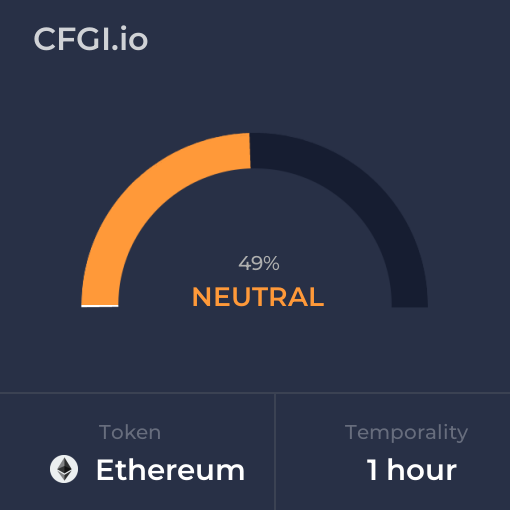

Historical Values

-

Now

Greed 71 -

Yesterday

Greed 71 -

7 Days Ago

Greed 71 -

1 Month Ago

Greed 71

Ethereum Breakdown

Price Score Greed

The Price Score indicator is a relevant indicator to analyze and assign the Ethereum price evolution a certain numerical value.

This module studies the price trend to determine if the Ethereum market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Ethereum price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the Ethereum Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Ethereum bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Greed

The Impulse indicator measures the current Ethereum price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Ethereum market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Extreme Greed

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Ethereum the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Extreme Greed

Dominance Neutral

This other indicator takes into account the dominance of Ethereum with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Ethereum's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Ethereum and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Extreme Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Ethereum has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Ethereum. For this, specific search terms are used that determine the purchasing or ceding interest of Ethereum, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Extreme Fear

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Ethereum and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Ethereum moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Extreme Greed

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Ethereum on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

Ethereum News

Ethereum News

Ethereum Foundation taps Bitwise tech for $140M, 70K ETH staking initiative

Sentiment: Positive

Read moreEthereum Foundation to Stake 70K ETH as Network Staking Approaches One-Third of Total Supply

Sentiment: Positive

Read moreBlackRock Moves $153M in BTC and ETH to Coinbase in Major Transfer Shift

Sentiment: Positive

Read moreTom Lee Declares ‘Mini Crypto Winter' Almost Gone as BitMine Goes Full Throttle On ETH Accumulation

Sentiment: Positive

Read moreSharplink posts $734M loss as Ethereum treasury grows to nearly 870K ETH

Sentiment: Negative

Read moreSharpLink Reports 2025 Results With Rapid ETH Growth and Heavy Volatility Losses

Sentiment: Positive

Read moreEthereum sees $18mln exchange inflows – Here's what happens next with ETH

Sentiment: Positive

Read morePrice predictions 3/9: SPX, DXY, BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH

Sentiment: Positive

Read moreTom Lee Predicts Ethereum To Bottom This Week As BitMine Buys 60,976 ETH

Sentiment: Positive

Read moreEthereum Foundation to stake 70K ETH as network staking nears one-third of supply

Sentiment: Positive

Read moreBitmine adds 61K ETH as prices hit $2K, Tom Lee says mini crypto winter may be ending

Sentiment: Positive

Read moreConsensys-backed SharpLink reports $734 million loss as ETH holdings climb

Sentiment: Negative

Read moreBitMine ETH holdings surge as treasury giant accelerates accumulation during crypto downturn

Sentiment: Positive

Read moreEthereum Rises to $2,000 as Tom Lee's BitMine Tops Up $9 Billion ETH Treasury

Sentiment: Positive

Read moreBitmine lifts Ethereum treasury to 4.53 million ETH after adding 60,976 tokens in a week amid ‘mini-crypto winter'

Sentiment: Positive

Read moreBreaking: Tom Lee's BitMine Acquires 60,976 ETH As BMNR Stock Eyes Recovery

Sentiment: Positive

Read moreETH Surges $2,013 Before Pulling Back, Charts Signal Consolidation Phase

Sentiment: Positive

Read moreEthereum Price Analysis: ETH Warning as Bearish Structure Persists Despite Recent Relief Bounce

Sentiment: Negative

Read moreETH Price Prediction: Ethereum Eyes $2,100 Recovery After Testing $1,890 Support

Sentiment: Positive

Read moreEthereum Co-Founder Dumps $158 Million ETH to Kraken, Sparking Fresh Market Jitters

Sentiment: Negative

Read moreEthereum (ETH) Whales Offset a Critical Transfer — Yet the $1,800 Zone Remains at Risk

Sentiment: Negative

Read moreETH and AI: How Ethereum's Decentralized Network Stands to Benefit from the Intelligence Revolution

Sentiment: Positive

Read moreEthereum Price Prediction: ETH Is Preparing for a Breakout From This Ascending Channel Formation

Sentiment: Positive

Read moreETH Tests the Crucial Zone That Defined Its Last Cycle: Could a 4x Rally Follow?

