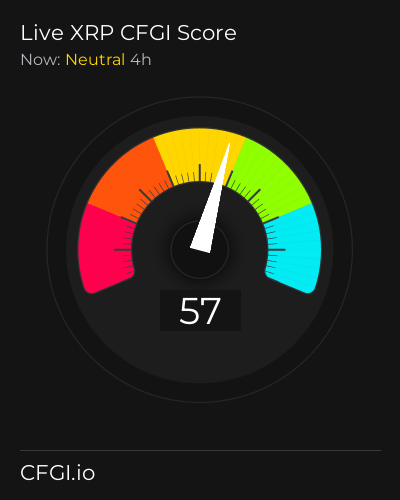

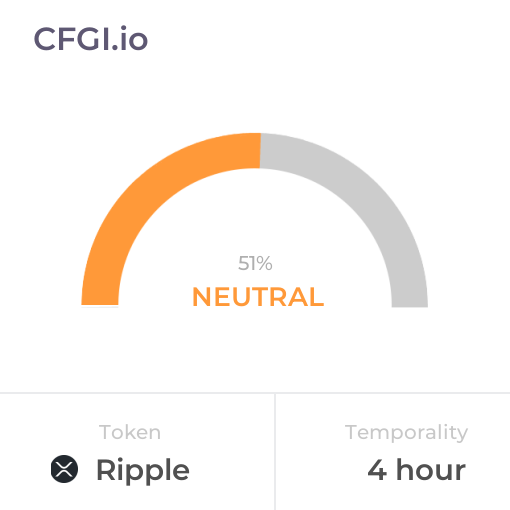

Historical Values

-

Now

Neutral 56 -

Yesterday

Neutral 56 -

7 Days Ago

Neutral 56 -

1 Month Ago

Neutral 56

Ripple Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Ripple price evolution a certain numerical value.

This module studies the price trend to determine if the Ripple market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Ripple price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the Ripple Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Ripple bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Neutral

The Impulse indicator measures the current Ripple price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Ripple market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Neutral

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Ripple the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Extreme Greed

Dominance Fear

This other indicator takes into account the dominance of Ripple with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Ripple's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Ripple and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Extreme Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Ripple has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Ripple. For this, specific search terms are used that determine the purchasing or ceding interest of Ripple, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Greed

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Ripple and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Ripple moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Extreme Greed

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Ripple on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

Ripple News

Ripple News

XRP Sees $991 Million Trading Volume Surge as Buyers Step In After Prolonged Sell-Off

Sentiment: Positive

Read moreXRP Funding Rate Drops To Lowest Level Since April 2025 — What This Means

Sentiment: Positive

Read more“Clear Whale Accumulation”: XRP Rebounds 20% With 1,389 Large Transactions in a Single Day

Sentiment: Positive

Read moreXRP Buyers Defend Most Major 200-Week Price Average: Can It Be Bottom of 2026?

Sentiment: Positive

Read moreXRP Price Prediction: Testing $1.50 Resistance as Technical Indicators Signal Mixed Outlook

Sentiment: Neutral

Read more1 Underrated Reason to Buy XRP With $1,000 and Hold It for 5 Years or More

Sentiment: Positive

Read morePatrick Bet-David Accumulates More XRP as Crypto Market Wipes Out Billions

Sentiment: Neutral

Read moreWe Asked 4 AIs How Low XRP Could Fall This Bear Cycle – The Answers Were Shocking

Sentiment: Negative

Read moreXRP Price Has Just Reached Most Oversold Level In History And This Analyst Is Predicting A Bounce

Sentiment: Positive

Read moreIf You'd Invested $100 in XRP 5 Years Ago, Here's How Much You'd Have Today

Sentiment: Positive

Read moreXRP Millionaires Are Back to Business — BlackRock XRP ETF Whispers Swirl

Sentiment: Positive

Read moreXRP News: Ripple's RLUSD Gets Boost as CFTC Expands Approved Tokenized Collateral

Sentiment: Positive

Read moreXRP Price Prediction 2026: Current Analysis After the Crash – News, Chart & Outlook

Sentiment: Negative

Read moreBitcoin and XRP Price Outlook Ahead of Crypto Market Bill Nearing Key Phase on Feb 10th

Sentiment: Positive

Read moreRipple ETF Investors Unfazed by Market Crash as XRP Price Begins Recovery

Sentiment: Positive

Read moreCrypto Markets Rebound—Here's Why Bitcoin, Ethereum, XRP Prices are Rising Today

Sentiment: Positive

Read moreXRP Still in Bull Market Versus Bitcoin, and XRP/BTC Chart Puts 51% Upside on the Menu

Sentiment: Positive

Read moreXRP Transitions Into Institutional Settlement Asset Under Ripple's XRPL Strategy

Sentiment: Positive

Read moreXRP Buying Volume Nears $500 Million as Oversold Conditions Spark Speculative Interest

