Historical Values

-

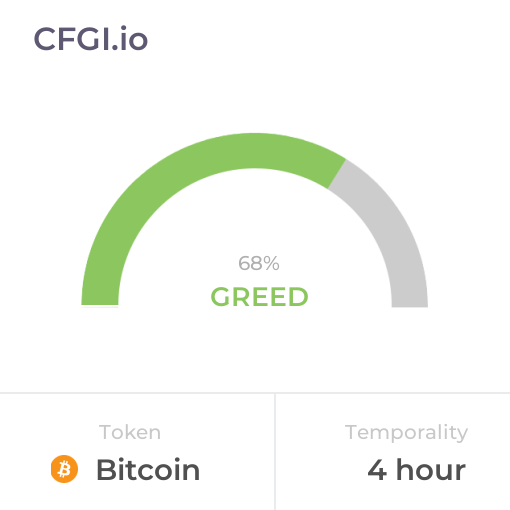

Now

Neutral 58 -

Yesterday

Neutral 58 -

7 Days Ago

Neutral 58 -

1 Month Ago

Neutral 58

Bitcoin Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Bitcoin price evolution a certain numerical value.

This module studies the price trend to determine if the Bitcoin market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Fear

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Bitcoin price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Fear

Like volatility, the Bitcoin Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Bitcoin bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Neutral

The Impulse indicator measures the current Bitcoin price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Bitcoin market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Neutral

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Bitcoin the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Extreme Greed

Dominance Neutral

This other indicator takes into account the dominance of Bitcoin with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Bitcoin's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Bitcoin and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Extreme Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Bitcoin has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Bitcoin. For this, specific search terms are used that determine the purchasing or ceding interest of Bitcoin, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Neutral

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Bitcoin and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Bitcoin moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Neutral

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Bitcoin on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

Bitcoin News

Bitcoin News

Nakamoto Inc. ($NAKA) Completes Acquisition of BTC Inc. and UTXO Management

Sentiment: Positive

Read moreBitcoin whales participate in V-shaped accumulation, offsetting 230K BTC sell-off

Sentiment: Positive

Read moreThe Great Bitcoin Handover: $8.2 Billion BTC Swamps Binance As Retail Momentum Fades

Sentiment: Negative

Read more‘Contrary to the Facts': Simon Gerovich Slams Critics of Metaplanet's BTC Strategy

Sentiment: Positive

Read morePrice predictions 2/20: BTC, ETH, XRP, BNB, SOL, DOGE, BCH, ADA, HYPE, XMR

Sentiment: Negative

Read moreBloomberg Intelligence Analyst Mike McGlone Has Revised BTC Price Prediction, but a Broader Concern Remains

Sentiment: Positive

Read moreBTC treasury executives call for reform of 1,250% risk weight in Basel III

Sentiment: Negative

Read moreCan Michael Saylor's Strategy Be Forced to Sell Bitcoin if BTC Drops to $55K?

Sentiment: Negative

Read moreBreaking: U.S. Supreme Court Rules Trump Tariffs Are Illegal, BTC Price Rises

Sentiment: Positive

Read moreBitcoin Hashrate Explodes in V-Shaped Recovery – Are Miners Betting on a BTC Price Breakout?

Sentiment: Positive

Read more“Sell Bitcoin Now,” Peter Schiff Projects Further BTC Price Crash to $20k

Sentiment: Negative

Read moreUS Spot Bitcoin ETFs Post Largest Cycle Drawdown, Balances Fall by 100,300 BTC

Sentiment: Negative

Read morePeter Schiff Says 'Highly Likely' Bitcoin 'At Least' Falls To $20,000: 'I Know BTC Has Done That Before, But

Sentiment: Negative

Read moreBitcoin Price Prediction: Trump Insider Confirms $1 Million BTC Target – Are Whales Preparing for a Massive Rally?

Sentiment: Positive

Read moreHacker voluntarily returns 320.88 BTC worth $21.3 million stolen from South Korean prosecutors

Sentiment: Positive

Read moreExpert Warns Bitcoin Bear Market Just In ‘Phase 1' as Glassnode Flags BTC Demand Exhaustion

Sentiment: Negative

Read moreBitcoin Price Prediction: BTC ETFs Record $133M in Outflows as Sentiment Stays in Extreme Fear

Sentiment: Negative

Read more‘Resilient' Bitcoin holders defend BTC, but bear floor sits 20% lower: Glassnode

Sentiment: Negative

Read moreDeep Pullback in a Bearish Context for Bitcoin Price Today (BTC/USDT Analysis)

Sentiment: Negative

Read moreBreaking: CME Group To Launch 24/7 BTC, ETH, XRP, SOL Futures Trading On May 29

Sentiment: Positive

Read moreCoinDesk 20 Performance Update: Bitcoin (BTC) Drops 0.3% as All Assets Decline

Sentiment: Negative

Read moreBitcoin Price Prediction: What Is the Most Probable Next Move for BTC as Momentum Stays Weak?

