read moreShiba Inu: Alert Issued as SHIB Participant Social Media Account Gets Hacked

Sentiment: Negative

Read moreXRP Has Chance to Break $1.45 Resistance, Peter Brandt Predicts Bitcoin May Not Rally Until After September, +844 Billion SHIB: Shiba Inu Hits 2026 High in Exchange Inflow: Morning Crypto Report

Sentiment: Positive

Read moreSHIB Burns Stuck at Zero for Second Consecutive Day Amid Surging Crypto Market

Sentiment: Negative

Read moreEx-Ripple Engineer: XRP Protocol Freeze Influenced Ethereum, Google Issues Scam Alert for iPhone Users, Shiba Inu (SHIB) Secures Binance Trading Expansion: Morning Crypto Report

Sentiment: Positive

Read moreShiba Inu (SHIB) on the Verge of Losing 80 Trillion Exchange Threshold, Will Selling End?

Sentiment: Positive

Read moreSHIB Exchange Reserves Hit Record Low as Whales Pull Millions Off Platforms

Sentiment: Negative

Read moreSHIB Price Prediction: Technical Recovery Targets $0.0000070 by April 2026

Sentiment: Positive

Read more-414 Billion Shiba Inu (SHIB) in 24 Hours Resets Bearish Exchange Inflows

Sentiment: Positive

Read moreMulti-Year Shiba Inu (SHIB) Bottom Almost Reached: What to Expect After It

Sentiment: Negative

Read moreSHIB Price Prediction: Technical Recovery Signals Point to $0.0000065 by April 2026

Sentiment: Positive

Read moreSHIB Price Prediction: SHIB Leader Drops Cryptic Profile Update — Is Something Big Coming?

Sentiment: Positive

Read more-337 Billion Shiba Inu (SHIB) Removed in 24 Hours: Is It Getting Better?

Sentiment: Negative

Read moreShiba Inu (SHIB) Price Reset Point: Three Oversold Indicators, 20% Potential

Sentiment: Negative

Read moreSHIB Price Prediction: Consolidation Phase Suggests $0.0000065 Target by March End

Sentiment: Positive

Read moreElon Musk's X Restricts Crypto From Paid Features, Shiba Inu (SHIB) Averages Historic 24% Price Rise in March, 'I Love Cardano': Hoskinson Teases More for ADA — Morning Crypto Report

Sentiment: Neutral

Read moreElon Musk's X Restricts Crypto From Paid Features, Shiba Inu (SHIB) Averages Historic 24% Price Rise in March, 'I Love Cardano': Hoskinson Teases More for ADA — Morning Crypto Report

Sentiment: Positive

Read more+600 Billion Shiba Inu (SHIB) Exchange Injection Spotted Amid Price's Critical Turnaround

Sentiment: Neutral

Read more+600 Billion Shiba Inu (SHIB) Exchange Injection Spotted Amid Price's Critical Turnaround

Sentiment: Neutral

Read moreShiba Inu Surge Incoming? 117 Billion SHIB Leaving Exchanges Sparks Bull Alert

Sentiment: Positive

Read moreShiba Inu Surge Incoming? 117 Billion SHIB Leaving Exchanges Sparks Bull Alert

Sentiment: Positive

Read moreSHIB Price Prediction: Neutral Consolidation Expected as Technical Indicators Show Mixed Signals

Sentiment: Neutral

Read moreSHIB Price Prediction: Neutral Consolidation Expected as Technical Indicators Show Mixed Signals

Sentiment: Neutral

Read moreShiba Inu Price Drops 4% as Crypto Market Loses $515M — What's Next for SHIB?

Sentiment: Negative

Read moreShiba Inu Price Drops 4% as Crypto Market Loses $515M — What's Next for SHIB?

Sentiment: Negative

Read moreShiba Inu Price Drops 4% as Crypto Market Loses $515M — What's Next for SHIB?

Sentiment: Negative

Read moreShiba Inu Price Drops 4% as Crypto Market Loses $515M — What's Next for SHIB?

Sentiment: Negative

Read moreSHIB Price Prediction: Technical Analysis Points to Critical Levels as March Approaches

Sentiment: Negative

Read moreSHIB Price Prediction: Technical Analysis Points to Critical Levels as March Approaches

Sentiment: Negative

Read moreSHIB Price Prediction: Technical Analysis Points to Critical Levels as March Approaches

Sentiment: Negative

Read moreSHIB Price Prediction: Technical Analysis Points to Critical Levels as March Approaches

Sentiment: Negative

Read moreShiba Inu Wallet Accumulates $9.45M in SHIB Through CoinOne — Identity Still Unknown

Sentiment: Positive

Read moreSouth Korea-Based Shiba Inu (SHIB) Whale Makes First Move in Months, Now Holding 1.616 Trillion Tokens

