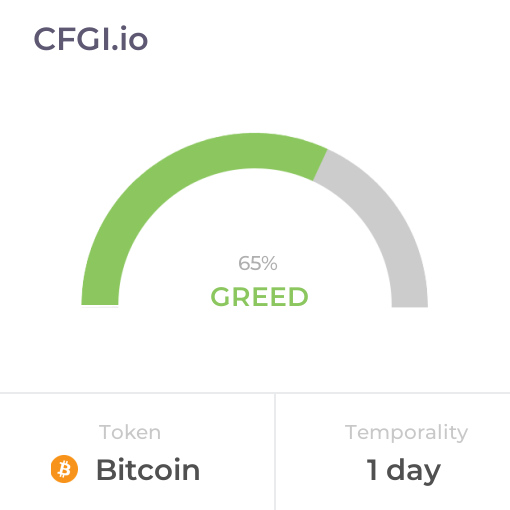

Historical Values

-

Now

Greed 61 -

Yesterday

Greed 61 -

7 Days Ago

Greed 61 -

1 Month Ago

Greed 61

Bitcoin Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Bitcoin price evolution a certain numerical value.

This module studies the price trend to determine if the Bitcoin market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Bitcoin price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the Bitcoin Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Bitcoin bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Greed

The Impulse indicator measures the current Bitcoin price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Bitcoin market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Neutral

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Bitcoin the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Extreme Greed

Dominance Neutral

This other indicator takes into account the dominance of Bitcoin with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Bitcoin's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Bitcoin and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Extreme Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Bitcoin has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Bitcoin. For this, specific search terms are used that determine the purchasing or ceding interest of Bitcoin, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Extreme Fear

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Bitcoin and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Bitcoin moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Extreme Greed

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Bitcoin on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

Bitcoin News

Bitcoin News

ARK and Unchained Warn That a Third of BTC Remains Vulnerable to Quantum Threats

Sentiment: Negative

Read moreQuantum threat lingers over legacy BTC as Ark flags structural tail risk

Sentiment: Negative

Read moreTHIS Bitcoin metric drops to FTX-era levels – And last time, BTC rallied 67%

Sentiment: Positive

Read moreBTC Price Today: Bitcoin Stabilizes Near $70K as Oscillators Flash Neutral Signals

Sentiment: Positive

Read moreBTC reserve firm Metaplanet targets Japan's digital asset ecosystem with $25M fund

Sentiment: Positive

Read moreAsia's Bitcoin Giant Metaplanet Drops $25 Million To Expand BTC Strategy With New Venture Arm

Sentiment: Positive

Read more$1 Million per Bitcoin or 1 Million BTC for Saylor's Strategy? Samson Mow Raises Important Question

Sentiment: Positive

Read morePi Network's PI Pumps After Big Listing, Bitcoin (BTC) Stalls Below $70K: Market Watch

Sentiment: Positive

Read moreBitcoin (BTC) Tumbles Under $70K as Middle East Oil Tanker Strikes Spark Crude Rally

Sentiment: Negative

Read moreBitcoin, Ethereum, XRP Flat, Dogecoin Slides Amid Trump Moves To Combat Iran War Oil Spike: Analyst Says BTC Downside Won't Be 'Heavier'

Sentiment: Negative

Read moreMiner Supply Hits Bitcoin Market as Marathon Moves 298 BTC to Cumberland Wallets

Sentiment: Neutral

Read moreBitcoin Price Prediction: New US Inflation Report Just Released — Where is BTC Going Now?

Sentiment: Neutral

Read morePrice predictions 3/11: BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH, HYPE, XMR

Sentiment: Positive

Read moreStrategy's STRC preferred series gets $50 million investment from fellow BTC treasury company Strive

Sentiment: Positive

Read moreOnly 1 Million BTC Left: Coinbase CEO Hails Bitcoin as ‘Decentralized, Inflation‑Proof Money'

Sentiment: Positive

Read moreArthur Hayes Deploys Net Liquidity Strategy: Not Buying BTC Now Even If He Has Only $1

Sentiment: Negative

Read moreRipple Cofounder Jed McCaleb Named on Forbes Rich List, Shiba Inu (SHIB) Has Chance to Break $3.5 Billion Price Threshold, Bitcoin Miner MARA Starts Selling BTC: Morning Crypto Report

Sentiment: Positive

Read moreArthur Hayes Warns of Bitcoin (BTC) Price Crash If Geopolitical Tensions Persist

Sentiment: Negative

Read moreBTC Price Prediction: Targets $75,000 by April as Technical Indicators Signal Recovery

Sentiment: Positive

Read moreBitcoin (BTC) Sentiment Skyrockets as Trump Hints at Conflict Resolution

Sentiment: Positive

Read moreBloomberg Analyst Mike McGlone Issues Bitcoin Warning, Says BTC Could Crash ‘Even Lower' Than $10,000

Sentiment: Negative

Read moreLondon BTC Company launch Tethered Gold companies to seek exploration opportunities

Sentiment: Positive

Read moreICP and PI Defy Altcoin Correction, BTC Price Slips Below $70K: Market Watch

Sentiment: Positive

Read moreSouth Korean authorities grapple with crypto security after $21.5M BTC liquidation

