Historical Values

-

Now

Greed 74 -

Yesterday

Greed 74 -

7 Days Ago

Greed 74 -

1 Month Ago

Greed 74

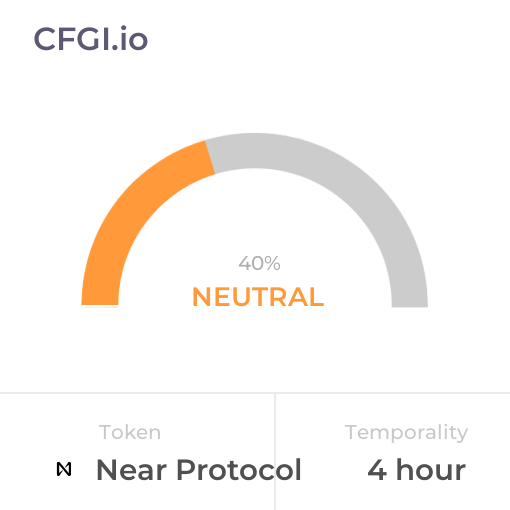

Near Protocol Breakdown

Price Score Greed

The Price Score indicator is a relevant indicator to analyze and assign the Near Protocol price evolution a certain numerical value.

This module studies the price trend to determine if the Near Protocol market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Extreme Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Near Protocol price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Extreme Greed

Like volatility, the Near Protocol Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Near Protocol bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Extreme Greed

The Impulse indicator measures the current Near Protocol price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Near Protocol market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Greed

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Near Protocol the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Fear

Dominance Extreme Fear

This other indicator takes into account the dominance of Near Protocol with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Near Protocol's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Near Protocol and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Fear

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Near Protocol has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Near Protocol. For this, specific search terms are used that determine the purchasing or ceding interest of Near Protocol, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Extreme Greed

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Near Protocol and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Near Protocol moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Neutral

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Near Protocol on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

Near Protocol News

Near Protocol News

Peter Schiff Says 'Dollars Win' Over Bitcoin As BTC Hovers Near $65,000: 'Bitcoiners Are Delusional'

Sentiment: Negative

Read moreNEAR Price Prediction: Eyes $1.35 Recovery by April as Bulls Test Key Resistance

Sentiment: Positive

Read moreCrypto Prediction Markets Say Bitcoin Is Nowhere Near $150,000 -- but Here's the Bull Case They Might Be Missing

Sentiment: Positive

Read moreSolana Price Prediction: SOL Consolidates Near $76 Support as Bears Eye $50

Sentiment: Negative

Read more20,000 Strong: Bitcoin Whale Wallets Near Crucial Threshold as BTC Trades Close to $68K

Sentiment: Positive

Read moreForward Industries Eyes Berkshire Hathaway Status as SOL Losses Near $1 Billion

Sentiment: Negative

Read moreBTC Price Coils Near $67K–$68K: Breakout Thesis Alive – Just Needs Patience (Feb 27 Update)

Sentiment: Positive

Read moreNEAR Protocol Drops 15x From ATH as Market Cap Shrinks to $1.4B and TVL Falls to $100M

Sentiment: Negative

Read moreEthereum Still Undervalued As Bitcoin, XRP Sit Near Neutral, Santiment Says

Sentiment: Positive

Read moreCrypto Rebound: Bitcoin Hits $68K, Circle Revenue Jumps, NEAR Outperforms

Sentiment: Positive

Read moreAltcoins Rally Today: DOT, NEAR, UNI & APT Jump as Crypto Market Turns Bullish

Sentiment: Positive

Read moreBitcoin snaps back near $69,000 but analysts warn the market may not be out of the woods yet

Sentiment: Neutral

Read moreBitcoin, Ethereum and Solana Shorts Get Rekt as BTC Price Rebounds Near $69K

Sentiment: Positive

Read moreCircle stock pops 30% on earnings beat as Allaire says USDC transactions now near 50% share

Sentiment: Positive

Read moreBitcoin daily gains near 5% as analysis eyes bullish 'rotation' from gold

Sentiment: Positive

Read moreXRP At Risk? Large Holders Stir The Market, Increasing Near-Term Turbulence

Sentiment: Negative

Read moreNEAR Launches Near.com Super App Integrating Crypto Wallets with AI Tools

Sentiment: Positive

Read moreNEAR Price Prediction: Protocol Faces Critical Support at $0.93 as RSI Shows Oversold Conditions

Sentiment: Positive

Read moreNEAR Introduces Near.com Super App Targeting AI Integration and Secure Crypto Payments

Sentiment: Positive

Read moreNEAR Launches Near.com Crypto Wallet, Blending Blockchain and AI for Mainstream Adoption

Sentiment: Positive

Read moreNEAR Protocol enters new phase of economic maturity with unlocked supply and revenue-generating products

Sentiment: Positive

Read moreNEAR Launches Near.com super app, touting AI capabilities and confidential transactions

Sentiment: Positive

Read moreBitcoin Had a Rough Weekend. Here's What Drove the Near-5% Drop In the World's Largest Cryptocurrency.