Sentiment: Positive

Read moreSouth Korea-Based Shiba Inu (SHIB) Whale Makes First Move in Months, Now Holding 1.616 Trillion Tokens

Sentiment: Positive

Read moreSouth Korea-Based Shiba Inu (SHIB) Whale Makes First Move in Months, Now Holding 1.616 Trillion Tokens

Sentiment: Positive

Read moreSouth Korea-Based Shiba Inu (SHIB) Whale Makes First Move in Months, Now Holding 1.616 Trillion Tokens

Sentiment: Positive

Read moreSHIB Price Prediction: Technical Analysis Points to $0.0000065-$0.0000070 Range by March 2026

Sentiment: Positive

Read moreXRP Sees 6% Increase as Bollinger Bands Signal Momentum, Bitcoin ETFs Record Renewed Inflows, 549 Billion SHIB Enter Circulation — U.Today Crypto Digest

Sentiment: Positive

Read moreXRP Sees 6% Increase as Bollinger Bands Signal Momentum, Bitcoin ETFs Record Renewed Inflows, 549 Billion SHIB Enter Circulation — U.Today Crypto Digest

Sentiment: Positive

Read moreXRP Sees 6% Increase as Bollinger Bands Signal Momentum, Bitcoin ETFs Record Renewed Inflows, 549 Billion SHIB Enter Circulation — U.Today Crypto Digest

Sentiment: Positive

Read moreXRP Sees 6% Increase as Bollinger Bands Signal Momentum, Bitcoin ETFs Record Renewed Inflows, 549 Billion SHIB Enter Circulation — U.Today Crypto Digest

Sentiment: Positive

Read moreShiba Inu Battles 2026 Slump After Whale Offloads 24 Billion SHIB on Binance

Sentiment: Negative

Read moreShiba Inu Technical Outlook: Is the 549B SHIB Inflow a Precursor to a Breakdown?

Sentiment: Negative

Read moreCan Shiba Inu Price Recover? Whale Dumps 24 Billion SHIB on Binance Amid 2026 Slump

Sentiment: Negative

Read moreShiba Inu Whale Sends 50% of SHIB Stack to Binance After Holding for 2 Years

Sentiment: Negative

Read moreShiba Inu Whale Sends 50% of SHIB Stack to Binance After Holding for 2 Years

Sentiment: Negative

Read moreShiba Inu Whale Sends 50% of SHIB Stack to Binance After Holding for 2 Years

Sentiment: Negative

Read moreShiba Inu Whale Sends 50% of SHIB Stack to Binance After Holding for 2 Years

Sentiment: Negative

Read more-117 Billion Shiba Inu (SHIB) in 24 Hours Flew out of Exchanges: Selling Pressure Easing

Sentiment: Positive

Read more-117 Billion Shiba Inu (SHIB) in 24 Hours Flew out of Exchanges: Selling Pressure Easing

Sentiment: Positive

Read more-117 Billion Shiba Inu (SHIB) in 24 Hours Flew out of Exchanges: Selling Pressure Easing

Sentiment: Positive

Read more-117 Billion Shiba Inu (SHIB) in 24 Hours Flew out of Exchanges: Selling Pressure Easing

Sentiment: Positive

Read moreShiba Inu (SHIB) Unable to Break 26 EMA as Key Breakthrough Attempt Fails

Sentiment: Negative

Read moreHistorical Values

-

Now

Neutral 50 -

Yesterday

Neutral 50 -

7 Days Ago

Neutral 48 -

1 Month Ago

Neutral 46

Shiba Inu Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Shiba Inu price evolution a certain numerical value.

This module studies the price trend to determine if the Shiba Inu market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Shiba Inu price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the Shiba Inu Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Shiba Inu bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Greed

The Impulse indicator measures the current Shiba Inu price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Shiba Inu market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Neutral

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Shiba Inu the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Extreme Fear

Dominance Fear

This other indicator takes into account the dominance of Shiba Inu with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Shiba Inu's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Shiba Inu and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Fear

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Shiba Inu has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Shiba Inu. For this, specific search terms are used that determine the purchasing or ceding interest of Shiba Inu, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Fear

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Shiba Inu and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Shiba Inu moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Greed

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Shiba Inu on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

