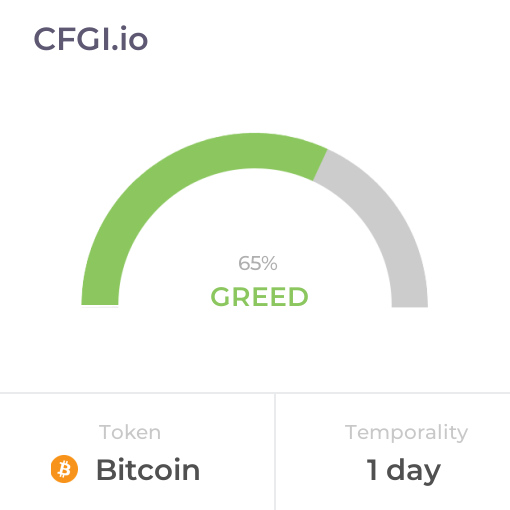

Historical Values

-

Now

Neutral 50 -

Yesterday

Neutral 50 -

7 Days Ago

Neutral 50 -

1 Month Ago

Neutral 50

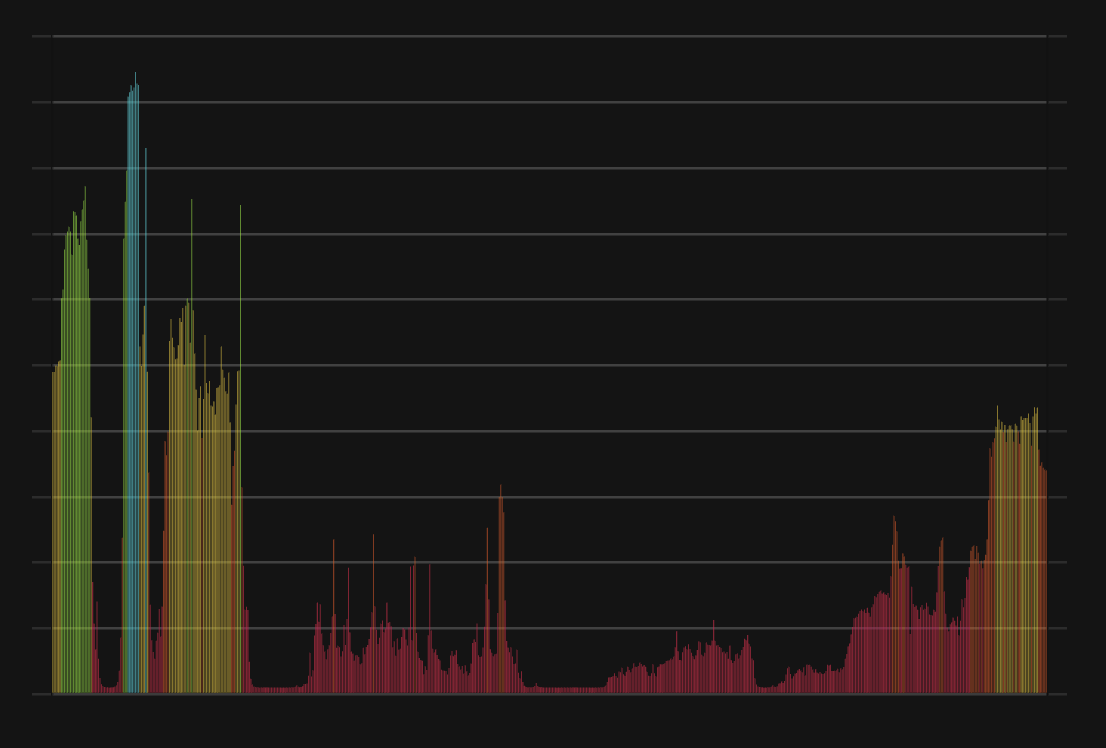

Bitcoin Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Bitcoin price evolution a certain numerical value.

This module studies the price trend to determine if the Bitcoin market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Bitcoin price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the Bitcoin Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Bitcoin bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Neutral

The Impulse indicator measures the current Bitcoin price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Bitcoin market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Fear

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Bitcoin the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Fear

Dominance Neutral

This other indicator takes into account the dominance of Bitcoin with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Bitcoin's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Bitcoin and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Neutral

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Bitcoin has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Bitcoin. For this, specific search terms are used that determine the purchasing or ceding interest of Bitcoin, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Extreme Greed

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Bitcoin and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Bitcoin moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Extreme Fear

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Bitcoin on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

Bitcoin News

Bitcoin News

Bitcoin 'anomalous' outflow sees 32K BTC leave exchanges in a single day

Sentiment: Positive

Read moreBitcoin Consolidates at $71K: Main Move Still to Come – BTC TA March 6, 2026

Sentiment: Positive

Read moreCrypto Market Crash Alert: Institutions Trap Retail Ahead of BTC, ETH, XRP Options Expiry & Nonfarm Payrolls

Sentiment: Negative

Read moreBitcoin Price Prediction: Will BTC Hold $70K as Iran-Israel Tensions Rise?

