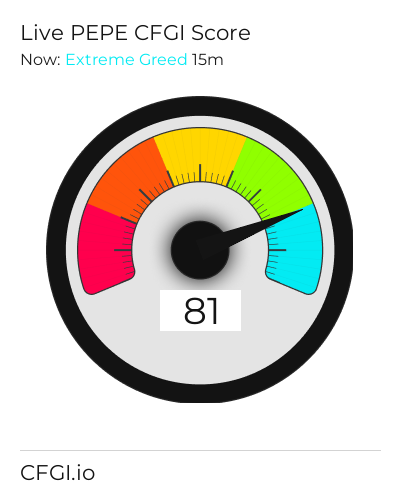

Historical Values

-

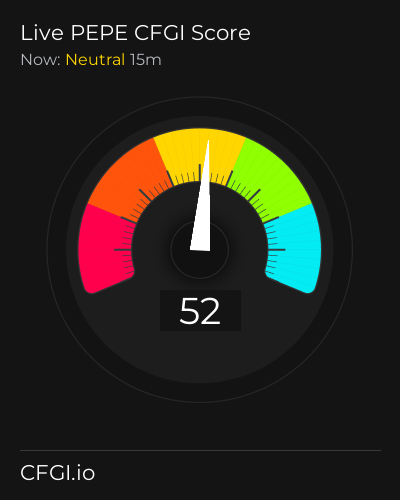

Now

Neutral 43 -

Yesterday

Neutral 43 -

7 Days Ago

Neutral 43 -

1 Month Ago

Neutral 43

Pepe Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Pepe price evolution a certain numerical value.

This module studies the price trend to determine if the Pepe market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Pepe price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the Pepe Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Pepe bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Fear

The Impulse indicator measures the current Pepe price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Pepe market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Neutral

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Pepe the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Extreme Fear

Dominance Greed

This other indicator takes into account the dominance of Pepe with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Pepe's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Pepe and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Extreme Fear

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Pepe has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Pepe. For this, specific search terms are used that determine the purchasing or ceding interest of Pepe, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Fear

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Pepe and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Pepe moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Greed

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Pepe on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

Pepe News

Pepe News

PEPE Price Prediction: Technical Indicators Signal Potential Recovery Despite Bearish Momentum

Sentiment: Positive

Read moreMeme Coin Market Dead? Top 5 Reasons Dogecoin, Shiba Inu, and Pepe Are Crashing

Sentiment: Negative

Read moreMeme Coin Market Dead? Top 5 Reasons Dogecoin, Shiba Inu, and Pepe Are Crashing

Sentiment: Negative

Read morePEPE Price Prediction: Technical Indicators Point to Challenging March as PEPE Tests Support

Sentiment: Negative

Read morePEPE Price Prediction: Technical Indicators Point to Challenging March as PEPE Tests Support

Sentiment: Negative

Read morePEPE Price Prediction: Technical Indicators Point to Challenging March as PEPE Tests Support

Sentiment: Negative

Read morePEPE Price Prediction: Technical Indicators Point to Challenging March as PEPE Tests Support

Sentiment: Negative

Read morePEPE Price Prediction: Neutral RSI Signals Potential Recovery to $0.000008 by March 2026

Sentiment: Positive

Read morePEPE Price Prediction: Meme Coin Tests Critical Support as Analysts Eye $0.000008 Recovery Target

Sentiment: Positive

Read moreBinance Expands Cross Margin With DOGE, ADA, PEPE, and TAO Pairs — What Traders Need to Know

Sentiment: Positive

Read moreImportant Binance Announcement Concerning DOGE, ADA, PEPE Traders: Details Inside

Sentiment: Positive

Read morePEPE Price Prediction: Recovery to $0.000008 Possible if Key Support Holds Through March 2026

Sentiment: Positive

Read moreStrange New Chinese AI ‘KIMI' Predicts the Price of XRP, PEPE and Cardano By the End of 2026

Sentiment: Positive

Read morePEPE Price Prediction: Technical Recovery Targets $0.000008 by March 2026

Sentiment: Positive

Read moreChina's Alibaba AI Predicts the Price of XRP, Shiba Inu and PEPE By the End of 2026

Sentiment: Positive

Read morePEPE Price Prediction: Technical Neutrality Suggests Consolidation Phase Ahead

Sentiment: Neutral

Read moreChina's DeepSeek AI Predicts the Price of XRP, PEPE and Shiba Inu By the End of 2026

Sentiment: Positive

Read morePepe price reclaims structure as bullish engulfing candles signal reversal

Sentiment: Positive

Read morePEPE Price Prediction: 23% Surge Ignites Recovery as Bitcoin Reclaims $70k

Sentiment: Positive

Read moreDogecoin and Pepe Coin Price Prediction: Can Meme Coins Recover as Bitcoin Falls Below $70K?