SHIB Price

1 SHIB = $0.000006

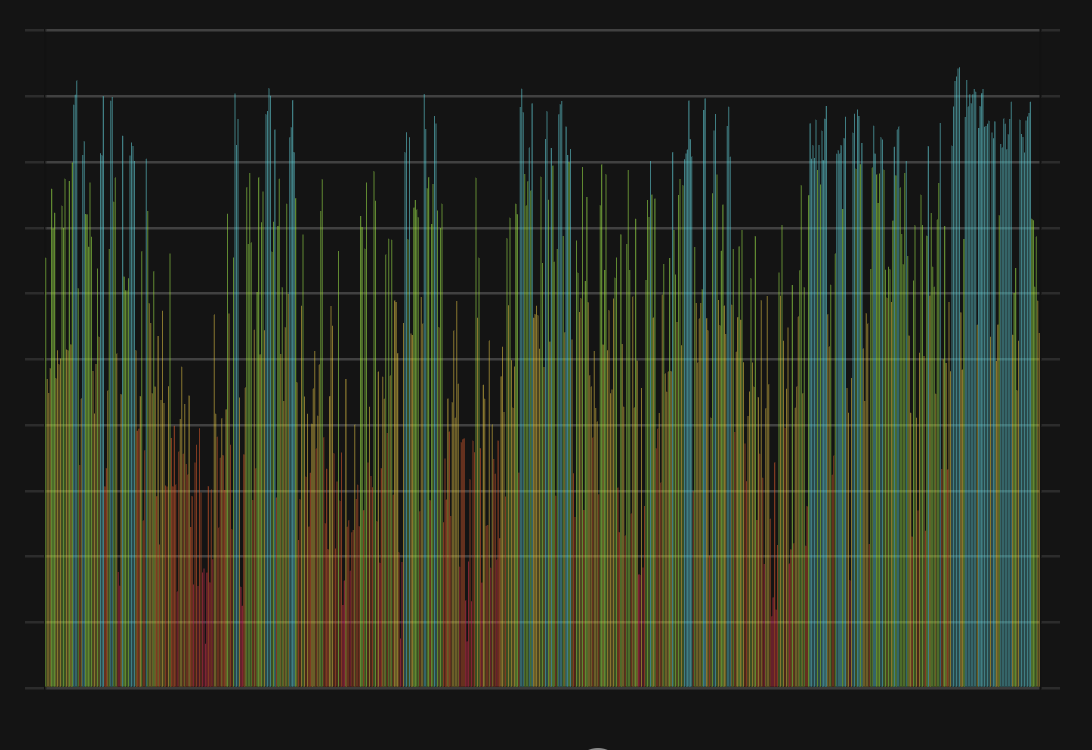

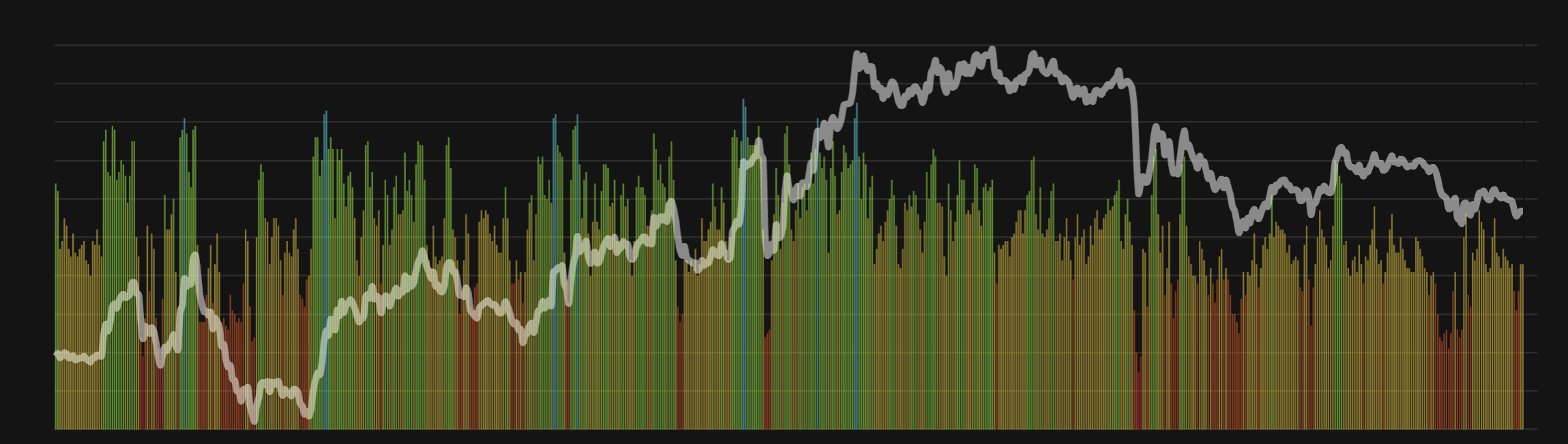

