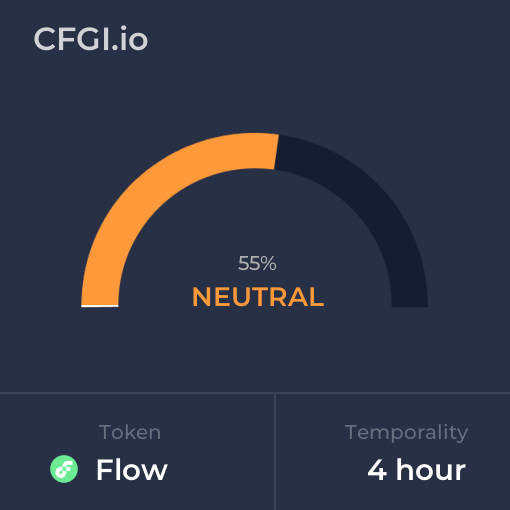

Historical Values

-

Now

Neutral 50 -

Yesterday

Neutral 50 -

7 Days Ago

Neutral 50 -

1 Month Ago

Neutral 50

Flow Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Flow price evolution a certain numerical value.

This module studies the price trend to determine if the Flow market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Fear

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Flow price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Fear

Like volatility, the Flow Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Flow bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Neutral

The Impulse indicator measures the current Flow price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Flow market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Neutral

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Flow the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Extreme Greed

Dominance Greed

This other indicator takes into account the dominance of Flow with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Flow's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Flow and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Flow has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Flow. For this, specific search terms are used that determine the purchasing or ceding interest of Flow, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Neutral

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Flow and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Flow moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Neutral

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Flow on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

Flow News

Flow News

XRP on the Move: 1,606% Surge in Futures Flow Signals Potential Volatility Ahead

Sentiment: Neutral

Read moreAnalyst Claims $5 Billion XRP Selling Flow on Upbit: What It Means for Price

Sentiment: Negative

Read moreEthereum Sell Pressure Expands As Short-Term Holder Supply Flow Turns Negative

Sentiment: Negative

Read moreBitcoin ETF flow numbers are fundamentally broken and most traders are missing the specific sign of a crash

Sentiment: Negative

Read moreEthereum Faces High-Stakes Moment at $2,200 as Whale Longs Clash With Bearish Flow Data

Sentiment: Negative

Read moreWalletConnect Integrates TRON Network, Connecting 600 Wallets to $21 Billion Daily Stablecoin Flow

Sentiment: Positive

Read moreBinance Order Flow Suggests Ethereum Is In Correction Mode: Demand Still Missing

Sentiment: Negative

Read moreCardano (ADA) Prints 750% Surge in One-Hour Futures Flow Spike: How Does It Affect Price?

Sentiment: Positive

Read moreHuobi HTX has called out the Flow network for creating an isolated recovery plan

Sentiment: Negative

Read more+654% Dogecoin (DOGE) Futures Flow Imbalance Spotted: Is This the Key to Growth?

Sentiment: Positive

Read moreBitcoin Hits Lowest Stock-to-Flow Band Ever as Whales Sell and Support Holds

Sentiment: Positive

Read moreFlow blames Cadence runtime type confusion vulnerability for $3.9M exploit

Sentiment: Negative

Read moreFlow details December exploit that led to $3.9M in losses due to counterfeit tokens

Sentiment: Negative

Read moreXRP's $1 billion ETF record is misleading, and one hidden flow metric explains why price remains stagnant

Sentiment: Negative

Read moreBinance delists Flow pairs and adds tokens to risk watch after $3.9M hack

Sentiment: Negative

Read moreFlow Moves Into Phase Two of $3.9M Recovery, Spotlight on Exchange Lapses

Sentiment: Positive

Read moreFlow Foundation has entered phase two of its recovery after a $3.9 million exploit hit the network

Sentiment: Negative

Read moreFlow advances recovery plan, raises exchange concerns after $3.9M exploit

Sentiment: Negative

Read moreFlow Abandons Blockchain Rollback After $3.9M Exploit, Opts for Targeted Recovery Plan

Sentiment: Negative

Read moreWhat Flow Network's ‘isolated recovery' plan after $3.9 mln hack entails

Sentiment: Negative

Read moreFlow scraps rollback plan after pushback over decentralization, security

Sentiment: Positive

Read moreFlow scraps blockchain 'rollback' plan after community backlash over decentralization

Sentiment: Negative

Read moreFlow Blockchain Plans Controversial Rollback to Undo $3.9M Hack — Partners “Blindsided”

Sentiment: Negative

Read moreFlow validators deploy fix, prepare for network restoration after security breach

Sentiment: Positive

Read moreFLOW Token Plummets 42% as Security Incident Sparks Exchange Suspensions

Sentiment: Negative

Read moreBitcoin Takes Backseat As Treasury's Cash Flow Becomes Must-Watch Chart – Here's Why

Sentiment: Negative

Read moreFusaka Upgrade Lands Tomorrow — Ethereum Set to Gain Strong L2 Data Flow and Sharper Gas Controls

Sentiment: Positive

Read moreCrypto Market Prediction: XRP Rockets 13% on Heavy Multimillion Flow, Ethereum (ETH) Hit With Mini-Death Cross, Shiba Inu (SHIB) Adds Trillion, What Does It All Mean?