Sentiment: Negative

Read moreDogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

Sentiment: Negative

Read morePepe Gains 16% In A Week Leaving Dogecoin, Shiba Inu Behind As 'History Is In The Making'

Sentiment: Positive

Read moreDogecoin and Top Memecoins Shiba Inu, PEPE Struggle as Analysts Dismiss 2027 Rally Claims

Sentiment: Negative

Read morePEPE Price Prediction: Technical Analysis Points to Consolidation Phase Through March 2026

Sentiment: Neutral

Read morePEPE Price Prediction: Technical Signals Point to Mixed Outlook Despite Recent 25.65% Surge

Sentiment: Neutral

Read moreCrypto market rally today: here's why Pepe Coin, Zcash, Morpho, and Dogecoin are rising

Sentiment: Positive

Read morePEPE Memecoin Whales Accumulate Trillions as Technical Breakout Signals Bullish Reversal

Sentiment: Positive

Read morePEPE Price Prediction: Technical Indicators Point to Consolidation Phase Ahead Despite Recent 7.65% Gain

Sentiment: Neutral

Read morePEPE Eyes Massive 860% Surge as Falling Wedge Signals Potential Breakout

Sentiment: Positive

Read morePEPE Price Prediction: Technical Analysis Suggests Consolidation Phase Despite January Rally Targets

Sentiment: Neutral

Read morePEPE Price Prediction: Whales Accumulate 23 Trillion Tokens Despite Six-Week Decline

Sentiment: Neutral

Read moreDOGE, SHIB, PEPE Suffer Brutal Crash—But Only One Has A Chance At A Reversal

Sentiment: Negative

Read morePEPE Price Prediction: Oversold Conditions Signal Potential 30-35% Rally to $0.0000070 by March

Sentiment: Positive

Read moreWhales Accumulate 23 Trillion PEPE During the Price Downturn, Fueling Recovery Hopes

Sentiment: Positive

Read morePepe coin price forms potential base after 73% collapse — will 23T whale accumulation spark reversal?

Sentiment: Positive

Read morePEPE Price Prediction: Technical Analysis Points to Neutral Zone Consolidation Amid Limited Price Data

Sentiment: Neutral

Read morePEPE Price Struggles to Find Footing as Bears Keep Pressure on Key Support

Sentiment: Negative

Read morePEPE Price Prediction: Technical Indicators Signal Mixed Outlook Amid Limited Price Data

Sentiment: Negative

Read morePEPE Price Prediction: Price at Make-or-Break Support With 600% Breakout Potential

Sentiment: Positive

Read moreShiba Inu, Dogecoin, and Pepe Coin Prices Record Major Losses as Crypto Market Drops 8%

Sentiment: Negative

Read moreDogecoin, Shiba Inu, and Pepe Coin Price Prediction as Bitcoin Crashes Below $70K.

Sentiment: Negative

Read morePepe Price Prediction: Everyone Panic Sold PEPE, But the Chart is Now Flashing a Bullish Signal

Sentiment: Positive

Read morePEPE Price Prediction: Technical Indicators Signal Potential Recovery Despite Bearish Momentum

Sentiment: Positive

Read morePepe Coin Price Prediction: Price Looks Dead, But Smart Holders Are Taking Control Behind the Scenes

Sentiment: Positive

Read morePEPE Price Prediction: Technical Indicators Signal Neutral Zone Despite 3% Daily Gain

Sentiment: Neutral

Read morePEPE Price Prediction: Meme Coin Targets Recovery Despite Technical Weakness

Sentiment: Positive

Read morePEPE Price Prediction: Token Slides Toward $0.00000455 Amid Strong Selling Pressure

Sentiment: Negative

Read moreTop AI Model Claude Forecasts XRP, Shiba Inu and PEPE Prices for End-2026

Sentiment: Positive

Read moreLeading AI Claude Predicts the Price of XRP, Shiba Inu and PEPE By the End of 2026

Sentiment: Positive

Read moreTop Meme Coins Price Prediction: Dogecoin, Shiba Inu, Pepe, and Pump. Fun as Crypto Market Recovers.

Sentiment: Positive

Read morePEPE Price Prediction 2026, 2027 – 2030: Can Pepe Memecoin Reach 1 Cent?

Sentiment: Positive

Read morePEPE Price Prediction: Targets $0.0000070 by January End as Technical Indicators Show Mixed Signals

Sentiment: Positive

Read morePEPE Price Eyes Breakout Amid Bullish Rebound and Descending Channel Pressure

Sentiment: Positive

Read morePEPE Price Prediction: Technical Indicators Signal Mixed Outlook Despite 3.33% Daily Gain

Sentiment: Neutral

Read morePEPE Price Prediction: Meme Coin Targets Recovery Amid Technical Consolidation

Sentiment: Positive

Read morePEPE Coin Price Eyes 45% Rebound as Buyers Regain Control on Spot Markets

Sentiment: Positive

Read moreMEXC Earn launches Hot Tokens Earn Fest with high-yield fixed savings on XRP, SUI, DOGE and PEPE

Sentiment: Positive

Read morePEPE Price Prediction: Meme Coin Eyes Recovery Amid Mixed Technical Signals

Sentiment: Positive

Read morePEPE Price Prediction: Technical Correction Expected Before Recovery to $0.000007 Range

Sentiment: Neutral

Read morePepe Coin Price Prediction: This Brutal Sell-Off Might Be the Best Buying Opportunity You'll Ever See

Sentiment: Positive

Read moreElon's Grok AI Predicts the Price of XRP, Solana and PEPE By the End of 2026

Sentiment: Positive

Read morePEPE Price Prediction: Critical Support Test Could Drive Recovery by February 2026