Shiba Inu CFGI Score & SHIB Price History

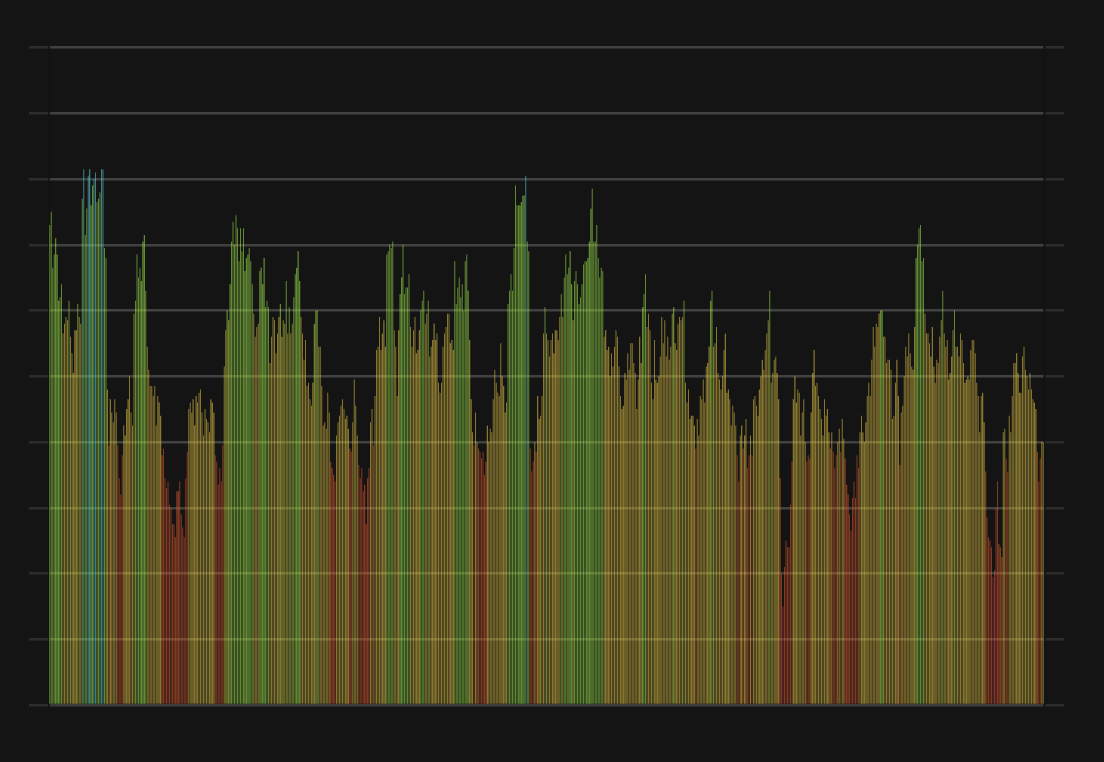

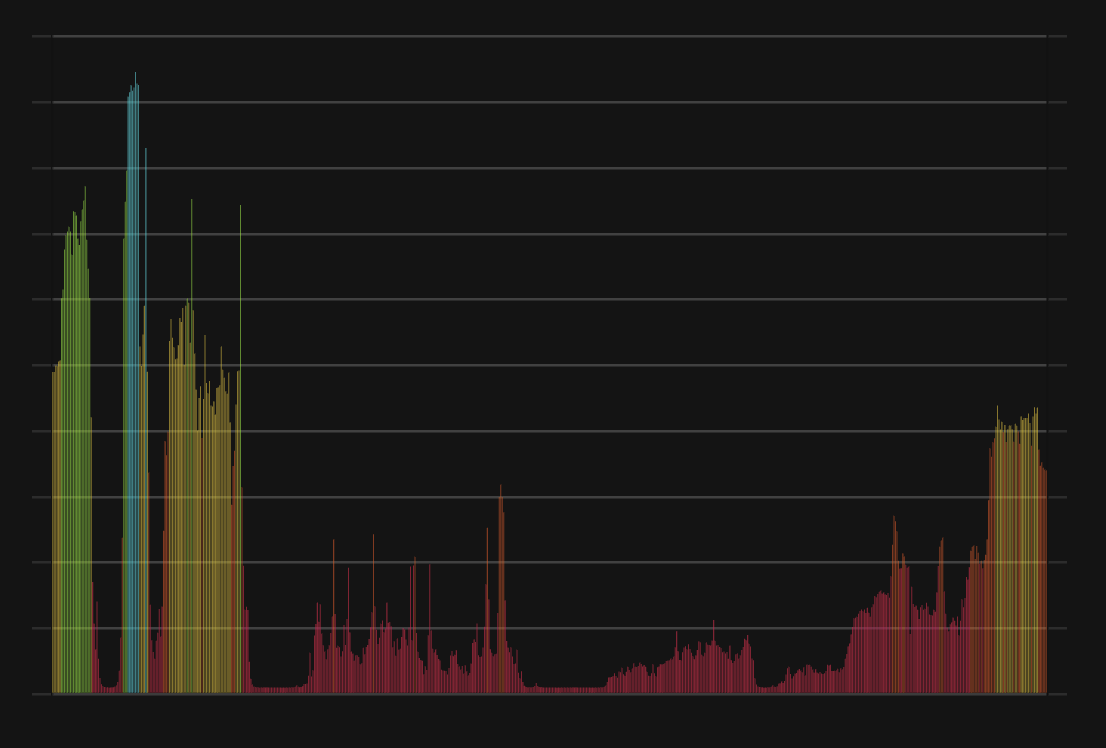