Sentiment: Negative

Read moreCountdown to $10? ADA Narrows Near Range Highs as Secret Cardano-Solana Meetup Sparks Market Buzz

Sentiment: Positive

Read moreModest Bitcoin Purchase From Strategy as Unrealized Losses Near $7 Billion: Details

Sentiment: Negative

Read moreNEAR Price Prediction: Technical Indicators Signal Potential Recovery to $1.35 by March 2026

Sentiment: Positive

Read moreBitcoin Price Bottom Near? On-Chain Signals Suggest a Macro Turning Point

Sentiment: Positive

Read moreXRP Hovers Near Make-or-Break $1.4 Support as Traders Watch Historical Rally Level

Sentiment: Negative

Read moreBitcoin Price Prediction: Will BTC Break Higher After Rejection Near $69K?

Sentiment: Neutral

Read moreBitcoin Price Near Bear Market Bottom? Analysts See Long Consolidation Ahead

Sentiment: Negative

Read moreNEAR Price Prediction: Testing $1.12 Resistance as Bulls Eye March Recovery

Sentiment: Positive

Read moreIf Bitcoin stays near $67k, it breaks the Power Law floor by mid-December

Sentiment: Negative

Read moreBitcoin Holds Near $67K as Traders Pay Up for Crash Protection in Options Markets

Sentiment: Negative

Read moreNEAR Price Prediction: Could Target $1.20 by March Despite Current Weakness

Sentiment: Positive

Read moreEthereum Squeezes Near $2,000 as Long-Term Chart Points to $9K–$18K Zone

Sentiment: Positive

Read moreEthereum Foundation Maps 2026 Protocol Priorities as Major Upgrades Near

Sentiment: Positive

Read moreHyperliquid Rally Stalls Near $30, Will HYPE Slide Further or Recover Toward $35?

Sentiment: Negative

Read moreBitcoin Price Holds Near $67,000 as Market Forces Push in Opposing Directions

Sentiment: Neutral

Read moreBitcoin holds near $68,000 as volatility cools, WLFI jumps ahead of Mar-a-Lago forum

Sentiment: Positive

Read moreJupiter DAO votes to cut Jupuary airdrops as JUP stalls near its all-time lows

Sentiment: Negative

Read moreEthereum Price Prediction: ETH Rebound Stalls Near $1,990 as Bears Watch $1,500 Options Strike

Sentiment: Negative

Read moreSolana (SOL) Price Consolidates Near $85 — Here's Why a Break Above $90 Could Trigger a Bigger Move

Sentiment: Neutral

Read moreRipple CEO Hints Crypto Bill Is Near Deal, Sets April as Approval Timeline

Sentiment: Positive

Read moreBitcoin Hits the Brakes Near $68,000—But Long-Term Holders Aren't Flinching

Sentiment: Positive

Read moreEthereum price struggles in “cold zone” near $2,000 — will bulls regain control?

Sentiment: Negative

Read moreNEAR Price Prediction: Targets $1.50-$1.76 by March 2026 Despite Bearish Momentum

Sentiment: Positive

Read moreZcash price tests resistance near $300 as shielded pool expands to 30% of supply

Sentiment: Positive

Read moreNEAR Price Prediction: Targets $1.20 Recovery by March Amid Oversold Conditions

Sentiment: Positive

Read moreBitcoin Price Near $70K as Brazil's Strategic Bitcoin Reserve Plan Boosts Market Sentiment

Sentiment: Positive

Read moreNEAR Price Prediction: Targets $1.50 Recovery by March 2026 Despite Technical Headwinds

Sentiment: Positive

Read moreBitcoin Soars Near $66,500 Mark While Short Bets Hit Peak Levels Since 2024

Sentiment: Positive

Read moreBitcoin stuck near $66K, XRP below $1.40: analysts expect more pain ahead

Sentiment: Negative

Read moreBitcoin tumbles back near last week's lows as AI fears crush tech and precious metals plunge

Sentiment: Negative

Read moreHistorical Values

-

Now

Greed 74 -

Yesterday

Neutral 74 -

7 Days Ago

Greed 75 -

1 Month Ago

Neutral 43

Near Protocol Breakdown

Price Score Greed

The Price Score indicator is a relevant indicator to analyze and assign the Near Protocol price evolution a certain numerical value.

