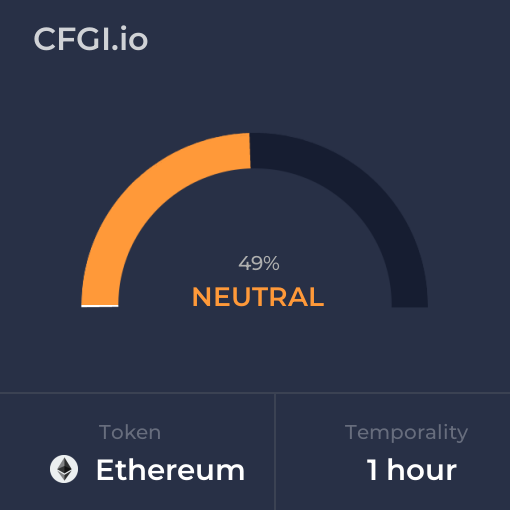

Historical Values

-

Now

Fear 36 -

Yesterday

Fear 36 -

7 Days Ago

Fear 36 -

1 Month Ago

Fear 36

Ethereum Breakdown

Price Score Fear

The Price Score indicator is a relevant indicator to analyze and assign the Ethereum price evolution a certain numerical value.

This module studies the price trend to determine if the Ethereum market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Ethereum price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the Ethereum Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Ethereum bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Neutral

The Impulse indicator measures the current Ethereum price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Ethereum market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Fear

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Ethereum the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Extreme Fear

Dominance Extreme Greed

This other indicator takes into account the dominance of Ethereum with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Ethereum's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Ethereum and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Extreme Fear

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Ethereum has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Ethereum. For this, specific search terms are used that determine the purchasing or ceding interest of Ethereum, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Extreme Fear

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Ethereum and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Ethereum moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Fear

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Ethereum on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

Ethereum News

Ethereum News

Tom Lee Bets Big on Ethereum With 51,162 ETH Purchase as Vitalik Buterin Sells $21 Million Worth

Sentiment: Neutral

Read moreEthereum (ETH) Bounces After 90% Selling Pressure Collapse — Bigger Move Coming?

Sentiment: Positive

Read moreVitalik Buterin Continues ETH Sales Through CoW Swap: Here is the Reason

Sentiment: Negative

Read moreBitMine Supercharges Ethereum Hoard to 4.42M ETH Even As Prices Slide To 2-Week Lows

Sentiment: Positive

Read morePrice predictions 2/23: SPX, DXY, BTC, ETH, XRP, BNB, SOL, DOGE, BCH, ADA

Sentiment: Negative

Read moreBitMine Buys 51,000 ETH As Ethereum Co-Founder Vitalik Buterin Sells Again

Sentiment: Positive

Read moreDigital Asset Treasury Firm Bitmine Adds 51,162 ETH Amid Market Pullback

Sentiment: Positive

Read moreBitmine ups Ethereum treasury stake to 4.42 million ETH, now holds 3.66% of supply

Sentiment: Positive

Read moreEther Risks Deeper Slide As Founder Vitalik Buterin Accelerates Multi-Million ETH Sales

Sentiment: Negative

Read moreBreaking: Tom Lee's BitMine Adds 51,162 ETH Amid Vitalik Buterin's Ethereum Sales

Sentiment: Positive

Read moreETH Price Prediction: Ethereum Eyes $2,041 Recovery as Technical Indicators Signal Potential Bounce

Sentiment: Positive

Read moreETH RSI Resets to Historical Lows as Momentum Cycles Grow Shorter Each Year

Sentiment: Negative

Read moreCrypto Market Update Today: BTC and ETH Slide Below Key Levels—Is More Downside Ahead?

Sentiment: Negative

Read moreCrypto Market Crash: Here's Why Bitcoin, ETH, XRP, SOL, ADA Are Falling Sharply

Sentiment: Negative

Read moreVitalik Buterin Sold Over 8,800 ETH in February: Did It Impact the Price?

Sentiment: Negative

Read moreVitalik's $6.95M ETH Move: Personal Agenda or Ethereum Foundation Strategy?

Sentiment: Negative

Read moreBitcoin see-saws around $68,000, DOGE, ETH slide as tariff uncertainty weighs on risk assets

Sentiment: Negative

Read moreMorning Crypto Report: XRP on the Edge vs Bitcoin as February Ends, Vitalik Buterin Donates More ETH for Charity, Shiba Inu (SHIB) May Challenge PayPal USD in March

Sentiment: Neutral

Read moreETH, XRP, SOL, BNB, ADA Kick Off Push As Historical Data Reads Extremely Bullish

Sentiment: Positive

Read moreEthereum Whales Underwater—Is This the ETH Price Capitulation or a Calm Before a Strong Rebound?

Sentiment: Positive

Read moreInside Vitalik Buterin's Wallet: How Much Ethereum (ETH) Does He Actually Own?

Sentiment: Neutral

Read moreXRP Vs. ADA Vs. LINK Vs. ETH: Which Alt Is More Undervalued and Has the Biggest Upside?

