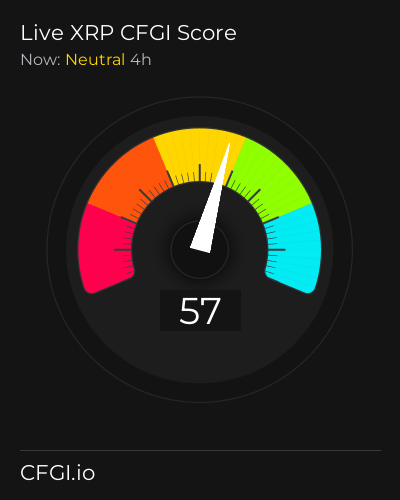

Historical Values

-

Now

Greed 73 -

Yesterday

Greed 73 -

7 Days Ago

Greed 73 -

1 Month Ago

Greed 73

Ripple Breakdown

Price Score Greed

The Price Score indicator is a relevant indicator to analyze and assign the Ripple price evolution a certain numerical value.

This module studies the price trend to determine if the Ripple market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Ripple price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the Ripple Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Ripple bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Extreme Greed

The Impulse indicator measures the current Ripple price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Ripple market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Greed

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Ripple the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Extreme Greed

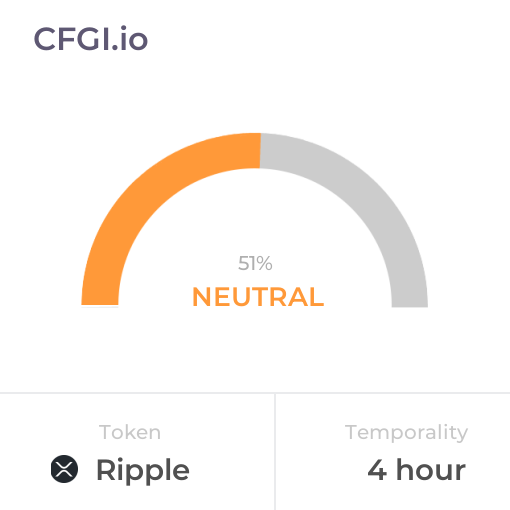

Dominance Neutral

This other indicator takes into account the dominance of Ripple with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Ripple's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Ripple and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Extreme Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Ripple has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Ripple. For this, specific search terms are used that determine the purchasing or ceding interest of Ripple, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Fear

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Ripple and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Ripple moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Extreme Greed

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Ripple on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

Ripple News

Ripple News

Bitcoin, Ethereum, Solana, XRP Rally as Ceasefire Hopes and $619M Institutional Inflows Fuel Crypto Rebound

Sentiment: Positive

Read moreHow High Will Bitcoin, Ethereum and XRP Prices Go As Trump Says Iran War ‘Almost Over'?

Sentiment: Positive

Read moreBitcoin, Ethereum, XRP, Dogecoin Rally As Trump Says Iran War 'Pretty Much' Complete: Analyst Predicts BTC Moves If Oil Keeps Falling

Sentiment: Positive

Read moreXRP Price Prediction: Whales Just Bought 210 Million Tokens – Is a Big Update Coming?

Sentiment: Neutral

Read moreAnalyst Flags ‘Suspicious' $280 Million XRP Move By Ripple Outside Of Unlock Schedule

Sentiment: Negative

Read moreElon's Grok AI Predicts the Price of XRP, Bitcoin and Ethereum by The End of 2026

Sentiment: Positive

Read moreXRP Starts New Week With Bullish Confirmation, But This Level Is A Problem

Sentiment: Positive

Read moreXRP Sees Major Liquidity Expansion Across Daily Trading Activity – Here's What Could Play Out Next

Sentiment: Positive

Read moreRipple 5-Year Goal: Brad Garlinghouse Forecasts XRP Investors Will Be Very Happy

Sentiment: Positive

Read moreRipple's XRP Whales Eye $1.7 Trillion Payments Industry as New SWIFT Narrative Gains Momentum

Sentiment: Positive

Read morePrice predictions 3/9: SPX, DXY, BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH

Sentiment: Positive

Read moreXRP Holders Now Have Over $50 Billion in Losses as SOPR Signals Capitulation Phase

Sentiment: Negative

Read moreXRP Ledger Is Rising Rapidly In This Main Metric That Could Change Its Course

Sentiment: Positive

Read moreXRP is bleeding with over $50 billion in unrealized losses as 60% of supply goes underwater

Sentiment: Negative

Read moreHistorical XRP Pattern Returns as One Bearish Metric Drops 80% — Trend Reversal Ahead?