Sentiment: Positive

Read moreEthereum Co-Founder Sends $157 Million ETH to Kraken, Sparking Insider-Selling Fears

Sentiment: Negative

Read moreEthereum at a Breaking Point as ETH/BTC Stalls and $2,340 Comes Into View

Sentiment: Positive

Read moreBlackRock's Former Head of Crypto Explains How He Pitches ETH to Wall Street

Sentiment: Positive

Read morePrediction Markets Bet Bearish on BTC, ETH, and Stocks — But Do The Charts Agree?

Sentiment: Negative

Read moreEthereum co-founder Jeffrey Wilcke sends $157M in ETH to Kraken after months of wallet silence

Sentiment: Negative

Read moreEthereum Co-founder Sparks $157M Sell-Off Fears as ETH Struggles Below $2k

Sentiment: Negative

Read moreETH Price Prediction: Ethereum Tests Critical $2,000 Support as Bears Target $1,850

Sentiment: Negative

Read moreEthereum (ETH) Price Analysis: Whale Buying Intensifies as Network Staking Demand Explodes

Sentiment: Positive

Read moreCrypto Market Down Today: Bitcoin Price Falls to $68K as $302M Liquidations Hit BTC, ETH, XRP

Sentiment: Negative

Read moreEthereum Price Shows First Bullish Signal of 2026 as ETH Attempts Recovery Above $2,000

Sentiment: Positive

Read moreCrypto Market Review: Ethereum (ETH) Hits First Bullish Setup in 2026, Bitcoin Must Get Comfortable in $70,000s, Was Shiba Inu (SHIB) Price Neutralized?

Sentiment: Positive

Read moreEthereum Price Prediction: Whales Are Defending Critical $2,000 Level — Is ETH About to Explode Higher?

Sentiment: Positive

Read morePrice predictions 3/6: BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH, HYPE, XMR

Sentiment: Negative

Read moreETH Price Analysis: Ethereum Risks Dumping Below $2K Again as Momentum Fades

Sentiment: Negative

Read moreWhy funds short Ethereum as Culper Research targets ETH after Fusaka upgrade

Sentiment: Negative

Read moreCrypto Market Crash Alert: Institutions Trap Retail Ahead of BTC, ETH, XRP Options Expiry & Nonfarm Payrolls

Sentiment: Negative

Read moreEthereum (ETH) Price Struggles Below $2,200 Amid Macro Headwinds and ETF Outflows

Sentiment: Negative

Read moreWhy Ethereum's Record 29.6M ETH Turnover Signals A High-Velocity Speculative Trap

Sentiment: Negative

Read moreBitcoin drops under $71,000, ETH, DOGE slide as war-week rally runs into resistance

Sentiment: Negative

Read moreEthereum's Price Dips, But Bitmine Immersion Is Buying More ETH Through Market Chaos

Sentiment: Positive

Read moreCulper Research Shorts Ethereum, Claims Fusaka Upgrade Weakened ETH Tokenomics

Sentiment: Negative

Read moreIs Ethereum Waking Up? Binance ETH Turnover Hits 6-Month High as Volatility Returns

Sentiment: Positive

Read moreEthereum (ETH) Could Rally by Double Digits if This Key Condition Is Met

Sentiment: Positive

Read moreEthereum Hovers at $2,150 — Can ETH Price Rally to $2,400 or Stall Below $2,200?

Sentiment: Positive

Read moreCrypto Market Today: BTC, ETH, XRP, SOL, and DOGE Rally as Geopolitical Tensions Ease

Sentiment: Positive

Read moreFrom Bear Trap to Breakout? Ethereum (ETH) Tests a Crucial Momentum Shift After a 7% Jump

Sentiment: Positive

Read moreEthereum (ETH) Surges Past $2,200 as Short Squeeze and ETF Inflows Drive Price Recovery

Sentiment: Positive

Read moreWhy is the Crypto Market Rising Today? Top Factors Impacting BTC, ETH & XRP Prices

Sentiment: Positive

Read moreMassive ETH Outflow From Binance to Anonymous Wallet as Price Turns Green

Sentiment: Positive

Read morePrice predictions 3/4: BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH, HYPE, LINK

Sentiment: Positive

Read moreEthereum Price Prediction: $2,750 in Sight if ETH Breaks This Resistance

Sentiment: Positive

Read more77,000 ETH Gone From Binance to Anon Wallet as Crypto Market Goes Back to Green

Sentiment: Positive

Read moreAlmost 40% of altcoins linger near lows while BTC and ETH lead market rebound

Sentiment: Negative

Read more31.6 Million ETH Leaves Exchanges as Vitalik Calls for Ethereum “Sanctuary” Tech

Sentiment: Positive

Read moreEthereum (ETH) Price: Major Holders Accumulate 320K Coins Amid Surging Network Usage

Sentiment: Positive

Read moreTom Lee's Bitmine bets on Ethereum again with fresh 50K ETH buy – Details

Sentiment: Positive

Read moreETH Price Prediction: Ethereum Eyes $2,300 Recovery Despite Technical Weakness

Sentiment: Positive

Read moreEthereum's 2020 Throwback: How A 3.46M ETH Supply Floor Creates A Liquidity Void

Sentiment: Negative

Read moreHistorical Values

-

Now

Greed 71 -

Yesterday

Neutral 71 -

7 Days Ago

Greed 67 -

1 Month Ago

Greed 67

Ethereum Breakdown

Price Score Greed

The Price Score indicator is a relevant indicator to analyze and assign the Ethereum price evolution a certain numerical value.