Sentiment: Negative

Read moreWhy is Bitcoin Moving Sideways? 3 Reasons for the BTC Price Consolidation

Sentiment: Neutral

Read moreBitcoin exchange supply hits record low even as Winklevoss twins move $130M BTC

Sentiment: Positive

Read moreBitcoin (BTC) Price Slips Under $70K Amid Iran Tensions and Upcoming CPI Report

Sentiment: Negative

Read moreStrategy Signs Its Biggest STRC Day With An Estimated Purchase Of 1420 BTC

Sentiment: Positive

Read moreGold vs. Bitcoin: BTC Rebounds from Key Support as XAUUSD Keeps Bullish Momentum

Sentiment: Positive

Read moreBitcoin Robbery: French Couple Held Hostage As Fake Cops Steal €900K in BTC

Sentiment: Negative

Read moreEarly Bitcoin Titans Reduce Exposure As $130M BTC Hits Gemini Wallets – Details

Sentiment: Negative

Read moreBrian Armstrong Says Mining Next 1 Million Bitcoin Will Take Over 100 Years, Coinbase CEO Hails BTC As 'Decentralized, Inflation-Proof'

Sentiment: Positive

Read moreBitcoin, Ethereum, XRP, Dogecoin Rebound Amid Iran War-Induced Oil Volatility: Analyst Targets BTC Upside Once This Barrier Is Cleared

Sentiment: Positive

Read moreStrategy Doubles Down on Bitcoin With $1.28 Billion Purchase, Holdings Reach 738,731 BTC

Sentiment: Positive

Read moreStrategy is paying investors huge yields to keep buying Bitcoin amid 66,231 BTC spending spree

Sentiment: Positive

Read moreCourt‑ordered BTC return to Bitfinex sets a precedent for crypto victim rights

Sentiment: Positive

Read moreBitcoin Supply on Exchanges Just Hit an All-Time Low — Is a BTC Supply Shock Next?

Sentiment: Positive

Read moreThe Daily: Winklevoss twins move $130 million in BTC to Gemini, South Korean prosecutors sell seized bitcoin and more

Sentiment: Negative

Read moreStrategy Hits Record STRC Issuance Day, Funding an Estimated 1,420 BTC Buy

Sentiment: Positive

Read moreBitcoin pushes past $70K – Will weak on-chain activity push BTC down again?

Sentiment: Negative

Read moreBitcoin Price Prediction: Will BTC Break $72,000 or See Another Pullback?

Sentiment: Positive

Read moreBitcoin Climbs Back Above $71K as $130M BTC Transfer Hits Gemini Wallets

Sentiment: Positive

Read moreBitcoin Price Today: BTC Consolidates at $70,400 With Key Resistance at $71K–$72K

Sentiment: Positive

Read moreWinklevosses Keep Holding $764 Million in Bitcoin After Selling $130 Million BTC Recently

Sentiment: Positive

Read moreWinklevoss Twins Are Selling Bitcoin Again? Arkham Flags Big BTC Transfer to Gemini

Sentiment: Positive

Read moreBitcoin Price Prediction: BTC Holds Key Support as Correlation With Stocks Grows

Sentiment: Positive

Read moreRoyal Government of Bhutan Moves 175 BTC as Bitcoin Price Reclaims $71,000

Sentiment: Positive

Read moreTraders snapped up nearly 600,000 BTC as bitcoin dipped below $70,000, blockchain data show

Sentiment: Positive

Read more$2 XRP Back on the Menu: Bollinger Bands, Bitcoin (BTC) Recovers to $70,000 Amid 500% Liquidation Imbalance, 494 Billion Shiba Inu (SHIB) Leaves Singapore's Coinhako to Major Market Maker: Morning Crypto Report

Sentiment: Positive

Read moreBitcoin Price Prediction: Oil Just Exploded 20% — Is BTC About to Crash?

Sentiment: Negative

Read moreBitcoin Continues Bounce as Trump Says Iran War Over 'Pretty Quickly': Rally Sustained? – BTC TA March 10, 2026

Sentiment: Positive

Read more$12M Bitcoin Transfer From Bhutan Sparks Buzz as BTC Snaps Back Above $70K

Sentiment: Positive

Read moreBhutan Transfers Nearly $12M in BTC as Total Transfers Near $42M This Year

Sentiment: Positive

Read moreWinklevoss Twins Move $130 Million BTC to Gemini, Cutting Holdings 92% Since 2014

Sentiment: Negative

Read moreBitcoin Exchange Balance Hits All-Time Low, BTC Supply Shock on Horizon?

Sentiment: Positive

Read moreHyperliquid (HYPE) Rockets by Double Digits, Bitcoin (BTC) Tops $71K: Market Watch

Sentiment: Positive

Read moreBitcoin Price Today: President Trump Signals Iran Conflict May End Soon As BTC Eyes $72k

Sentiment: Positive

Read moreIs the 'Bitcoin Pyramid' Cracking? Peter Schiff Predicts Forced BTC Liquidations by MicroStrategy

Sentiment: Negative

Read moreBitcoin Reclaims $70,000: Why is BTC Price Surging Despite Middle East Tensions?