Sentiment: Positive

Read moreXRP Price Prediction: Bears Target $1 as XRP Struggles Below Key Resistance

Sentiment: Negative

Read moreXRP Suffers $30.3 Million Blow From ETFs, Is Shiba Inu (SHIB) Now Available in Europe by Coinbase? Dogecoin (DOGE) Hints at 37% Breakout Chance: Morning Crypto Report

Sentiment: Neutral

Read moreXRP Price Faces Pressure as $50B Turns Underwater – But Data Hints at a Possible Setup

Sentiment: Negative

Read moreRetail capitulates on XRP as $51B in losses mount – Yet ONE group refuses to sell

Sentiment: Negative

Read moreRipple Holders Alert: 60% of XRP Circulating Supply Currently Underwater

Sentiment: Negative

Read moreBitcoin And XRP Price Prediction As US Oil Prices Fall Sharply- Will This Spark a New Bull Rally

Sentiment: Positive

Read moreXRP (XRP) Price: Unpacking the Massive $51B in Unrealized Losses for Token Holders

Sentiment: Negative

Read moreRipple News: $50B XRP Losses Grow as Analyst Points to $6.8 Capitulation Level

Sentiment: Negative

Read moreXRP Holders Face $50 Billion in Unrealized Losses: What Whales Are Doing Now

Sentiment: Negative

Read moreXRP Notes 27% Surge in Daily Burn Activity as On-Chain Metrics Turn Promising

Sentiment: Positive

Read moreBitcoin, Ethereum Slide, XRP, Dogecoin Steady As Iran War Spooks Investors: Popular Chartist Says This Indicator Acting As 'Ceiling' For BTC Price

Sentiment: Negative

Read moreWhy U.S. lawmakers signing against CBDC could be bullish signal for XRP?

Sentiment: Positive

Read moreAnalyst Predicts XRP Breakout Against BTC, Says $10 Move Could Be Just The Starts

Sentiment: Positive

Read moreEight Applications, 90% Odds and an Empty Exchange: The XRP Supply Shock Nobody Is Prepared For

Sentiment: Positive

Read moreXRP Price Prediction: Ripple Targets $1.50 Breakout Amid Mixed Analyst Forecasts

Sentiment: Positive

Read moreXRP, SOL, ADA, DOGE Altseason Delayed to 2027 as Dominance Cycle Requires 2-3 Years: Analyst

Sentiment: Negative

Read moreXRP Price Analysis: Potential Decline to $1 Looms as ETFs Experience Weekly Outflows

Sentiment: Negative

Read moreHow Ripple Plans to Turn XRP Into the Collateral Layer of Institutional DeFi

Sentiment: Positive

Read moreRipple Whales Take Control of XRP Trading as Key Metric Signals Potential Rally

Sentiment: Positive

Read more$100 XRP Price Dream? — Analysts Reveal Setup for ‘Face Melting' Rally On The Horizon

Sentiment: Positive

Read moreRipple Price Analysis: Why the XRP/BTC Pair Is Flashing a Major Warning Signal

Sentiment: Negative

Read moreWhy Black Swan Capitalist Founder Believes Ripple's XRP May Survive Quantum Threats That Gravely Endanger Bitcoin, Ethereum

Sentiment: Positive

Read moreAnalyst Predicts XRP Price Could Fall to $1 as XRP ETFs Record Net Weekly Outflows

Sentiment: Negative

Read moreRipple (XRP) Unveils Ambitious Digital Prime Broker Strategy for Institutional Adoption

Sentiment: Positive

Read moreXRP Price Prediction: Can Ripple Reclaim $1.50 Amid Record Low Liquidity?

Sentiment: Negative

Read moreBitcoin, Ethereum, XRP and the Quantum Era: Which Network Will Survive the Next Technological Shift?

Sentiment: Negative

Read moreHistorical Values

-

Now

Greed 73 -

Yesterday

Neutral 73 -

7 Days Ago

Greed 66 -

1 Month Ago

Greed 62

Ripple Breakdown

Price Score Greed

The Price Score indicator is a relevant indicator to analyze and assign the Ripple price evolution a certain numerical value.

This module studies the price trend to determine if the Ripple market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Ripple price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the Ripple Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Ripple bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Extreme Greed

The Impulse indicator measures the current Ripple price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Ripple market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Greed

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Ripple the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Extreme Greed

Dominance Neutral

This other indicator takes into account the dominance of Ripple with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Ripple's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Ripple and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Extreme Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Ripple has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Ripple. For this, specific search terms are used that determine the purchasing or ceding interest of Ripple, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Fear

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Ripple and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Ripple moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Extreme Greed

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Ripple on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