This module studies the price trend to determine if the Ethereum market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Ethereum price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the Ethereum Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Ethereum bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Greed

The Impulse indicator measures the current Ethereum price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Ethereum market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Extreme Greed

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Ethereum the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Extreme Greed

Dominance Neutral

This other indicator takes into account the dominance of Ethereum with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Ethereum's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Ethereum and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Extreme Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Ethereum has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Ethereum. For this, specific search terms are used that determine the purchasing or ceding interest of Ethereum, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Extreme Fear

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Ethereum and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Ethereum moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Extreme Greed

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Ethereum on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

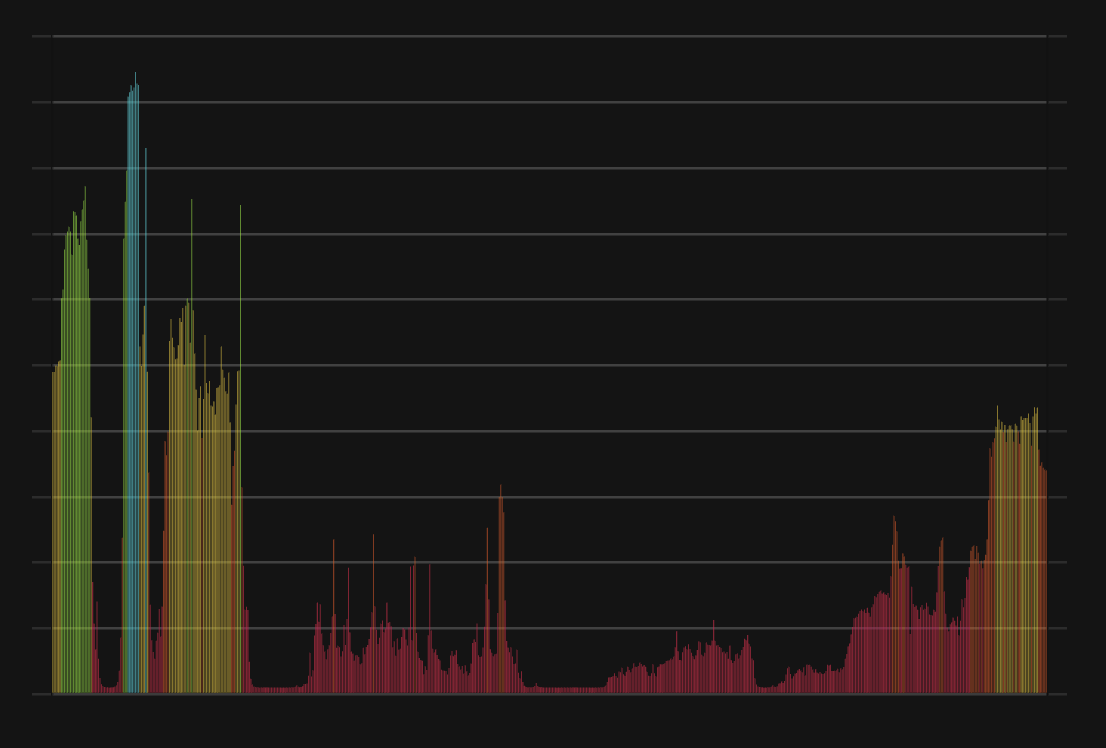

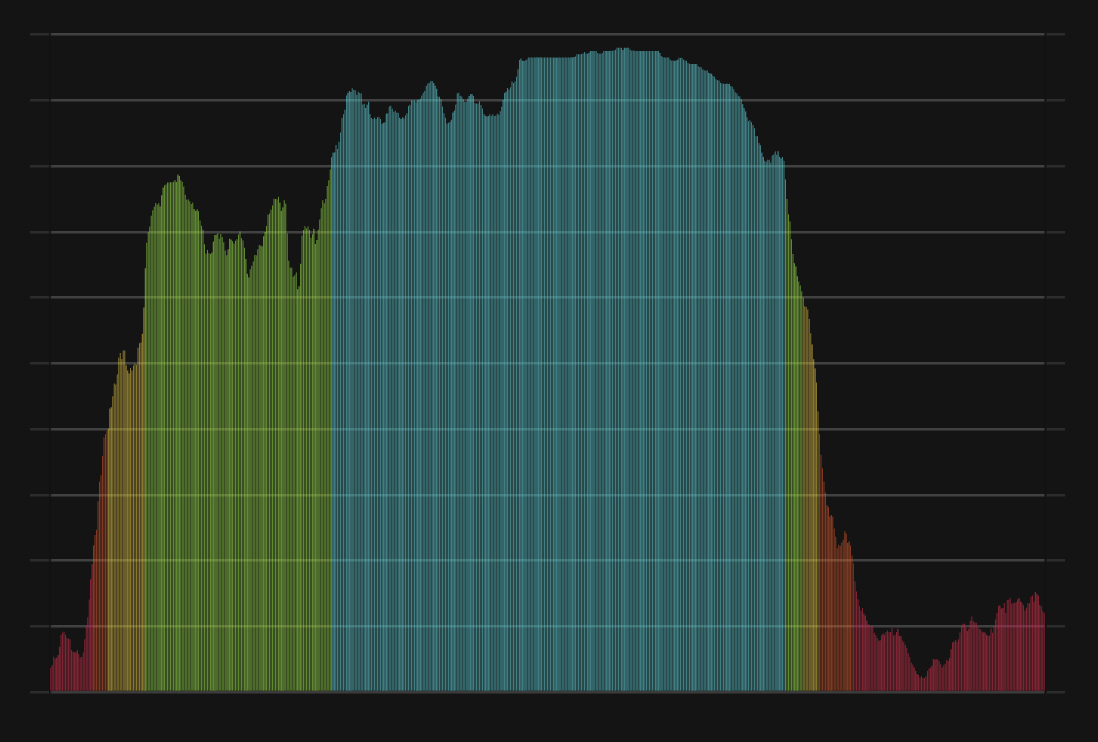

ETH Price

1 ETH = $2,061.33

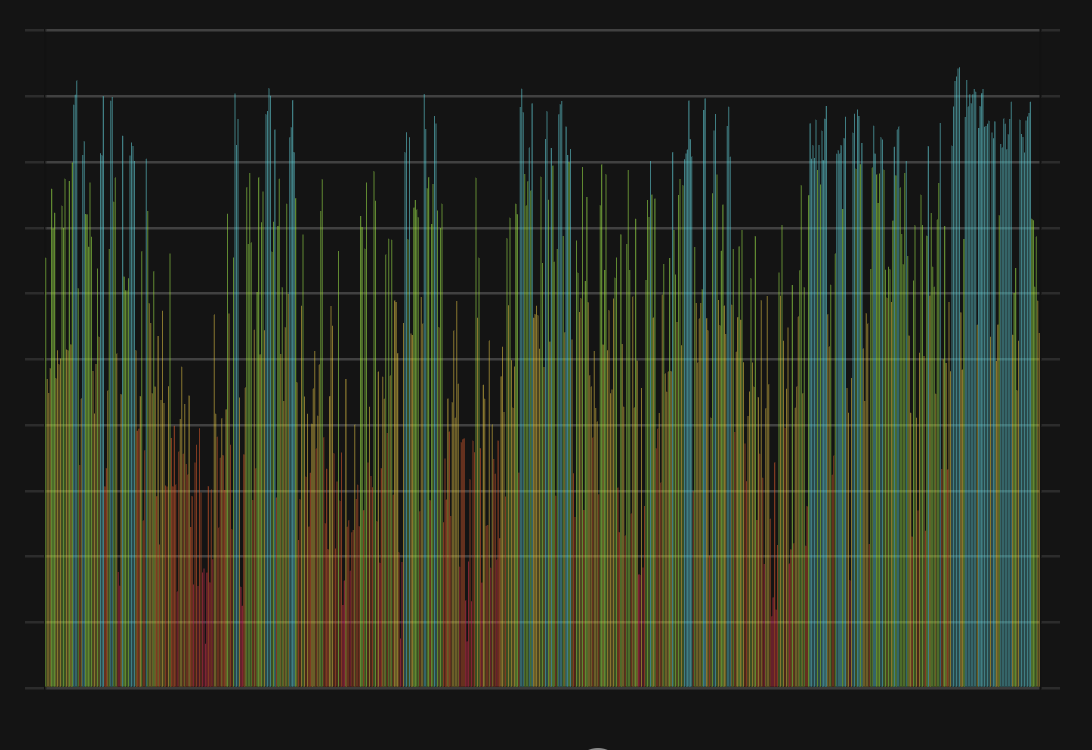

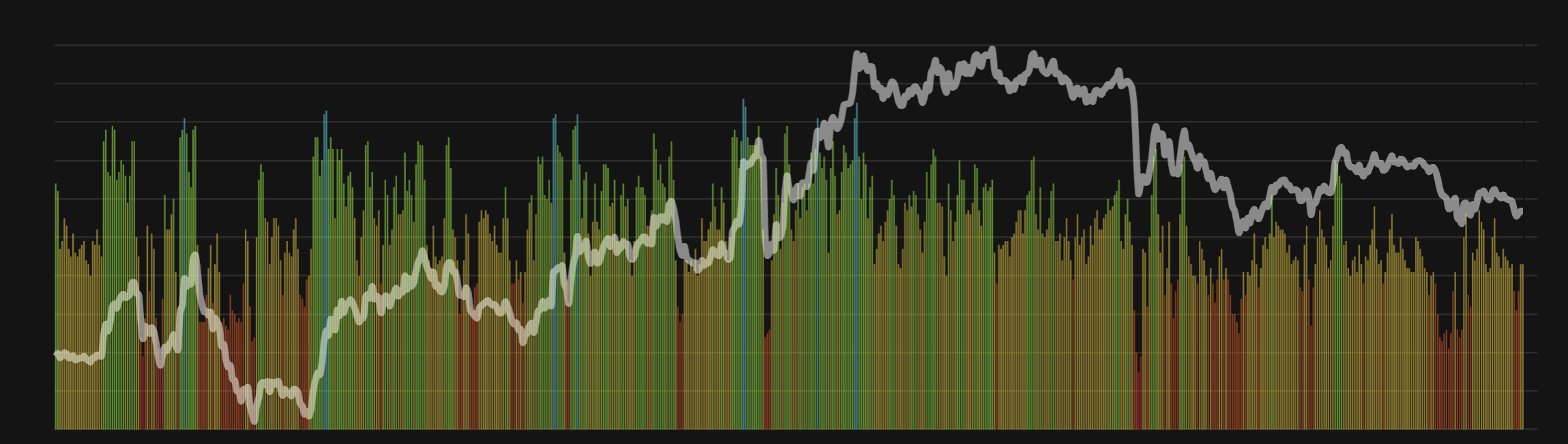

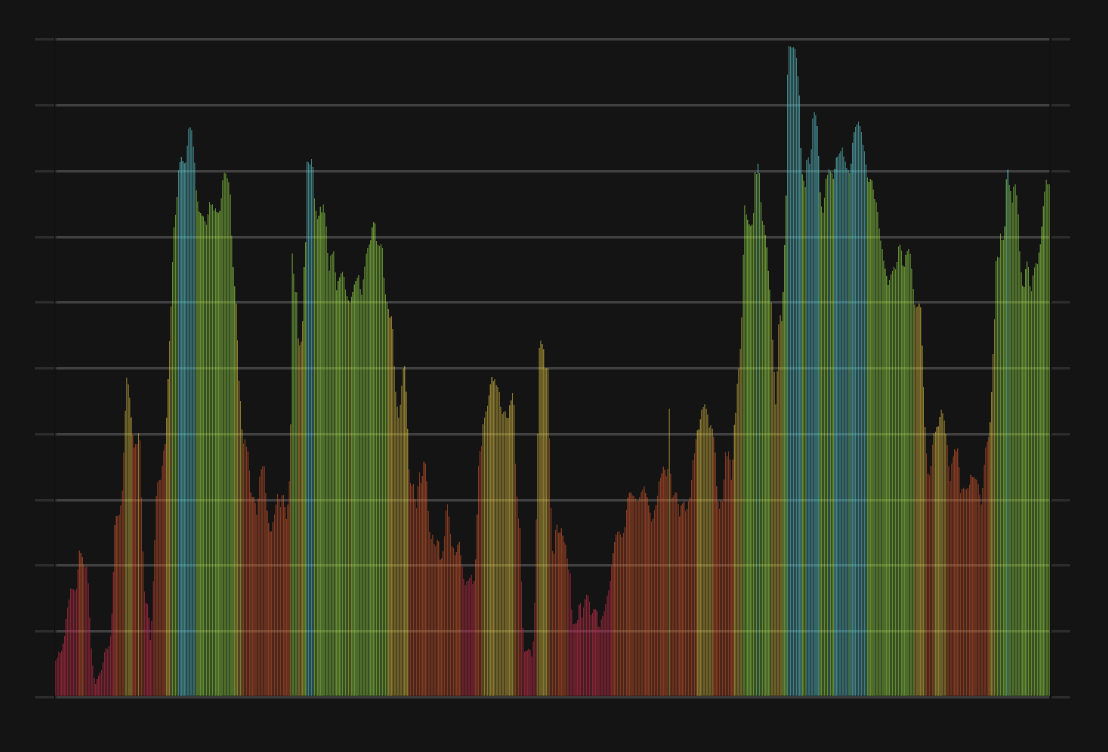

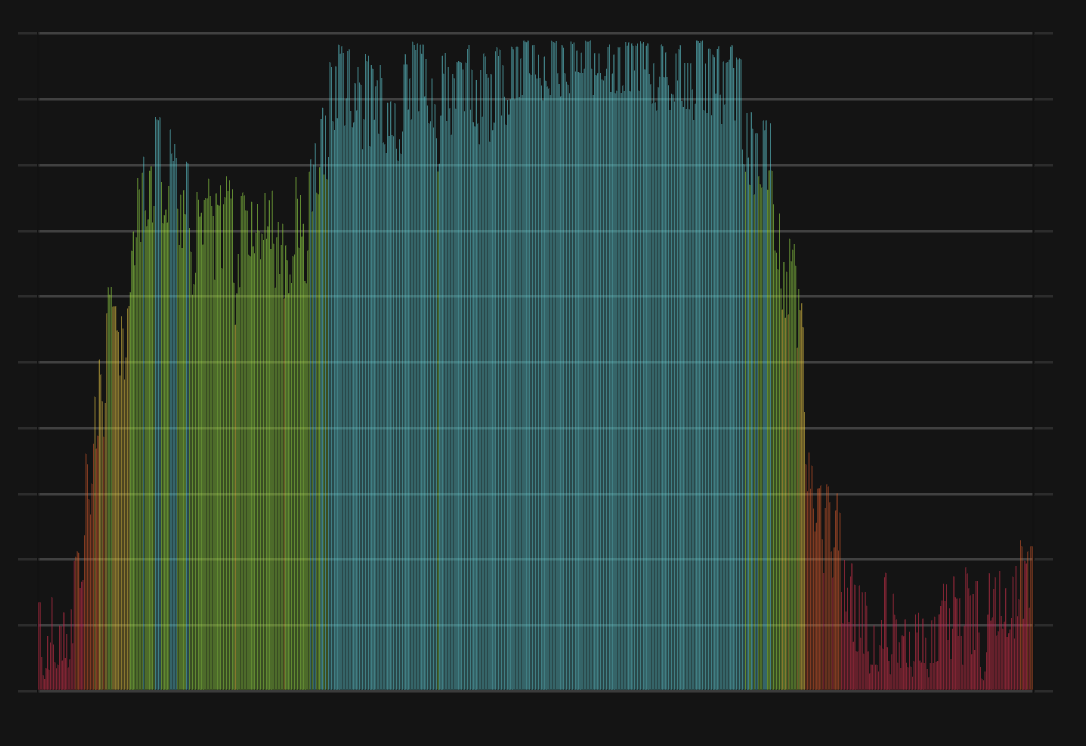

Ethereum CFGI Score & ETH Price History

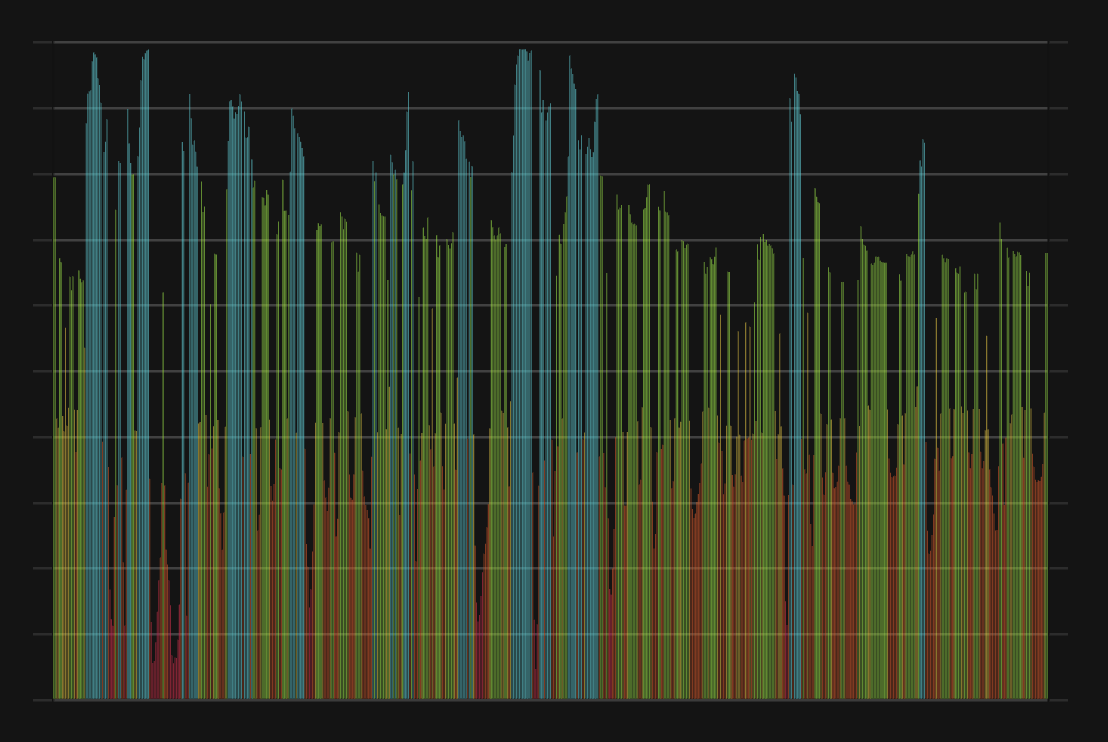

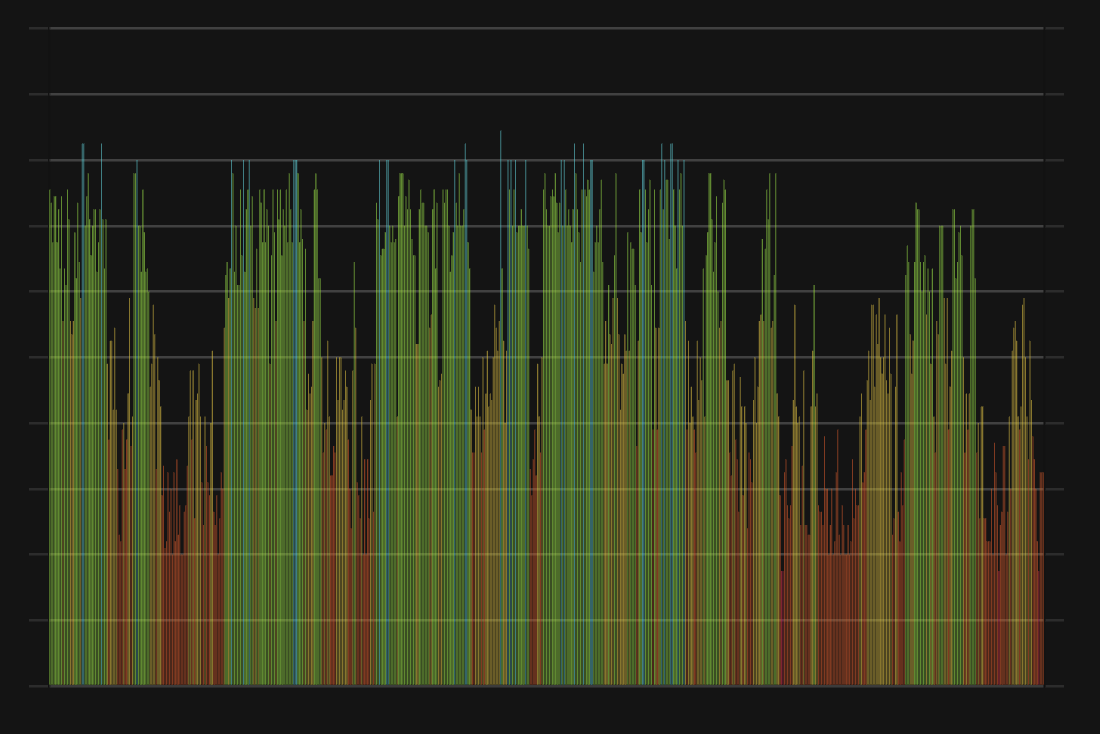

