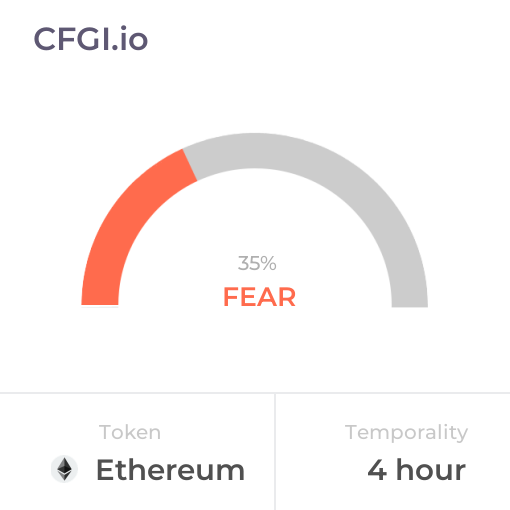

Historical Values

-

Now

Neutral 45 -

Yesterday

Neutral 45 -

7 Days Ago

Neutral 45 -

1 Month Ago

Neutral 45

Ethereum Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Ethereum price evolution a certain numerical value.

This module studies the price trend to determine if the Ethereum market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Ethereum price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the Ethereum Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Ethereum bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Neutral

The Impulse indicator measures the current Ethereum price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Ethereum market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Fear

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Ethereum the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Neutral

Dominance Greed

This other indicator takes into account the dominance of Ethereum with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Ethereum's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Ethereum and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Fear

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Ethereum has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Ethereum. For this, specific search terms are used that determine the purchasing or ceding interest of Ethereum, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Fear

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Ethereum and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Ethereum moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Extreme Greed

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Ethereum on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

Ethereum News

Ethereum News

ETH Price Prediction: Ethereum Tests Critical $2,000 Support as Bears Target $1,850

Sentiment: Negative

Read moreEthereum (ETH) Price Analysis: Whale Buying Intensifies as Network Staking Demand Explodes

Sentiment: Positive

Read moreCrypto Market Down Today: Bitcoin Price Falls to $68K as $302M Liquidations Hit BTC, ETH, XRP

Sentiment: Negative

Read moreEthereum Price Shows First Bullish Signal of 2026 as ETH Attempts Recovery Above $2,000

Sentiment: Positive

Read moreEthereum Price Prediction: Whales Are Defending Critical $2,000 Level — Is ETH About to Explode Higher?

Sentiment: Positive

Read morePrice predictions 3/6: BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH, HYPE, XMR

Sentiment: Negative

Read moreETH Price Analysis: Ethereum Risks Dumping Below $2K Again as Momentum Fades

Sentiment: Negative

Read moreWhy funds short Ethereum as Culper Research targets ETH after Fusaka upgrade

Sentiment: Negative

Read moreCrypto Market Crash Alert: Institutions Trap Retail Ahead of BTC, ETH, XRP Options Expiry & Nonfarm Payrolls

Sentiment: Negative

Read moreEthereum (ETH) Price Struggles Below $2,200 Amid Macro Headwinds and ETF Outflows

Sentiment: Negative

Read moreWhy Ethereum's Record 29.6M ETH Turnover Signals A High-Velocity Speculative Trap

Sentiment: Negative

Read moreBitcoin drops under $71,000, ETH, DOGE slide as war-week rally runs into resistance

Sentiment: Negative

Read moreEthereum's Price Dips, But Bitmine Immersion Is Buying More ETH Through Market Chaos

Sentiment: Positive

Read moreCulper Research Shorts Ethereum, Claims Fusaka Upgrade Weakened ETH Tokenomics

Sentiment: Negative

Read moreIs Ethereum Waking Up? Binance ETH Turnover Hits 6-Month High as Volatility Returns

Sentiment: Positive

Read moreEthereum (ETH) Could Rally by Double Digits if This Key Condition Is Met

Sentiment: Positive

Read moreEthereum Hovers at $2,150 — Can ETH Price Rally to $2,400 or Stall Below $2,200?