XRP Price

1 XRP = $1.43

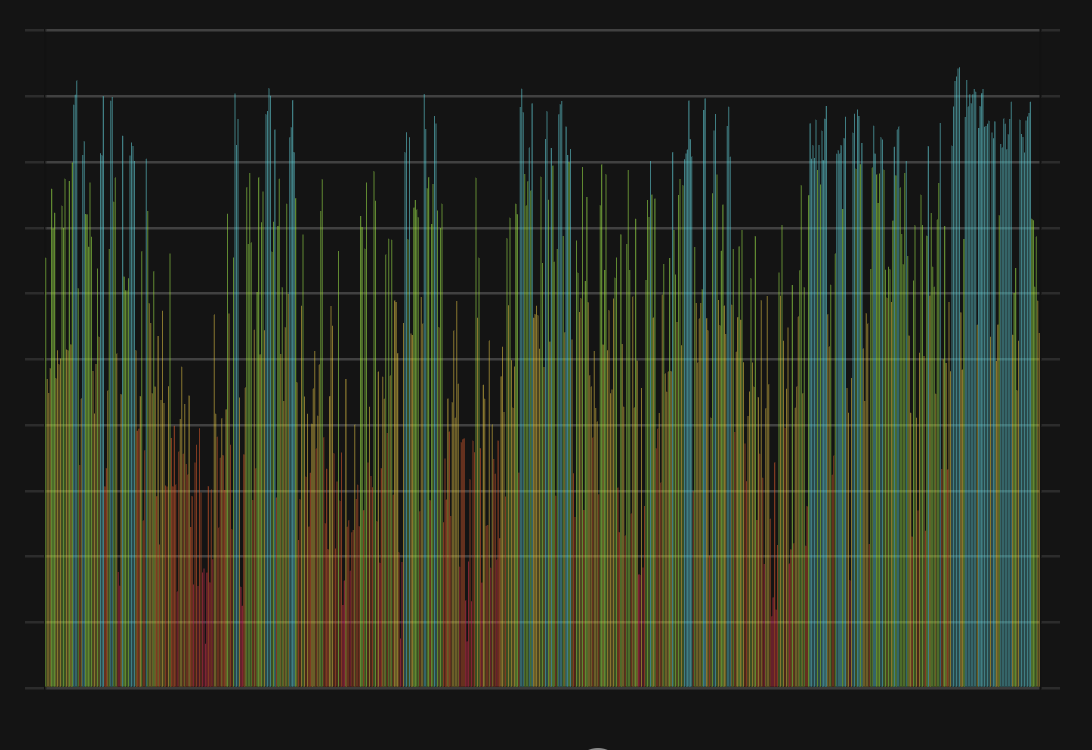

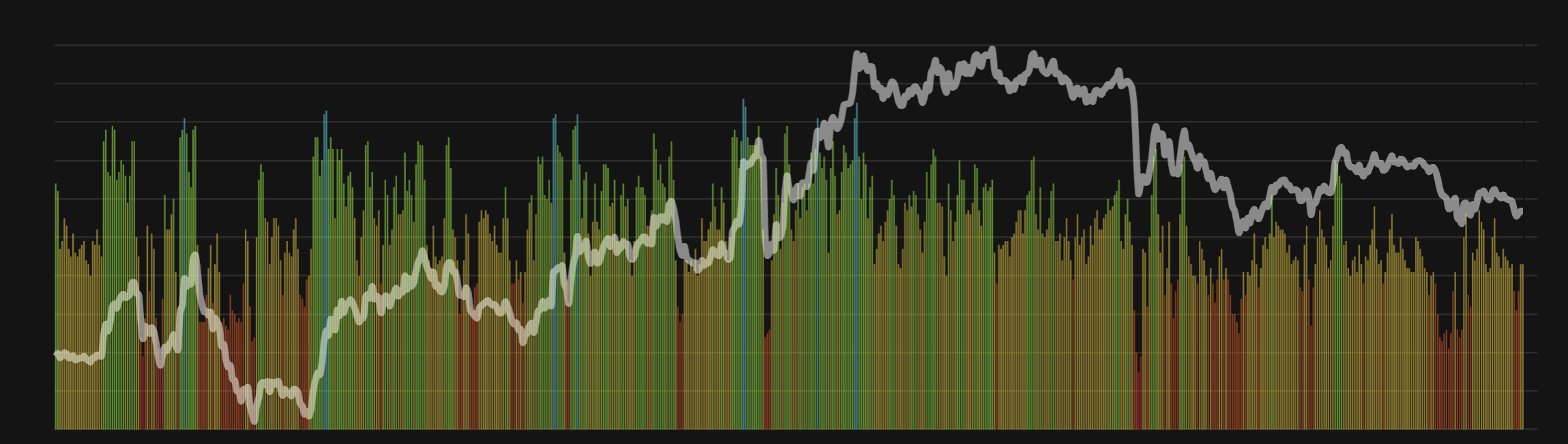

