Historical Values

-

Now

Neutral 54 -

Yesterday

Neutral 54 -

7 Days Ago

Neutral 54 -

1 Month Ago

Neutral 54

Cardano Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Cardano price evolution a certain numerical value.

This module studies the price trend to determine if the Cardano market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Cardano price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the Cardano Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Cardano bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Greed

The Impulse indicator measures the current Cardano price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Cardano market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Fear

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Cardano the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Greed

Dominance Neutral

This other indicator takes into account the dominance of Cardano with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Cardano's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Cardano and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Extreme Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Cardano has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Cardano. For this, specific search terms are used that determine the purchasing or ceding interest of Cardano, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Neutral

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Cardano and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Cardano moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Extreme Greed

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Cardano on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

Cardano News

Cardano News

Cardano (ADA) Attracts Fresh Institutional Capital As Grayscale Expands Holdings

Sentiment: Positive

Read moreCardano Whales Load Up With $161M Buying Spree—But This Support Level Determines ‘Wen $1 ADA'

Sentiment: Positive

Read moreImportant Coinbase Announcement Concerning XRP, ADA, and Other Altcoin Investors

Sentiment: Positive

Read moreCoinbase Expands Crypto-Backed Loans to XRP, ADA, Dogecoin, and Litecoin Holders

Sentiment: Positive

Read moreCardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

Sentiment: Positive

Read moreAnalyst Predictions of $10 ADA Price Gain Traction as Cardano Earns Praise for Research-First Approach

Sentiment: Positive

Read moreCardano's Trading Activity Crashes to a 6-Month Low — Can ADA Still Attempt a Reversal?

Sentiment: Negative

Read moreCoinbase Expands Crypto-Backed Loans to XRP, DOGE, ADA and Litecoin Across the U.S.

Sentiment: Positive

Read moreCoinbase lets XRP, ADA and dogecoin holders borrow up to $100,000 without selling

Sentiment: Positive

Read moreCoinbase adds support for XRP, DOGE, ADA, LTC as loan collateral via Morpho

Sentiment: Positive

Read moreCoinbase Expands Onchain Lending With XRP, DOGE, ADA, and LTC Collateral

Sentiment: Positive

Read moreADA Futures Open Interest Fails to Break $500M, Signaling Weak Trader Conviction

Sentiment: Negative

Read morePrice predictions 2/18: BTC, ETH, XRP, BNB, SOL, DOGE, BCH, ADA, HYPE, XMR

Sentiment: Negative

Read moreCardano's “Ethereum Moment” Coming? Analyst Eyes $6-$10 Target as ADA Enters Accumulation Range

Sentiment: Positive

Read moreCardano Bounces, But Bearish Structure Remains—Can the Bulls Push ADA Price to $0.5

Sentiment: Negative

Read moreADA Price Prediction: Cardano Eyes $0.31 Recovery as Technical Indicators Signal Potential Breakout

Sentiment: Positive

Read moreMorning Crypto Report: XRP Not Ready for $1.50: Bollinger Bands, Cardano Foundation Votes 'Yes' on 500,000 ADA Withdrawal, Kiyosaki Details 'Rich Dad' Bitcoin Strategy

Sentiment: Positive

Read morePrice predictions 2/16: SPX, DXY, BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH

Sentiment: Negative

Read moreCardano (ADA) Back in ‘Survival Mode' Despite Whale Accumulation and DeFi Expansion Plans

Sentiment: Negative

Read moreCardano's $0.244 defense returns, but will on-chain activity pull ADA down?

Sentiment: Negative

Read moreCardano (ADA) Reclaims $10 Billion Market Cap, But Top 10 Bar Is Now Higher

Sentiment: Positive

Read moreADA Price Prediction: Cardano Eyes $0.32 Resistance Test as Bulls Target March Rally

Sentiment: Positive

Read moreADA Price in Focus as Cardano Expands Interoperability and Post-Quantum Push

Sentiment: Positive

Read morePundit Predicts Cardano Rocket to $10 ADA Price as CME Futures Launch Unlocks Institutional Floodgates

Sentiment: Positive

Read moreBitcoin, ETH, SOL, ADA, BNB, XRP Remain Under Pressure After Coinbase's $667 Million Loss

Sentiment: Negative

Read morePrice predictions 2/13: BTC, ETH, BNB, XRP, SOL, DOGE, BCH, HYPE, ADA, XMR

Sentiment: Positive

Read moreCardano (ADA) Price Analysis: Support Holds at $0.25 Amid Market-Wide Pullback

Sentiment: Neutral

Read moreADA Hits Most Oversold Levels in History as Grayscale Drops Cardano From Large Cap Fund

Sentiment: Negative

Read moreADA Price Rallies 4% as Cardano Foundation Secures LayerZero Integration

Sentiment: Positive

Read moreCardano Price Prediction: CME Cardano Futures Launch Triggers 3% ADA Dip

Sentiment: Negative

Read moreCardano (ADA) rises 5% as funding rates flip bullish, eyes $0.30 breakout

