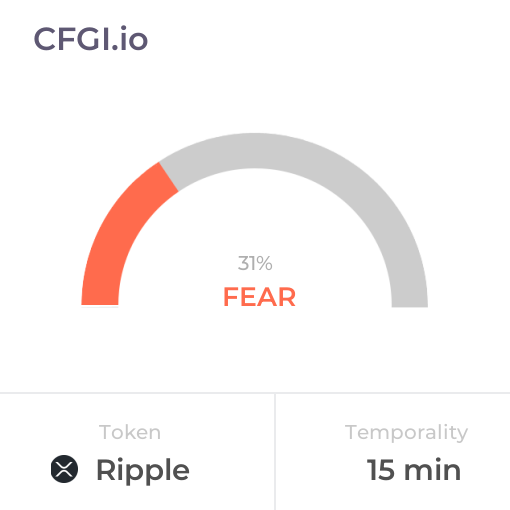

Historical Values

-

Now

Neutral 40 -

Yesterday

Neutral 40 -

7 Days Ago

Neutral 40 -

1 Month Ago

Neutral 40

Ripple Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Ripple price evolution a certain numerical value.

This module studies the price trend to determine if the Ripple market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Fear

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Ripple price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Fear

Like volatility, the Ripple Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Ripple bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Neutral

The Impulse indicator measures the current Ripple price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Ripple market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Fear

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Ripple the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Extreme Fear

Dominance Greed

This other indicator takes into account the dominance of Ripple with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Ripple's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Ripple and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Extreme Fear

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Ripple has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Ripple. For this, specific search terms are used that determine the purchasing or ceding interest of Ripple, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Greed

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Ripple and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Ripple moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Fear

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Ripple on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

Ripple News

Ripple News

XRP price retests range lows as open interest crashes 70% — volatility expansion next?

Sentiment: Negative

Read moreXRP News: Ripple Expands Payments Platform To Unify Fiat and Stablecoins Globally

Sentiment: Positive

Read moreRipple Targets Traditional Banking With Major Expansion of XRP-Focused Ripple Payments Service

Sentiment: Positive

Read moreCME Now Commands 75% of the Crypto Futures Arena With XRP Among Those Pulling the Strings

Sentiment: Positive

Read more'Seems Important,' Ripple Exec Says About This Development—But XRP Disagrees

Sentiment: Positive

Read moreXRP Price Analysis: XRP Coin Targets $2 as Middle East Conflict Intensifies

Sentiment: Positive

Read moreRipple (XRP) Payments Unifies Fiat and Stablecoin Rails After $200M Rail Acquisition

Sentiment: Positive

Read moreBitcoin At $67,000, Ethereum, XRP, Dogecoin Hold Support As Sentiment Improves

Sentiment: Positive

Read moreXRP Vampirized by Leverage-Driven Pump; Bitcoin Extends 18% Gains vs. Silver; Binance Lists 5 Major Pairs, Litecoin and Zcash Too: Morning Crypto Report

Sentiment: Neutral

Read moreBank of Japan Launches Blockchain Settlement Sandbox, XRP Ledger be Chosen?

Sentiment: Positive

Read moreXRP Volatility Hits Highest Level Since March 2025 as Whales Snap Up 1.3 Billion Tokens

Sentiment: Positive

Read moreThis 1 Accelerating Trend Could Drive XRP and Ethereum Higher and Higher

Sentiment: Positive

Read moreXRP Gears Up for a Breakout Battle at the 2 Billion Sell Wall — What's Next for Price?

Sentiment: Positive

Read moreXRP News Today: David Schwartz Says Ripple's DTCC Move “Seems Important” for Institutional Crypto

Sentiment: Positive

Read moreCrypto Prices Today: BTC, ETH, XRP Prices Surge Despite Iran's Strait of Hormuz Closure

Sentiment: Positive

Read moreXRP Would Have Been Security Under New Crypto Bill, Cardano Founder Says

Sentiment: Negative

Read moreXRP price outlook as Ripple Prime connects XRPL to NSCC for post-trade settlement

Sentiment: Positive

Read moreXRP News: Ripple Prime to Move Post-Trade Activity to XRPL via NSCC Link

Sentiment: Positive

Read moreXRP Price Prediction: Ripple Eyes $1.46 Breakout Despite Bearish Momentum - March 2026 Forecast

Sentiment: Positive

Read moreXRP news today: What's next as escrow unlock sends 1B tokens into circulation?

Sentiment: Neutral

Read moreBitcoin, Ethereum, XRP Rally, Dogecoin Flat As Iran Conflict Enters Its 3rd Day: Analyst Says Selling Pressure From Recent Buyers 'Fading'

Sentiment: Positive

Read moreRipple Mints Record 69 Million RLUSD on XRP Ledger as Stablecoin Market Cap Surpasses $1.5B

Sentiment: Positive

Read moreXRP Price Prediction: $650 Million Floods Exchanges — Are Investors Preparing to Dump XRP?