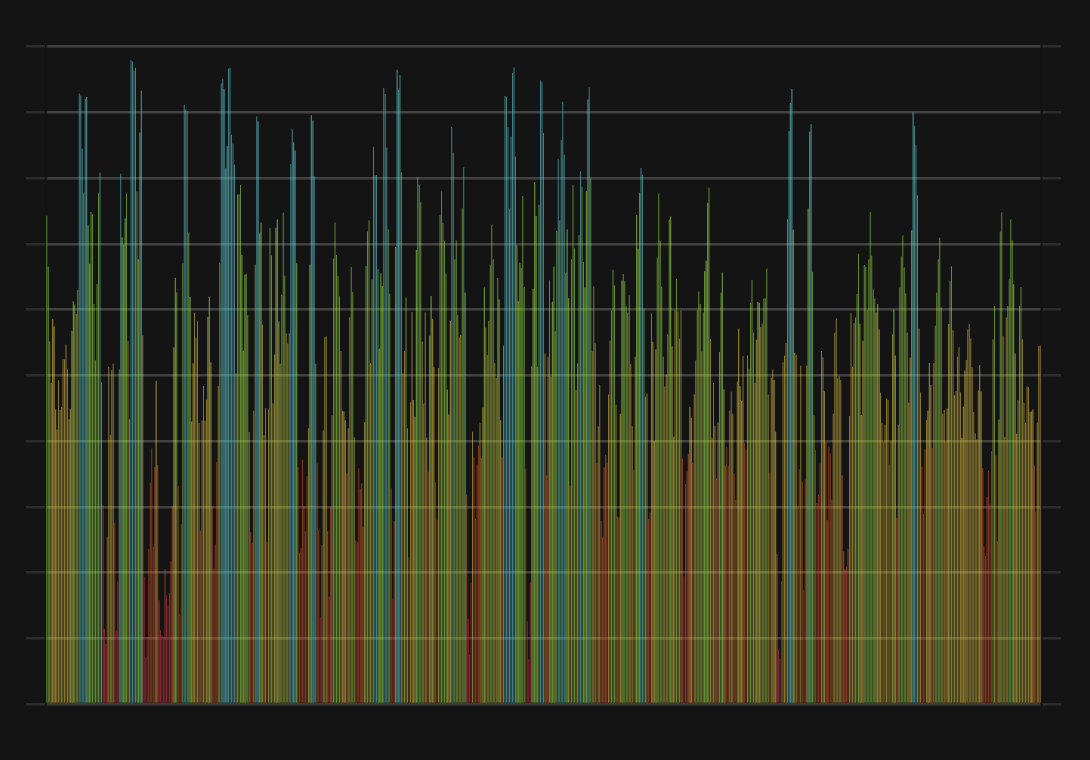

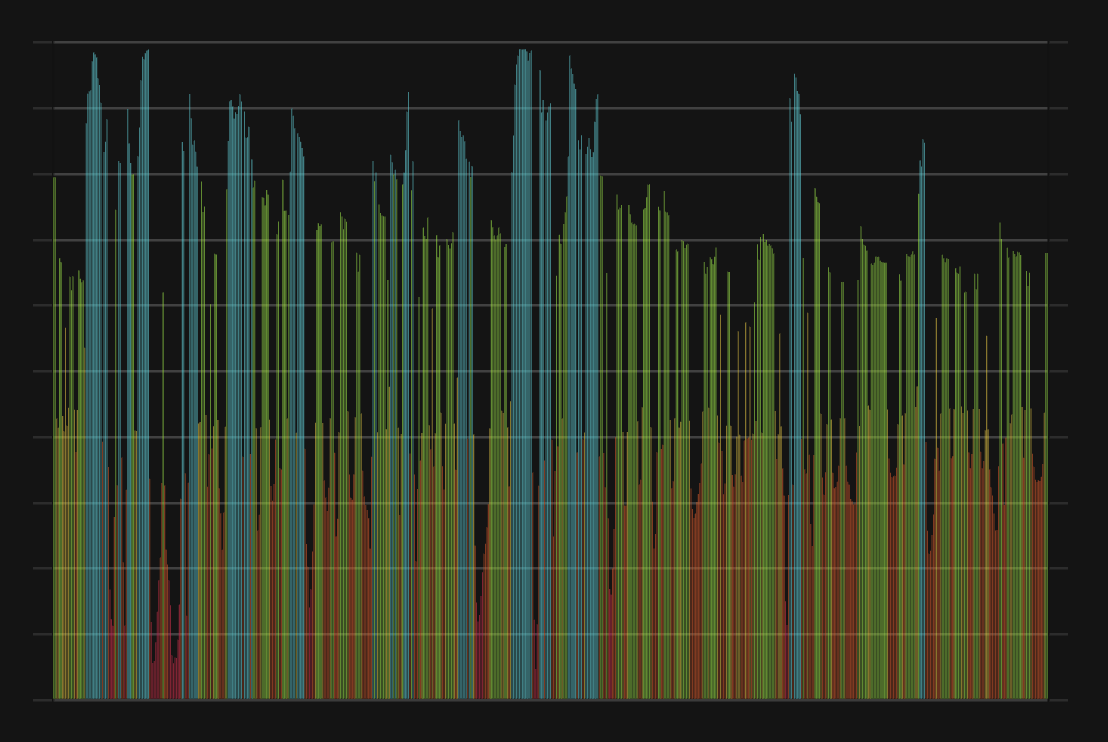

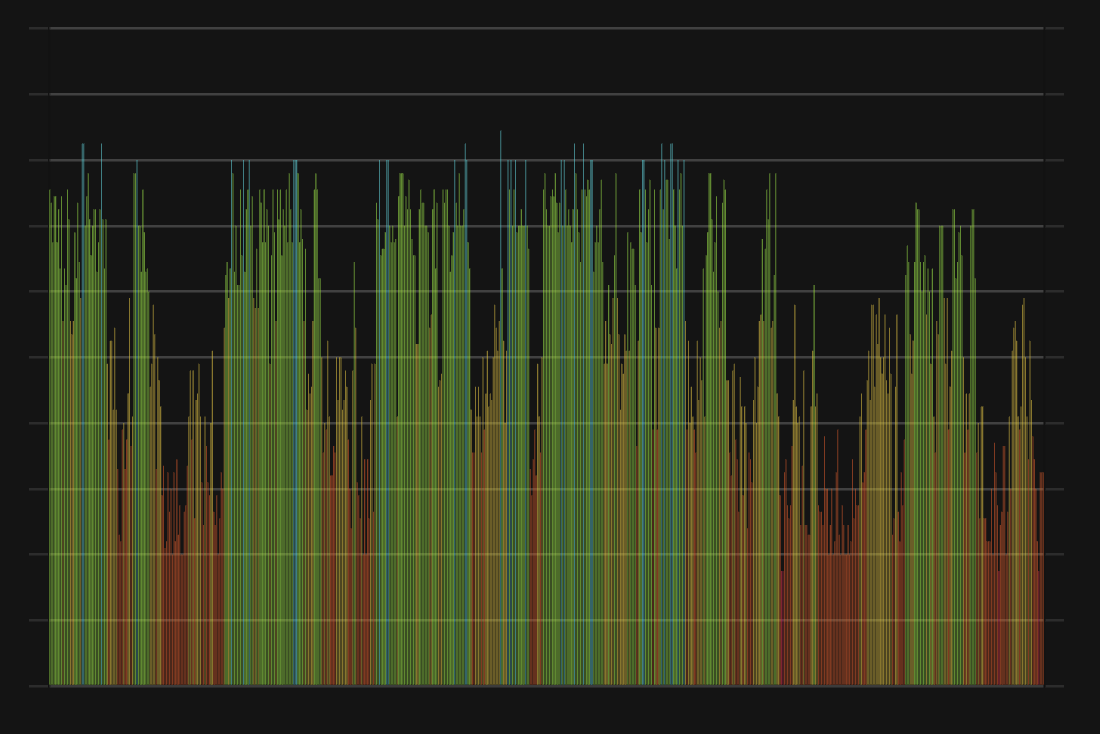

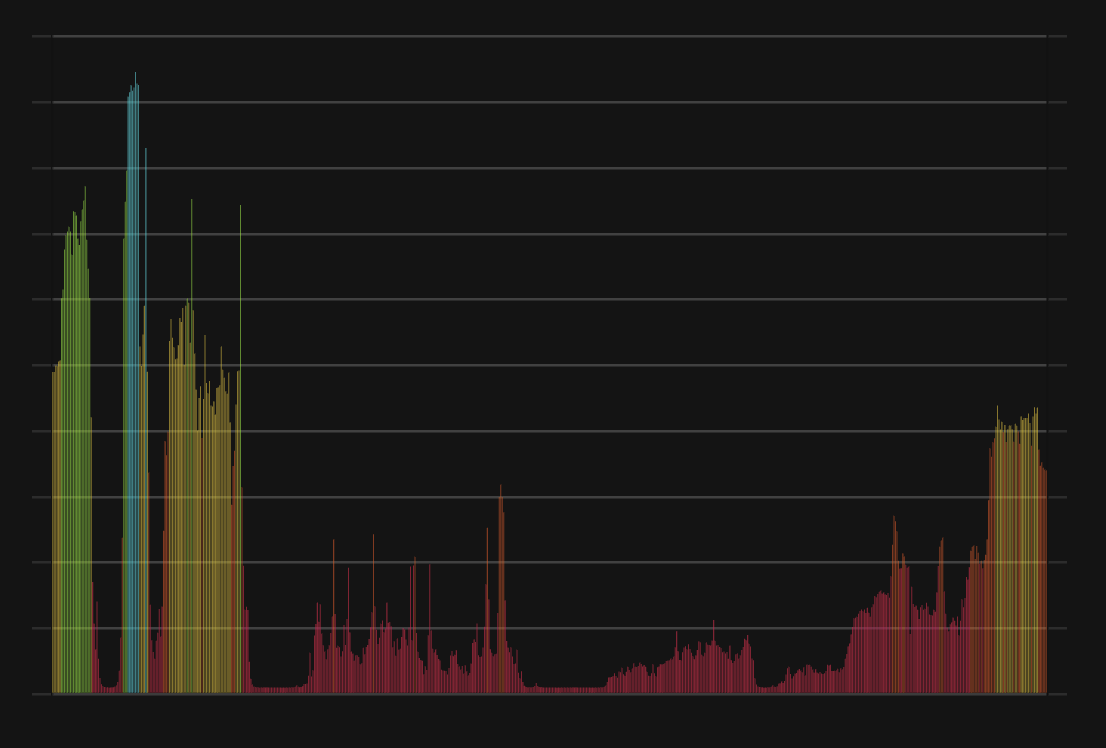