Sentiment: Positive

Read morePrice predictions 2/11: BTC, ETH, BNB, XRP, SOL, DOGE, BCH, HYPE, ADA, XMR

Sentiment: Neutral

Read moreADA Price Prediction: Targets $0.30-$0.35 Recovery by March as Technical Indicators Signal Oversold Bounce

Sentiment: Positive

Read moreCardano Price Today: ADA Stuck Near Lows as Market Trades in Extreme Fear

Sentiment: Negative

Read moreAre Cardano Investors Exiting? ADA Open Interest Collapses In Sudden Derivatives Reset

Sentiment: Negative

Read moreADA Price Prediction: Cardano Eyes $0.31 Recovery Despite Technical Weakness

Sentiment: Positive

Read moreCME Adds ADA, XLM Futures in Move That Could Reshape Institutional Crypto Demand

Sentiment: Positive

Read morePrice predictions 2/9: SPX, DXY, BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH

Sentiment: Positive

Read moreCME Adds Cardano (ADA) and Stellar (XLM) Futures: Are XRP and Solana (SOL) About to Lose Their Institutional Edge?

Sentiment: Positive

Read moreGrayscale Drops Cardano From Large Cap Fund as ADA Hits Most Oversold Levels in History

Sentiment: Negative

Read more‘Falling Knife': Gemini and ChatGPT Predict Shocking Lows for Cardano's ADA

Sentiment: Negative

Read moreCardano (ADA) Make-or-Break Moment: Why $0.13 Could Trigger a 4,500% Expansion

Sentiment: Positive

Read moreCardano ADA Price Jumps 10%: Will Institutional Buying Trigger a Bigger Rally?

Sentiment: Positive

Read morePrice predictions 2/6: BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH, HYPE, XMR

Sentiment: Neutral

Read more“I've Lost $3 Billion”: Cardano Founder Hoskinson Defends Crypto Vision as ADA Crashes 92%

Sentiment: Negative

Read moreMorning Crypto Report: One of Biggest XRP Sellers Revealed, -80% for Cardano (ADA): Founder Admits $3 Billion Loss, Binance Delists 20 Pairs After $2.6 Billion Liquidation Tsunami: Bitcoin Affected Too

Sentiment: Negative

Read moreCardano Price Forecast Turns Bearish as ADA Loses ETF Ground and $0.29 Support Weakens

Sentiment: Negative

Read moreADA Loses Position in Top 10 as Cardano Introduces Artificial Intelligence Tools

Sentiment: Negative

Read moreCardano Creator Calls on ADA Community Amid $1.05 Billion Crypto Bloodbath

Sentiment: Negative

Read moreCardano Whales Add 100M ADA While Long-Term Holder Selling Collapses 99% as Historically Bullish Metric Reappears

Sentiment: Positive

Read moreADA Price Prediction: Oversold Cardano Targets $0.31-$0.35 Recovery by March 2026

Sentiment: Positive

Read morePrice predictions 2/4: BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH, HYPE, XMR

Sentiment: Negative

Read moreADA Price Prediction: Cardano Eyes $0.44 Recovery by March 2026 Despite Technical Headwinds

Sentiment: Positive

Read moreADA Falls Out of Top 10 Ranking While Hyperliquid Surges, Is Cardano Losing Its Edge?

Sentiment: Negative

Read moreCardano Price Prediction: ADA Just Touched a Level That Sparked Explosive Rallies in the Past – Is It About to Repeat?

Sentiment: Positive

Read moreADA Price Alert: Why Cardano Investors Are Moving Assets to Self-Custody Now

Sentiment: Negative

Read moreADA Price Holds Firm After ETF Filing Sparks Institutional Interest: Can Cardano See a Recovery Ahead?

Sentiment: Positive

Read moreCrypto prices today (Feb. 3): BTC, BNB, ADA, AVAX rebound as liquidations ease

Sentiment: Positive

Read moreCardano Price Prediction: 2026 Hard Fork Update Drops – Is This the Upgrade That Changes Everything for ADA?

Sentiment: Positive

Read moreHistorical Values

-

Now

Neutral 54 -

Yesterday

Neutral 54 -

7 Days Ago

Neutral 52 -

1 Month Ago

Neutral 49

Cardano Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Cardano price evolution a certain numerical value.