Sentiment: Positive

Read moreDogecoin, Shiba Inu, and Pepe Price Predictions as Bitcoin Drops Below $90k

Sentiment: Negative

Read morePEPE Price Prediction: Technical Indicators Signal Potential Recovery Despite Current Weakness

Sentiment: Positive

Read morePEPE Price Prediction: Technical Correction Signals Potential Recovery by February 2026

Sentiment: Positive

Read moreNew ChatGPT Predicts the Price of XRP, PEPE and Ethereum By the End of 2026

Sentiment: Positive

Read morePEPE price holds the 21 EMA as bullish retest signals reversal potential

Sentiment: Positive

Read morePEPE Price Prediction: Technical Indicators Point to Consolidation Phase as January Targets Emerge

Sentiment: Positive

Read moreHistorical Values

-

Now

Neutral 43 -

Yesterday

Neutral 43 -

7 Days Ago

Neutral 49 -

1 Month Ago

Neutral 47

Pepe Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Pepe price evolution a certain numerical value.

This module studies the price trend to determine if the Pepe market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Pepe price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the Pepe Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Pepe bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Fear

The Impulse indicator measures the current Pepe price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Pepe market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Neutral

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Pepe the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Extreme Fear

Dominance Greed

This other indicator takes into account the dominance of Pepe with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Pepe's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Pepe and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Extreme Fear

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Pepe has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Pepe. For this, specific search terms are used that determine the purchasing or ceding interest of Pepe, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Fear

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Pepe and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Pepe moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Greed

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Pepe on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