Sentiment: Negative

Read moreBitcoin Goes Mainstream: Morgan Stanley, TD Bank, and Citi Announce Major BTC Plans

Sentiment: Positive

Read moreBitcoin (BTC) Maintains $70K Level While Treasury Yields Signal Market Headwinds

Sentiment: Neutral

Read moreBitcoin Supply Shrinks to 2017 Levels as Wallets Hit Record High—Is BTC Price Preparing for a Big Move?

Sentiment: Positive

Read moreArthur Hayes Predicts Fed Money Printing From US-Iran Tensions Could Propel Bitcoin (BTC) Higher

Sentiment: Positive

Read moreBitcoin (BTC) Price Retreats to $70K as Geopolitical Tensions and Failed Rally Spark Concerns

Sentiment: Negative

Read moreBitcoin Miners Sell 15K BTC After $126K High, Is This the Reason Why Bitcoin is Dropping

Sentiment: Negative

Read moreBitcoin not an ‘allowable asset': Vancouver city staff asks council to drop BTC reserve motion

Sentiment: Negative

Read moreBitcoin, Ethereum, XRP, Dogecoin Fall, While Oil Surges Amid Middle East War: Analytics Firm Says BTC Is 'Still In A Bear Market'

Sentiment: Negative

Read moreCourt Freezes BlockFills Assets Amid 70 BTC Dispute With Dominion Capital

Sentiment: Negative

Read moreAmerican Bitcoin adds 11k ASICs in bold BTC mining play – Why it matters

Sentiment: Positive

Read moreCleanSpark Sells Nearly All February BTC Production to Accelerate AI Expansion

Sentiment: Positive

Read moreBitcoin Supply Shift: 212,000 BTC Moves Into Long-Term Holder Hands, Price Nearing A Bounce?

Sentiment: Positive

Read morePeter Schiff Predicts BTC to Fall, Gold to Rise as Markets Price in Prolonged Iran War

Sentiment: Negative

Read moreCleanSpark sells 553 BTC for $36.6M in February as miners offload Bitcoin

Sentiment: Positive

Read moreCore Scientific secured $500 million from Morgan Stanley amid plans to liquidate its BTC portfolio in 2026 to finance AI expansion

Sentiment: Positive

Read moreBitcoin trader sees 'lower soon' as BTC price starts to erase $74K breakout

Sentiment: Negative

Read moreAmerican Bitcoin Expands Treasury to 6,500 BTC as Eric Trump Accuses Big Banks of Lobbying Against Crypto

Sentiment: Positive

Read moreMorgan Stanley Advances Spot Bitcoin ETF Plan With Amendment Detailing BTC Holding Strategy

Sentiment: Positive

Read moreDormant Bitcoin whales move $56 mln: Can BTC withstand the sudden selling?

Sentiment: Negative

Read moreBitcoin Safe Haven Narrative Returns: Will Global Instability Push Investors Toward BTC?

Sentiment: Positive

Read moreBitcoin Price Prediction: What's the Most Likely Scenario for BTC After Reclaiming $70K

Sentiment: Neutral

Read moreBTC Rallies to $73K in Fresh Monthly Peak, Lifting Ethereum, Solana and the Wider Market

Sentiment: Positive

Read moreBitcoin ETFs Pull In $462M, Signaling Broadening Crypto Demand With BTC Above $73K

Sentiment: Positive

Read moreCrypto Market Today: BTC, ETH, XRP, SOL, and DOGE Rally as Geopolitical Tensions Ease

Sentiment: Positive

Read moreBTC Price Reaches $74K Before Retreat: Is $85K Next After Consolidation? (March 5 Update)

Sentiment: Positive

Read morePi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

Sentiment: Positive

Read moreBitcoin (BTC) Surges Past $73K as ETFs Record $1.1B Three-Day Inflow Streak

Sentiment: Positive

Read moreBitcoin (BTC) Price Surges Past $73K Amid $1.47B ETF Inflow Surge and Brandt's Bullish Pivot

Sentiment: Positive

Read moreGold vs. Bitcoin: XAUUSD Rises on Middle East Conflict as BTC Recovers From $60000

Sentiment: Positive

Read moreWhy is the Crypto Market Rising Today? Top Factors Impacting BTC, ETH & XRP Prices

Sentiment: Positive

Read moreThe $11,000 Deficit: Why the Record $8.9B Bitcoin ETF Drawdown Is Paralyzing Wall Street's BTC Appetite

Sentiment: Negative

Read moreBitwise Channels $233K in Bitcoin ETF Gains to Support Open-Source BTC Developers

Sentiment: Positive

Read moreBitcoin Outflows Hit 28,700 BTC: Is the Bitfinex Transfer Distorting the Market Signal?

Sentiment: Negative

Read moreSenate to vote on Trump's pro-Bitcoin Fed pick as BTC hits four-week high

Sentiment: Positive

Read moreBitwise Donates $233K of Bitcoin ETF Profits to Open-Source BTC Developers

Sentiment: Positive

Read moreBitcoin Price Prediction: Fed Rate Cut Hints Send BTC Flying Past $72K — Is a Mega Rally Starting?

