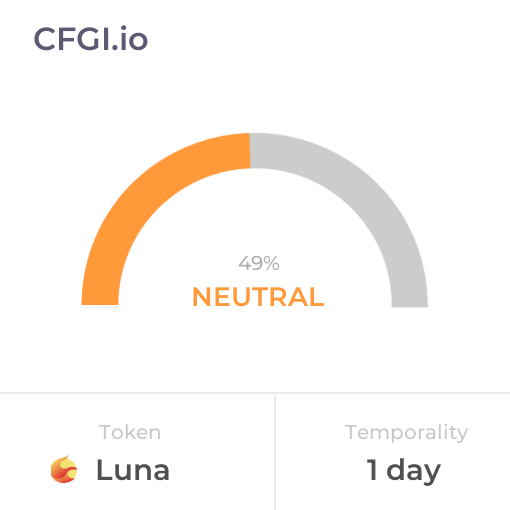

Historical Values

-

Now

Neutral 44 -

Yesterday

Neutral 44 -

7 Days Ago

Neutral 44 -

1 Month Ago

Neutral 44

Luna Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Luna price evolution a certain numerical value.

This module studies the price trend to determine if the Luna market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Fear

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Luna price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Fear

Like volatility, the Luna Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Luna bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Neutral

The Impulse indicator measures the current Luna price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Luna market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Fear

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Luna the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Greed

Dominance Fear

This other indicator takes into account the dominance of Luna with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Luna's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Luna and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Luna has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Luna. For this, specific search terms are used that determine the purchasing or ceding interest of Luna, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Extreme Fear

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Luna and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Luna moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Neutral

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Luna on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

Luna News

Luna News

Terraform Labs Sues Jane Street for Alleged Insider Trading Prior to Terra-Luna Collapse: Report

Sentiment: Negative

Read moreLUNC News: Terraform Labs Administrator Sues Jane Street for Terra-LUNA Crisis

Sentiment: Negative

Read moreBitcoin's Decay Signals the Most Severe Bearish Pivot Since the LUNA Collapse – A 2022 Echo

Sentiment: Negative

Read moreTerraform Labs sues Jane Street for alleged insider trading prior to Terra-Luna collapse: WSJ

Sentiment: Negative

Read moreBitcoin Shows Greater Weakness Than Post-LUNA Crash; Is a Crash Below $60K Next?

Sentiment: Negative

Read moreBitcoin on-chain loss metrics hit 2022 Luna collapse levels at higher prices

Sentiment: Negative

Read moreBitcoin Realized Losses Hit Luna Crash Levels — But Price Context Points To A Different Market Phase

Sentiment: Negative

Read moreBitcoin Logs $3.2B In Loss-Taking Wave, Beating Luna And FTX-Era Shock Levels

Sentiment: Negative

Read moreLUNA price prediction – Is recovery in sight now after 20% slide from Monday's high?

Sentiment: Positive

Read moreTerra Luna Price Prediction: LUNA Hits 7-Month High – But One Analyst Says This Pump Could End Badly

Sentiment: Negative

Read moreDisgraced Terraform Labs Founder Do Kwon Receives 15-Yr Prison Sentence Over Terra-Luna Collapse

Sentiment: Negative

Read moreFallen Crypto Mogul Do Kwon Sentenced To 15 Years In Prison For Colossal $40B Terra-Luna Fraud

Sentiment: Negative

Read moreTerra Luna Price Prediction: LUNA Explodes 222% – Is This Comeback Just Getting Started?

Sentiment: Positive

Read moreDo Kwon sentenced to 15 years in U.S. federal prison — LUNA price spikes, then pulls back

Sentiment: Negative

Read moreTerra Luna Classic Price Prediction: Terra Chain Upgrade Ignites Explosive Rally – Beginning of a Full Recovery?

Sentiment: Positive

Read moreTerraform Labs founder Do Kwon sentenced to 15 years over $40 billion Terra-Luna collapse: Inner City Press

Sentiment: Negative

Read moreRisky Tokens Defy Downturn: LUNA, JELLYJELLY, Memes Rally Against Market Trends

Sentiment: Positive

Read moreCrypto market volatility surges as do kwon sentencing coincides with sharp LUNC and LUNA rally

Sentiment: Neutral

Read moreLUNA, JELLYJELLY, and risky memes turn bullish, defying bearish sentiments

Sentiment: Positive

Read moreTerra (LUNA) Sees Remarkable Surge as Trading Volume Escalates Amid Do Kwon's Sentencing Anticipation

Sentiment: Positive

Read moreLUNC Price Skyrockets Over 20% as Terra Luna Classic Begins Voting on Major Upgrade

Sentiment: Positive

Read moreTERRA LUNA Price Prediction 2025, 2026 – 2030: Will LUNA 2.0 Hit $1 In 2025?