PEPE Price

1 PEPE = $0.00000343

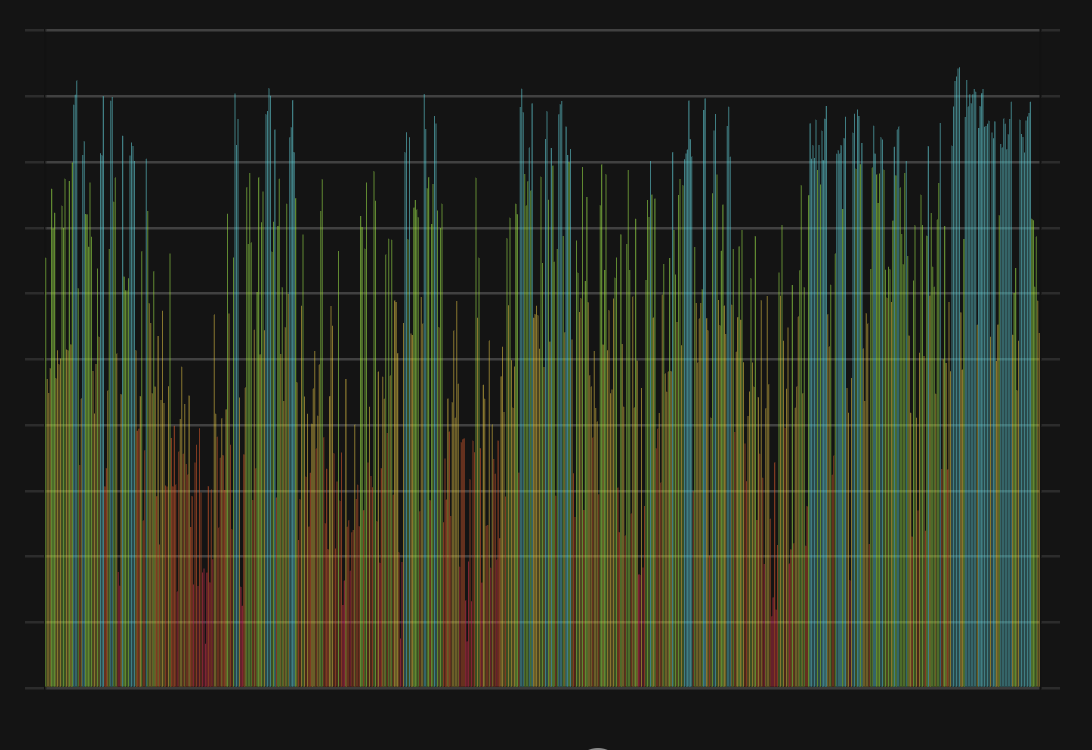

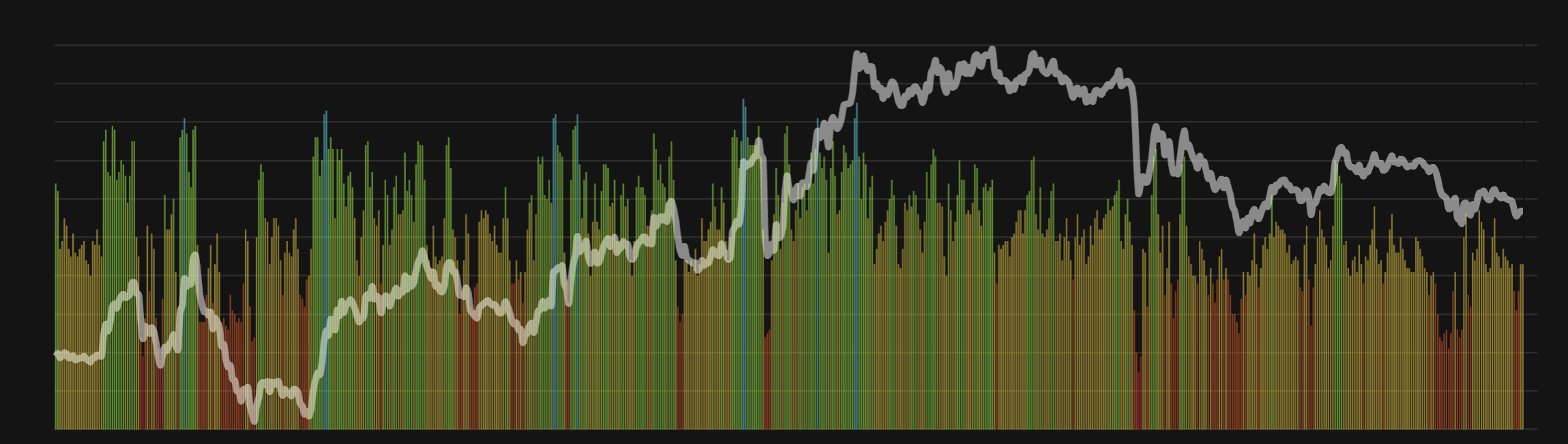

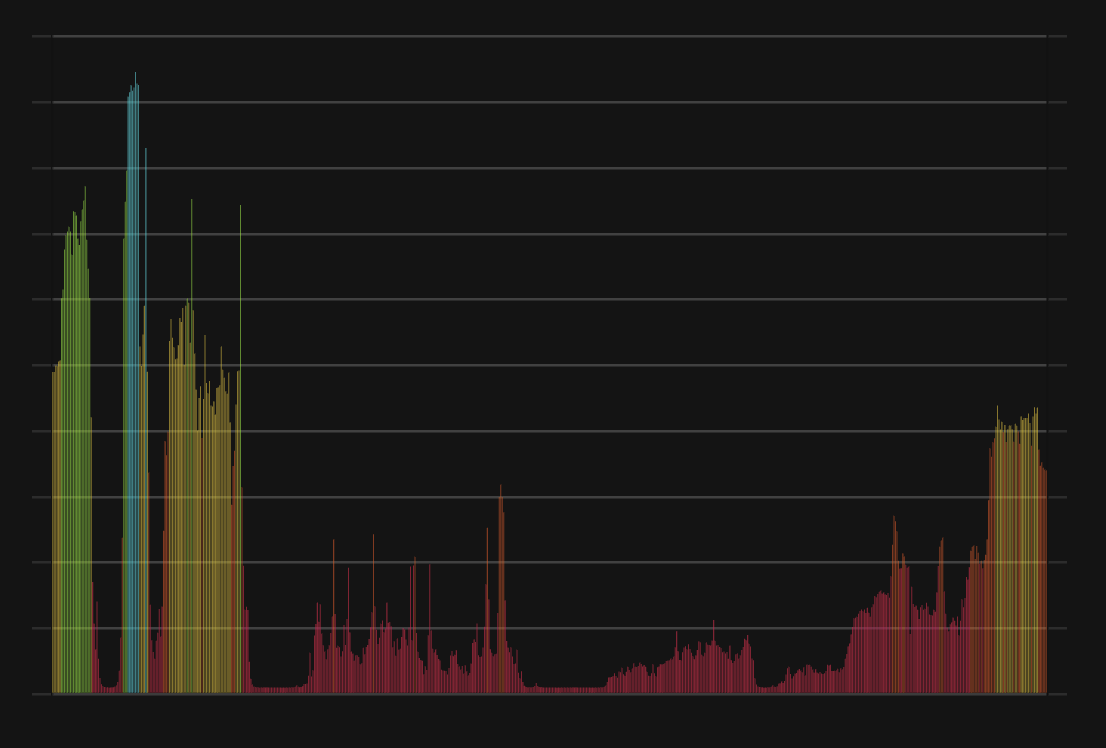