Sentiment: Positive

Read moreABTC Stock Rises 12% as Trump-Backed American Bitcoin Holdings Increase To 6,500 BTC

Sentiment: Positive

Read moreBitcoin Soars Above $73K As Spot BTC ETF Buying Frenzy Defies Middle East Unrest

Sentiment: Positive

Read morePrice predictions 3/4: BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH, HYPE, LINK

Sentiment: Positive

Read moreRiot mines 5,686 BTC and earns $647mln in 2025 – Yet its stock barely moved

Sentiment: Neutral

Read moreBitcoin Price Prediction: Analyst Says $220,000 BTC Is Coming — But Only After This Happens

Sentiment: Positive

Read moreBitcoin bears could walk into a brutal short squeeze next as BTC retakes $70k

Sentiment: Positive

Read moreBitcoin still due 'next leg down' as $73K BTC price precedes death cross

Sentiment: Negative

Read moreRipple Price Analysis: XRP at a Make-or-Break Level – Key Zones on USDT and BTC Pairs

Sentiment: Neutral

Read moreBitcoin (BTC) Nears $72,000: Major Rally Ahead or Another Dead-Cat Bounce?

Sentiment: Positive

Read moreLong-Term Bitcoin Holders Buy $14 Billion In BTC As Retail Headed For The Exit

Sentiment: Positive

Read moreStrategy expands bitcoin holdings as STRC stock signals $198.7 million trading surge and 1,000 BTC purchase

Sentiment: Positive

Read moreTop Bitcoin miner MARA open to selling entire $3.8 billion BTC stash creating a new liquidity test

Sentiment: Negative

Read moreBTC Price Surges Past $70,000: Rally Targets & Next Levels (March 4 Update)

Sentiment: Positive

Read moreStrategy's STRC stock signals 1,000 BTC purchase in biggest-one day issuance since July

Sentiment: Positive

Read moreBitcoin nears $72,000 as spot BTC ETF inflows extend despite risks from US-Israel war with Iran

Sentiment: Positive

Read moreHere's what happened in crypto today: BTC ETFs, Trump, CLARITY Act, & more

Sentiment: Positive

Read moreBitcoin (BTC) Rejection at $70K Amid Middle East Crisis Dragging Down Global Markets

Sentiment: Negative

Read moreBTC Rejected at $70K Again: The Massive ‘Obstacle' Holding Bitcoin's Price Down

Sentiment: Negative

Read moreAlmost 40% of altcoins linger near lows while BTC and ETH lead market rebound