This module studies the price trend to determine if the Near Protocol market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Extreme Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Near Protocol price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Extreme Greed

Like volatility, the Near Protocol Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Near Protocol bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Extreme Greed

The Impulse indicator measures the current Near Protocol price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Near Protocol market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Greed

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Near Protocol the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Fear

Dominance Extreme Fear

This other indicator takes into account the dominance of Near Protocol with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Near Protocol's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Near Protocol and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Fear

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Near Protocol has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Near Protocol. For this, specific search terms are used that determine the purchasing or ceding interest of Near Protocol, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Extreme Greed

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Near Protocol and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Near Protocol moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Neutral

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Near Protocol on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

NEAR Price

1 NEAR = $1.17

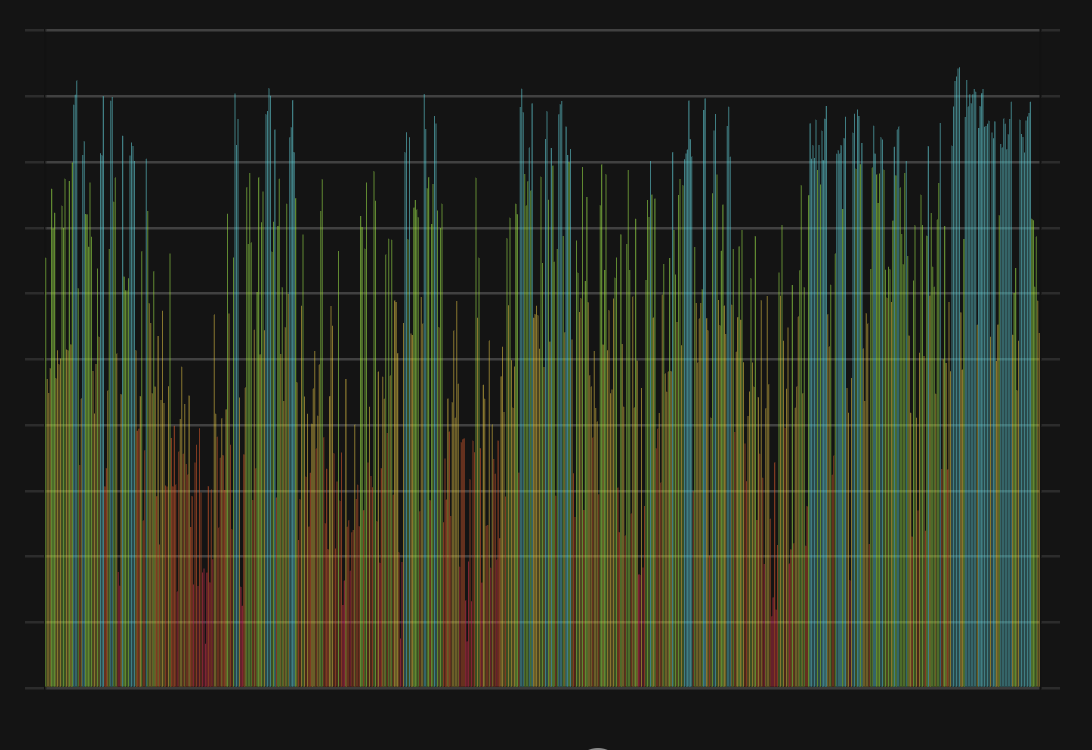

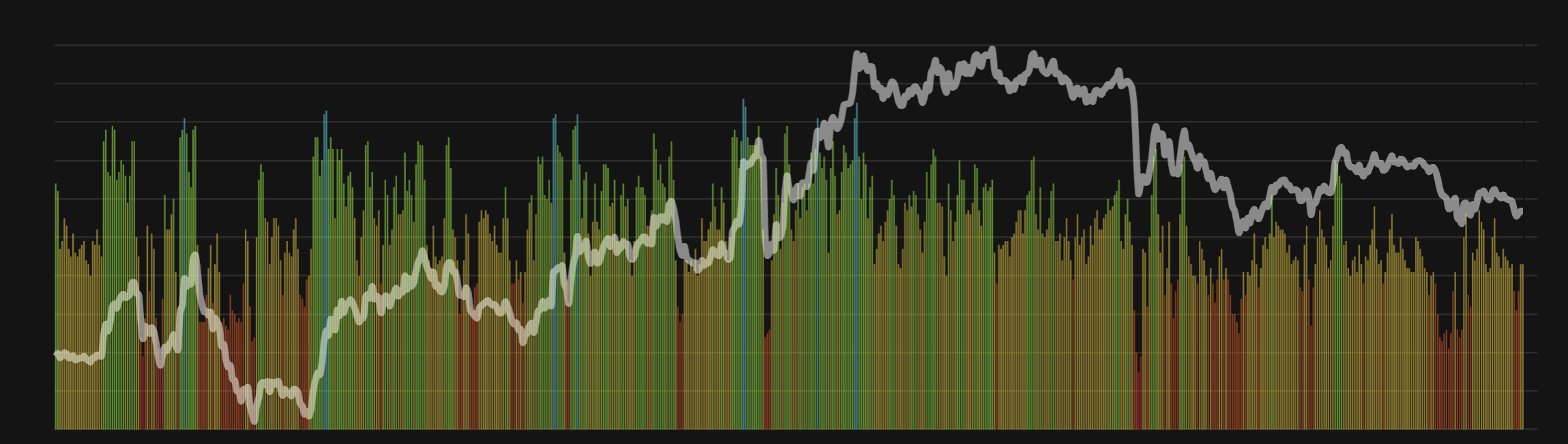

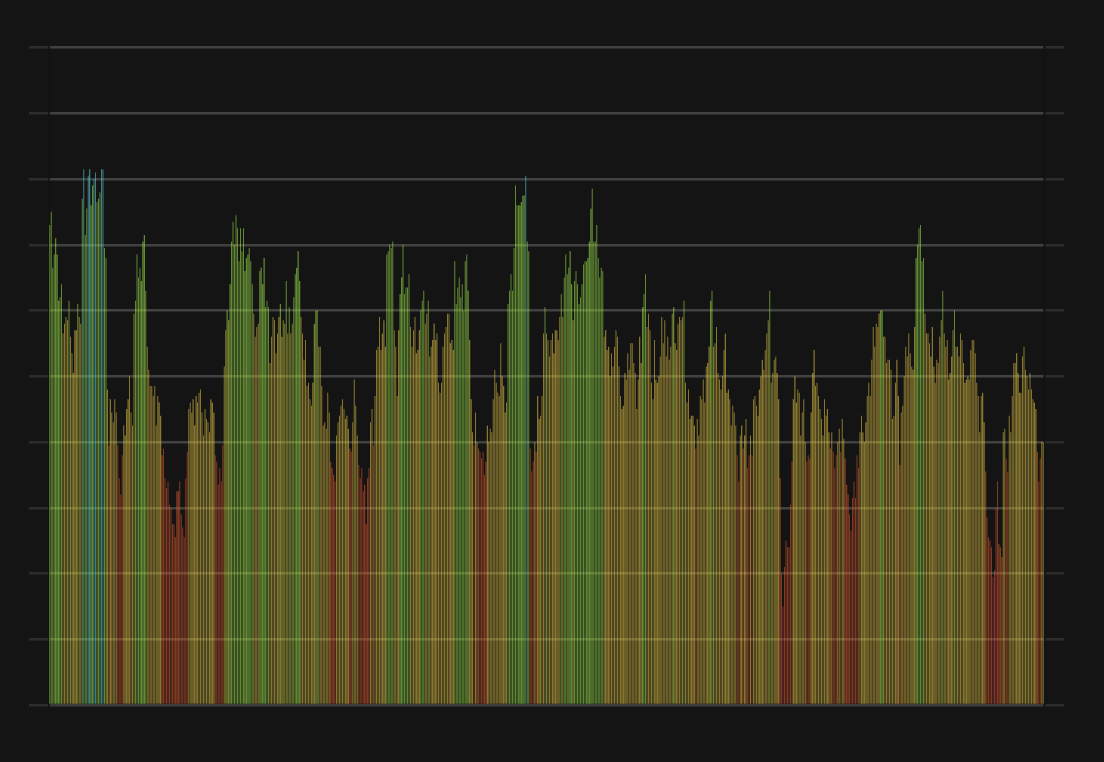

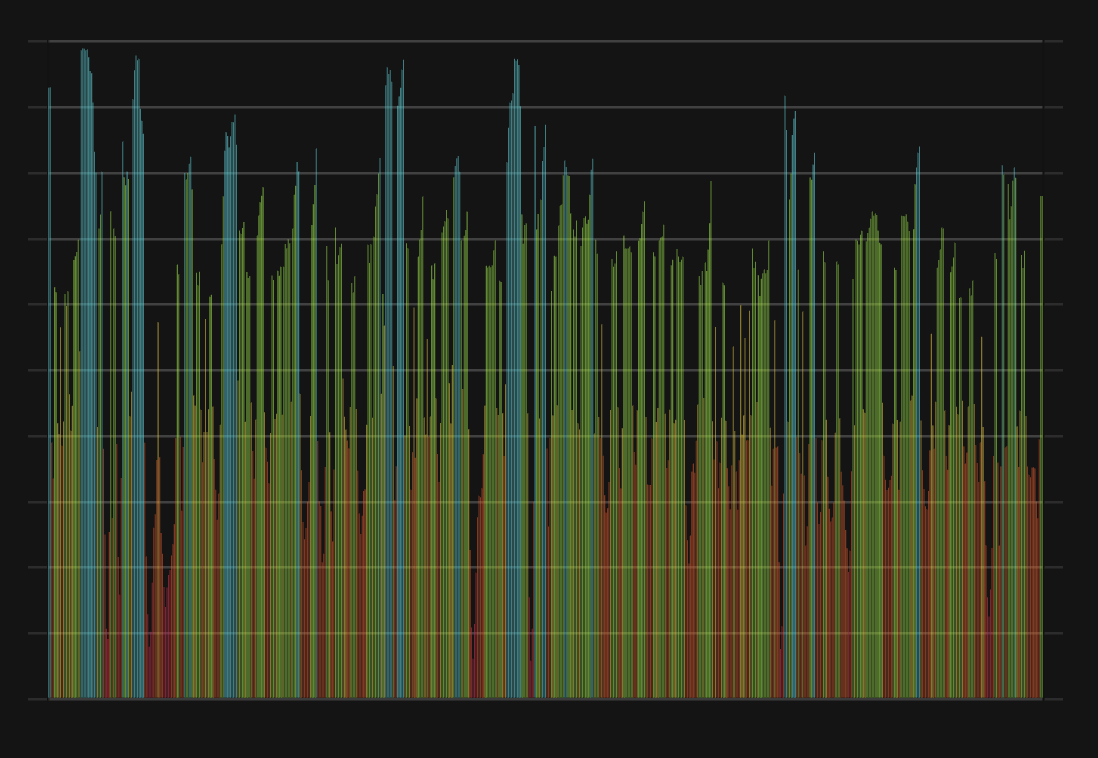

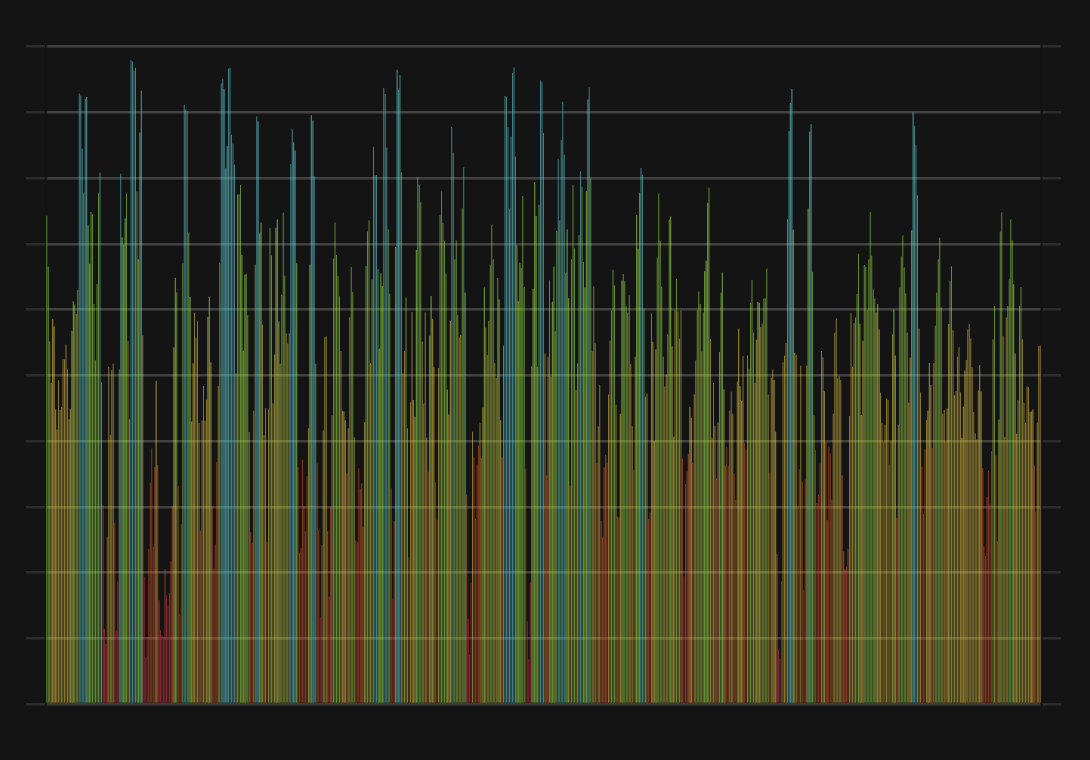

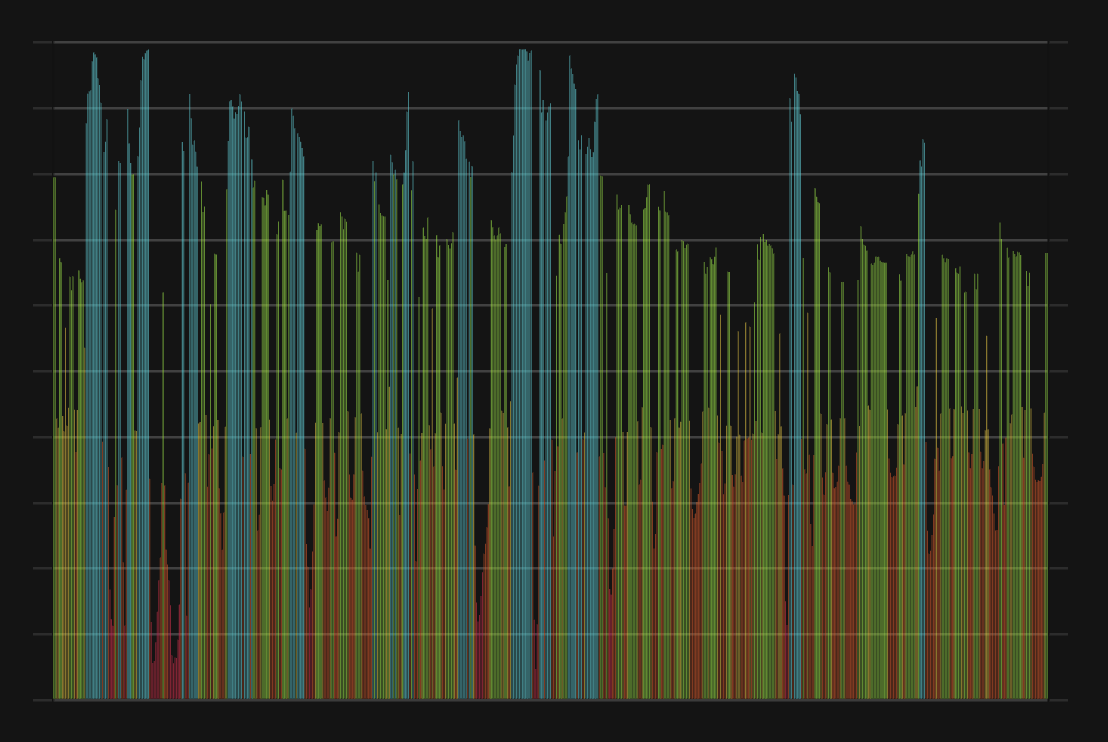

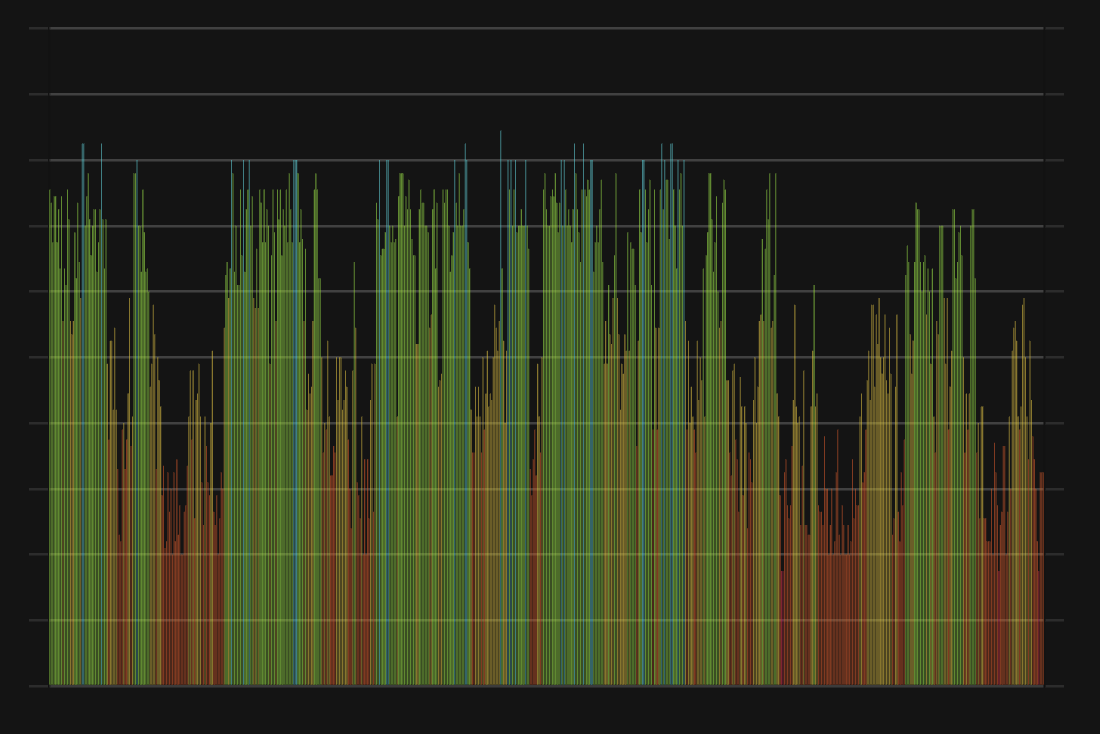

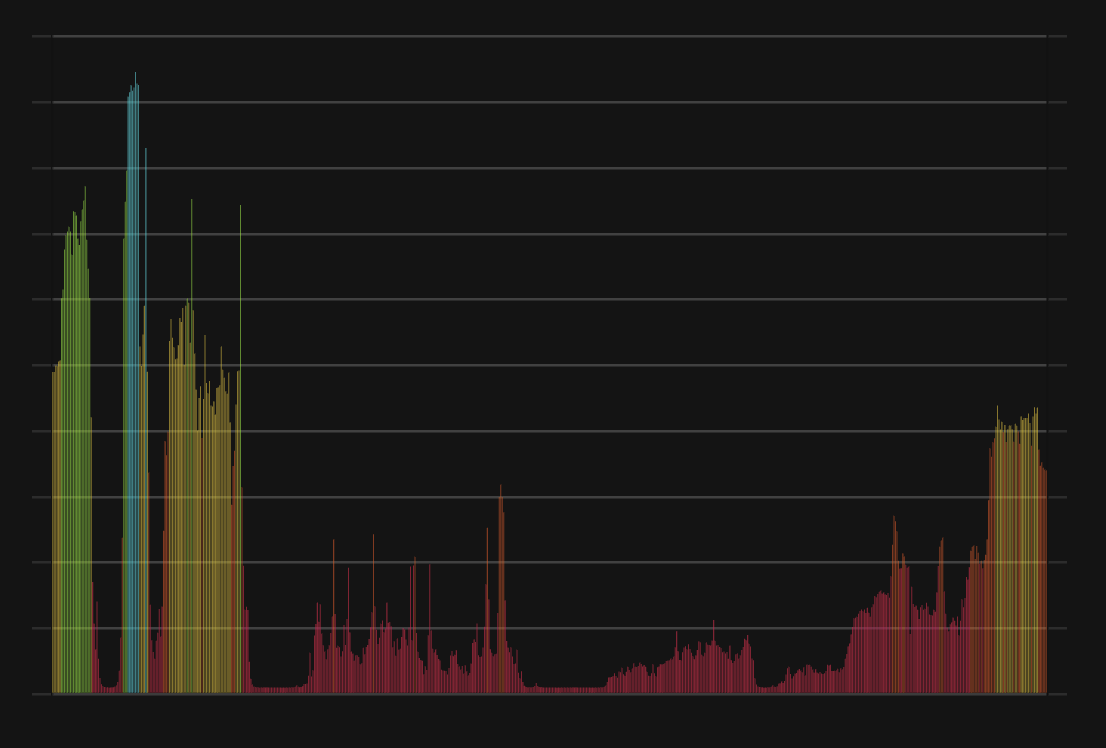