Sentiment: Positive

Read moreTop 6 Altcoins with Important Events Worth Noting This Week: SOL, BTC, ASTER, LUNA, TAO, AVAX

Sentiment: Positive

Read moreDo Kwon Deserves 12-Year Prison Sentence For His Role In $40B Terra-Luna Crash, US Prosecutors Say

Sentiment: Negative

Read moreTerra Luna Classic (LUNC) Soars 100% After Viral T-Shirt Moment in Dubai

Sentiment: Positive

Read moreBitcoin Capitulation Now Mirrors COVID, China Ban, and Luna Collapse Levels – Historical Stress Point

Sentiment: Negative

Read moreTerra (LUNA): A Stablecoin Ecosystem With Algorithmic Stability Mechanisms And Its Token

Sentiment: Positive

Read moreTerraform Co-Founder Do Kwon Pleads Guilty Over Dramatic $60 Billion Terra/LUNA Collapse

Sentiment: Negative

Read moreTerraform Labs Founder Do Kwon Pleads Guilty To Fraud In $60B Terra/Luna Collapse

Sentiment: Negative

Read moreBREAKING: Do Kwon pleads guilty of wire fraud — What's next for LUNA and LUNC?

Sentiment: Negative

Read moreBreaking: Terra's Do Kwon Pleads Guilty to Fraud Charges Over $40B LUNA Collapse

Sentiment: Negative

Read moreLUNA and LUNC on the edge as Do Kwon eyes guilty plea in $40B Terraform case

Sentiment: Negative

Read moreTerraform Co-founder Do Kwon May Enter a Change of Plea Today: What's Next for LUNA Price?

Sentiment: Negative

Read moreIs Solana Headed to $300 or a LUNA-Like Breakdown? A Deep Dive Into Recent Gains and Growing Concerns

Sentiment: Neutral

Read moreSolana Rises 20% in a Week, But Analyst Warns of LUNA-Like Breakdown Ahead

Sentiment: Neutral

Read more“Jerome Powell's Firing Is Imminent,” Claims Florida Rep. Anna Paulina Luna

Sentiment: Neutral

Read morePi Network Might Crash Like Terra Luna : Analyst Raises Red Flags Over Centralization

Sentiment: Negative

Read moreMantra bounces 200% after OM price crash but poses LUNA-like 'big scandal' risk

Sentiment: Negative

Read moreCrypto Investment Firm Galaxy Digital Settles With New York AG for $200,000,000 Over Luna Allegations

Sentiment: Negative

Read moreTerraform Labs to launch creditor claims portal next week: what's next for LUNA price?

Sentiment: Negative

Read moreGalaxy Digital Agrees to $200 Million Settlement Over LUNA 'Misrepresentations'

Sentiment: Negative

Read moreHistorical Values

-

Now

Neutral 44 -

Yesterday

Neutral 44 -

7 Days Ago

Neutral 44 -

1 Month Ago

Fear 35

Luna Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Luna price evolution a certain numerical value.

This module studies the price trend to determine if the Luna market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Fear

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Luna price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Fear

Like volatility, the Luna Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Luna bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Neutral

The Impulse indicator measures the current Luna price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Luna market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Fear

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Luna the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Greed

Dominance Fear

This other indicator takes into account the dominance of Luna with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Luna's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Luna and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Luna has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Luna. For this, specific search terms are used that determine the purchasing or ceding interest of Luna, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Extreme Fear

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Luna and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Luna moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Neutral

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Luna on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

LUNA Price

1 LUNA = $0.06

Luna CFGI Score & LUNA Price History

LUNA Price & Luna Sentiment Breakdown Charts

Price Score Sentiment

Volatility Sentiment

Volume Sentiment

Impulse Sentiment

Technical Sentiment

Social Sentiment

Dominance Sentiment

Search Sentiment

Whales Sentiment

Order Book Sentiment

![With $0.16 defended, can Terra [LUNA] extend its rally by another 50%?](https://crypto.snapi.dev/images/v1/d/n/x/terra-featured-835864.webp)