Sentiment: Negative

Read moreHistorical Values

-

Now

Neutral 50 -

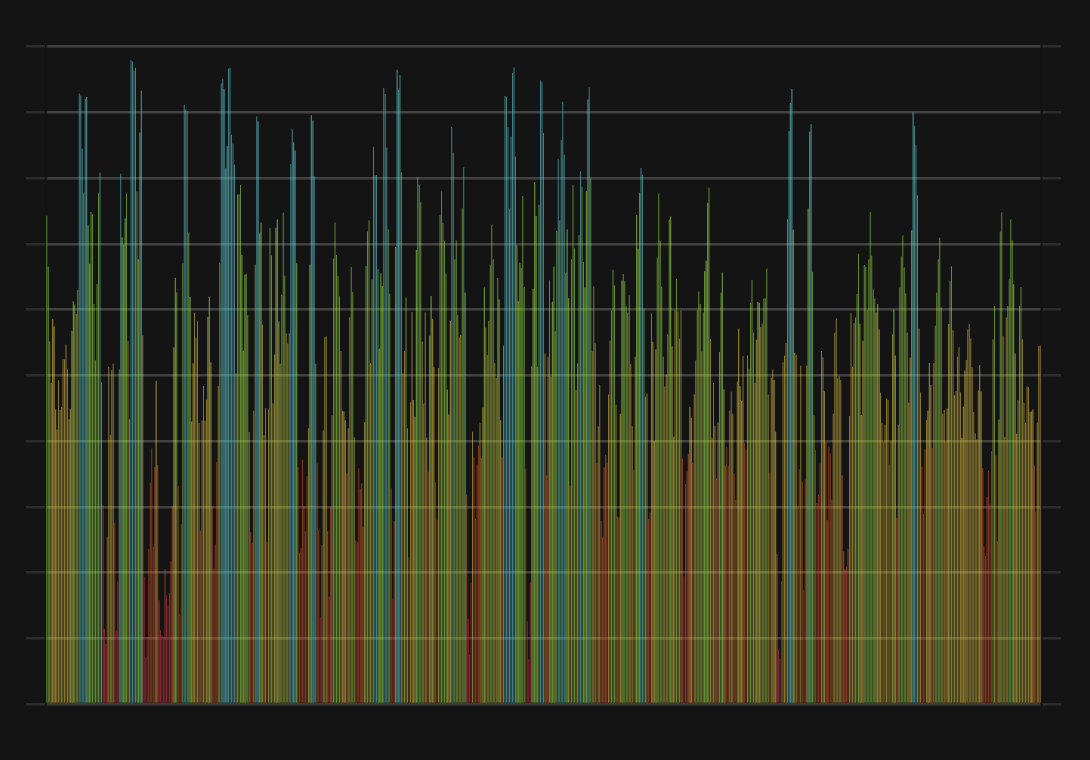

Yesterday

Neutral 50 -

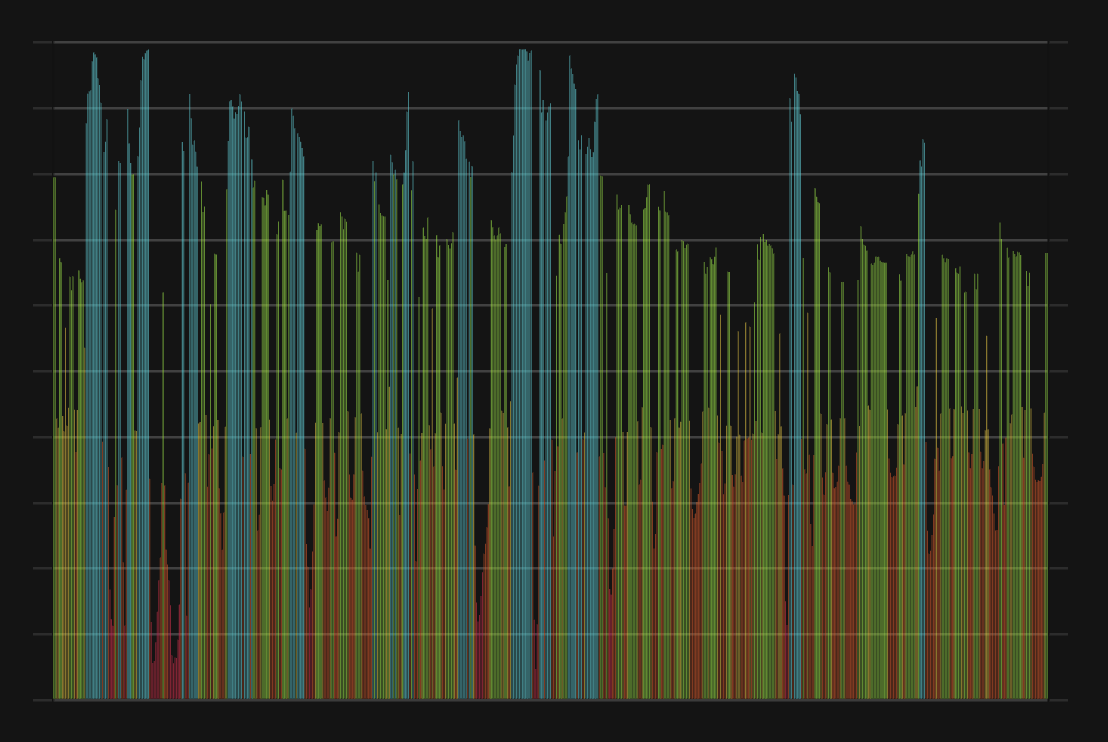

7 Days Ago

Neutral 50 -

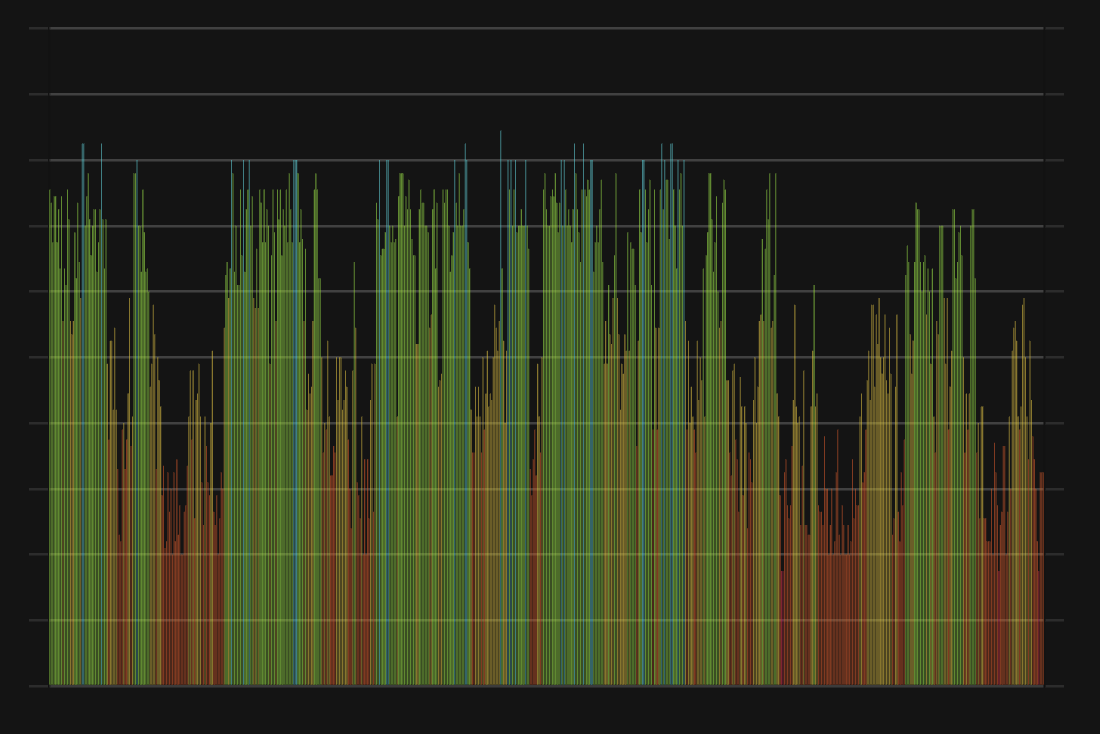

1 Month Ago

Neutral 55

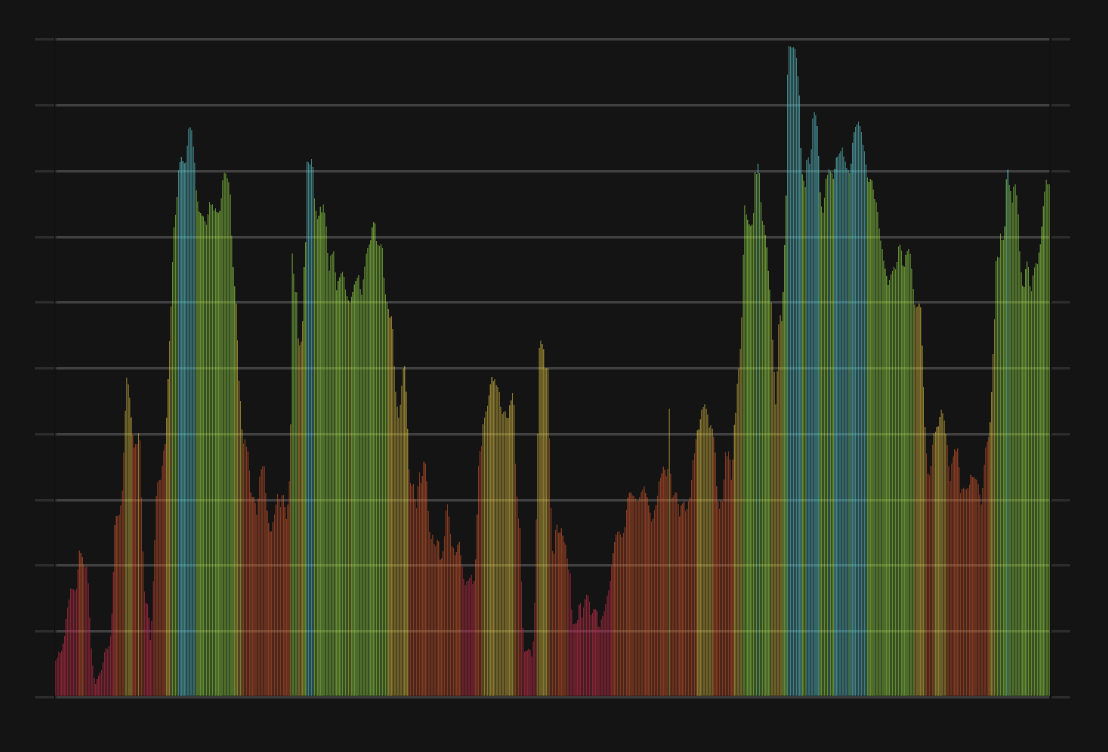

Bitcoin Breakdown

Price Score Neutral

The Price Score indicator is a relevant indicator to analyze and assign the Bitcoin price evolution a certain numerical value.

This module studies the price trend to determine if the Bitcoin market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Greed

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Bitcoin price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Greed

Like volatility, the Bitcoin Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Bitcoin bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Neutral

The Impulse indicator measures the current Bitcoin price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Bitcoin market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Fear

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Bitcoin the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Fear

Dominance Neutral

This other indicator takes into account the dominance of Bitcoin with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Bitcoin's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Bitcoin and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Neutral

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Bitcoin has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Bitcoin. For this, specific search terms are used that determine the purchasing or ceding interest of Bitcoin, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Extreme Greed

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Bitcoin and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Bitcoin moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Extreme Fear

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Bitcoin on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