Sentiment: Positive

Read moreCrypto Market Today: BTC, ETH, XRP, SOL, and DOGE Rally as Geopolitical Tensions Ease

Sentiment: Positive

Read moreFrom Bear Trap to Breakout? Ethereum (ETH) Tests a Crucial Momentum Shift After a 7% Jump

Sentiment: Positive

Read moreEthereum (ETH) Surges Past $2,200 as Short Squeeze and ETF Inflows Drive Price Recovery

Sentiment: Positive

Read moreWhy is the Crypto Market Rising Today? Top Factors Impacting BTC, ETH & XRP Prices

Sentiment: Positive

Read moreMassive ETH Outflow From Binance to Anonymous Wallet as Price Turns Green

Sentiment: Positive

Read morePrice predictions 3/4: BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH, HYPE, LINK

Sentiment: Positive

Read moreEthereum Price Prediction: $2,750 in Sight if ETH Breaks This Resistance

Sentiment: Positive

Read more77,000 ETH Gone From Binance to Anon Wallet as Crypto Market Goes Back to Green

Sentiment: Positive

Read moreAlmost 40% of altcoins linger near lows while BTC and ETH lead market rebound

Sentiment: Negative

Read more31.6 Million ETH Leaves Exchanges as Vitalik Calls for Ethereum “Sanctuary” Tech

Sentiment: Positive

Read moreEthereum (ETH) Price: Major Holders Accumulate 320K Coins Amid Surging Network Usage

Sentiment: Positive

Read moreTom Lee's Bitmine bets on Ethereum again with fresh 50K ETH buy – Details

Sentiment: Positive

Read moreETH Price Prediction: Ethereum Eyes $2,300 Recovery Despite Technical Weakness

Sentiment: Positive

Read moreEthereum's 2020 Throwback: How A 3.46M ETH Supply Floor Creates A Liquidity Void

Sentiment: Negative

Read more$129,300,000 ETH Buy Wall Identified on Binance Under Current Spot Price

Sentiment: Positive

Read moreEthereum Price Prediction Alert, Six Red Months Put ETH at a Make or Break Level

Sentiment: Negative

Read moreTom Lee's Bitmine Buys Another $102 Million ETH Despite $7 Billion in Unrealized Losses

Sentiment: Positive

Read moreStandard Chartered Says Ethereum (ETH) Will Reach $4,000 This Year. But It Will Fall Further First

Sentiment: Positive

Read moreCrypto Prices Today: BTC, ETH, XRP Prices Surge Despite Iran's Strait of Hormuz Closure

Sentiment: Positive

Read moreEthereum price outlook as Bitmine buys another $103 million worth of ETH

Sentiment: Positive

Read moreEthereum usage is at record highs yet ETH nears its longest monthly losing streak since 2018

Sentiment: Negative

Read moreEthereum Price Prediction: A Short Squeeze Could Push ETH Back to $2.8K Rapidly

Sentiment: Positive

Read morePrice predictions 3/2: SPX, DXY, BTC, ETH, XRP, BNB, SOL, DOGE, BCH, ADA

Sentiment: Positive

Read moreCrypto Holds Its Range With Iran Tensions Rising and BTC, ETH Recovering From Weekend Lows

Sentiment: Neutral

Read moreBitmine's Reserves Climb to $9.9B Following Major Expansion in ETH Holdings

Sentiment: Positive

Read moreBitMine expands Ether holdings with $98M purchase as ETH surges past $2K

Sentiment: Positive

Read moreTom Lee's Bitmine boosts ether holdings to 4.47 million tokens with $98 million ETH purchase

Sentiment: Positive

Read moreEthereum price forecast: ETH struggles to rally above $2,092 amid strong institutional support

Sentiment: Neutral

Read moreBitmine ETH holdings surge to 4.474 million tokens as crypto and cash reserves hit $9.9 billion

Sentiment: Positive

Read moreBitmine lifts ether treasury to 4.47 million ETH as total holdings near $10 billion

Sentiment: Positive

Read moreBreaking: Ethereum Treasury BitMine Adds 50,928 ETH as Tom Lee Predicts March Bottom For Crypto Prices

Sentiment: Positive

Read moreEthereum Price Prediction: Will ETH Drop Below $1.8K Amid Escalating Macro Uncertainty?