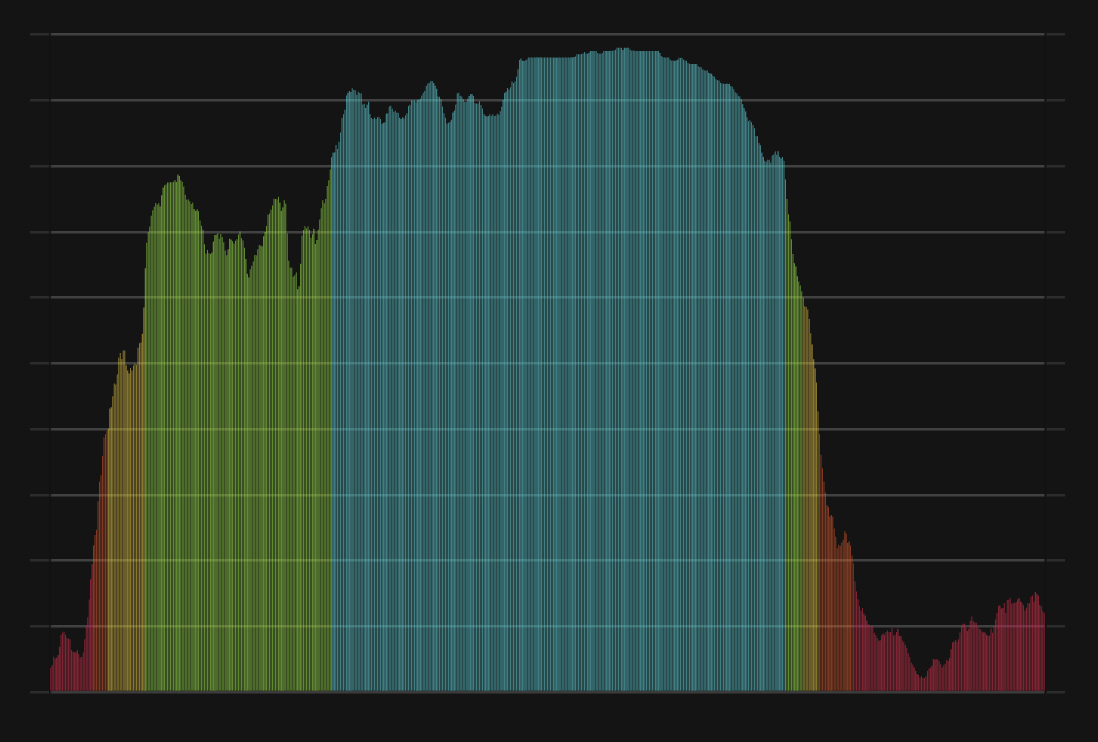

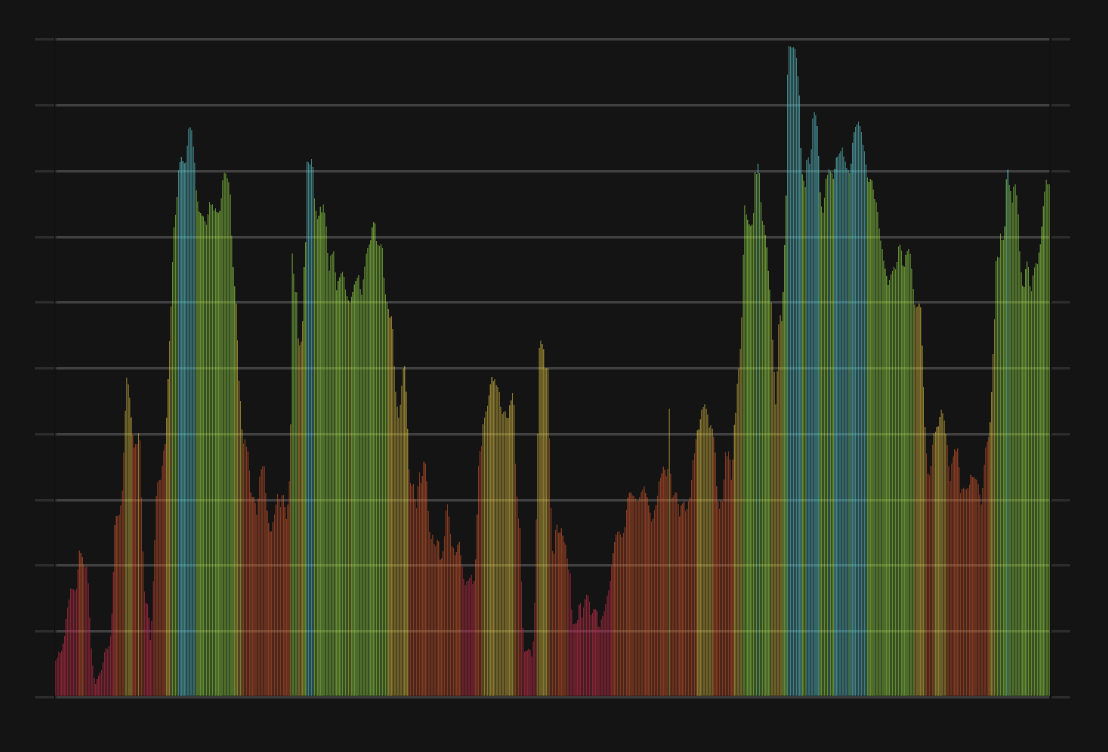

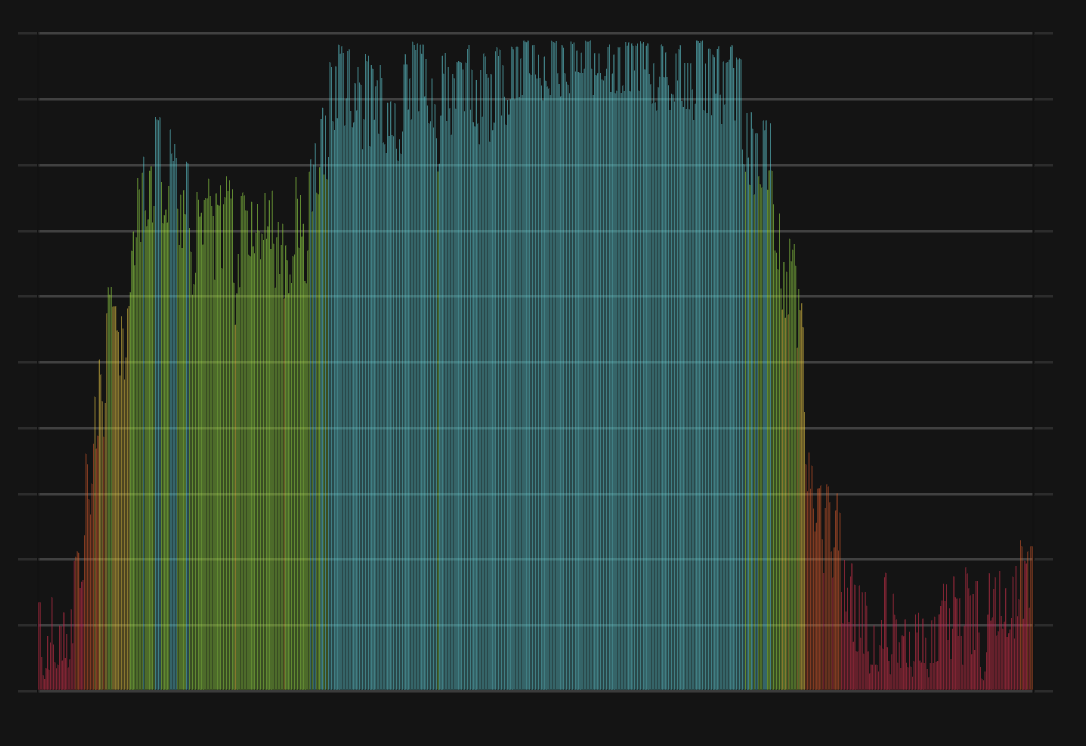

Pepe CFGI Score & PEPE Price History