Sentiment: Positive

Read moreCap and EigenLayer Partner With Flow Traders to Expand Institutional Access to DeFi

Sentiment: Positive

Read moreFlow Traders Opens New Institutional Gateway to DeFi With Cap and EigenLayer

Sentiment: Positive

Read moreArthur Hayes Sees Bitcoin Defending $80K as Fed QT End Sparks High-Stakes Flow Pivot

Sentiment: Positive

Read moreXRP Staking Surge New Debate as Ripple Engineers Explore Future of Network Value Flow

Sentiment: Positive

Read moreXRP Staking Enters Spotlight With Questions That Could Recode Network Value Flow

Sentiment: Positive

Read moreKiyosaki Cashes Out Bitcoin for $2.25M, Shifts into Cash-Flow Businesses

Sentiment: Positive

Read moreBNB Holds Above $930 as Technical Consolidation Continues Amid Quiet News Flow

Sentiment: Neutral

Read moreBitcoin ETF flow volatility reveals the market's biggest fear heading into key inflation data

Sentiment: Negative

Read moreSolana: Top 3 reasons SOL's stablecoin flow could be its biggest edge yet!

Sentiment: Positive

Read moreXRP's Next Earthquake: Billions Set To Flow In, ‘Supply Shock' Coming—Analyst

Sentiment: Positive

Read more$1 Billion in New Capital Could Soon Flow to XRP. Here's Why That's 1 More Reason to Buy It

Sentiment: Positive

Read moreBitcoin Retail Traders Take Over as Whale Activity Declines in BTC Fund Flow

Sentiment: Negative

Read moreInvestors should be 'cautious' when using BTC stock-to-flow model: Analyst

Sentiment: Negative

Read moreEthereum OG Drives $500M Liquidity Flow Into ConcreteXYZ & Stable Vaults – Details

Sentiment: Positive

Read more$2B to flow into BlackRock's UK Bitcoin ETF: How UK traders could recycle into IBIT

Sentiment: Positive

Read moreBNB market cap taps $165b, here is where experts believe capital could flow to next

Sentiment: Positive

Read moreXRP, DOGE, SOL See Friday Pullback as $2.7B Flow to Bitcoin ETFs This Week

Sentiment: Negative

Read moreRipple's Middle East expansion could put XRP and RLUSD in the flow – here's how?

Sentiment: Positive

Read moreBitcoin Capital Flow Must Enter The Network Before Global Dominance — Here's What Will Happen

Sentiment: Positive

Read moreUSDT liquidity flow to Ethereum could fuel altcoin season rally: CryptoQuant

Sentiment: Positive

Read more2.8M ETH flow into accumulation wallets, exchange reserves drop amid price downturn

Sentiment: Positive

Read moreCrypto Market Flash Crash: BTC, ETH, and XRP Investors Turn to BAY Miner for Stable Cash Flow

Sentiment: Negative

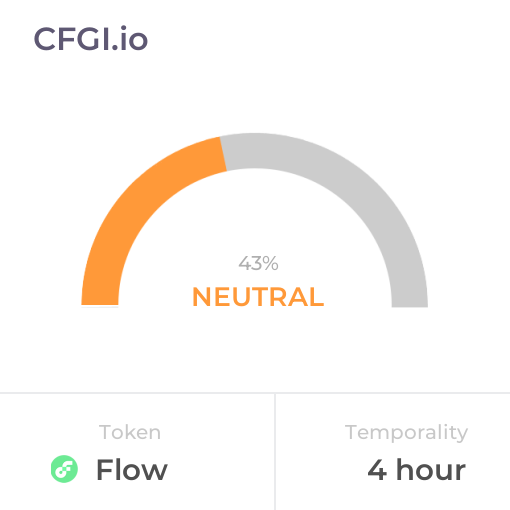

Read moreHistorical Values

-

Now

Neutral 50 -

Yesterday

Neutral 50 -

7 Days Ago

Neutral 44 -

1 Month Ago

Neutral 43

Flow Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Flow price evolution a certain numerical value.

This module studies the price trend to determine if the Flow market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Fear

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Flow price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Fear

Like volatility, the Flow Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Flow bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Neutral

The Impulse indicator measures the current Flow price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Flow market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Neutral

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Flow the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Extreme Greed

Dominance Greed

This other indicator takes into account the dominance of Flow with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Flow's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Flow and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Flow has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Flow. For this, specific search terms are used that determine the purchasing or ceding interest of Flow, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Neutral

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Flow and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Flow moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Neutral

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Flow on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

FLOW Price

1 FLOW = $0.04

Flow CFGI Score & FLOW Price History

FLOW Price & Flow Sentiment Breakdown Charts

Price Score Sentiment

Volatility Sentiment

Volume Sentiment

Impulse Sentiment

Technical Sentiment

Social Sentiment

Dominance Sentiment

Search Sentiment

Whales Sentiment

Order Book Sentiment