ETH Price & Ethereum Sentiment Breakdown Charts

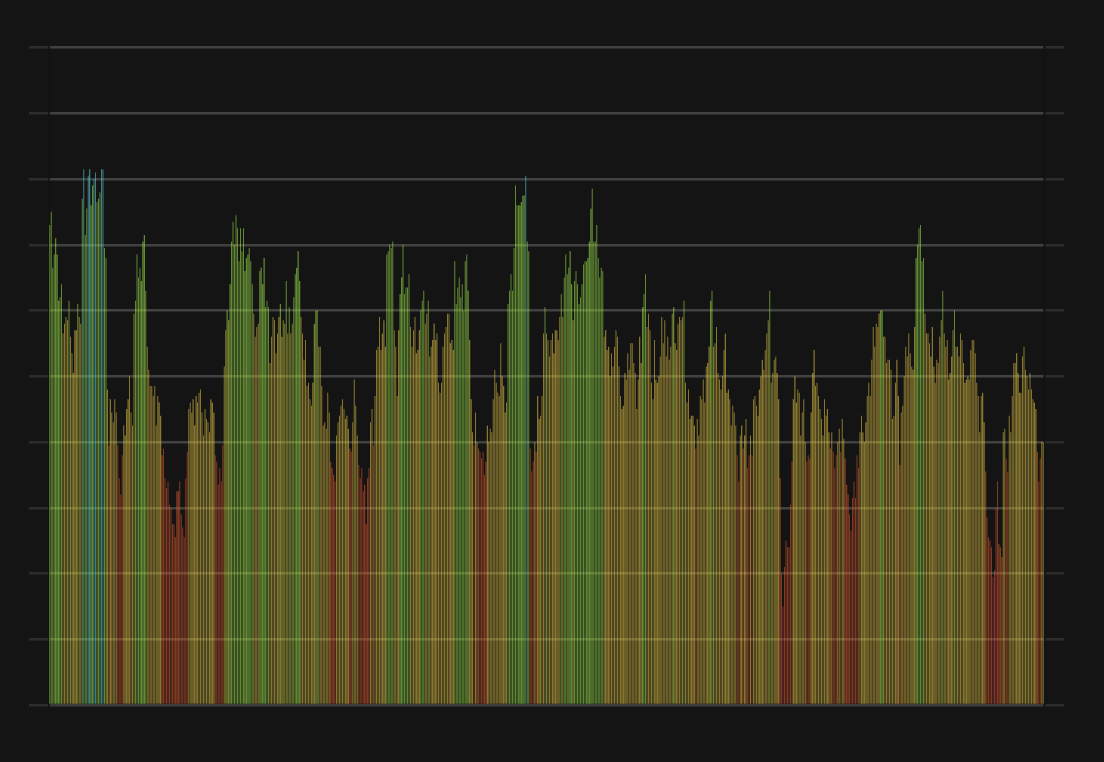

Price Score Sentiment

Volatility Sentiment

Volume Sentiment

Impulse Sentiment

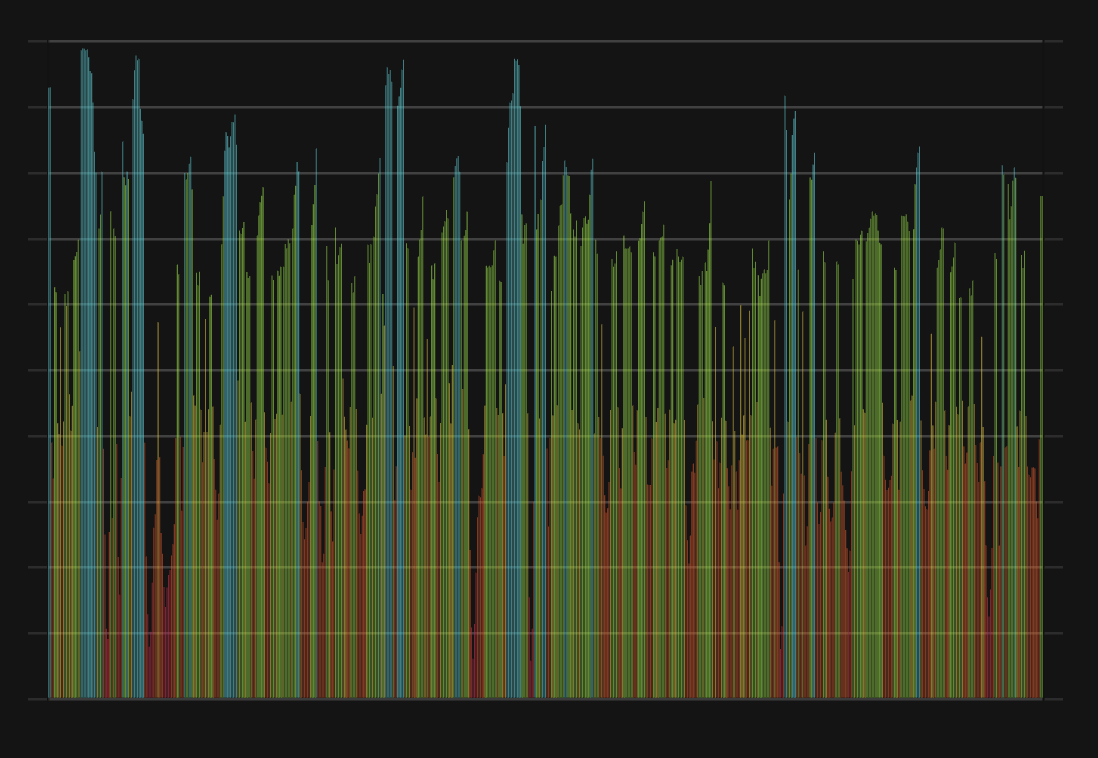

Technical Sentiment

Social Sentiment

Dominance Sentiment

Search Sentiment

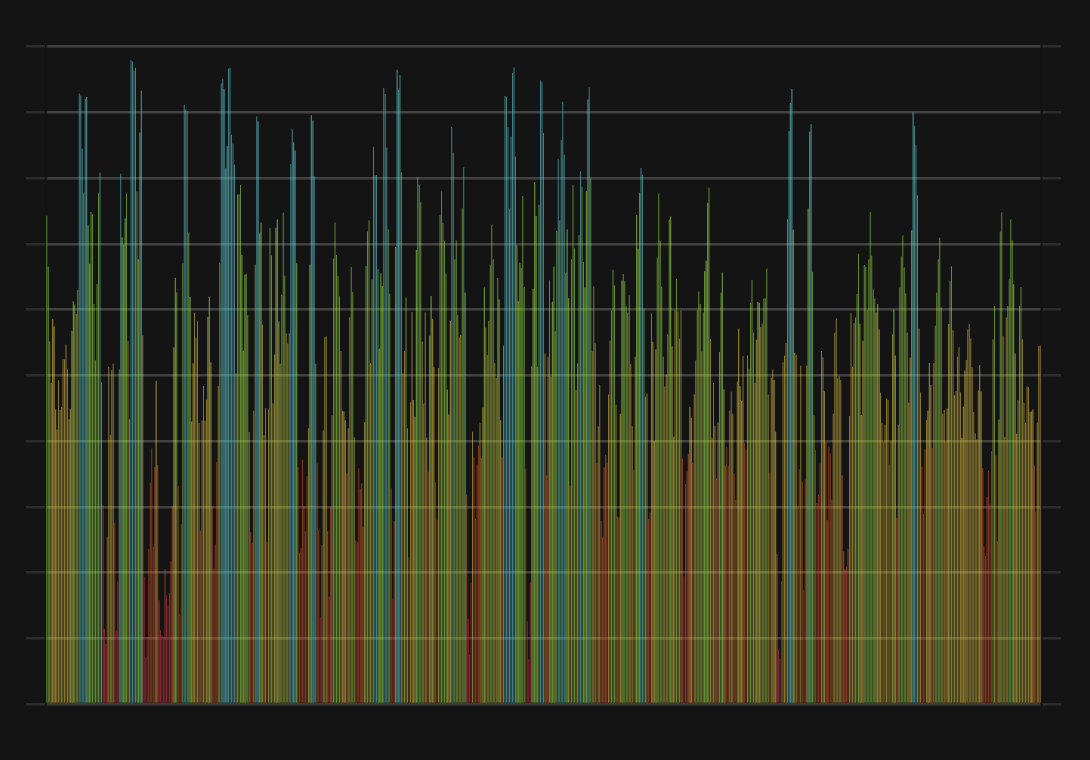

Whales Sentiment

Order Book Sentiment