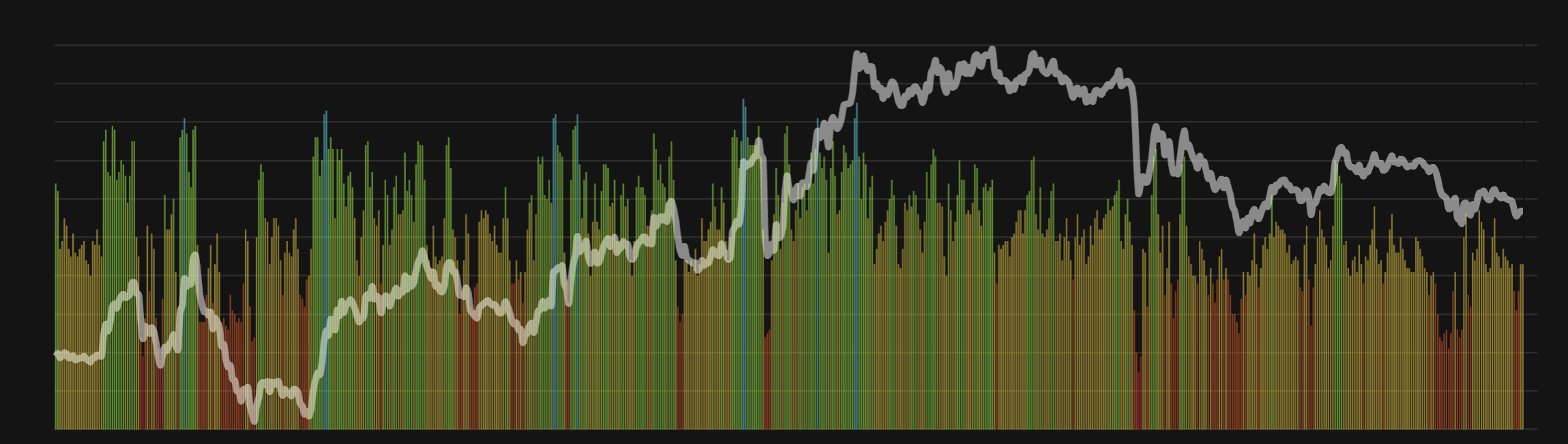

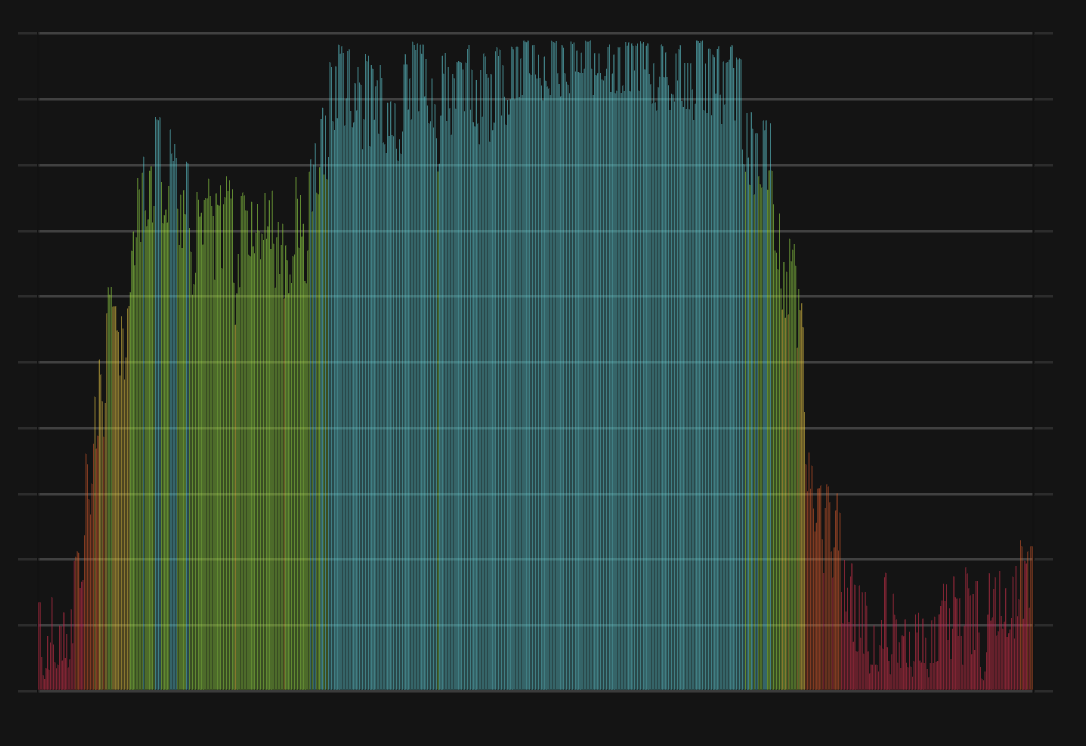

BTC Price

1 BTC = $68,073.50

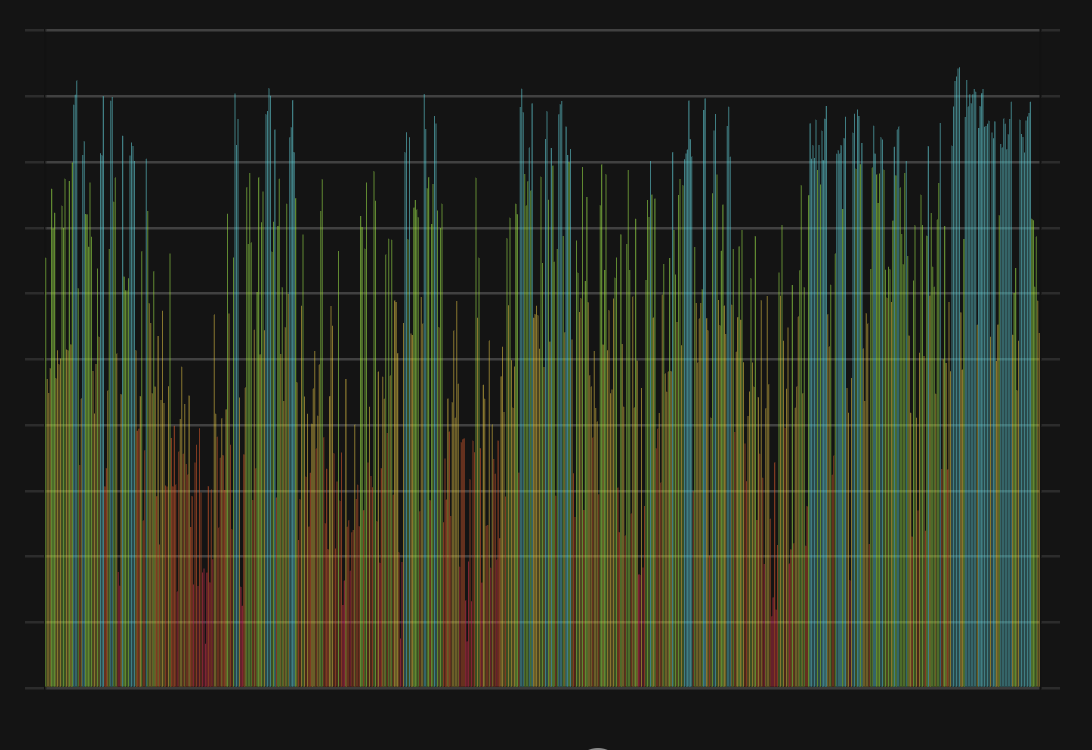

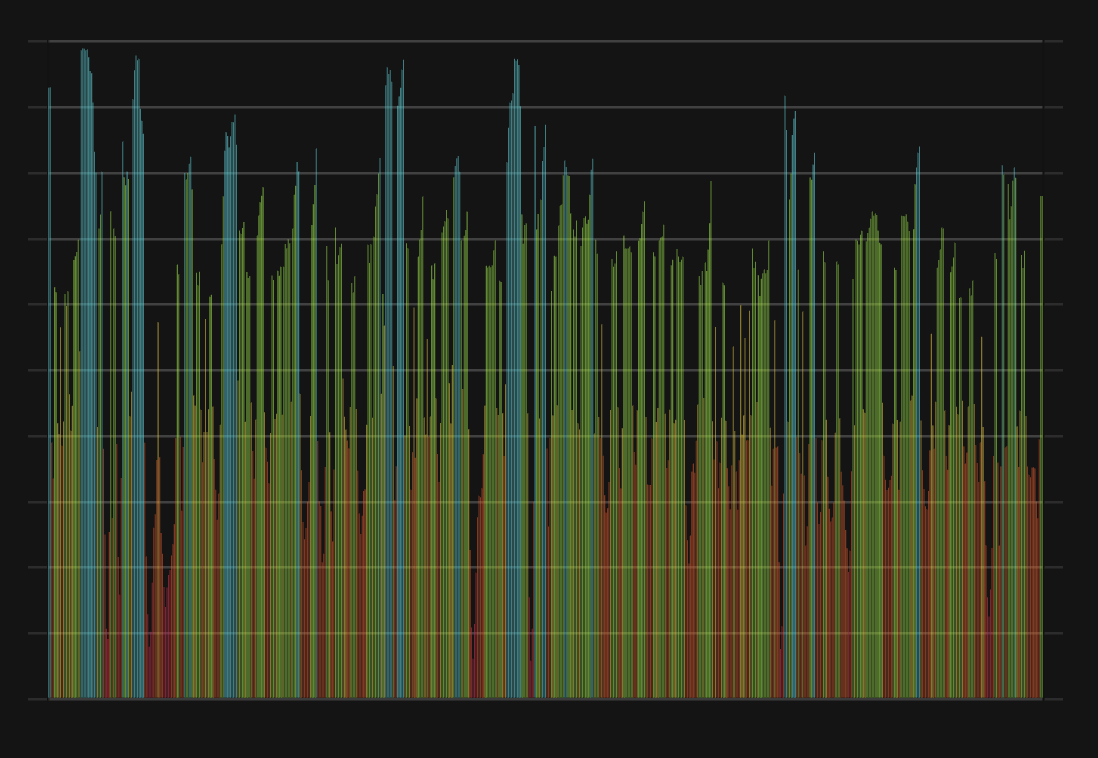