Sentiment: Negative

Read moreEthereum price Crashes While Supply Quietly Vanishes: Is ETH Supply Shock Brewing Now?

Sentiment: Negative

Read moreFounder of Major Bitcoin Mining Pool Linked to Large ETH Position as Price Is Under $2,000

Sentiment: Positive

Read moreEthereum News: Crypto Whale Loses $74M Longing ETH, Left With Just $8.5K on Hyperliquid

Sentiment: Negative

Read moreHow BTC, ETH and XRP Prices React as Crude Oil and Safe Havens Surge After Khamenei's Death

Sentiment: Negative

Read moreETH Price Prediction: Targets $2,200 by March End Despite Current Bearish Momentum

Sentiment: Positive

Read moreVitalik Buterin Wraps Up Ethereum Selling Spree — Is an ETH Breakout Imminent?

Sentiment: Positive

Read moreCrypto market at risk as US PPI report shows sticky inflation: Will BTC, SOL, ETH slide further?

Sentiment: Negative

Read moreEthereum Price Analysis: ETH Must Reclaim This Key Level to Confirm a Bullish Reversal

Sentiment: Negative

Read moreEthereum Price Analysis: ETH Must Reclaim This Key Level to Confirm a Bullish Reversal

Sentiment: Negative

Read moreETH Price Prediction: Ethereum Eyes $2,175 Breakout Despite Bearish Momentum

Sentiment: Positive

Read moreETH Price Prediction: Ethereum Eyes $2,175 Breakout Despite Bearish Momentum

Sentiment: Positive

Read moreEther's 60% down from its 2025 high, but TradFi keeps betting on ETH: Here's why

Sentiment: Positive

Read moreEther's 60% down from its 2025 high, but TradFi keeps betting on ETH: Here's why

Sentiment: Positive

Read moreEther's 60% down from its 2025 high, but TradFi keeps betting on ETH: Here's why

Sentiment: Positive

Read moreEther's 60% down from its 2025 high, but TradFi keeps betting on ETH: Here's why

Sentiment: Positive

Read moreCrypto Weekly Wrap: Jane Street Targeted After Terra Suit, Vitalik's ETH Selloffs, Regulatory Progress Feb 23-27

Sentiment: Negative

Read moreHistorical Values

-

Now

Neutral 45 -

Yesterday

Neutral 45 -

7 Days Ago

Neutral 44 -

1 Month Ago

Neutral 46

Ethereum Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Ethereum price evolution a certain numerical value.

This module studies the price trend to determine if the Ethereum market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Ethereum price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the Ethereum Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Ethereum bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Neutral

The Impulse indicator measures the current Ethereum price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Ethereum market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Fear

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Ethereum the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Neutral

Dominance Greed

This other indicator takes into account the dominance of Ethereum with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Ethereum's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Ethereum and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Fear

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Ethereum has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Ethereum. For this, specific search terms are used that determine the purchasing or ceding interest of Ethereum, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Fear

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Ethereum and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Ethereum moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Extreme Greed

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Ethereum on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

ETH Price

1 ETH = $1,982.46

Ethereum CFGI Score & ETH Price History

ETH Price & Ethereum Sentiment Breakdown Charts

Price Score Sentiment

Volatility Sentiment

Volume Sentiment

Impulse Sentiment

Technical Sentiment

Social Sentiment

Dominance Sentiment

Search Sentiment

Whales Sentiment

Order Book Sentiment