Sentiment: Positive

Read moreXRP Price Prediction: Key Ledger Upgrade Quietly Activated – Why This Could Be the Most Bullish Signal Yet

Sentiment: Positive

Read moreXRP Rebounds as Whale Accumulation and Network Activity Signal Price Reversal

Sentiment: Positive

Read moreRipple Integrating Hyperliquid Into Its Prime Brokerage Platform To Broaden Institutional DeFi Access Fails To Bump XRP Bulls

Sentiment: Negative

Read moreBitcoin Reclaims $70K As XRP Rallies 20%, Ethereum, Dogecoin Gain Over 10% Heading Into The Weekend

Sentiment: Positive

Read moreThese Metrics Are Flashing Warning Signs As XRP Approaches A Potential Bear Market Shift

Sentiment: Negative

Read moreIs This the Moment XRP Millionaires Are Made? Garlinghouse Quote Sets Crypto Twitter Ablaze

Sentiment: Positive

Read morePrice predictions 2/6: BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH, HYPE, XMR

Sentiment: Neutral

Read moreWhy Is XRP Sentiment Rising To The Positive While Bitcoin And Ethereum Suffer?

Sentiment: Positive

Read moreXRP Sees Impressive Recovery Wick With Massive 37% Price Surge: Here's Why

Sentiment: Positive

Read moreXRP snaps back after near-20% sell-off as volatility dominates post-crash trading

Sentiment: Positive

Read moreBitcoin reclaims $70K, XRP rockets 20%: what's fueling crypto market's surge

Sentiment: Positive

Read moreU.Today Crypto Digest: Ripple Prime CEO Hints at Potential Upside for XRP, Legendary Trader Brandt Warns of Bitcoin 'Campaign Selling,' Vitalik Buterin Triggers Ethereum Sell-Off

Sentiment: Positive

Read moreWhy The Market Cap Argument For XRP Price Not Reaching $10,000 Is ‘Flawed'

Sentiment: Positive

Read moreKey Ripple (XRP) Metric Plunges to 4-Month Low: Is This the Ultimate Rebound Signal?

Sentiment: Positive

Read moreXRP and Shiba Inu (SHIB) in Focus: Is Latest $1,000,000,000 USDT Mint a Bear Market Turning Point?

Sentiment: Positive

Read moreExclusive: Expert Reveals What's Next For Bitcoin, Ethereum and XRP Prices As Market Recovers

Sentiment: Positive

Read moreXRP Price Prediction Update: Can XRP Rally as Analysts Eye the Next Big Crypto?

Sentiment: Negative

Read moreCoinDesk 20 Performance Update: Ripple (XRP) Surges 20.1% as All Assets Trade Higher

Sentiment: Positive

Read moreHere Are The Next Major Levels To Watch For XRP As The Crypto Market Enters Red Season

Sentiment: Negative

Read moreRipple sets institutional DeFi blueprint on the XRP ledger with XRP at the core

Sentiment: Positive

Read moreXRP Derivatives Rocket 5,674% in $2.51 Billion Market Bloodbath, What to Watch Now?

Sentiment: Neutral

Read moreMorning Crypto Report: One of Biggest XRP Sellers Revealed, -80% for Cardano (ADA): Founder Admits $3 Billion Loss, Binance Delists 20 Pairs After $2.6 Billion Liquidation Tsunami: Bitcoin Affected Too

Sentiment: Negative

Read moreBitcoin Slides To $65,000 As Liquidations Hit $2 Billion; Ethereum, Dogecoin Sink, XRP Holds Steady

Sentiment: Negative

Read moreXRP Price Drops 7% as Evernorth's $380 Million Paper Loss Becomes First Test of Ripple's 2026 Roadmap

Sentiment: Negative

Read moreXRP Price Outlook As Peter Brandt Predicts BTC Price Might Crash to $42k

Sentiment: Negative

Read moreHistorical Values

-

Now

Neutral 56 -

Yesterday

Neutral 56 -

7 Days Ago

Neutral 51 -

1 Month Ago

Neutral 56

Ripple Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Ripple price evolution a certain numerical value.

This module studies the price trend to determine if the Ripple market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Ripple price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the Ripple Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Ripple bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Neutral

The Impulse indicator measures the current Ripple price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Ripple market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Neutral

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Ripple the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Extreme Greed

Dominance Fear

This other indicator takes into account the dominance of Ripple with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Ripple's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Ripple and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Extreme Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Ripple has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Ripple. For this, specific search terms are used that determine the purchasing or ceding interest of Ripple, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Greed

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Ripple and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Ripple moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Extreme Greed

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Ripple on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

XRP Price

1 XRP = $1.45

Ripple CFGI Score & XRP Price History

XRP Price & Ripple Sentiment Breakdown Charts

Price Score Sentiment

Volatility Sentiment

Volume Sentiment

Impulse Sentiment

Technical Sentiment

Social Sentiment

Dominance Sentiment

Search Sentiment

Whales Sentiment

Order Book Sentiment