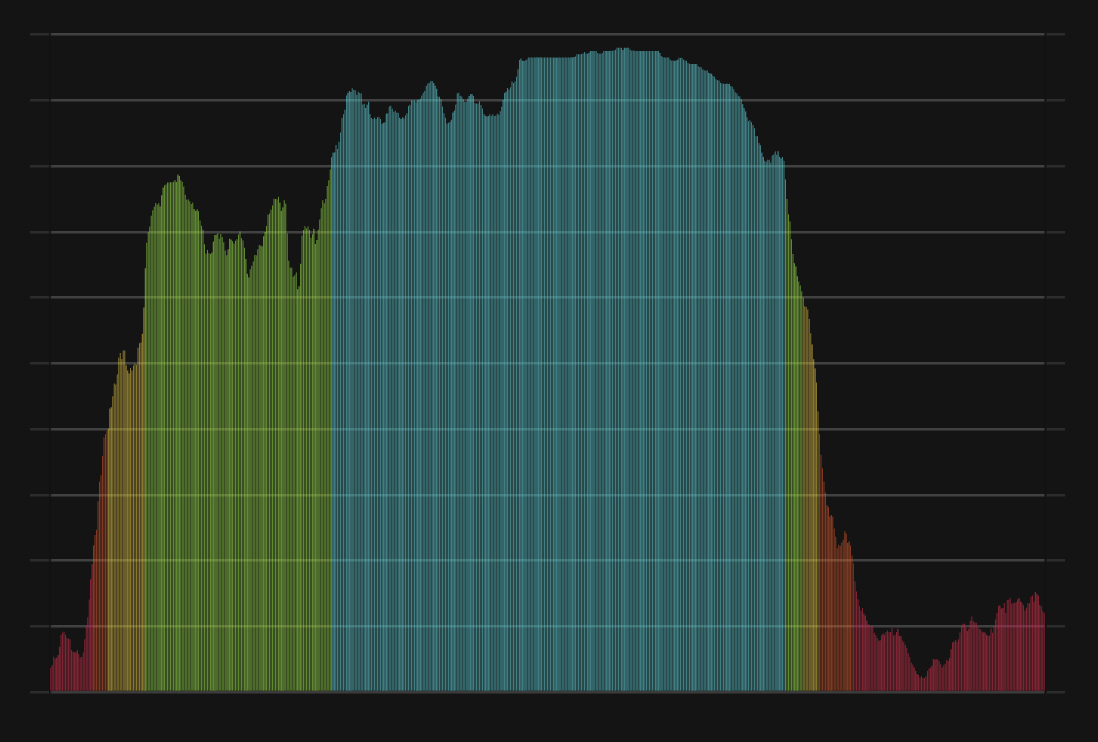

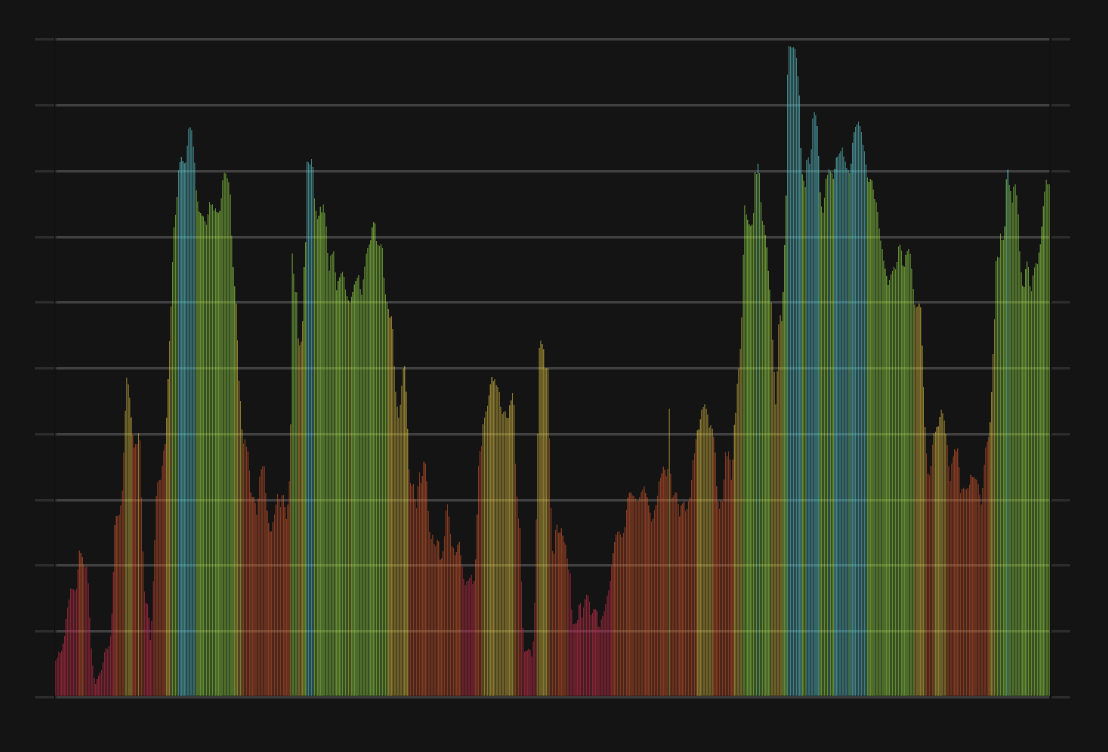

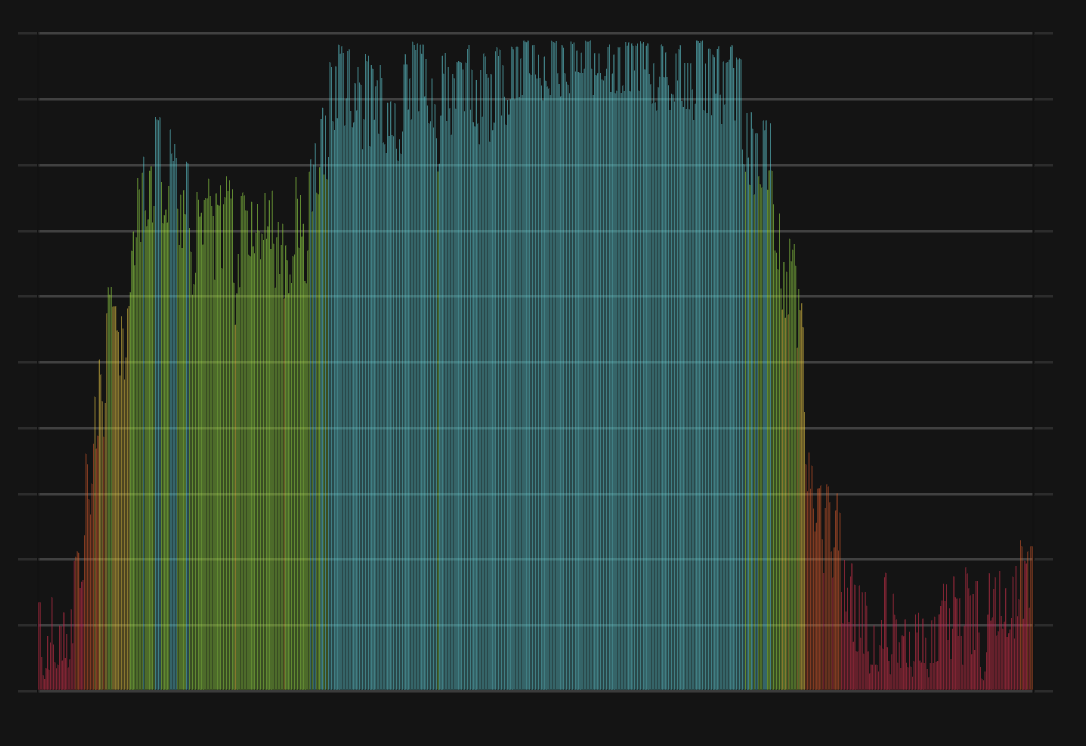