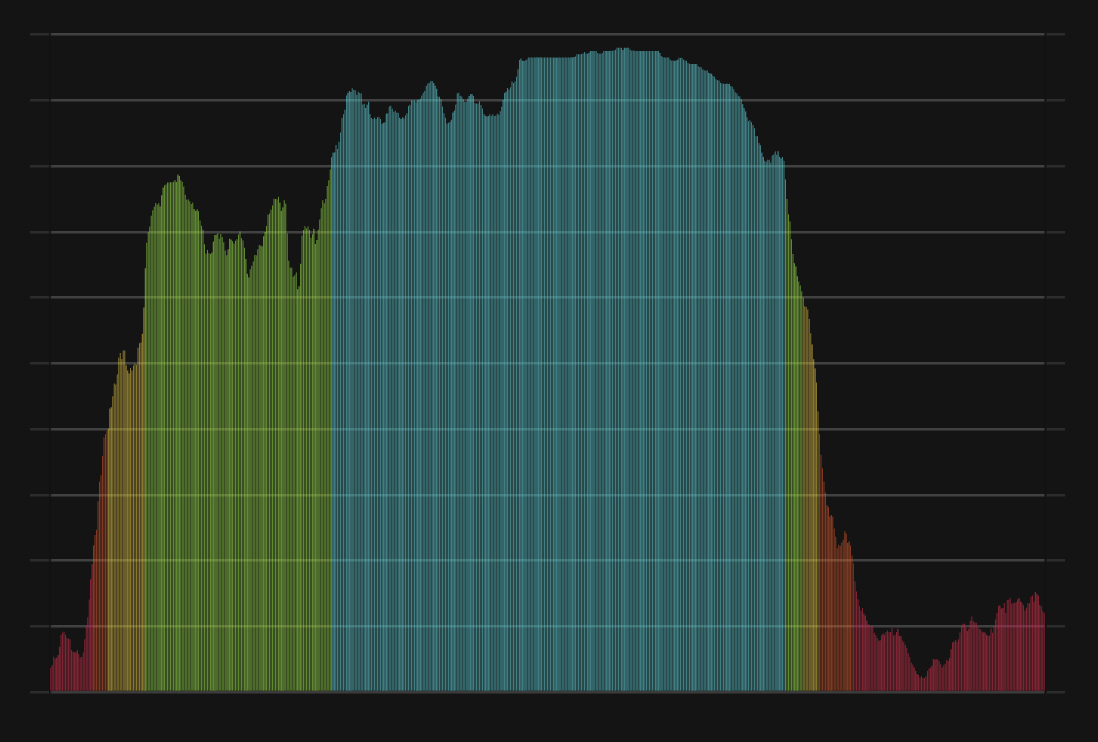

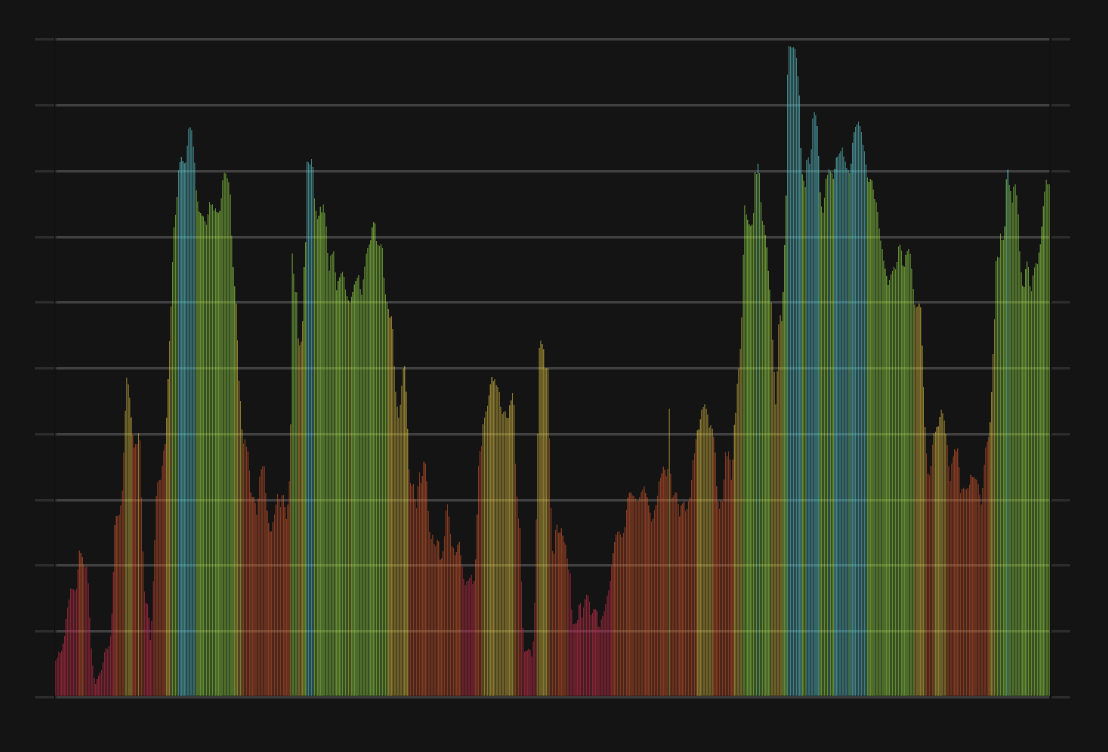

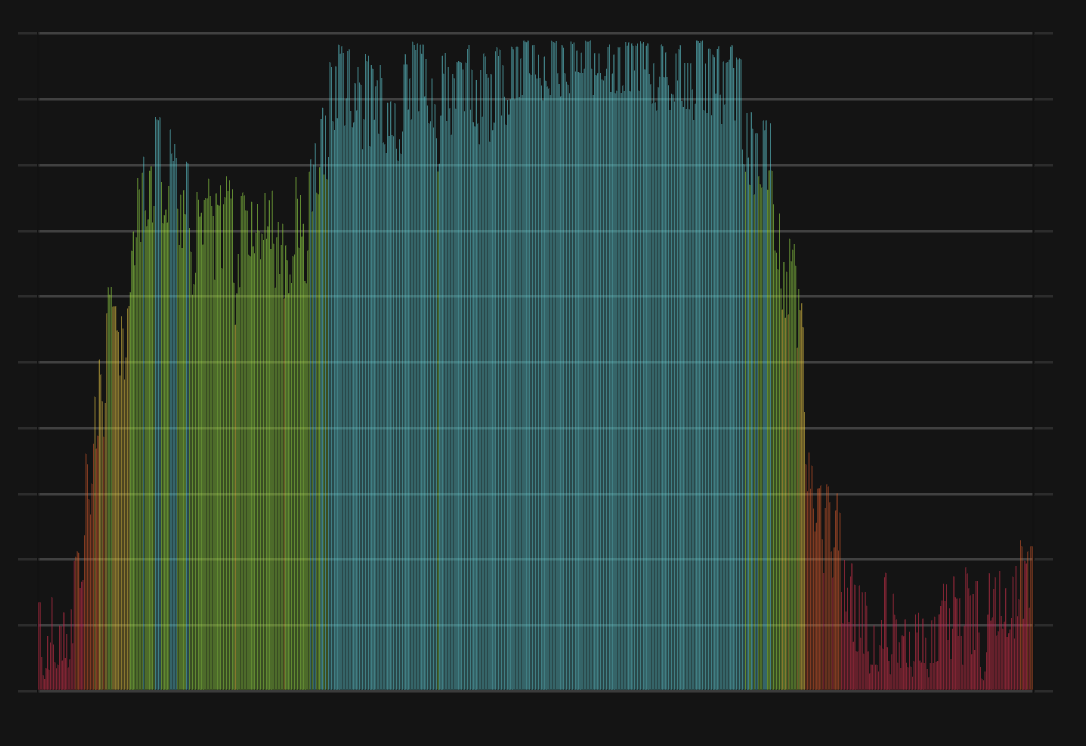

SHIB Price & Shiba Inu