Sentiment: Negative

Read moreNew ChatGPT Predicts the Price of XRP, Solana and Shiba Inu By the End of 2026

Sentiment: Positive

Read moreRipple Frees 1 Billion XRP, Solana Leads Top 10 With 11% Price Jump, Musk Compares Anthropic CEO to SBF — U.Today Crypto Digest

Sentiment: Positive

Read moreJPMorgan Identifies 8 CLARITY Act Catalysts—And Altcoins Like XRP Could Benefit

Sentiment: Positive

Read moreXRP Price Prediction as Ripple Re-Locks 700 Million XRP in Escrow Account

Sentiment: Neutral

Read moreXRP Could Hit $1,000 Under Full Institutional Adoption Scenario, Commentators Claim

Sentiment: Positive

Read moreBitcoin At $69,000, Ethereum, XRP, Dogecoin Rebound 2% Despite Iran Airstrike Campaign

Sentiment: Positive

Read moreXRP Vs. Traditional Banks: Ripple CEO Sends Strong Message To Established Leaders

Sentiment: Positive

Read moreXRP faces a brutal 2026 paradox as XRPL adoption surges and the token captures little value

Sentiment: Negative

Read moreXRP Network Activity Plummets by 26% as Ripple CEO Sparks Buzz with Trump Mention

Sentiment: Negative

Read morePrice predictions 3/2: SPX, DXY, BTC, ETH, XRP, BNB, SOL, DOGE, BCH, ADA

Sentiment: Positive

Read moreDeutsche Bank Moves Toward Faster Global Settlements With XRP Ledger Integration

Sentiment: Positive

Read moreBitcoin tops $70K, XRP, Ether rise as traders shrug off Middle East tensions

Sentiment: Positive

Read more472 Million XRP Floods Binance Following Geopolitical Turmoil: Is Ripple's Price in Danger?

Sentiment: Negative

Read moreWill XRP price rebound as Brad Garlinghouse predicts $10 trillion flowing to XRPL?

Sentiment: Neutral

Read more470 Million XRP at Risk of Sell-Off on Binance, Here Are Price Scenarios

Sentiment: Negative

Read moreWhat Happens To The XRP Price If It Follows The Amazon Trend And Begins Parabola

Sentiment: Positive

Read moreAfter 5 Red Months, Is Bitcoin About to Explode? What It Means for XRP Price

Sentiment: Positive

Read moreRipple Price Analysis: Is the Bottom In for XRP? The Critical Levels You Need to Watch

Sentiment: Neutral

Read moreBitcoin Steady At $66,000 As Ethereum, XRP, Dogecoin Slip On US-Iran Engagement

Sentiment: Negative

Read moreXRP–BNB Rivalry Heats Up With BTC Settled at $66K After Weekend Developments

Sentiment: Positive

Read moreXRP News: XRPL Set to Add Options Trading for Investors Amid Major Upgrade

Sentiment: Positive

Read moreXRP Yield Risks Explained by XRPL Contributor, Schiff Acknowledges Satoshi's Innovation With Bitcoin, Six Macro Events to Define Crypto Market This Week: Morning Crypto Report

Sentiment: Positive

Read moreXRP Long Traders in Loss Amid $358 Million in Combined Crypto Liquidations

Sentiment: Negative

Read moreDeutsche Bank accelerates global payments with ripple xrp ledger integration

Sentiment: Positive

Read moreHistorical Values

-

Now

Neutral 40 -

Yesterday

Neutral 40 -

7 Days Ago

Neutral 40 -

1 Month Ago

Neutral 54

Ripple Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Ripple price evolution a certain numerical value.

This module studies the price trend to determine if the Ripple market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Fear

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Ripple price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Fear

Like volatility, the Ripple Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Ripple bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Neutral

The Impulse indicator measures the current Ripple price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Ripple market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Fear

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Ripple the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Extreme Fear

Dominance Greed

This other indicator takes into account the dominance of Ripple with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Ripple's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Ripple and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Extreme Fear

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Ripple has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Ripple. For this, specific search terms are used that determine the purchasing or ceding interest of Ripple, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Greed

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Ripple and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Ripple moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Fear

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Ripple on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

XRP Price

1 XRP = $1.35

Ripple CFGI Score & XRP Price History

XRP Price & Ripple Sentiment Breakdown Charts

Price Score Sentiment

Volatility Sentiment

Volume Sentiment

Impulse Sentiment

Technical Sentiment

Social Sentiment

Dominance Sentiment

Search Sentiment

Whales Sentiment

Order Book Sentiment