Sentiment: Negative

Read moreCrypto News Today: BTC Slips as US-Iran Tensions and Hawkish Fed Spark "Risk-Off"

Sentiment: Negative

Read moreBTC Price Downtrend Continues: Bearish Momentum Dominates – But Relief Rally Possible? (Feb 19 Update)

Sentiment: Negative

Read moreCrypto Veteran Bobby Lee Issues Brutal Bitcoin Warning, Says BTC ‘Very Likely' To Crash Below $50,000

Sentiment: Negative

Read moreBitcoin ETFs Hold Billions as BTC Slips Below $70K, Analysts Warn of Potential Free Fall

Sentiment: Negative

Read moreCrypto Market Slides as Hawkish FOMC Minutes Trigger BTC, ETH, XRP Sell-Off

Sentiment: Negative

Read moreBitcoin, Ethereum Flat, While XRP, Dogecoin Dive Amid US-Iran Tensions: Analyst Compares Current Downturn To 2022, Forecasts BTC At $51,000

Sentiment: Negative

Read moreGoldman Sachs Chief David Solomon Calls Himself ‘Observer' as He Reveals Small BTC Investment

Sentiment: Positive

Read moreBitcoin Price Prediction: Abu Dhabi Gov Funds Buy $1 Billion in BTC – What Do They Know?

Sentiment: Positive

Read more'Bitcoin Has Failed'—Crypto Influencer Questions Entire BTC Thesis After 12 Years

Sentiment: Negative

Read moreJane Street accumulates, yet BTC $65,000 support remains fragile weeks later

Sentiment: Negative

Read moreTrump Sons Tout a $1 Million Bitcoin Price as Goldman CEO Says He Owns BTC

Sentiment: Positive

Read morePrice predictions 2/18: BTC, ETH, XRP, BNB, SOL, DOGE, BCH, ADA, HYPE, XMR

Sentiment: Negative

Read moreBitcoin whales added 200,000 BTC in a month — but short-term demand is fading at the same time

Sentiment: Negative

Read moreBitcoin 2024 buyers steady BTC price as trader sees $52K 'next week or so'

Sentiment: Positive

Read moreBitcoin Price at $67K: Is the Next Leg Down About to Start? – BTC TA February 18, 2026

Sentiment: Negative

Read moreBitcoin Quantum Threat: CryptoQuant's CEO Flags Risk of Losing Satoshi's 1M BTC Stash to Hackers

Sentiment: Negative

Read moreAltcoin markets endure selling pressure as liquidity shifts to BTC, memes and RWA tokens

Sentiment: Negative

Read moreCryptoQuant CEO: Quantum Hackers Might Render Satoshi's 1M BTC Unrecoverable

Sentiment: Negative

Read morePeter Schiff to Saylor: ‘Congratulations' after $168mln BTC buy but warns of

Sentiment: Positive

Read moreStrategy bitcoin reserves grow as firm adds $168 million BTC during market downturn

Sentiment: Positive

Read moreBitcoin Price Prediction: Wave 3 Setup Builds While BTC Clings to $67K Zone

Sentiment: Positive

Read moreInstitutional Investors Sell $3,740,000,000 in Bitcoin and Crypto in Just One Month As BTC Price Craters: CoinShares

Sentiment: Negative

Read moreEthereum Reclaims $2,000 as Bitcoin Breaks Above $68K—What's Next for BTC and ETH Prices?

Sentiment: Positive

Read moreShould Satoshi's Bitcoin Be Frozen? CryptoQuant CEO Warns 6.89M BTC Face Quantum Risk

Sentiment: Negative

Read moreSatoshi's 1 Million BTC Might Have to Be Frozen or Lost to Quantum Hackers: CryptoQuant CEO

Sentiment: Negative

Read morePi Network (PI) Surges 40% Weekly, Bitcoin (BTC) Fights for $68K: Market Watch

Sentiment: Positive

Read moreBitcoin ETFs Retain $85B Despite BTC Price Crash, But Structure Tells a Different Story

Sentiment: Negative

Read moreEric Trump Celebrates American Bitcoin's 'Incredible' 6,000 BTC Milestone — But Stock Has Sunk 85% Since Nasdaq Debut

Sentiment: Positive

Read moreBitcoin, Ethereum, XRP, Dogecoin Slide Ahead Of Fed Meeting Minutes: Analyst Says BTC In An Area Where They'd 'Fancy' Buying Some

Sentiment: Negative

Read moreUS Government Holds 328,372 BTC as Onchain Data Confirms $23B Federal Crypto Stockpile

Sentiment: Positive

Read moreTrump-led American Bitcoin crosses 6,000 BTC mark as treasury firms ramp activity

Sentiment: Positive

Read moreNakamoto (NAKA) to Acquire BTC Inc and UTXO Management in $107M All-Stock Deal

Sentiment: Positive

Read moreBitcoin: Corporations rush to secure BTC – So why is price still falling?

Sentiment: Negative

Read moreHistorical Values

-

Now

Neutral 58 -

Yesterday

Neutral 58 -

7 Days Ago

Greed 60 -

1 Month Ago

Neutral 58

Bitcoin Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Bitcoin price evolution a certain numerical value.

This module studies the price trend to determine if the Bitcoin market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Fear

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Bitcoin price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Fear

Like volatility, the Bitcoin Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Bitcoin bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Neutral

The Impulse indicator measures the current Bitcoin price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Bitcoin market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Neutral

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Bitcoin the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Extreme Greed

Dominance Neutral

This other indicator takes into account the dominance of Bitcoin with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Bitcoin's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Bitcoin and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Extreme Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Bitcoin has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Bitcoin. For this, specific search terms are used that determine the purchasing or ceding interest of Bitcoin, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Neutral

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Bitcoin and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Bitcoin moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Neutral

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Bitcoin on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

BTC Price

1 BTC = $67,946.30

Bitcoin CFGI Score & BTC Price History

BTC Price & Bitcoin Sentiment Breakdown Charts

Price Score Sentiment

Volatility Sentiment

Volume Sentiment

Impulse Sentiment

Technical Sentiment

Social Sentiment

Dominance Sentiment

Search Sentiment

Whales Sentiment

Order Book Sentiment