Sentiment: Positive

Read moreBitcoin (BTC) Surges Past $70K as Oil Prices Plunge and Trump Signals Iran Conflict Resolution

Sentiment: Positive

Read moreBhutan Offloads $42M in Bitcoin (BTC) Holdings as National Reserve Shrinks by 58%

Sentiment: Negative

Read moreBTC Price Prediction: Targets $75,000 by End of March as Bulls Eye Upper Bollinger Band

Sentiment: Positive

Read moreBitcoin News Today: BTC on the Verge of ‘Banana Split', Peter Brandt Predicts Imminent Breakout

Sentiment: Positive

Read moreHistorical Values

-

Now

Greed 61 -

Yesterday

Neutral 61 -

7 Days Ago

Greed 60 -

1 Month Ago

Neutral 59

Bitcoin Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Bitcoin price evolution a certain numerical value.

This module studies the price trend to determine if the Bitcoin market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

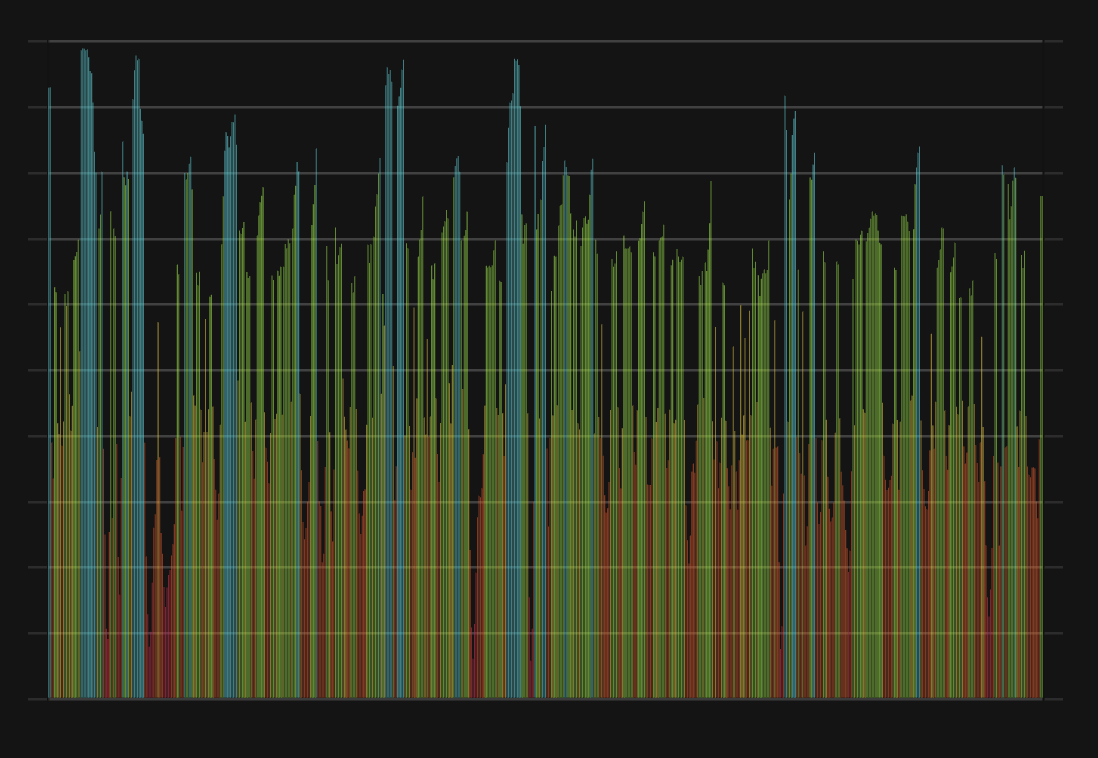

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Bitcoin price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