Ripple CFGI Score & XRP Price History

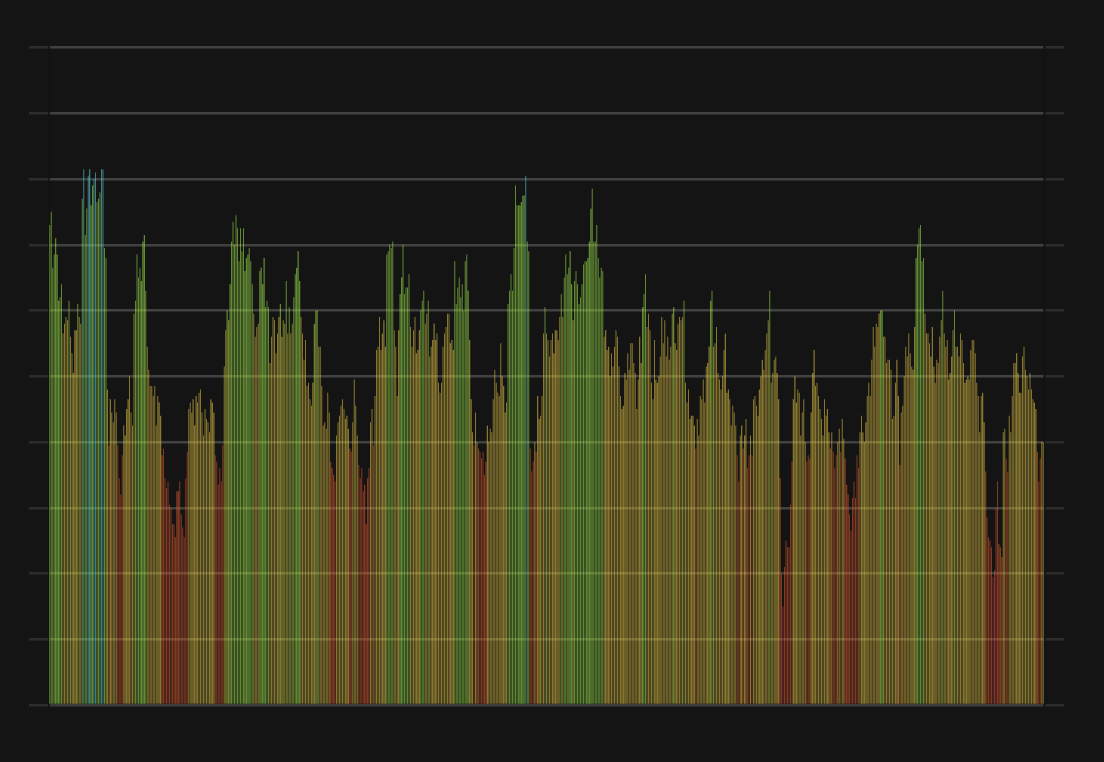

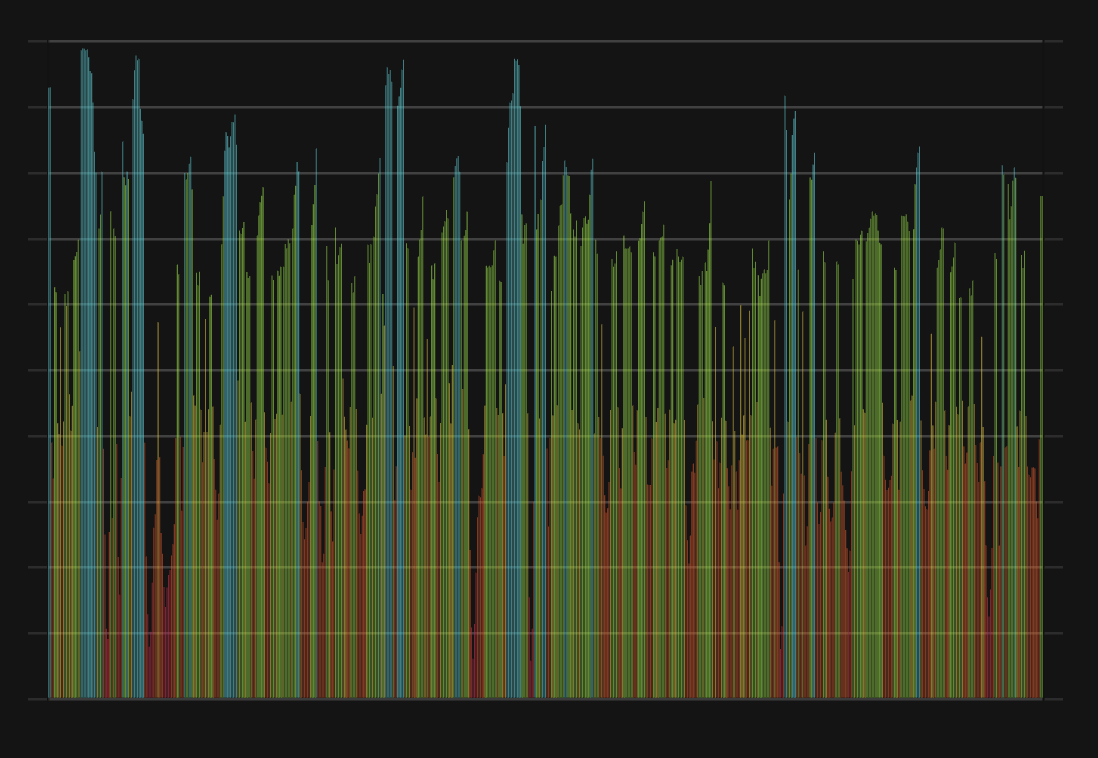

XRP Price & Ripple Sentiment Breakdown Charts

Price Score Sentiment

Volatility Sentiment

Volume Sentiment

Impulse Sentiment

Technical Sentiment

Social Sentiment

Dominance Sentiment

Search Sentiment

Whales Sentiment

Order Book Sentiment