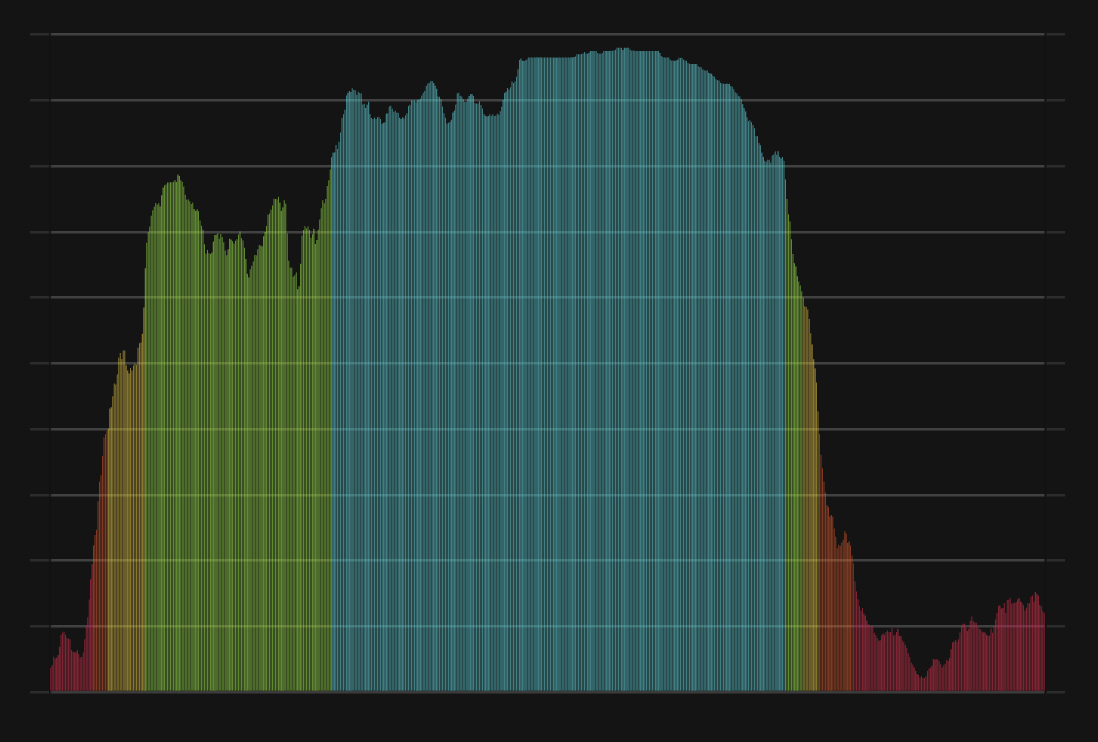

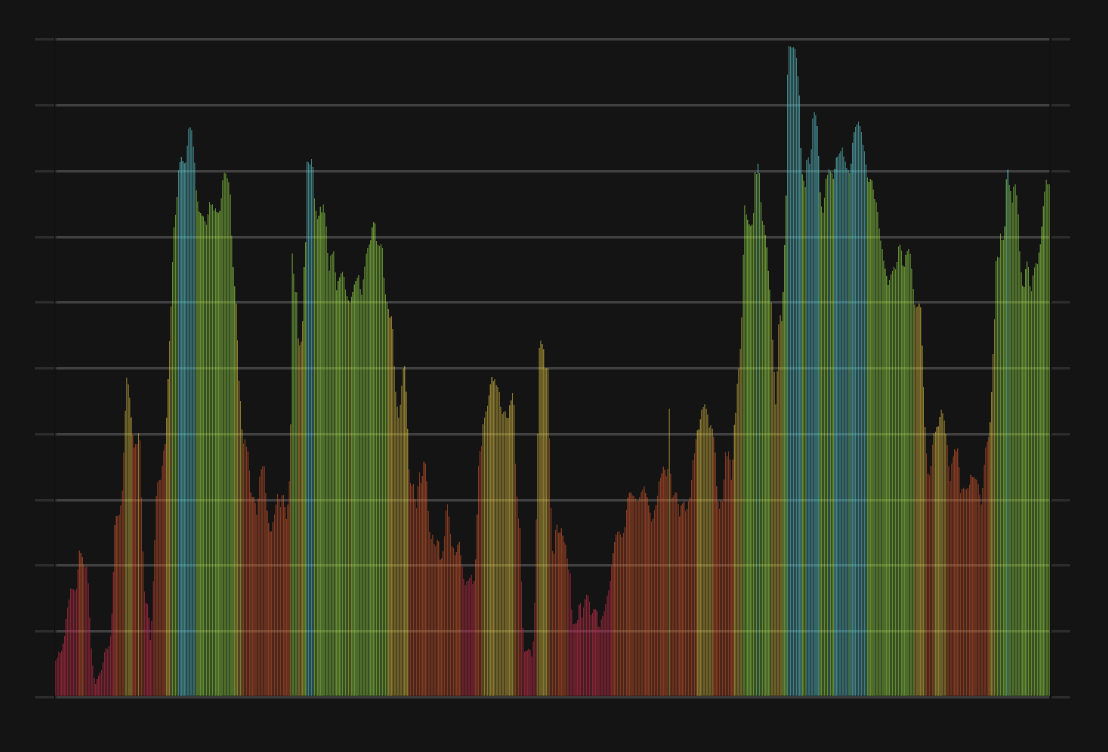

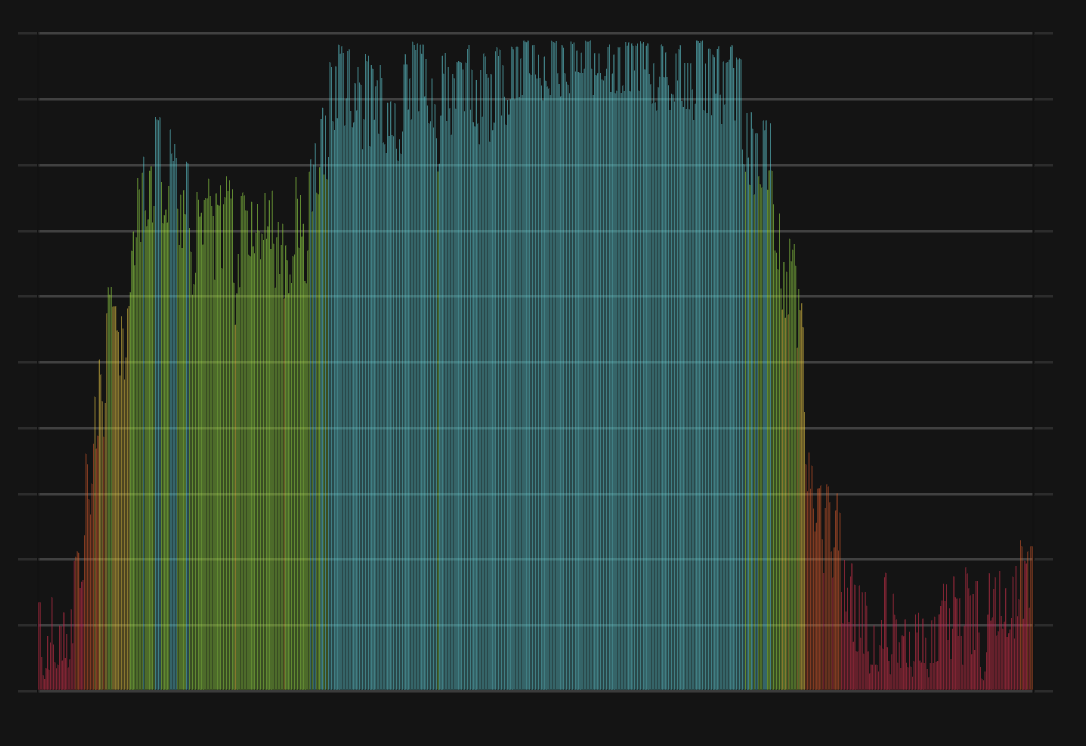

Near Protocol CFGI Score & NEAR Price History

NEAR Price & Near Protocol Sentiment Breakdown Charts

Price Score Sentiment

Volatility Sentiment

Volume Sentiment

Impulse Sentiment

Technical Sentiment

Social Sentiment

Dominance Sentiment

Search Sentiment

Whales Sentiment

Order Book Sentiment