This module studies the price trend to determine if the Cardano market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Cardano price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the Cardano Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Cardano bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Greed

The Impulse indicator measures the current Cardano price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Cardano market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Fear

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Cardano the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Greed

Dominance Neutral

This other indicator takes into account the dominance of Cardano with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Cardano's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Cardano and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Extreme Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Cardano has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Cardano. For this, specific search terms are used that determine the purchasing or ceding interest of Cardano, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Neutral

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Cardano and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Cardano moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Extreme Greed

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Cardano on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

ADA Price

1 ADA = $0.28

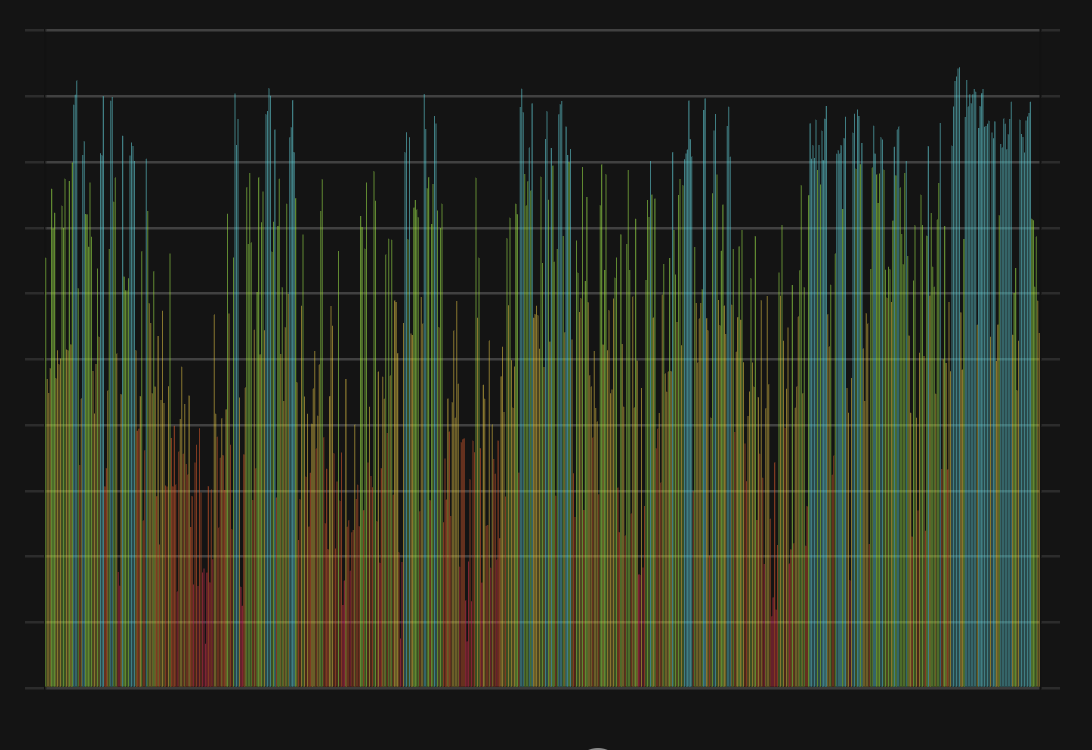

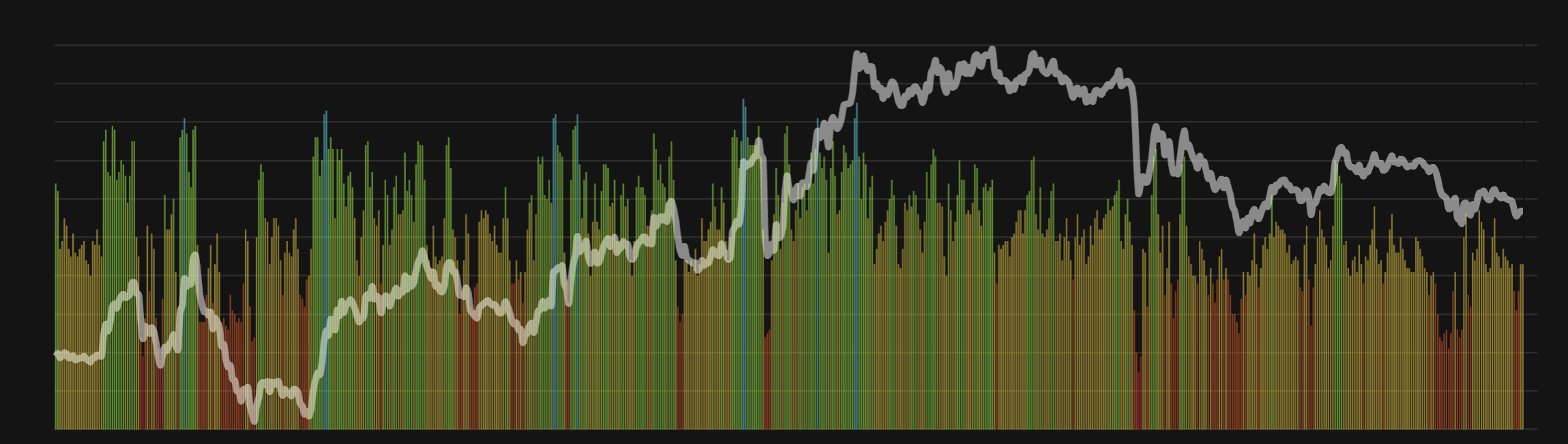

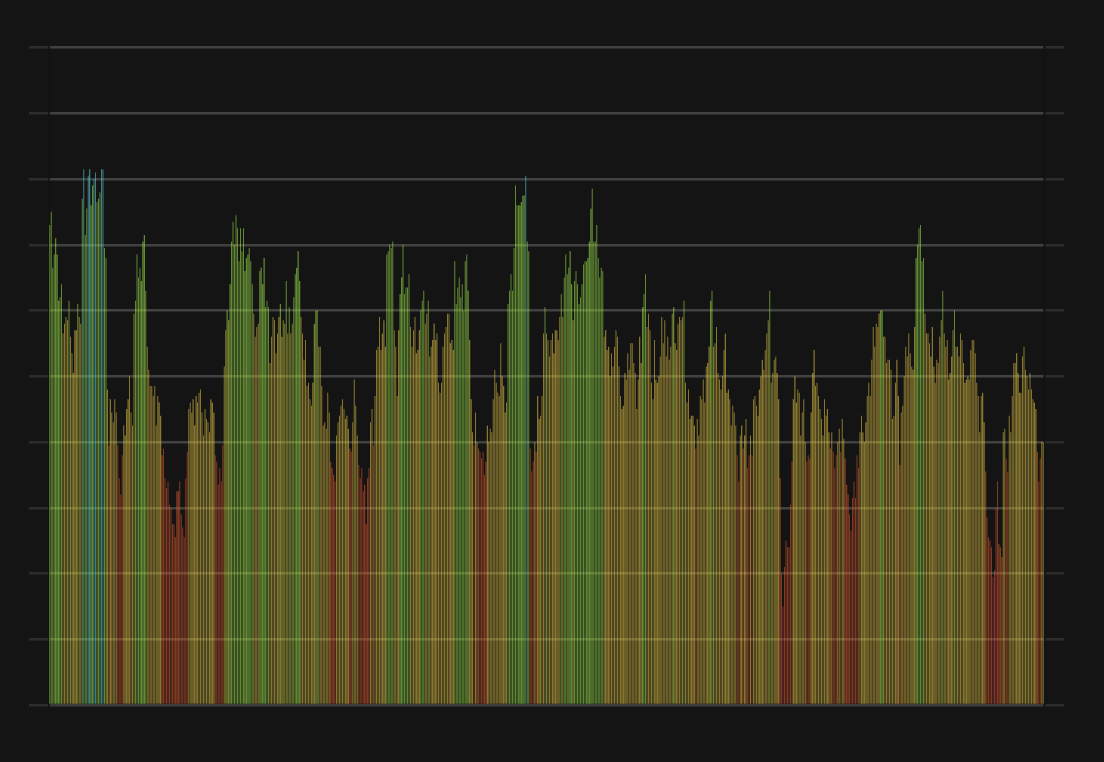

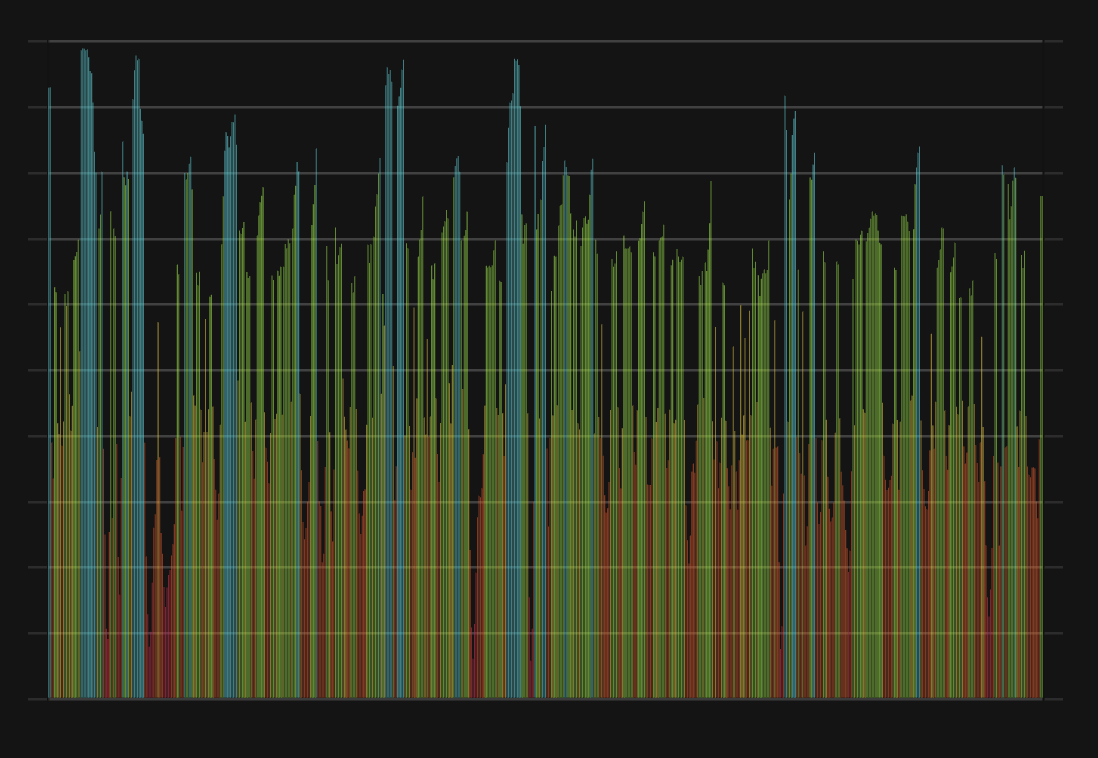

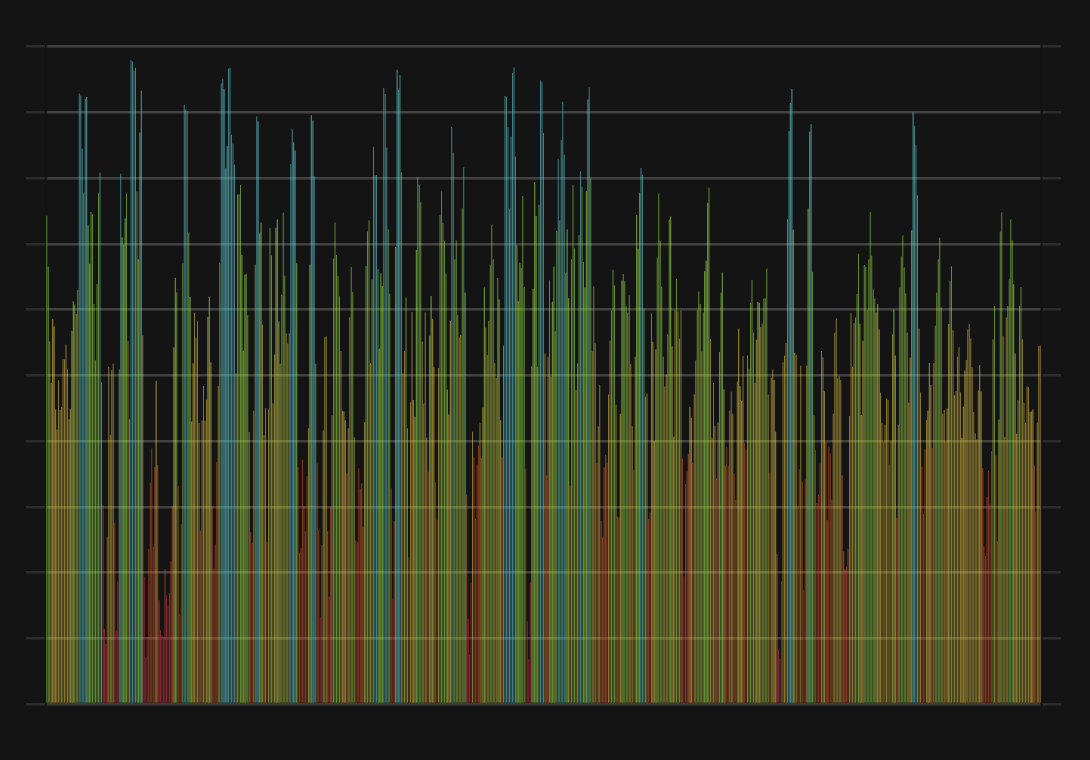

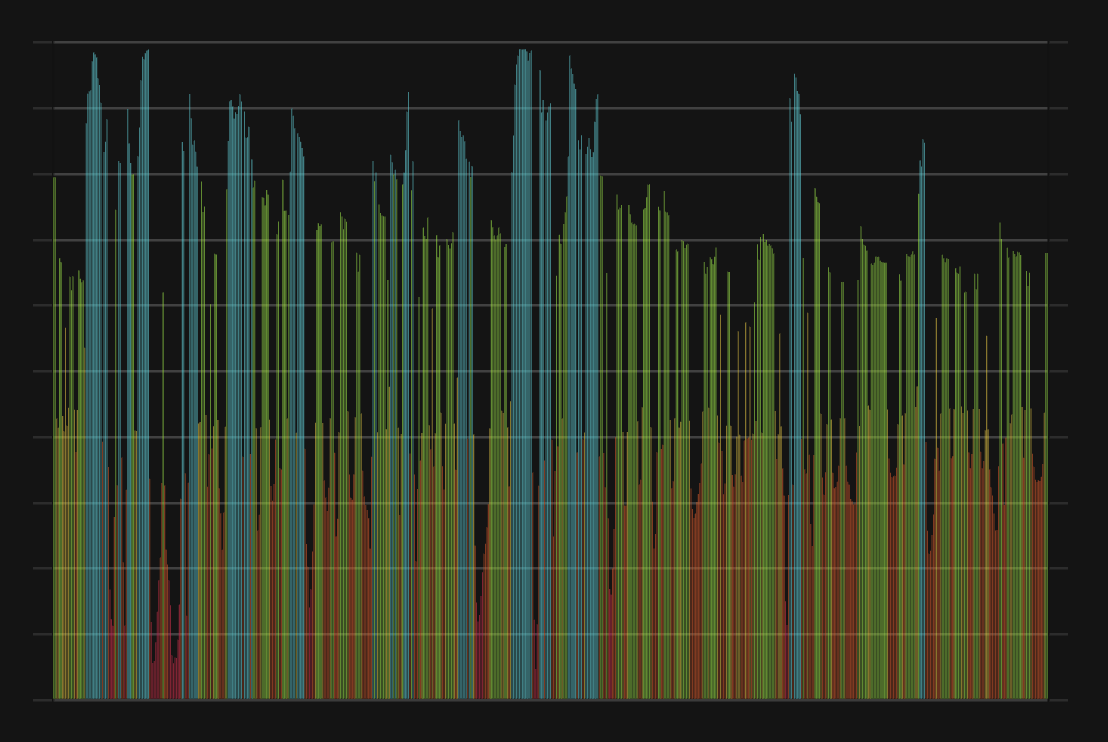

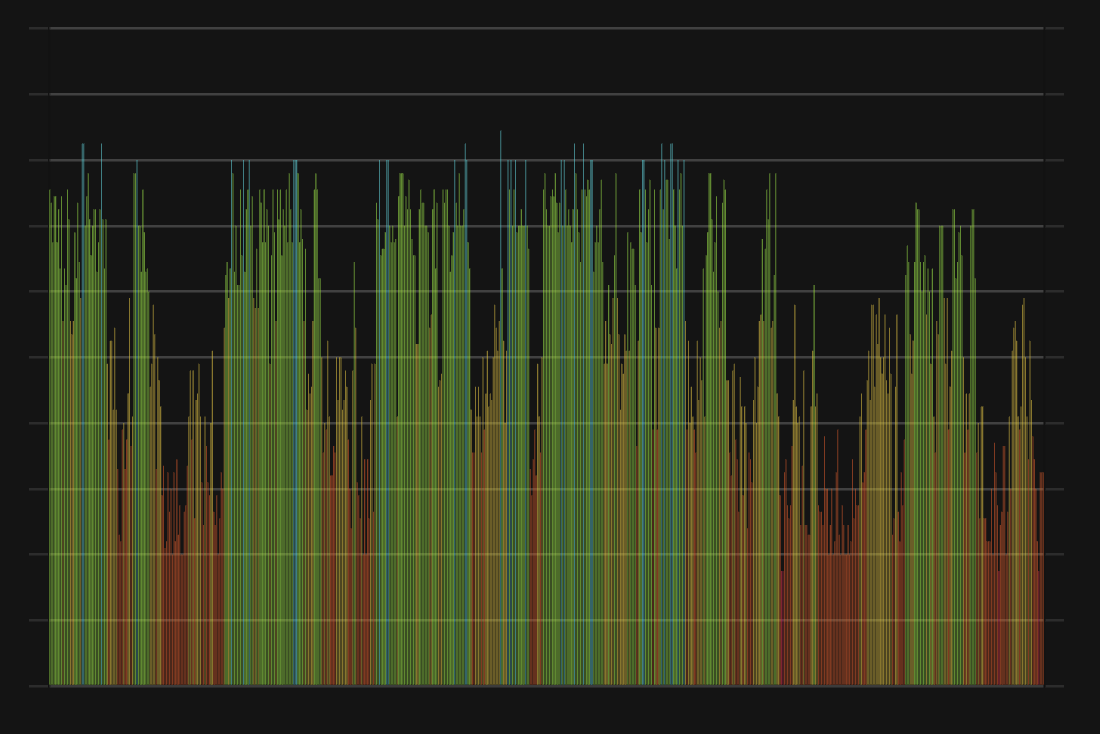

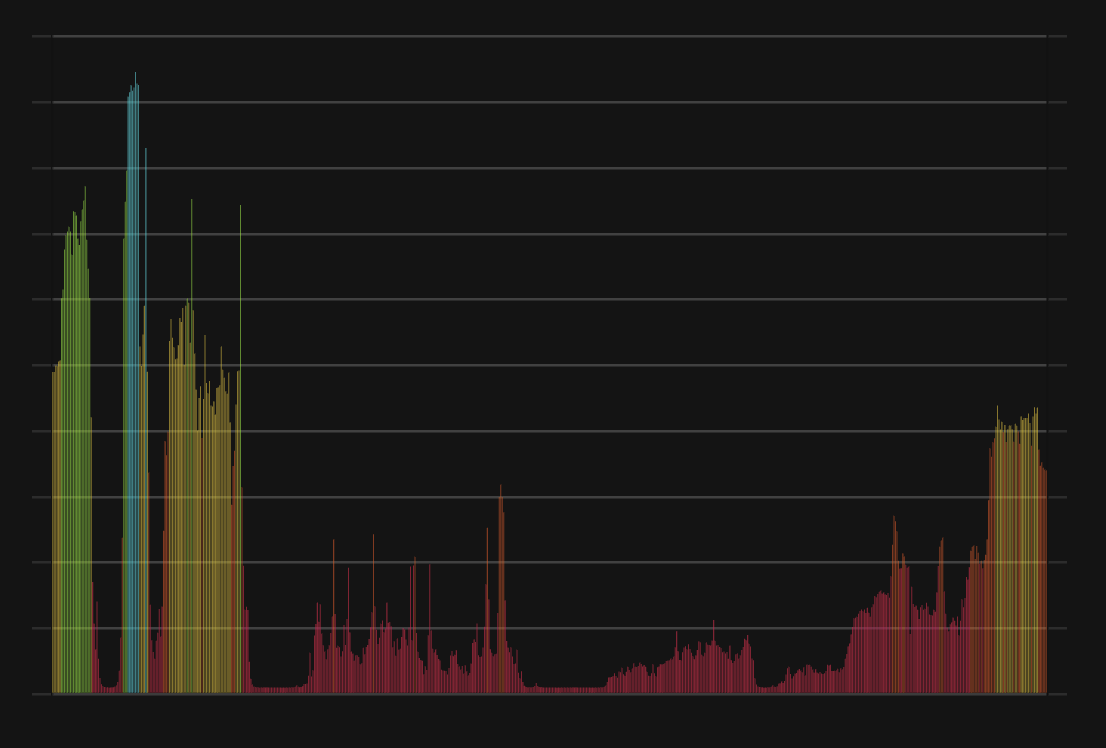

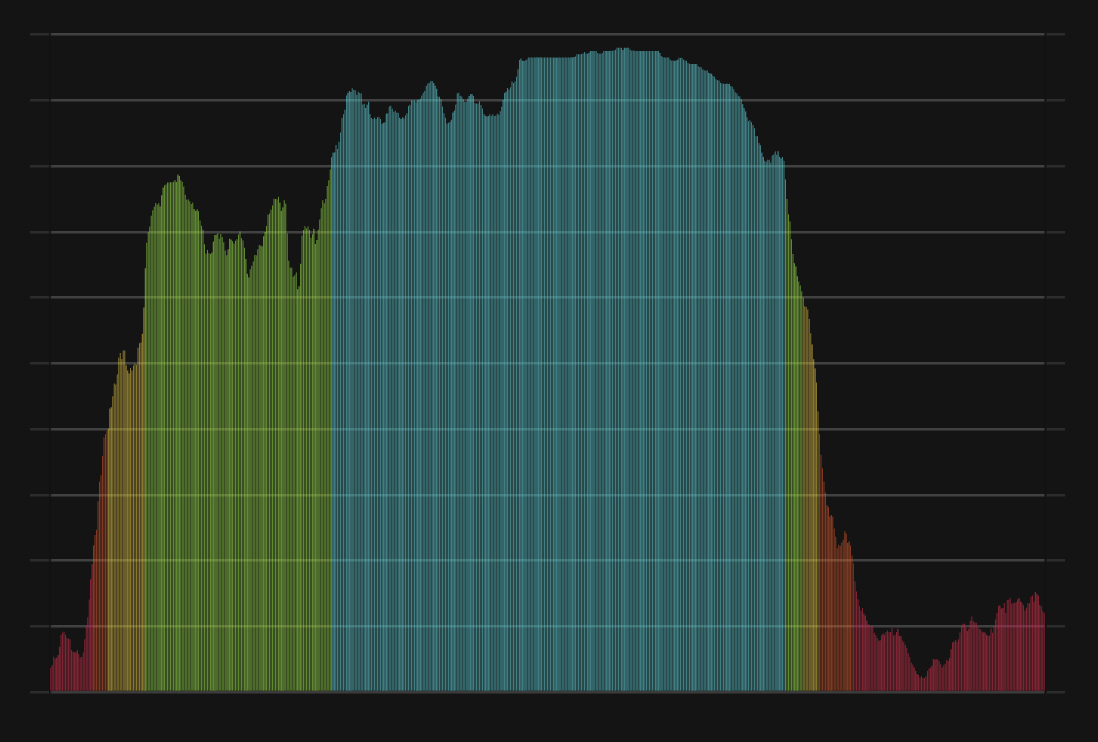