Sentiment Breakdown Charts

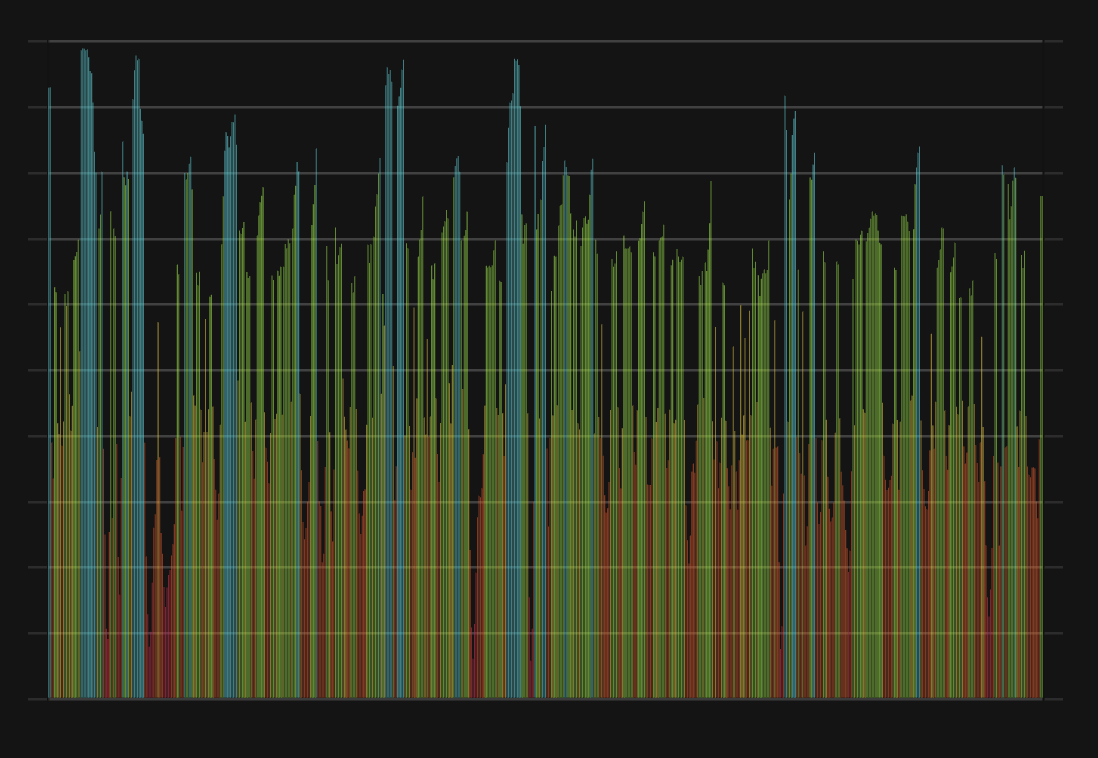

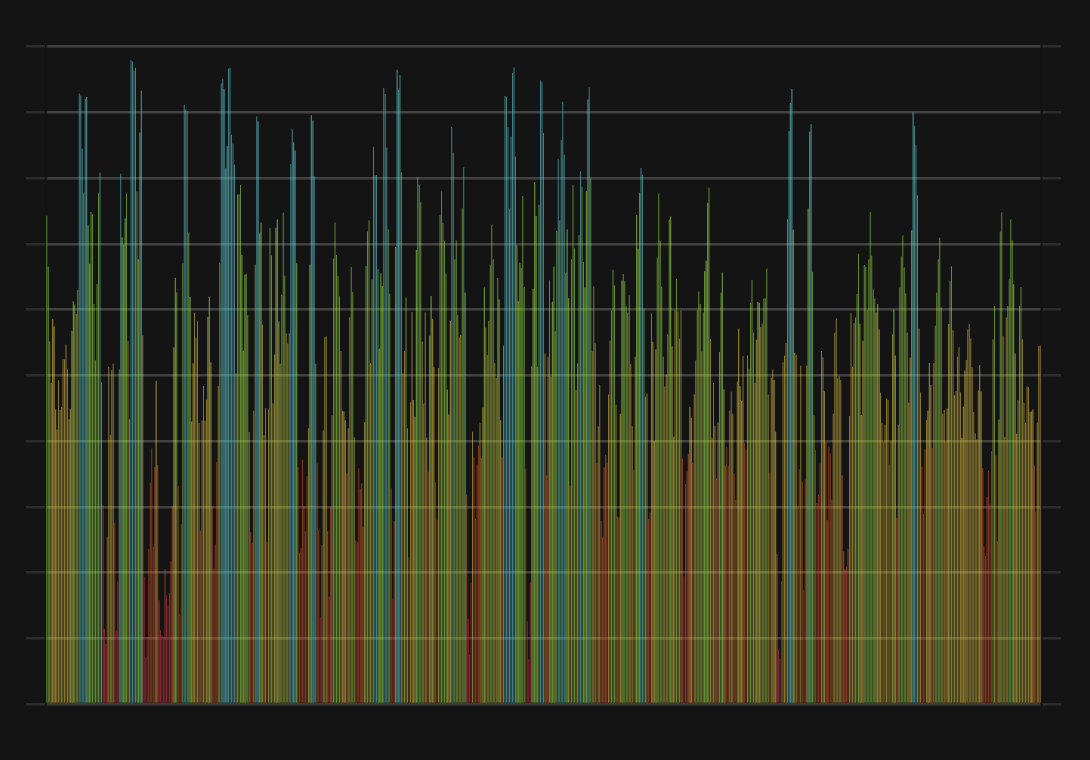