PEPE Price & Pepe Sentiment Breakdown Charts

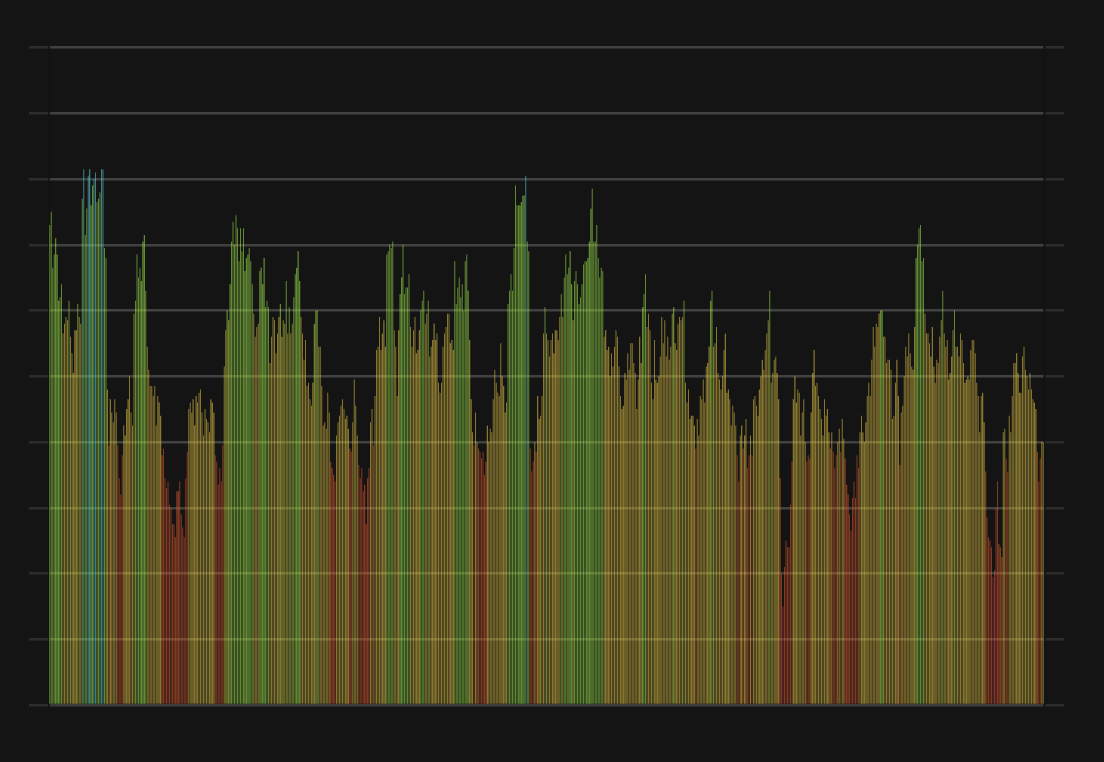

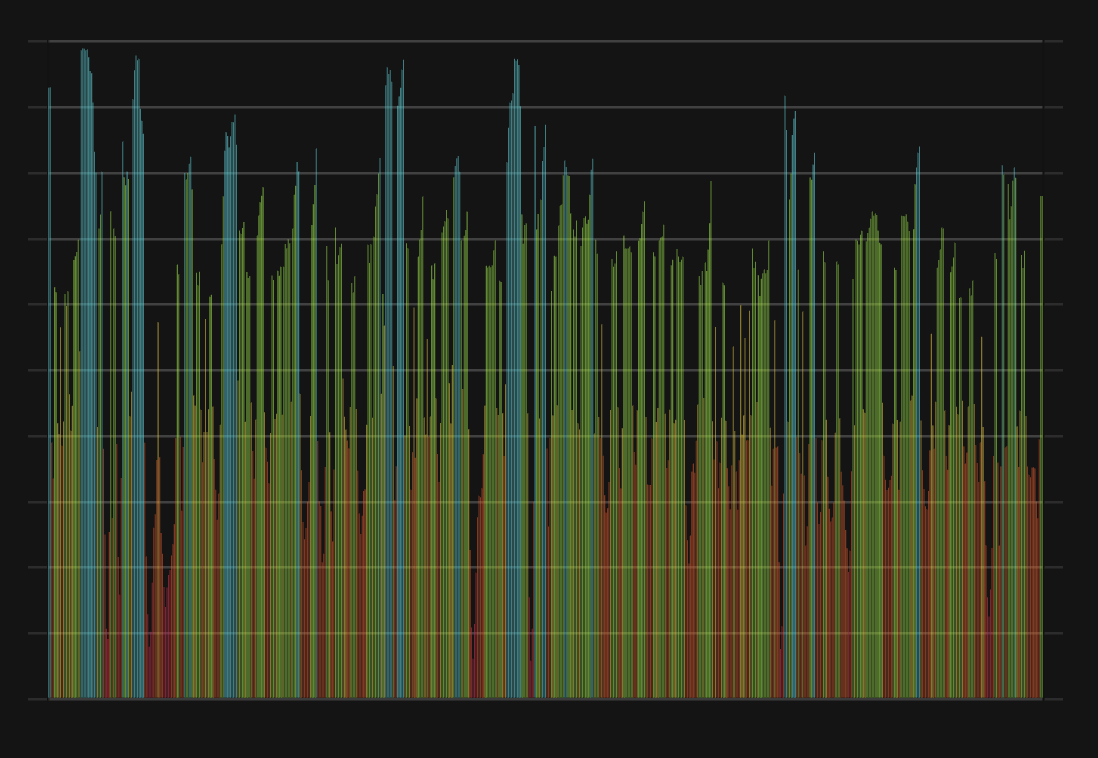

