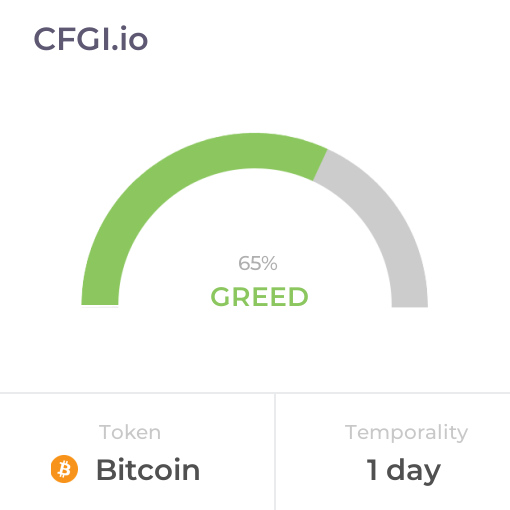

Historical Values

-

Now

Neutral 42 -

Yesterday

Neutral 42 -

7 Days Ago

Neutral 42 -

1 Month Ago

Neutral 42

Bitcoin Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Bitcoin price evolution a certain numerical value.

This module studies the price trend to determine if the Bitcoin market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Fear

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Bitcoin price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Fear

Like volatility, the Bitcoin Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Bitcoin bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Fear

The Impulse indicator measures the current Bitcoin price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Bitcoin market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Neutral

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Bitcoin the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Fear

Dominance Greed

This other indicator takes into account the dominance of Bitcoin with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Bitcoin's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Bitcoin and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Fear

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Bitcoin has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Bitcoin. For this, specific search terms are used that determine the purchasing or ceding interest of Bitcoin, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Fear

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Bitcoin and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Bitcoin moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Extreme Greed

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Bitcoin on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

Bitcoin News

Bitcoin News

Bitcoin Price Prediction: BTC Retests Breakout as $64K Liquidity Zone Looms

Sentiment: Negative

Read moreAnalyst Predicts XRP Breakout Against BTC, Says $10 Move Could Be Just The Starts

Sentiment: Positive

Read moreMichael Saylor Hints at Another Strategy Bitcoin Buy Despite BTC and Broader Market Weakness

Sentiment: Positive

Read moreCapital Rotates? Largest Gold ETF Suffers Huge Outflow as BTC Funds Recover

Sentiment: Positive

Read moreBTC Price Prediction: Targets $72,000 by End of March Amid Technical Recovery

Sentiment: Positive

Read moreUAE Carries Out First Iran Strike As BTC Bulls Struggle to Defend Key Support

Sentiment: Negative

Read more137% in Bitcoin Spot Market Flow: Volatility Spikes as BTC Loses $70,000

Sentiment: Negative

Read moreOn-Chain Data Signals Weakening BTC Sell Pressure as Spot Demand Recovers

Sentiment: Positive

Read moreBitcoin (BTC) Price: Whales Dumped 66% of Holdings at $74K Peak — Data Analysis

Sentiment: Negative

Read moreSatoshi Nakamoto's Bitcoin Could Get Stolen, But A BTC Dev Has Proprosed A Solution

Sentiment: Negative

Read moreEthereum at a Breaking Point as ETH/BTC Stalls and $2,340 Comes Into View

Sentiment: Positive

Read moreBitcoin Price Analysis: BTC Must Break This Key Level to Confirm a Real Rally

Sentiment: Neutral

Read morePrediction Markets Bet Bearish on BTC, ETH, and Stocks — But Do The Charts Agree?

Sentiment: Negative

Read moreRipple Price Analysis: Why the XRP/BTC Pair Is Flashing a Major Warning Signal

Sentiment: Negative

Read moreShort Term Bitcoin Holders Send 27,000 BTC to Exchanges as Selling Pressure Increases

Sentiment: Negative

Read moreBitcoin (BTC) Price Battle: Will Bears Push It to $60K or Can Bulls Reclaim $70K?