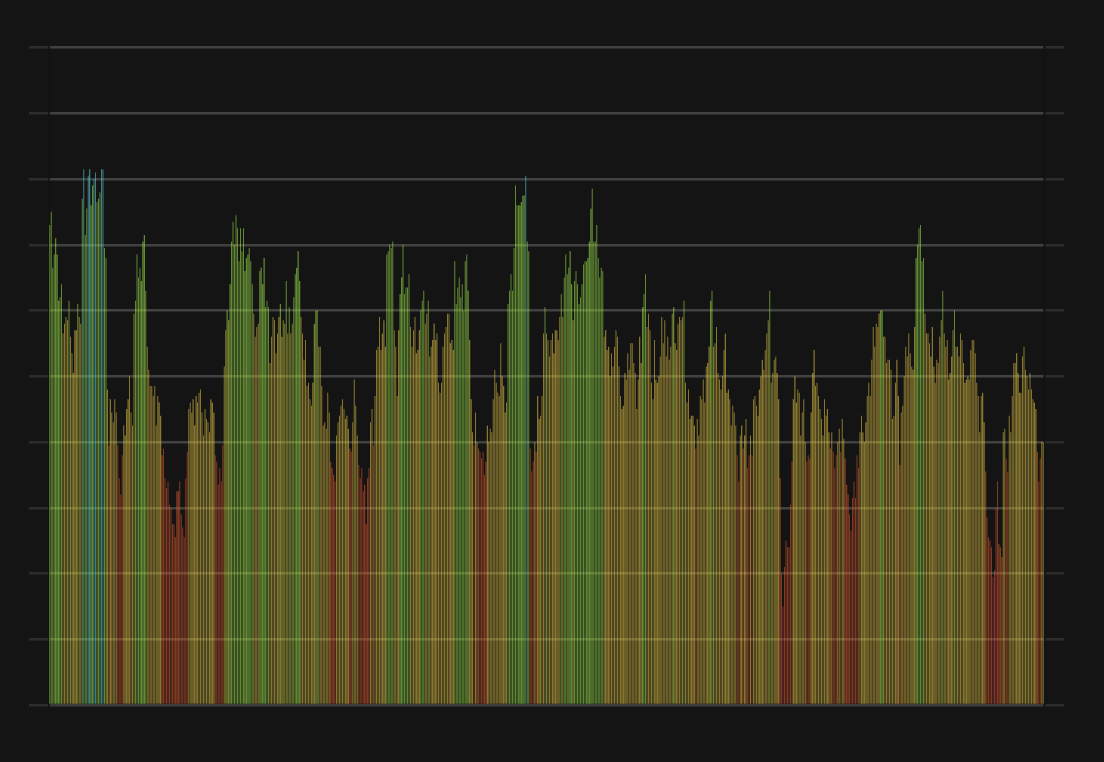

Volume Greed

Like volatility, the Bitcoin Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Bitcoin bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Greed

The Impulse indicator measures the current Bitcoin price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Bitcoin market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Neutral

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Bitcoin the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Extreme Greed

Dominance Neutral

This other indicator takes into account the dominance of Bitcoin with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Bitcoin's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Bitcoin and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Extreme Greed

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Bitcoin has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Bitcoin. For this, specific search terms are used that determine the purchasing or ceding interest of Bitcoin, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Extreme Fear

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Bitcoin and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Bitcoin moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Extreme Greed

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Bitcoin on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