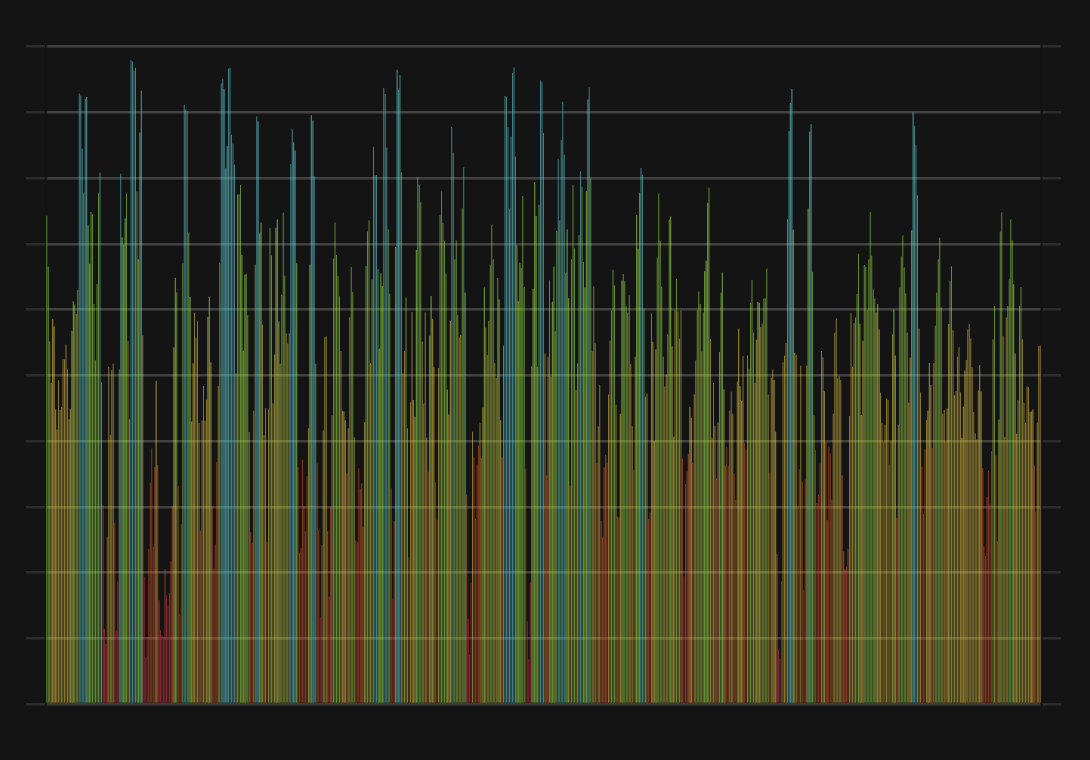

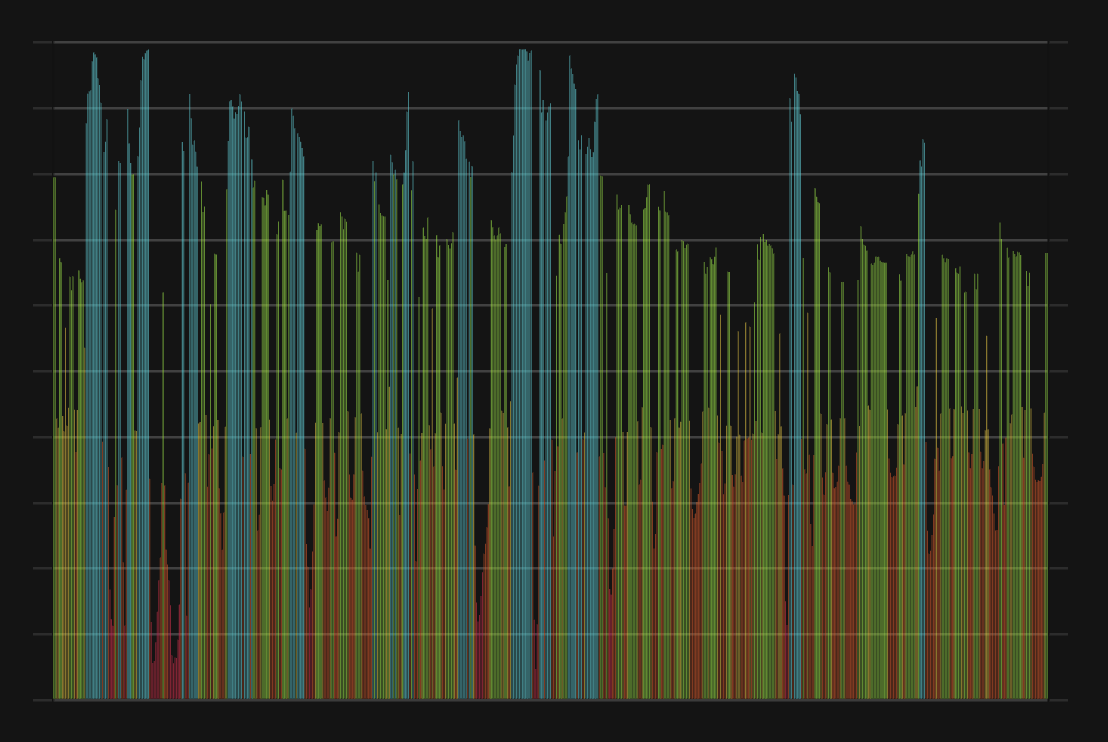

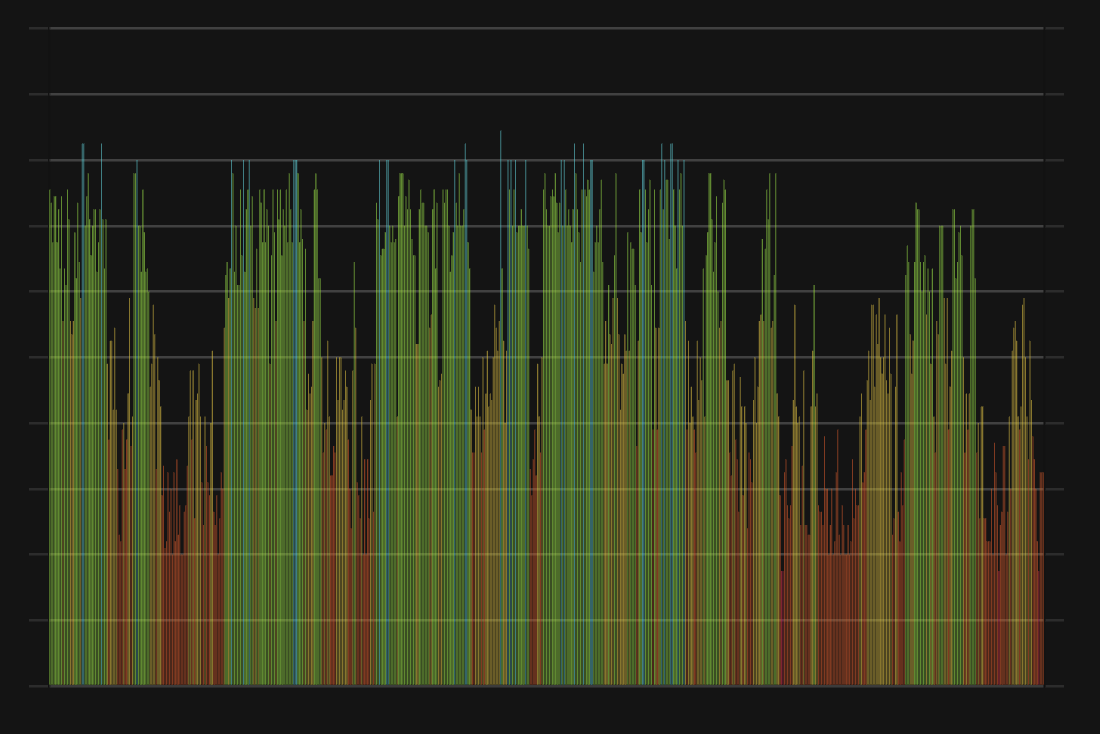

Price Score Sentiment

Volatility Sentiment

Volume Sentiment

Impulse Sentiment

Technical Sentiment

Social Sentiment

Dominance Sentiment

Search Sentiment

Whales Sentiment

Order Book Sentiment