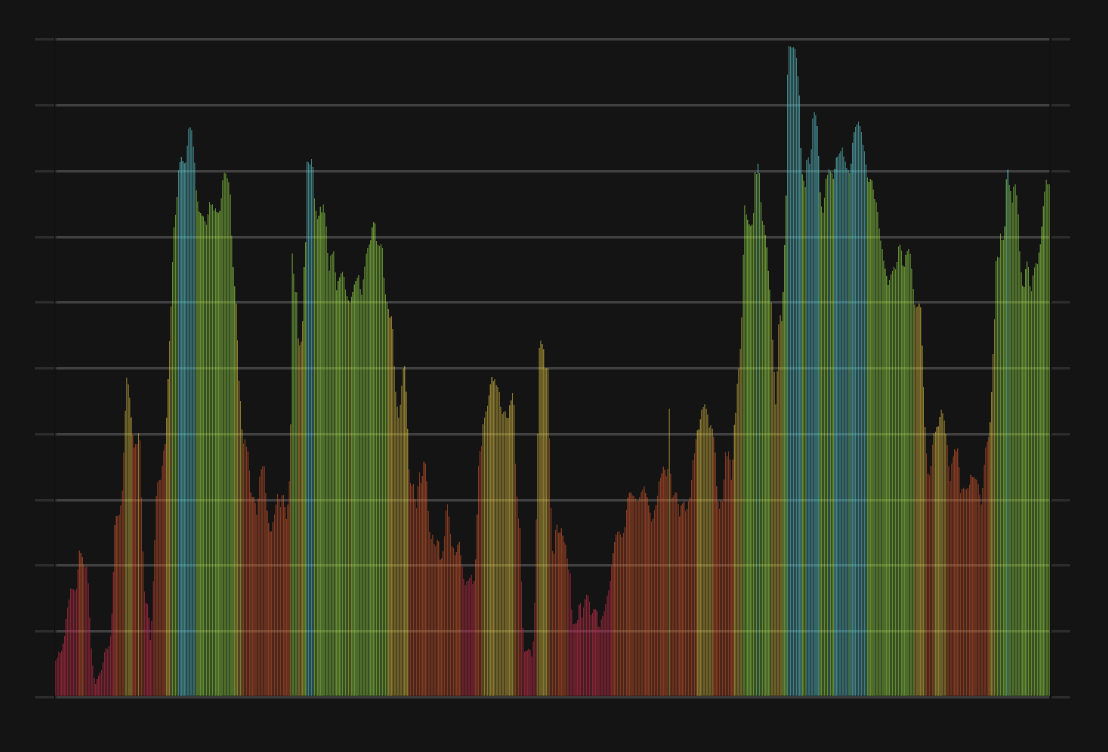

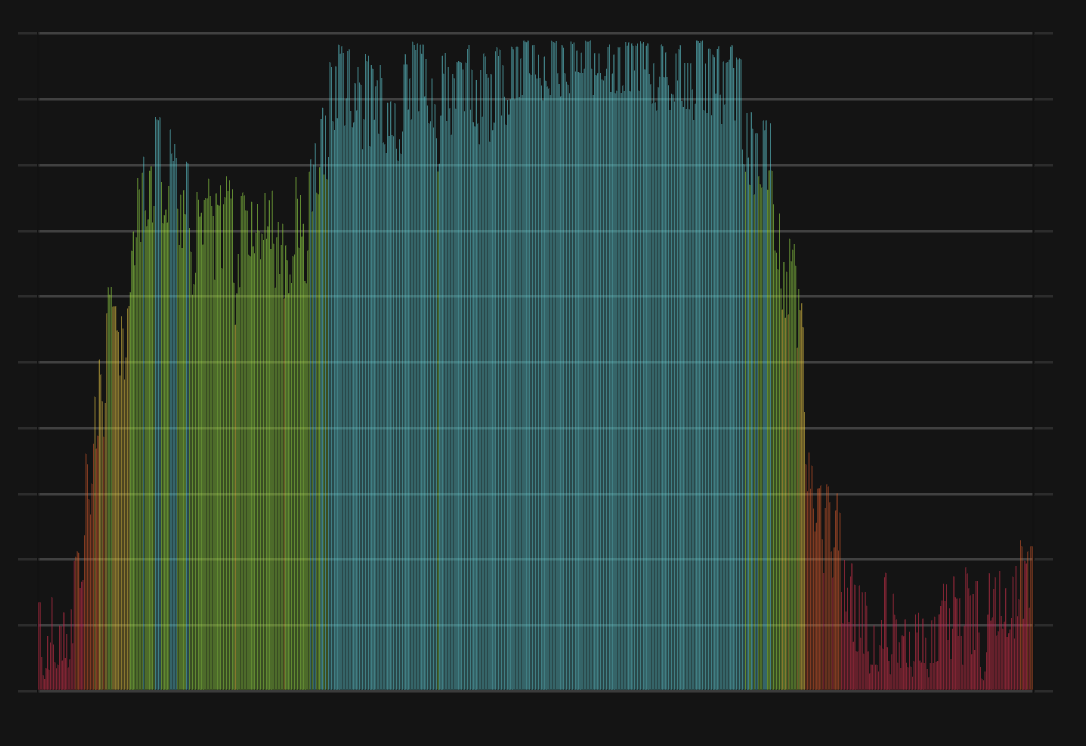

Cardano CFGI Score & ADA Price History

ADA Price & Cardano Sentiment Breakdown Charts

Price Score Sentiment

Volatility Sentiment

Volume Sentiment

Impulse Sentiment

Technical Sentiment

Social Sentiment

Dominance Sentiment

Search Sentiment

Whales Sentiment

Order Book Sentiment