Sentiment: Negative

Read moreDogecoin, Pepe coin, and Shiba Inu Price Prediction As BTC Crashes Below $70k

Sentiment: Negative

Read moreBitcoin Rally Falters Under $68,000 As Investors Pull $228 Million From Spot BTC ETFs

Sentiment: Negative

Read moreBitcoin Price Faces Further Crash as Whales Liquidates Recently Bought BTC: Report

Sentiment: Negative

Read more4,277 BTC bought, is 10K next? How STRC is fueling MSTR's Bitcoin moves!

Sentiment: Positive

Read moreBTC Price Prediction: Bitcoin Eyes $75K Recovery After Testing $67K Support

Sentiment: Positive

Read morePi Network's PI Taps 3-Month High, Bitcoin (BTC) Fights for $68K: Weekend Watch

Sentiment: Positive

Read moreBitcoin (BTC) Price Retreats to $68K Following Dismal February Jobs Report

Sentiment: Negative

Read moreCrypto Market Down Today: Bitcoin Price Falls to $68K as $302M Liquidations Hit BTC, ETH, XRP

Sentiment: Negative

Read moreBitcoin Strategist Shares 8-Figure BTC Price Prediction, But The Reason Is Even More Interesting

Sentiment: Positive

Read morePrice predictions 3/6: BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH, HYPE, XMR

Sentiment: Negative

Read moreBitcoin Bottom In? This Key Metric Signals BTC May Have Reached Its Floor

Sentiment: Positive

Read moreCleanSpark, Cango and BitFuFu Post Solid February Output With 1,250 BTC Mined

Sentiment: Positive

Read moreBitcoin Repeats Rare 2018 Pattern That Drove 308% Rally – Can BTC Hit $270,000?

Sentiment: Positive

Read more32,000 BTC leave exchanges in one day: Accumulation signal or simple transfer?

Sentiment: Positive

Read moreCleanSpark, Cango and BitFuFu produce 1,250 BTC in February as AI infrastructure ambitions grow

Sentiment: Positive

Read moreBitcoin options show market panic is fading as BTC pulls back from highs

Sentiment: Positive

Read more$50,000 BTC in 2026: Bloomberg's Commodities Strategist Names Bitcoin "Young Bear"

Sentiment: Negative

Read moreWhy Is Bitcoin Price Plunging? Is Jane Street Behind the Latest BTC Volatility?

Sentiment: Negative

Read moreJane Street Bitcoin Manipulation Fears Are Back as $19M in BTC Hits Exchanges

Sentiment: Negative

Read moreMomentum Fades As Bitcoin price Holds $70K: Multi‑Timeframe Outlook On BTC

Sentiment: Neutral

Read moreU.S. court freezes 70 BTC in Blockfills dispute as investor sues over locked funds

Sentiment: Negative

Read moreBitcoin 'anomalous' outflow sees 32K BTC leave exchanges in a single day

Sentiment: Positive

Read moreBitcoin Consolidates at $71K: Main Move Still to Come – BTC TA March 6, 2026

Sentiment: Positive

Read moreCrypto Market Crash Alert: Institutions Trap Retail Ahead of BTC, ETH, XRP Options Expiry & Nonfarm Payrolls

Sentiment: Negative

Read moreBitcoin Price Prediction: Will BTC Hold $70K as Iran-Israel Tensions Rise?

Sentiment: Negative

Read moreBitcoin Goes Mainstream: Morgan Stanley, TD Bank, and Citi Announce Major BTC Plans

Sentiment: Positive

Read moreBitcoin (BTC) Maintains $70K Level While Treasury Yields Signal Market Headwinds

Sentiment: Neutral

Read moreBitcoin Supply Shrinks to 2017 Levels as Wallets Hit Record High—Is BTC Price Preparing for a Big Move?