Sentiment: Positive

Read moreBitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore' of Crypto Amid Market Weakness

Sentiment: Positive

Read moreTop Bluechip Crypto Flash Undervalued Signals: Is Is a Relief Rally Brewing in BTC, ETH, XRP, ADA, & LINK?

Sentiment: Positive

Read moreEvery Ethereum Whale Cohort Now Underwater: ETH Capitulation Marking The Final Bottom?

Sentiment: Negative

Read morePrice predictions 2/20: BTC, ETH, XRP, BNB, SOL, DOGE, BCH, ADA, HYPE, XMR

Sentiment: Negative

Read moreEthereum Whale Profits Turn Negative: Will Whale Pressure Trigger a Sell-Off for ETH Price?

Sentiment: Negative

Read moreEthereum's 2026 roadmap just hit — but ETH won't recover until one metric flips

Sentiment: Negative

Read moreEthereum Whales Dump $2.7 Billion in ETH, but Bottom Signals Are Flashing

Sentiment: Negative

Read moreTom Lee's Bitmine snaps up 45,000 ETH in rapid two-day accumulation: Onchain data

Sentiment: Positive

Read moreWill Bitcoin, ETH, XRP, Solana Rebound to Max Pain Price amid Short Liquidations Today?

Sentiment: Positive

Read moreETH Price Prediction: Ethereum Eyes $2,200 Recovery After Testing Critical Support

Sentiment: Positive

Read moreETH Whales Are Quietly Buying the Dip: On-Chain Data Reveals What's Really Happening

Sentiment: Positive

Read moreEthereum Treasury Sharplink Reports Growing ETH Holdings, Institutional Investment

Sentiment: Positive

Read moreSharplink Increases Ethereum Holdings to 867,798 ETH with Staking Rewards

Sentiment: Positive

Read moreEthereum ETFs Break 4-Week Outflow Streak — Can ETH Price Finally Recover?

Sentiment: Positive

Read moreBreaking: CME Group To Launch 24/7 BTC, ETH, XRP, SOL Futures Trading On May 29

Sentiment: Positive

Read moreCrypto Market Turns Red With Bitcoin Under $66K and ETH Breaking $2K Support

Sentiment: Negative

Read moreEthereum Outlines 2026 Protocol Priorities: What It Could Mean for ETH Price

Sentiment: Positive

Read moreCrypto Market Slides as Hawkish FOMC Minutes Trigger BTC, ETH, XRP Sell-Off

Sentiment: Negative

Read moreBitMine Expands Ethereum Holdings as ETH Staking Surpasses 50% of Total Supply

Sentiment: Positive

Read more$91M Ethereum Buy: Bitmine Immersion Bets Big On ETH Even As Market Volatility Persists

Sentiment: Positive

Read moreEthereum Staking Surpasses 50% of Issued ETH, Sparking Debate Over Supply Metrics

Sentiment: Positive

Read morePeter Thiel dumps all ETH treasury shares after “Ethereum's MicroStrategy” fell 95% since August

Sentiment: Negative

Read moreBitMine Adds 20,000 ETH As Staked Ethereum Surpasses Half Of Total Supply

Sentiment: Positive

Read morePrice predictions 2/18: BTC, ETH, XRP, BNB, SOL, DOGE, BCH, ADA, HYPE, XMR

Sentiment: Negative

Read moreEthereum Price Prediction: This Metric Says ETH is Heavily Undervalued at $2K

Sentiment: Positive

Read moreEthereum News: Peter Thiel Exits ETH Treasury Firm ETHZilla Amid Ethereum Price Collapse

Sentiment: Negative

Read moreEthereum Price Prediction: What Happens to ETH if $2K Support Is Decisively Lost?

Sentiment: Negative

Read moreHistorical Values

-

Now

Fear 36 -

Yesterday

Neutral 36 -

7 Days Ago

Fear 31 -

1 Month Ago

Fear 34

Ethereum Breakdown

Price Score Fear

The Price Score indicator is a relevant indicator to analyze and assign the Ethereum price evolution a certain numerical value.

This module studies the price trend to determine if the Ethereum market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Ethereum price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the Ethereum Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Ethereum bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Neutral

The Impulse indicator measures the current Ethereum price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Ethereum market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Fear

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Ethereum the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Extreme Fear

Dominance Extreme Greed

This other indicator takes into account the dominance of Ethereum with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Ethereum's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Ethereum and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Extreme Fear

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Ethereum has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Ethereum. For this, specific search terms are used that determine the purchasing or ceding interest of Ethereum, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Extreme Fear

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Ethereum and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Ethereum moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Fear

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Ethereum on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

ETH Price

1 ETH = $1,825.45

Ethereum CFGI Score & ETH Price History

ETH Price & Ethereum Sentiment Breakdown Charts

Price Score Sentiment

Volatility Sentiment

Volume Sentiment

Impulse Sentiment

Technical Sentiment

Social Sentiment

Dominance Sentiment

Search Sentiment

Whales Sentiment

Order Book Sentiment