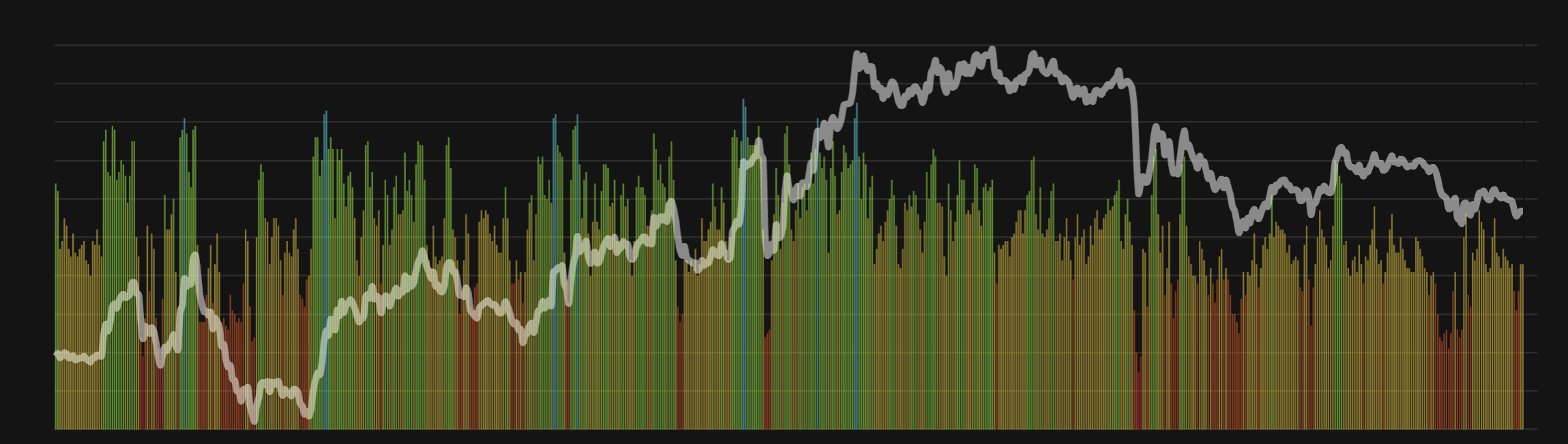

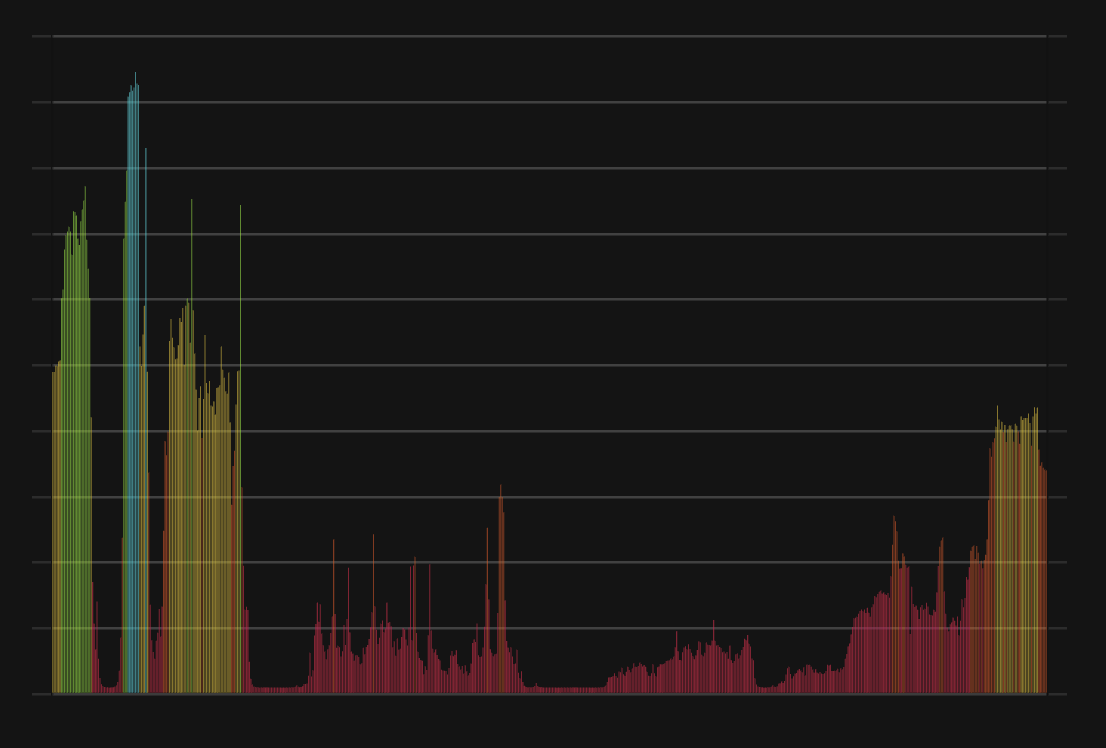

BTC Price

1 BTC = $71,555.30

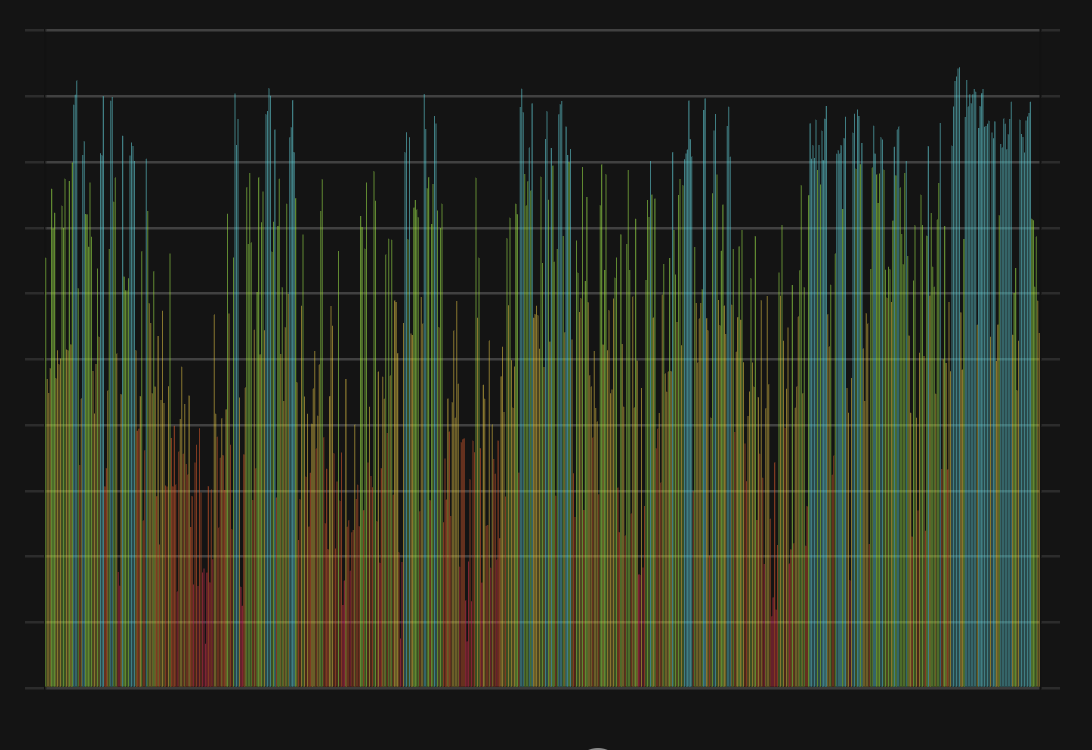