Sentiment: Positive

Read moreArthur Hayes Predicts Fed Money Printing From US-Iran Tensions Could Propel Bitcoin (BTC) Higher

Sentiment: Positive

Read moreBitcoin (BTC) Price Retreats to $70K as Geopolitical Tensions and Failed Rally Spark Concerns

Sentiment: Negative

Read moreBitcoin Miners Sell 15K BTC After $126K High, Is This the Reason Why Bitcoin is Dropping

Sentiment: Negative

Read moreBitcoin not an ‘allowable asset': Vancouver city staff asks council to drop BTC reserve motion

Sentiment: Negative

Read moreBitcoin, Ethereum, XRP, Dogecoin Fall, While Oil Surges Amid Middle East War: Analytics Firm Says BTC Is 'Still In A Bear Market'

Sentiment: Negative

Read moreCourt Freezes BlockFills Assets Amid 70 BTC Dispute With Dominion Capital

Sentiment: Negative

Read moreAmerican Bitcoin adds 11k ASICs in bold BTC mining play – Why it matters

Sentiment: Positive

Read moreCleanSpark Sells Nearly All February BTC Production to Accelerate AI Expansion

Sentiment: Positive

Read moreBitcoin Supply Shift: 212,000 BTC Moves Into Long-Term Holder Hands, Price Nearing A Bounce?

Sentiment: Positive

Read morePeter Schiff Predicts BTC to Fall, Gold to Rise as Markets Price in Prolonged Iran War

Sentiment: Negative

Read moreCleanSpark sells 553 BTC for $36.6M in February as miners offload Bitcoin

Sentiment: Positive

Read moreCore Scientific secured $500 million from Morgan Stanley amid plans to liquidate its BTC portfolio in 2026 to finance AI expansion

Sentiment: Positive

Read moreBitcoin trader sees 'lower soon' as BTC price starts to erase $74K breakout

Sentiment: Negative

Read moreAmerican Bitcoin Expands Treasury to 6,500 BTC as Eric Trump Accuses Big Banks of Lobbying Against Crypto

Sentiment: Positive

Read moreMorgan Stanley Advances Spot Bitcoin ETF Plan With Amendment Detailing BTC Holding Strategy

Sentiment: Positive

Read moreDormant Bitcoin whales move $56 mln: Can BTC withstand the sudden selling?

Sentiment: Negative

Read moreBitcoin Safe Haven Narrative Returns: Will Global Instability Push Investors Toward BTC?

Sentiment: Positive

Read moreBitcoin Price Prediction: What's the Most Likely Scenario for BTC After Reclaiming $70K

Sentiment: Neutral

Read moreBTC Rallies to $73K in Fresh Monthly Peak, Lifting Ethereum, Solana and the Wider Market

Sentiment: Positive

Read moreBitcoin ETFs Pull In $462M, Signaling Broadening Crypto Demand With BTC Above $73K

Sentiment: Positive

Read moreCrypto Market Today: BTC, ETH, XRP, SOL, and DOGE Rally as Geopolitical Tensions Ease

Sentiment: Positive

Read moreBTC Price Reaches $74K Before Retreat: Is $85K Next After Consolidation? (March 5 Update)

Sentiment: Positive

Read moreHistorical Values

-

Now

Neutral 42 -

Yesterday

Neutral 42 -

7 Days Ago

Neutral 41 -

1 Month Ago

Fear 33

Bitcoin Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Bitcoin price evolution a certain numerical value.

This module studies the price trend to determine if the Bitcoin market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Fear

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Bitcoin price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Fear

Like volatility, the Bitcoin Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Bitcoin bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Fear

The Impulse indicator measures the current Bitcoin price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Bitcoin market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Neutral

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Bitcoin the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Fear

Dominance Greed

This other indicator takes into account the dominance of Bitcoin with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Bitcoin's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Bitcoin and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Fear

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Bitcoin has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Bitcoin. For this, specific search terms are used that determine the purchasing or ceding interest of Bitcoin, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Fear

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Bitcoin and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Bitcoin moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Extreme Greed

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Bitcoin on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

BTC Price

1 BTC = $67,559.90

Bitcoin CFGI Score & BTC Price History

BTC Price & Bitcoin Sentiment Breakdown Charts

Price Score Sentiment

Volatility Sentiment

Volume Sentiment

Impulse Sentiment

Technical Sentiment

Social Sentiment

Dominance Sentiment

Search Sentiment

Whales Sentiment

Order Book Sentiment