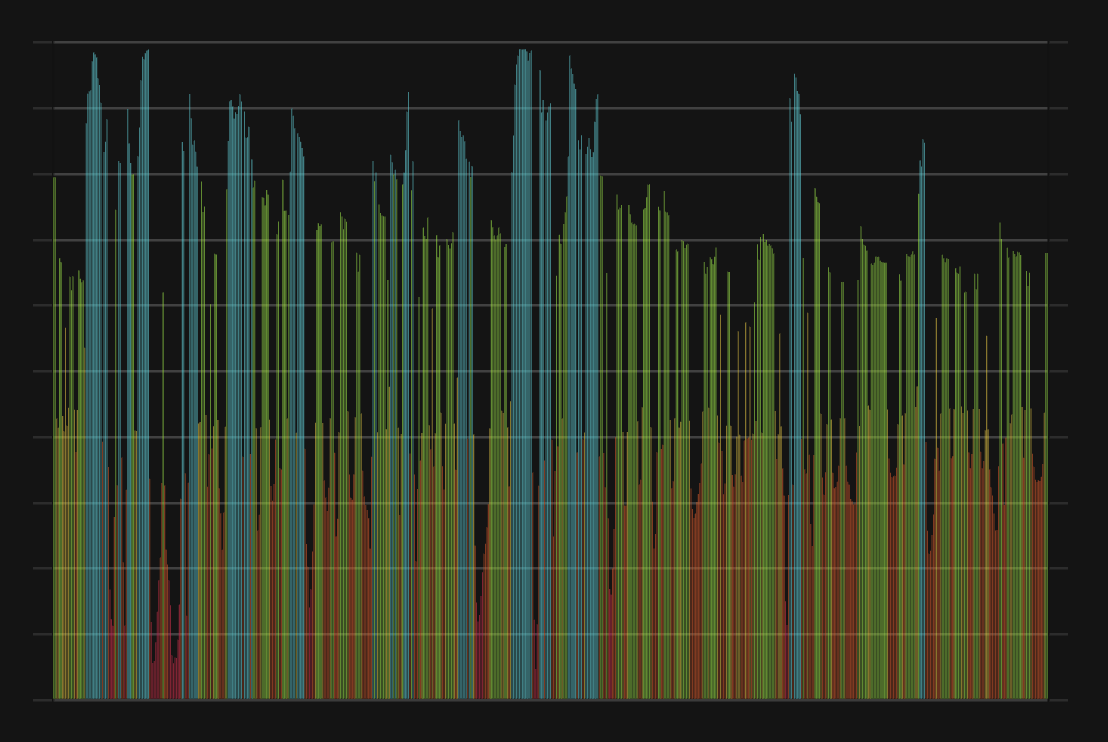

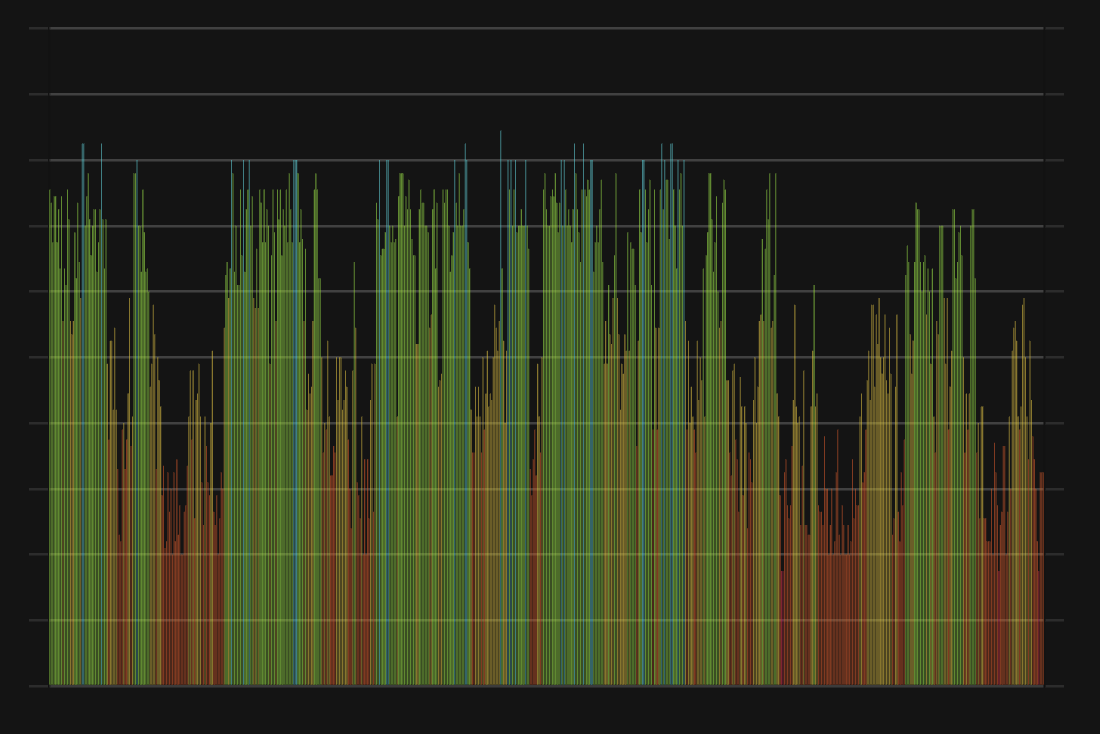

Price Score Sentiment

Volatility Sentiment

Volume Sentiment

Impulse Sentiment

Technical Sentiment

Social Sentiment

Dominance Sentiment

Search Sentiment

Whales Sentiment

Order Book Sentiment