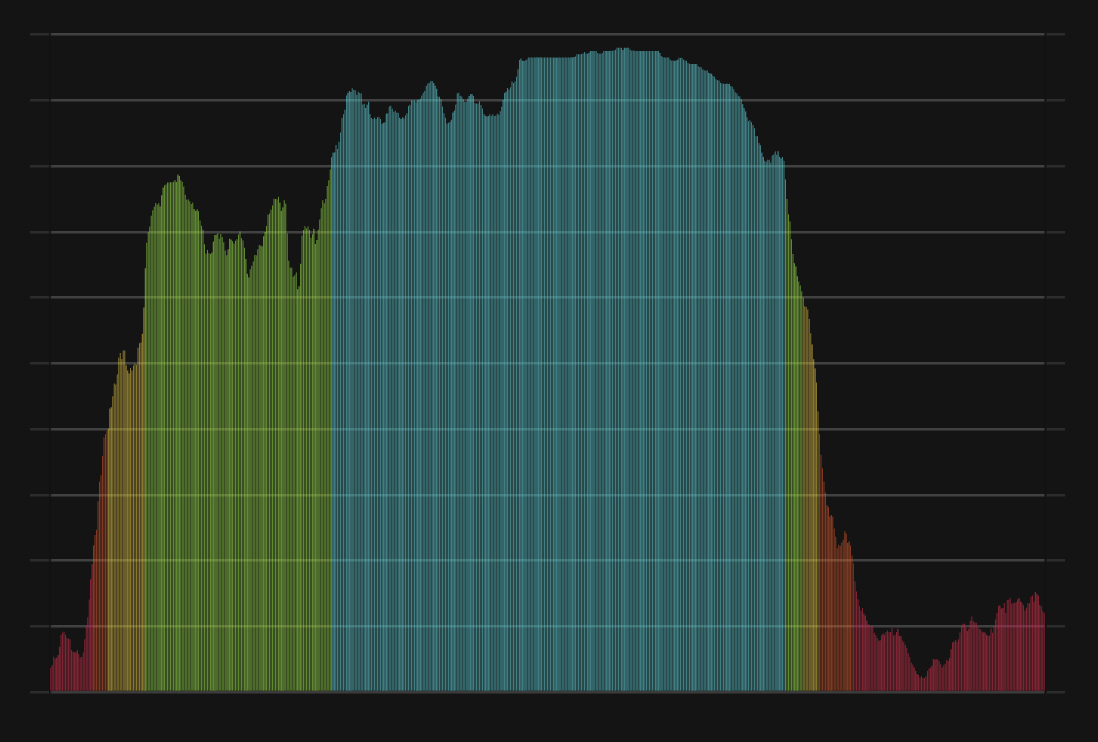

Bitcoin CFGI Score & BTC Price History

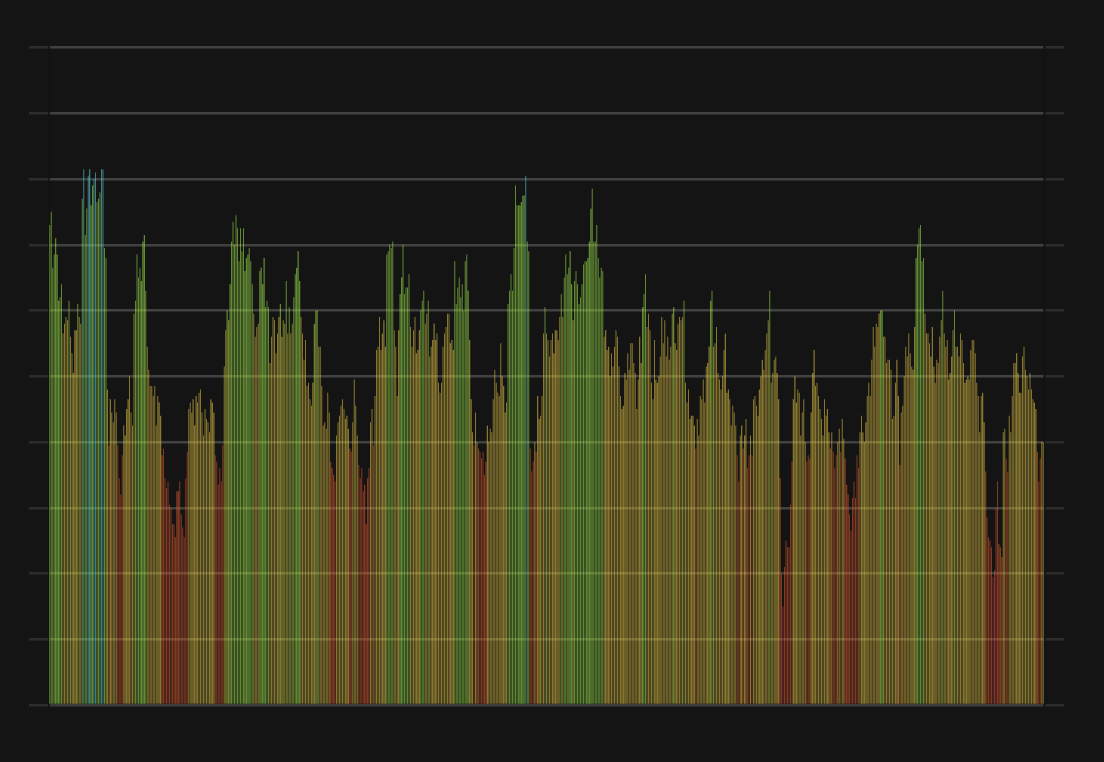

BTC Price & Bitcoin Sentiment Breakdown Charts

Price Score Sentiment

Volatility Sentiment

Volume Sentiment

Impulse Sentiment

Technical Sentiment

Social Sentiment

Dominance Sentiment

Search Sentiment

Whales Sentiment

Order Book Sentiment