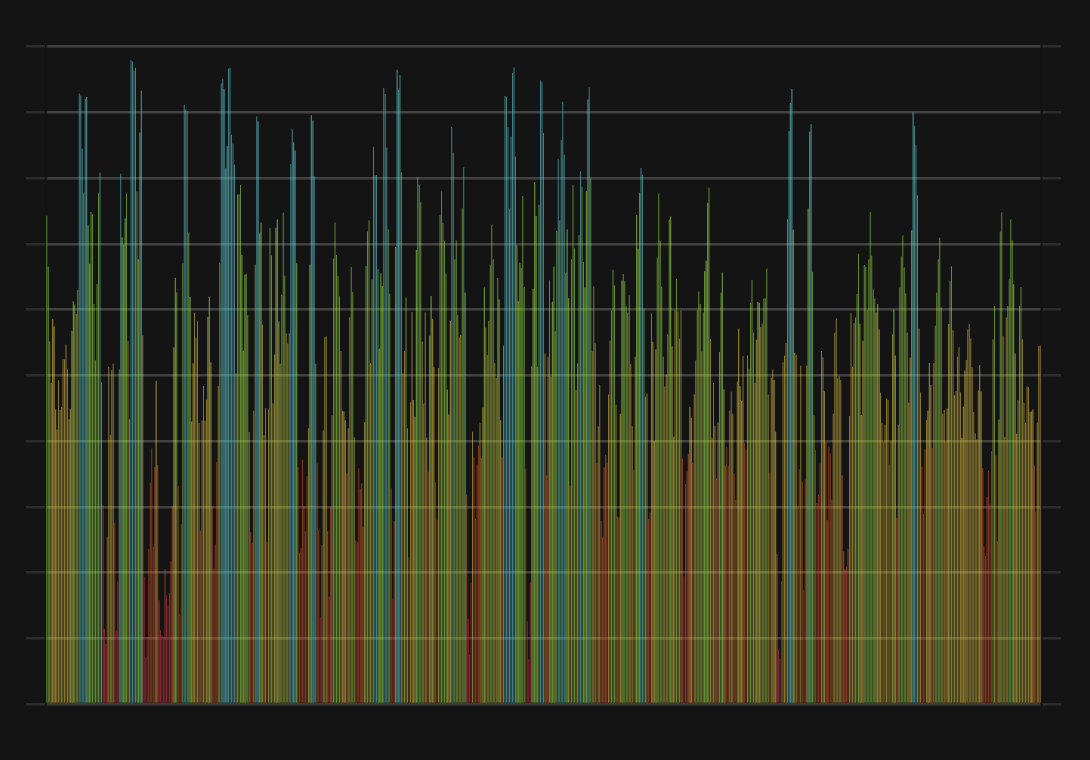

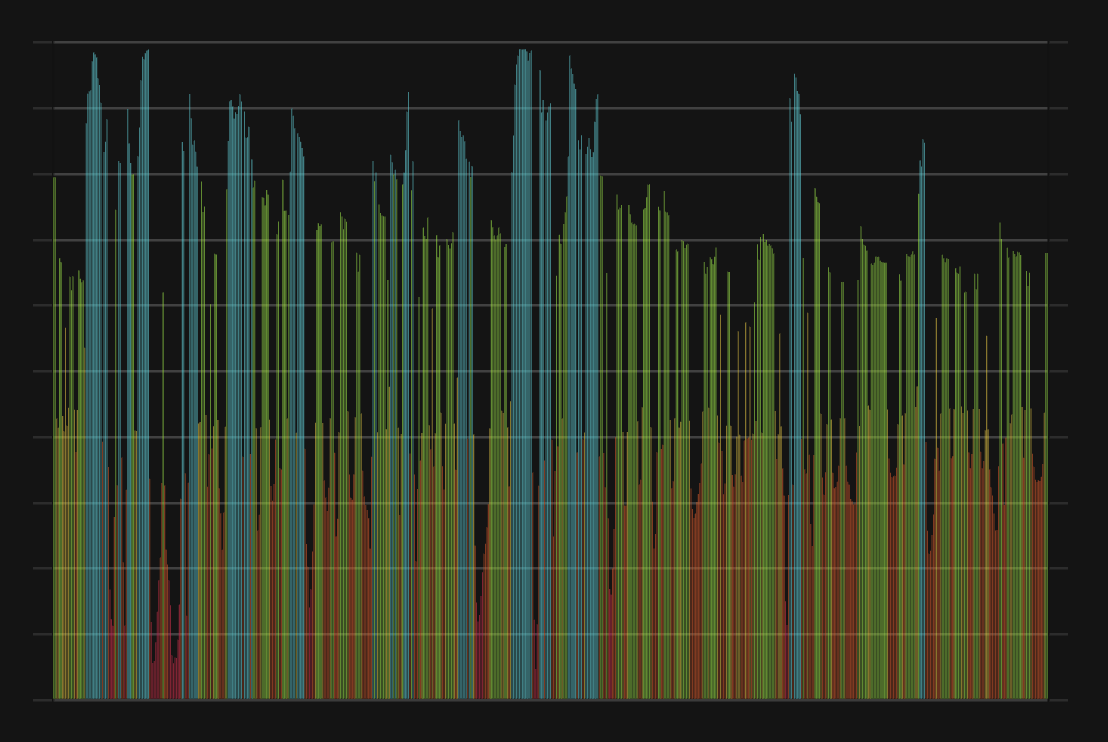

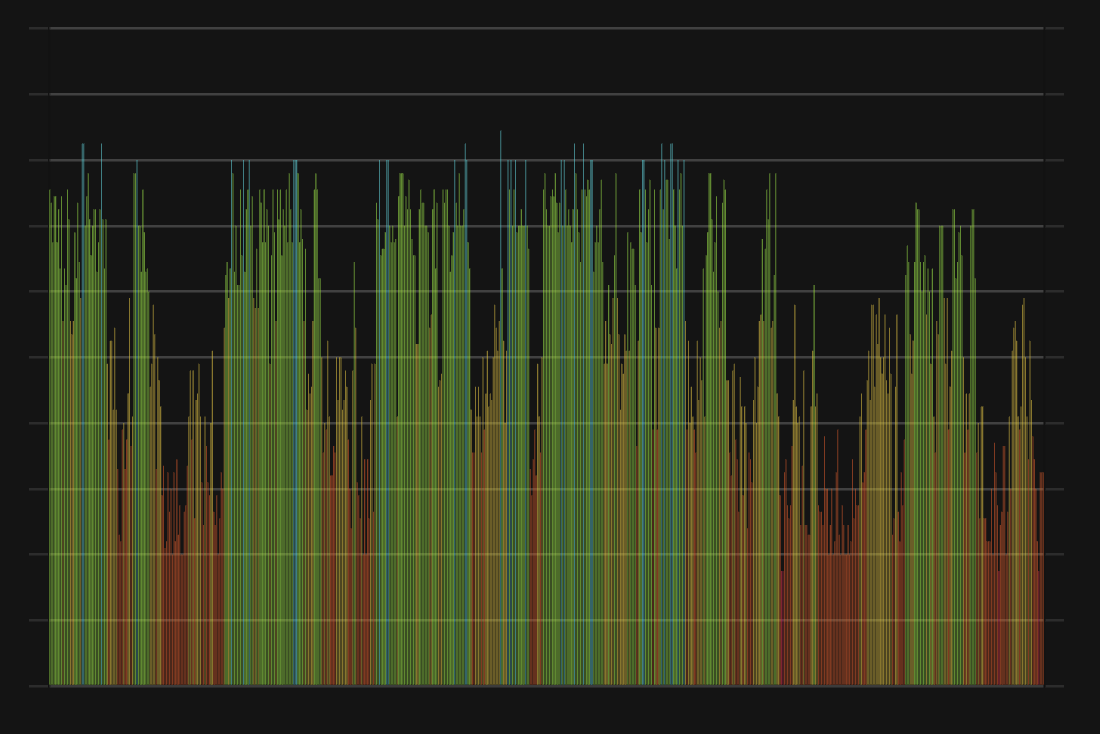

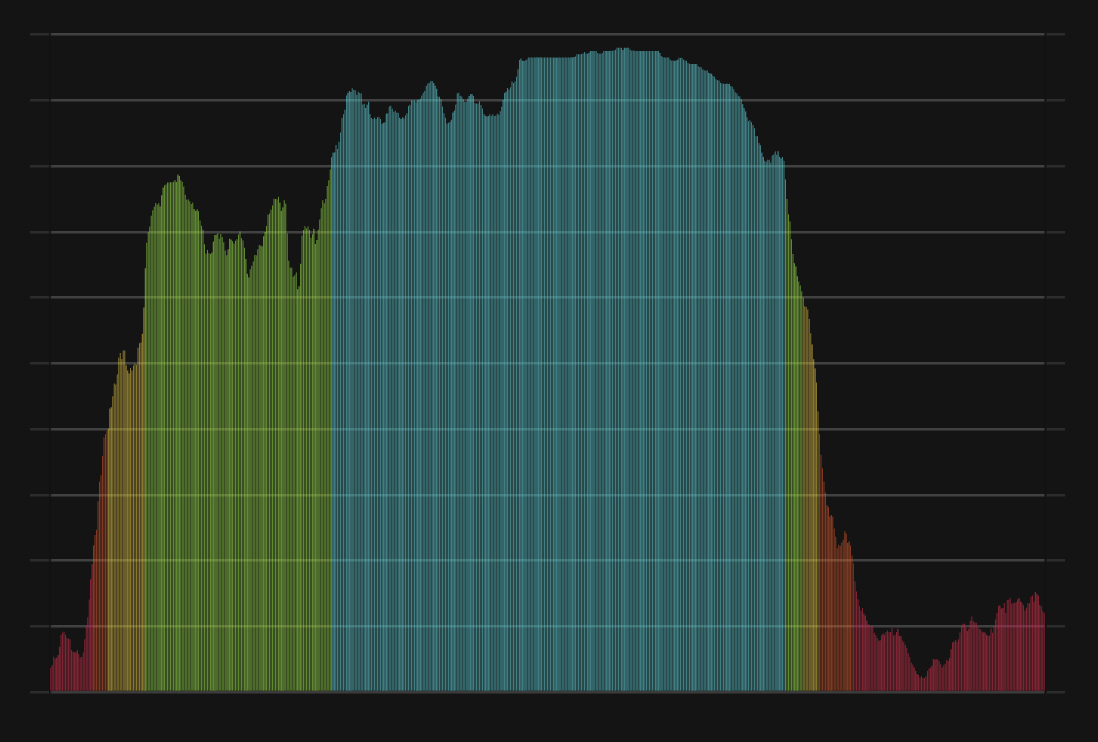

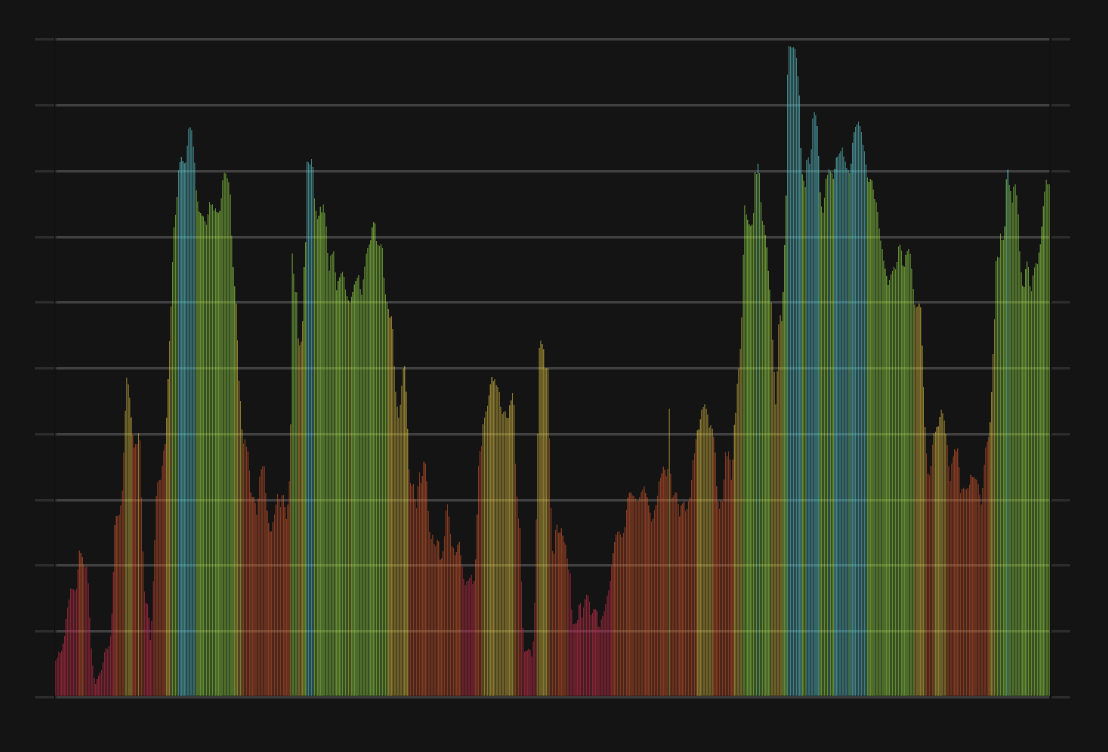

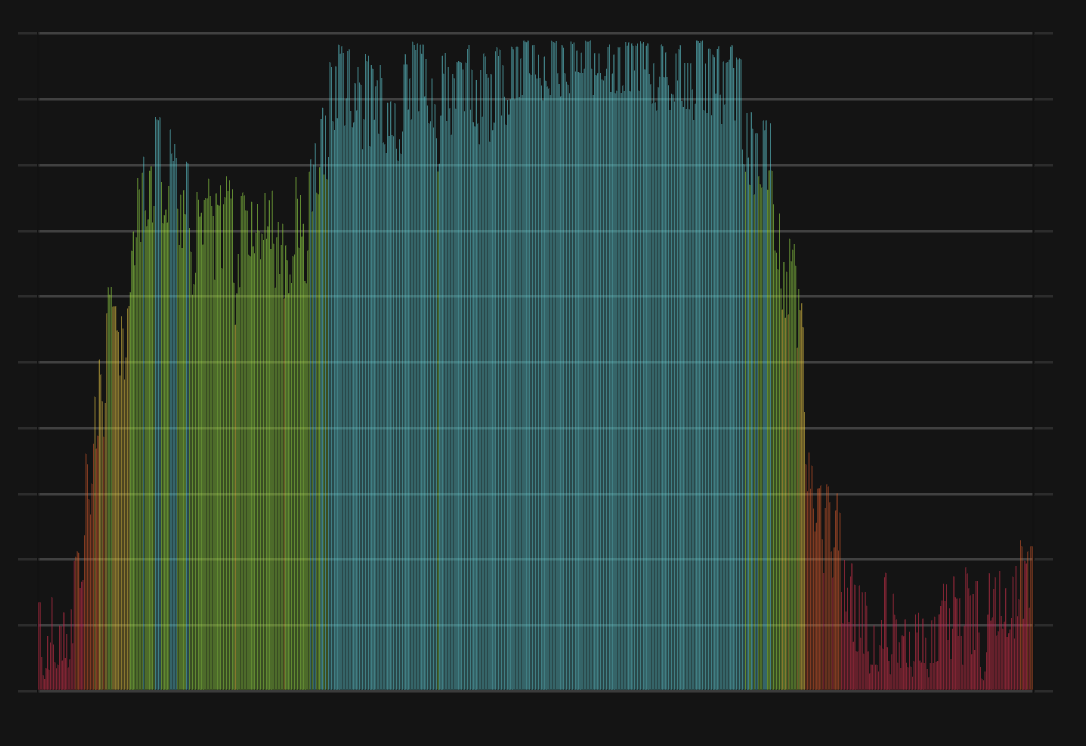

Bitcoin CFGI Score & BTC Price History

BTC Price & Bitcoin Sentiment Breakdown Charts

Price Score Sentiment

Volatility Sentiment

Volume Sentiment

Impulse Sentiment

Technical Sentiment

Social Sentiment

Dominance Sentiment

Search Sentiment

Whales Sentiment

Order Book Sentiment